Wednesday Color - Dow Stocks, Dumb Money, Gamma, Microsoft Expectations, Germany

Here's what's piquing my interest as some of the negatives that have piled up start to take some effect.

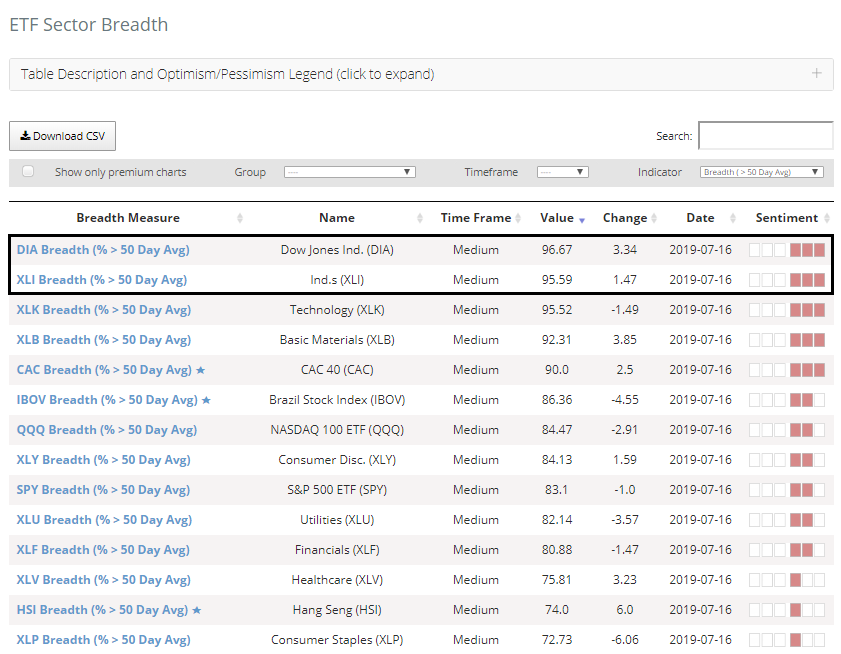

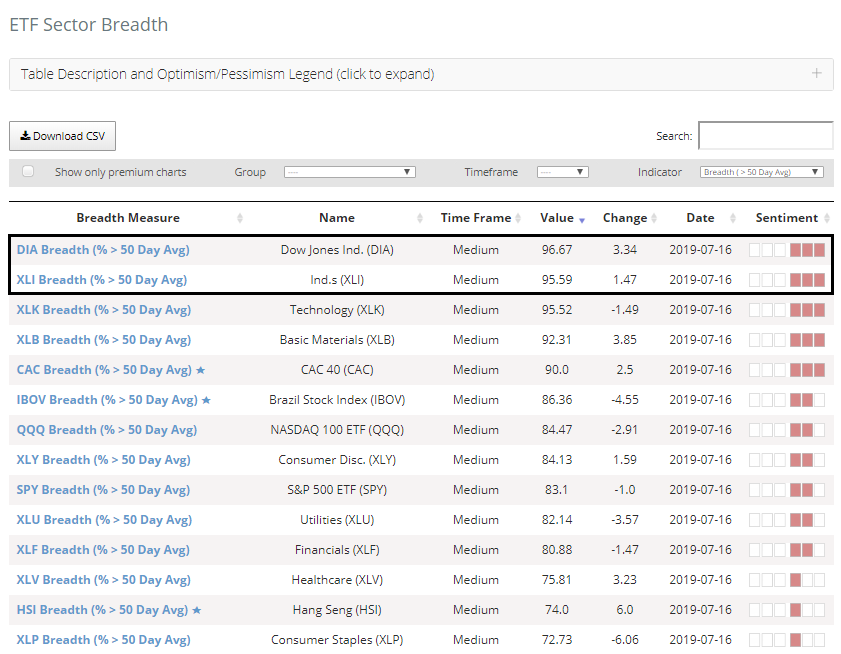

Sector Breadth

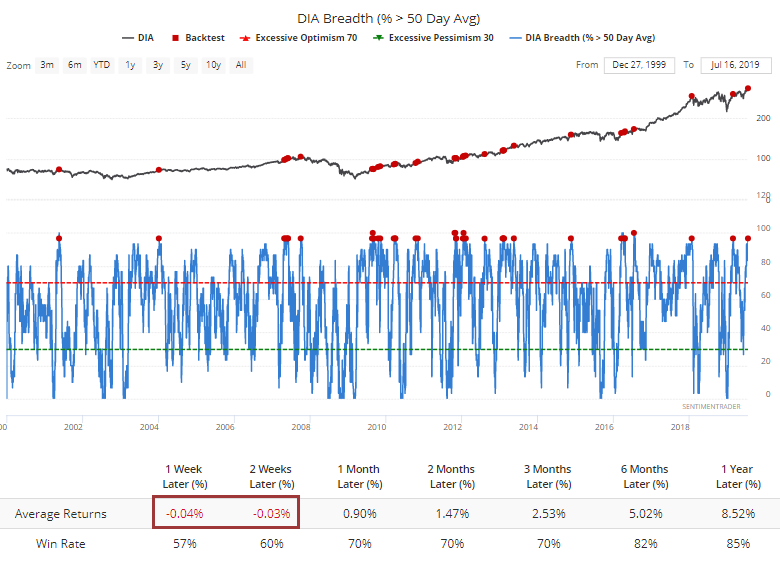

Industrial stocks have been chugging higher, and it has been enough that nearly every Dow Industrial stock is trading above