Wednesday Color - Bulls Gone, Put Volume, Energy Drop, Asian Axiety

Here's what's piquing my interest on another volatile morning.

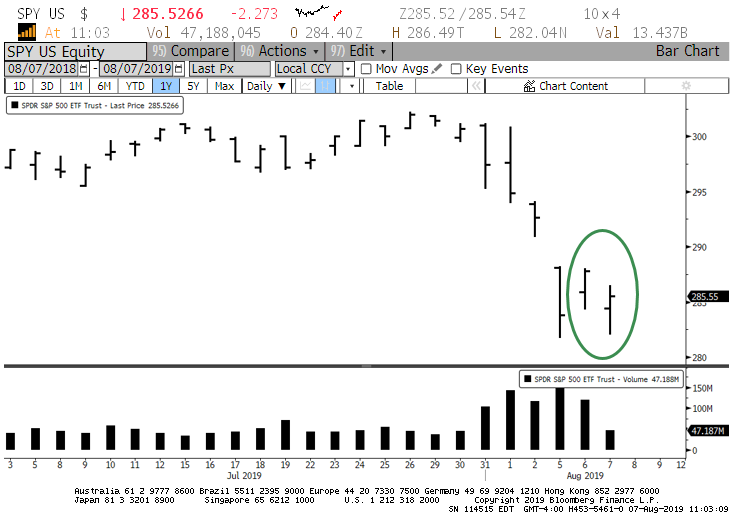

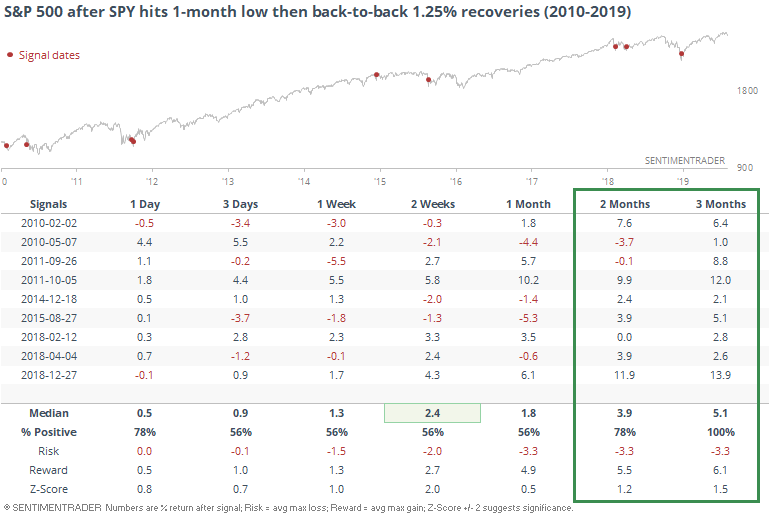

Buy The Dip

It's still awfully early, but SPY is on track to recover at least 1.25% from its intraday low on back-to-back sessions, after having dropped to at least a one-month low.

Since the end of the financial crisis, that has typically led to follow-through.

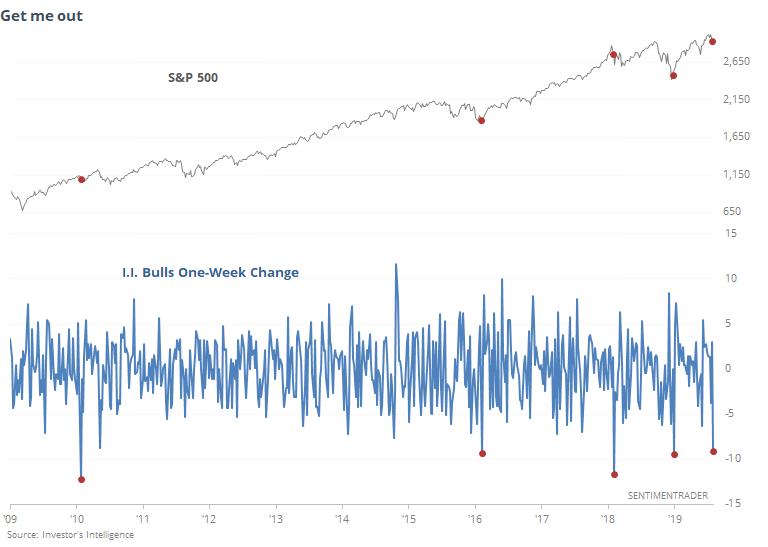

Leaving, Quickly

The latest survey of newsletter writers by Investor's Intelligence shows a quick exodus among bulls. The percentage of newsletters bolstering a bullish bias dropped by more than 9%, one of the largest one-week drops since the financial crisis.