their 50-day moving average. This is the best out of every sector and country we follow.

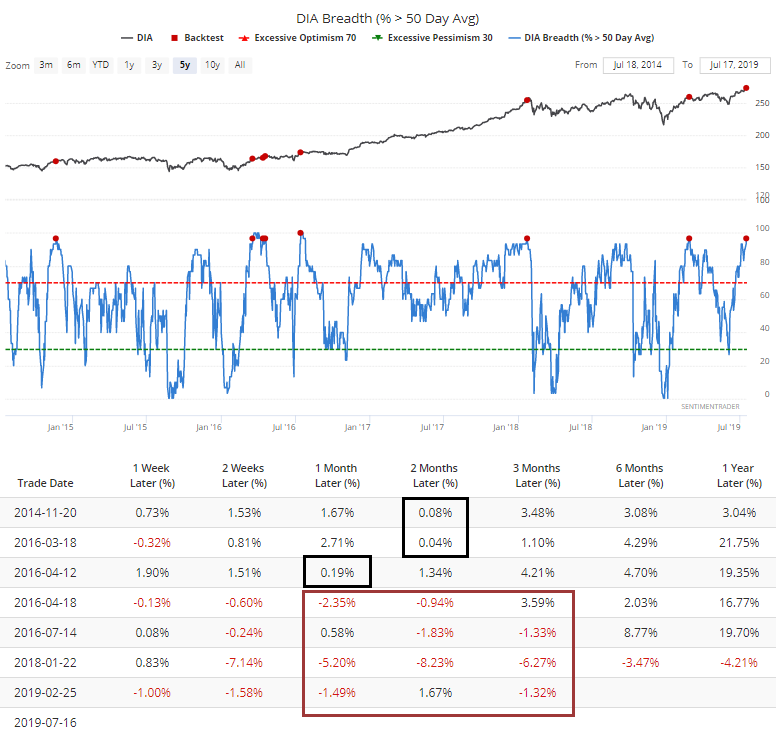

More than 95% of stocks above their average is historically an extremely high figure, but other than the short-term, has not been a negative for returns.

It's been more of an issue in recent years. It preceded flat returns over the next 1-2 months in 2014 and 2016, and outright negative ones over the past couple of years.