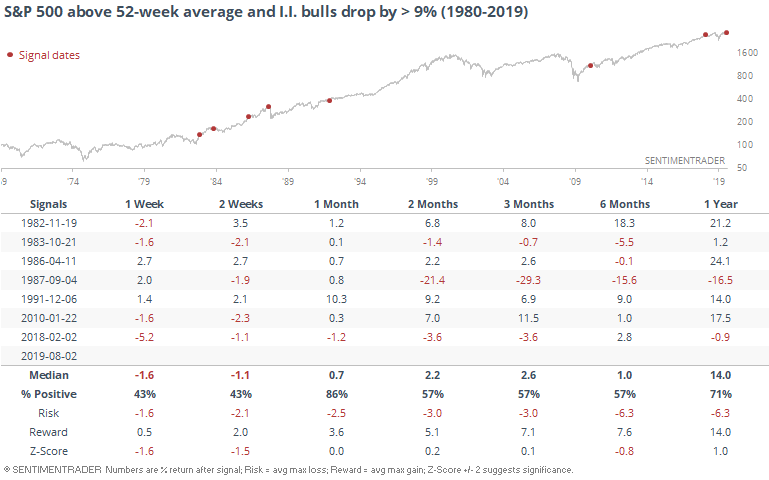

Prior to 1980 or so, the survey was very noisy week-to-week, so big swings were not all that unusual. In the decades since, it has been less common, especially when the S&P 500 was still trading above its 52-week average at the time.

We can see that other times there was a quick exit, stocks actually suffered a bit short-term, then tended to rally, though that signal right before the '87 crash is disturbing.

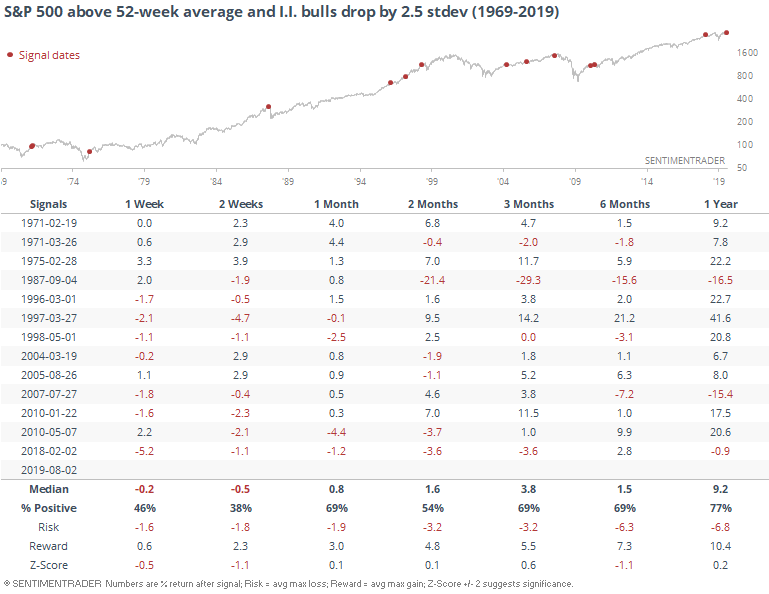

Since the data series was volatile, we can use a z-score to normalize the week-to-week changes and see if more signals pop up. There were a few.

Again, pretty weak shorter-term results, mostly good longer-term ones, but it was not a raging buy signal.

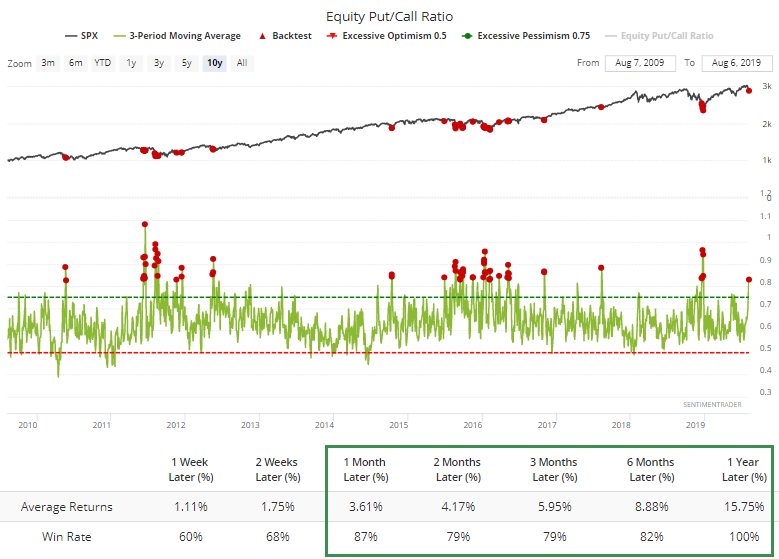

Other Signs Of Concern

The selling is being taken seriously by other traders as well. Over the past three sessions, there has been a spike in the number of equity put options traded relative to the number of calls. Over the past 10 years, that has meant good returns, especially over the next month.

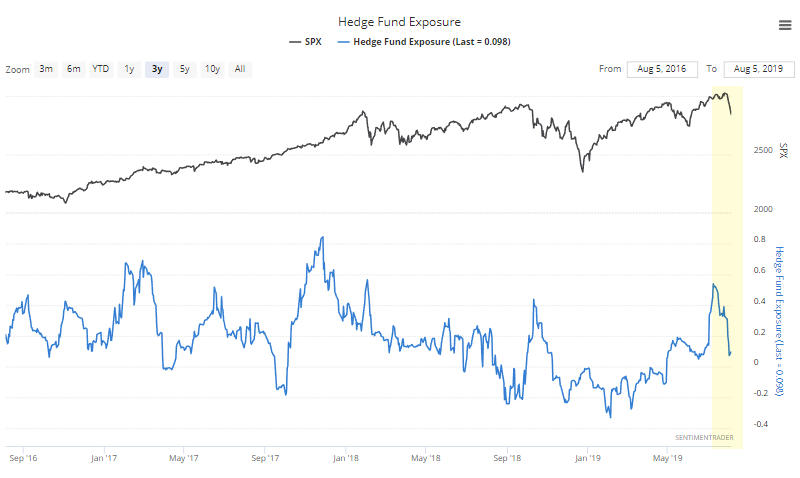

Hedge funds seem to be pulling back, too. After trend-following traders ramped up their exposure prior to the peak, they've greatly reduced it. It's still not extreme, and it's by no means a perfect indicator, but it would be nice to see this continue to sink.

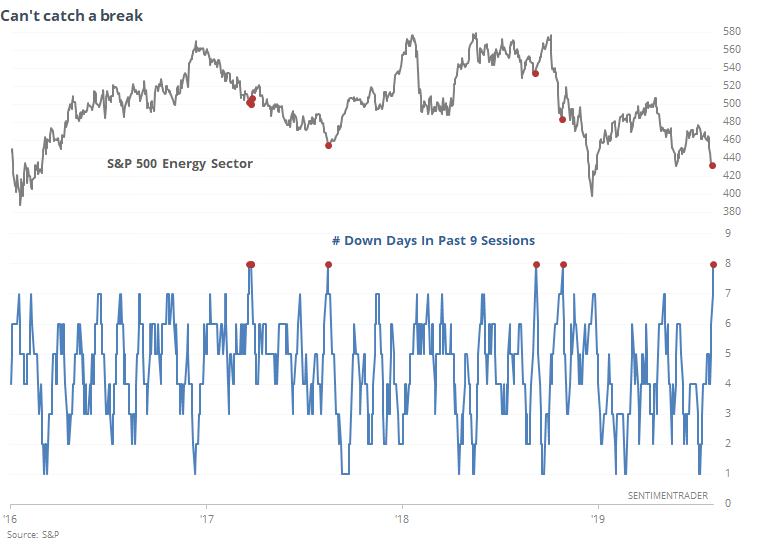

Lack Of Energy

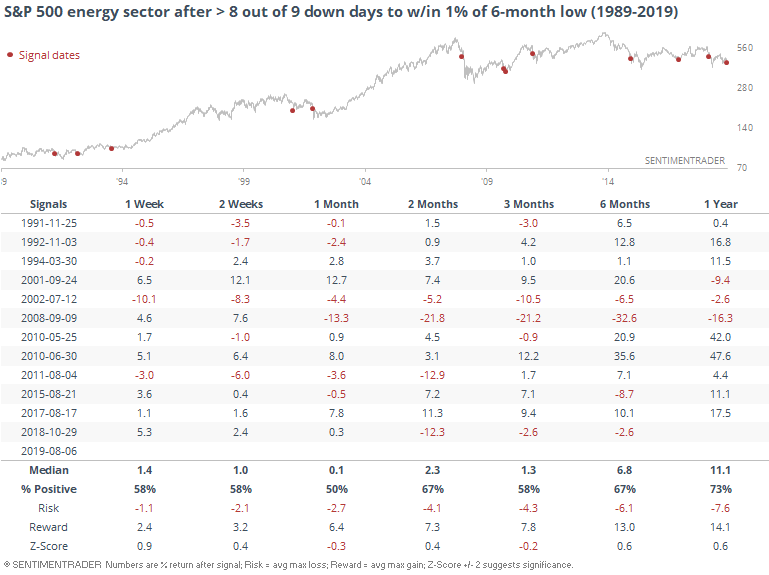

The S&P 500's energy stock components can't seem to catch a break. Out of the past 9 sessions, the sector has lost value 8 times, one of its worst stretches of the past few years.