Highly Confident

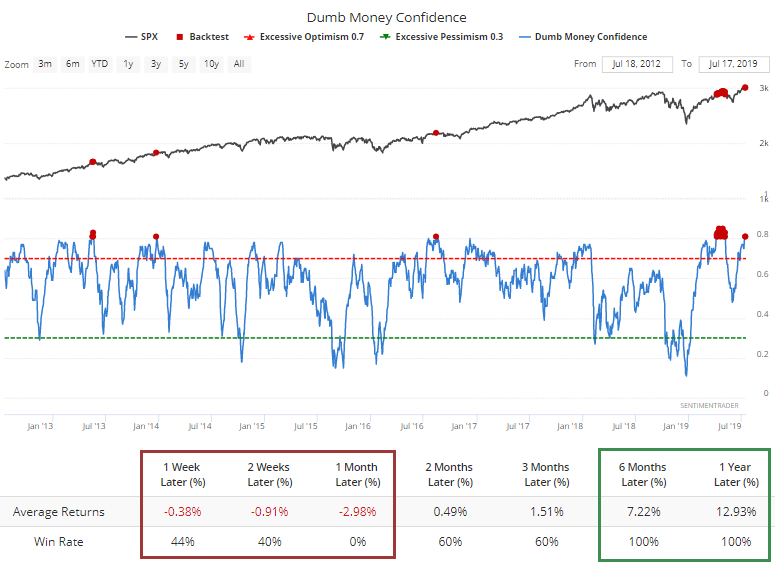

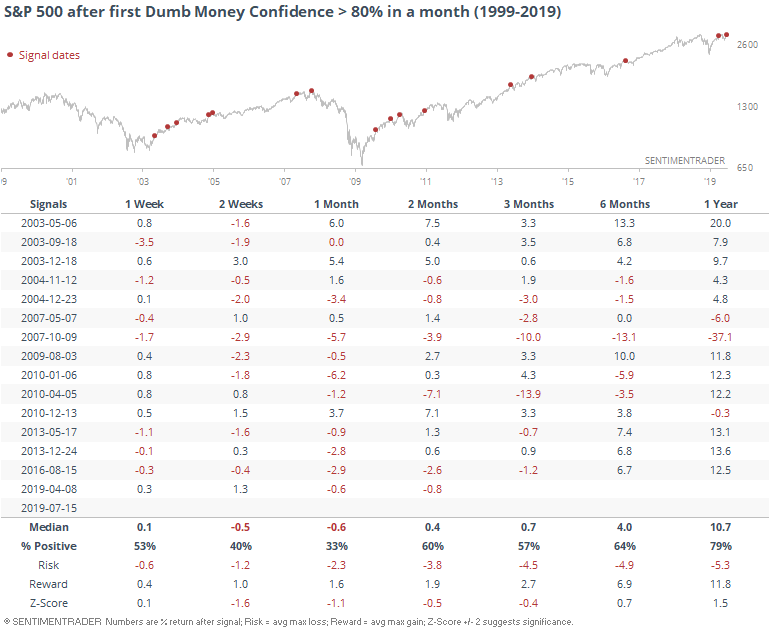

Confidence among Dumb Money investors has returned fully, and is at the 2nd-highest level in the past three years. Over the past 7 years, this has not been a good formula for further gains. All 25 days showed losses over the next month. It's been a bull market, you know, so long-term returns were still fine.

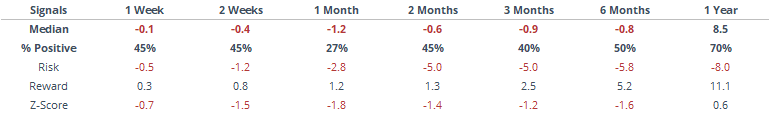

If we go back further and only look at the days when Dumb Money first climbed above 80% in at least a month, it was still sketchy.

Some of the best gains occurred in 2003 and 2009, when Confidence made its initial return after a long hibernation. It's highly questionable to suggest we're in the same environment now.

If we only exclude the few dates from those two years, the risk/reward profile gets considerably worse.

Gamma Capped

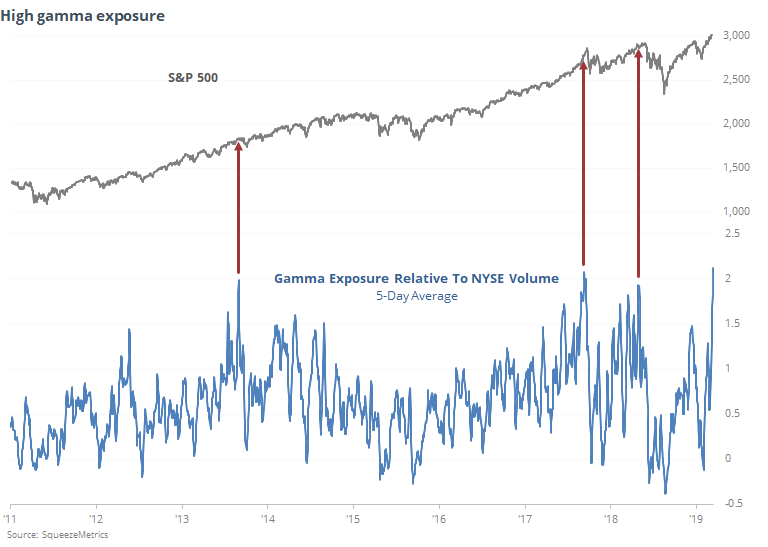

Stocks haven't been moving much lately, and most investors assume it's because traders are waiting around for earnings or some clarity surrounding the trade talks or Fed sentiment. Recent articles by the WSJ and CNBC suggest a different reason - options traders have become so aggressive that they're suppressing the market.

These days it’s not strange to see the market going from a long period of serenity to complete chaos in the blink of an eye. One explanation is a phenomenon dubbed a “gamma trap,” The Wall Street Journal reported. CNBC confirmed with options traders the trend that may be artificially suppressing the market’s daily changes for long periods of time, but then exacerbating sudden volatile moves in the market.

According to SqueezeMetrics, this typically occurs during periods of low volatility, when traders project that low volatility into the future.

Gamma Exposure (GEX) is a dollar-denominated measure of option market-makers' hedging obligations. When GEX is high, the option market is implying that volatility will be low. When GEX is low, volatility is high, and while we expect a choppy market, further losses are unlikely.

Also from SqueezeMetrics:

When GEX is a high number, it acts as a brake on market price. When GEX is low (including negative), it acts as an accelerator. Practically, the "brake" stifles the market's upside while the "accelerator" ultimately enables upward price action resembling a squeeze (in both form and function).

This is an issue right now because their Gamma Exposure index just hit a record high. Taking a 5-day average of the exposure relative to NYSE volume, it has never been higher in the 8 years of history they've computed.

Other times it reached a very high level, stocks suffered at least a short-term pullback.

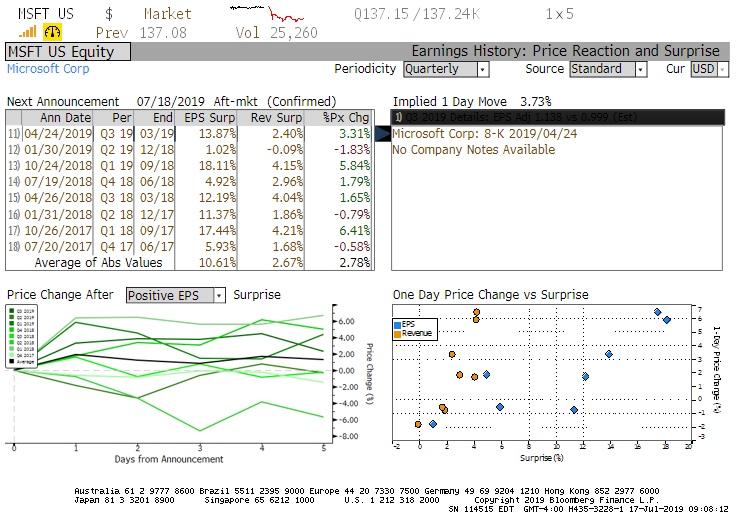

Mr. Softee

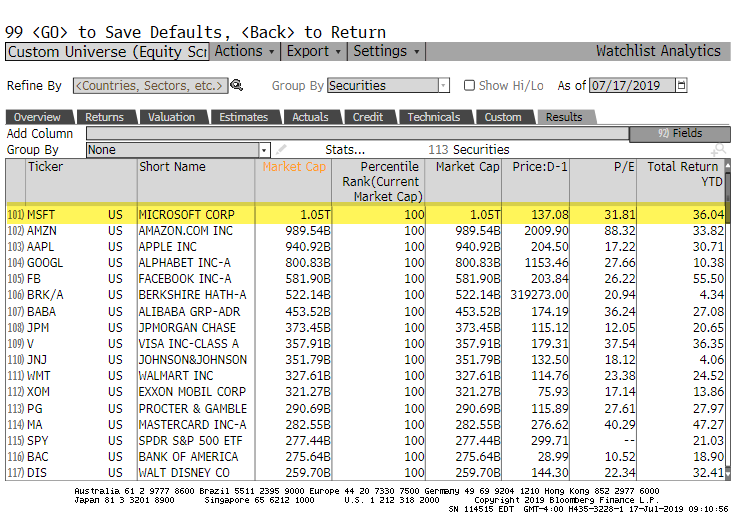

The WSJ notes that there are some important earnings reports coming up soon, perhaps none more so than Microsoft. It is, after all, the current king of the hill, the most highly-valued U.S. company.

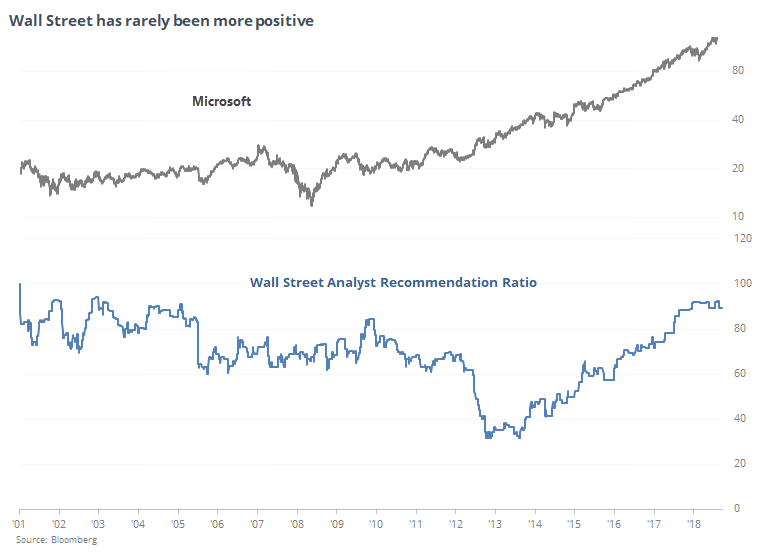

Wall Street couldn't be much more positive about its prospects with 34 buy recommendations and a whopping 2 sells.

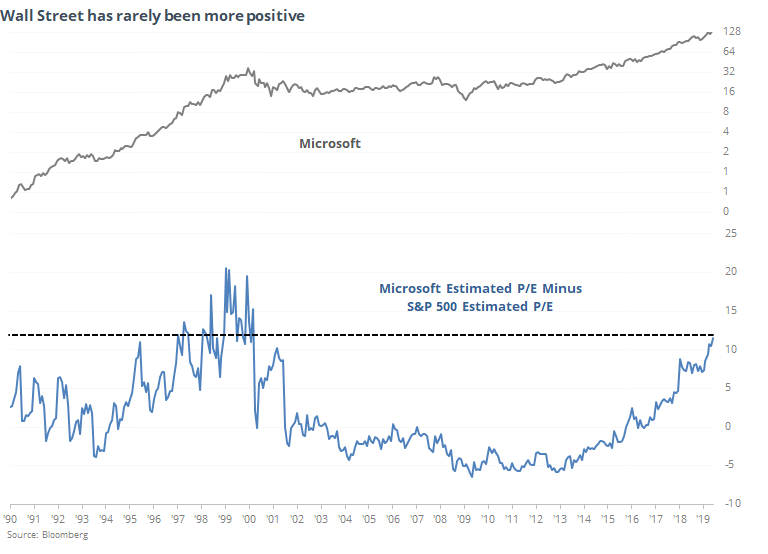

The only time it has been more richly valued relative to the market was in the late 1990s.

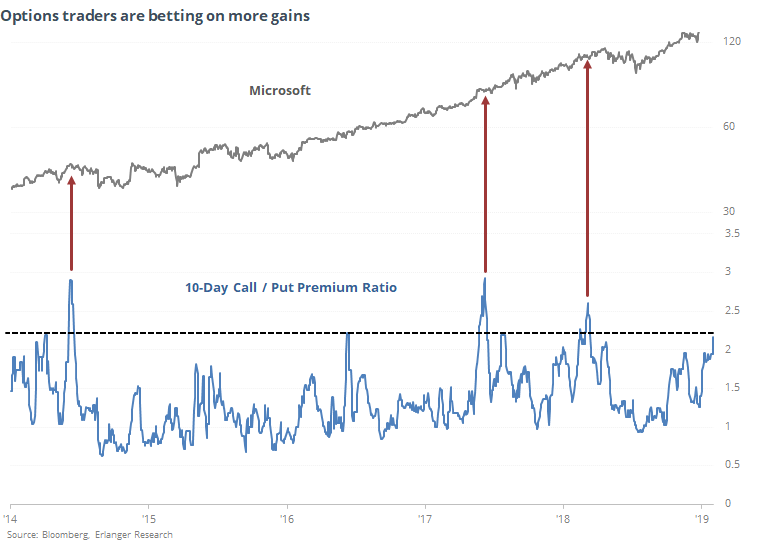

Options traders are betting that the good times will continue to roll ahead of their earnings announcement tomorrow.

Even if earnings are good, it doesn't mean those call options are going to pay off. There has been little correlation between positive earnings surprises and quick gains.

Seems like a relatively high hurdle to jump, especially if earnings are good and the stock happens to jump after hours.

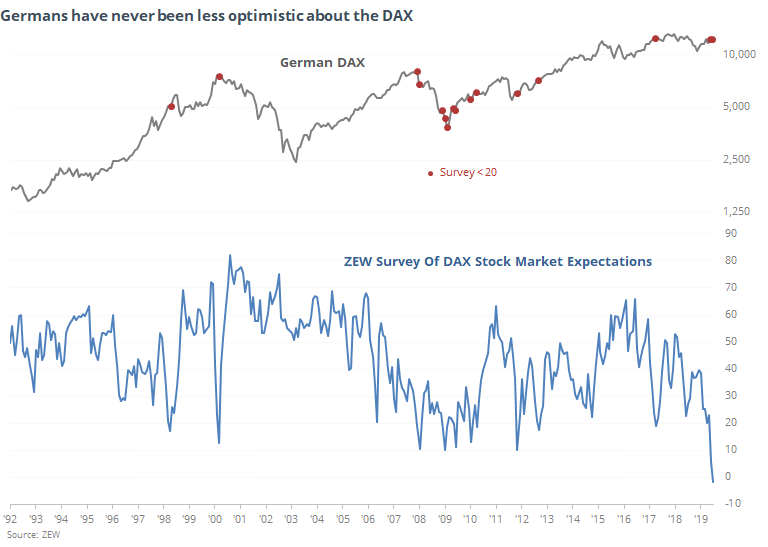

Schlecht

The WSJ notes that Germans are not all that hip about their own market's potential. The ZEW survey of expectations about the DAX has plunged to a record low.

That *should* be a good sign of wash-out sentiment, but not so fast.

We can see from the chart that these folks had some very good calls. Sentiment collapsed before major declines several times. When it was poor while the DAX was rallying, it tended to show below-average returns going forward. Only when the market had tanked and sentiment was low was it an effective contrary indicator.