All of the others were good for at least a short-term bounce, so if recent history is any guide, this bout of selling pressure should see a reprieve, at least for a few sessions.

Longer-term, it hasn't been a consistent sign of excessive pessimism. When it lost this many days in a cluster, and was within spitting distance of at least a 6-month low, returns were mixed, and about in line with random.

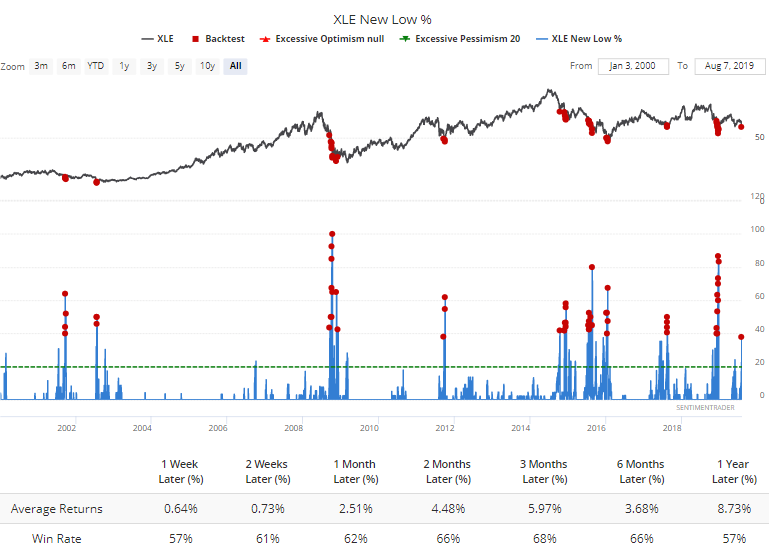

The losses have been enough to push nearly 40% of energy stocks to fresh 52-week lows. That's high, but not enough to be considered capitulation based on past behavior. Forward returns after similar readings were "meh." Same with most other breadth readings in the sector as of Tuesday.

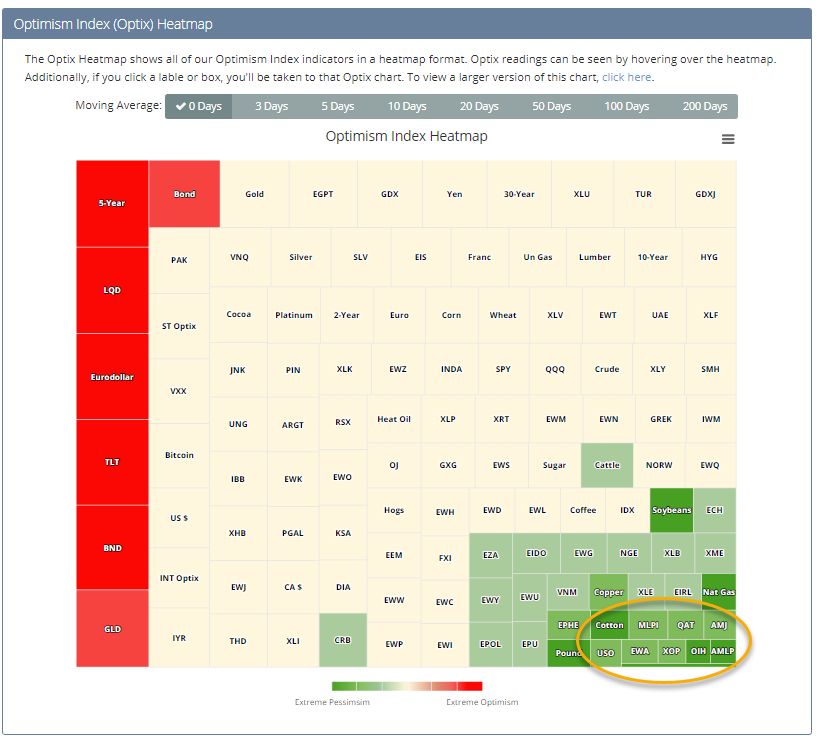

Looking at the Heatmap, most of the markets with extreme pessimism on a daily time frame are energy-related.

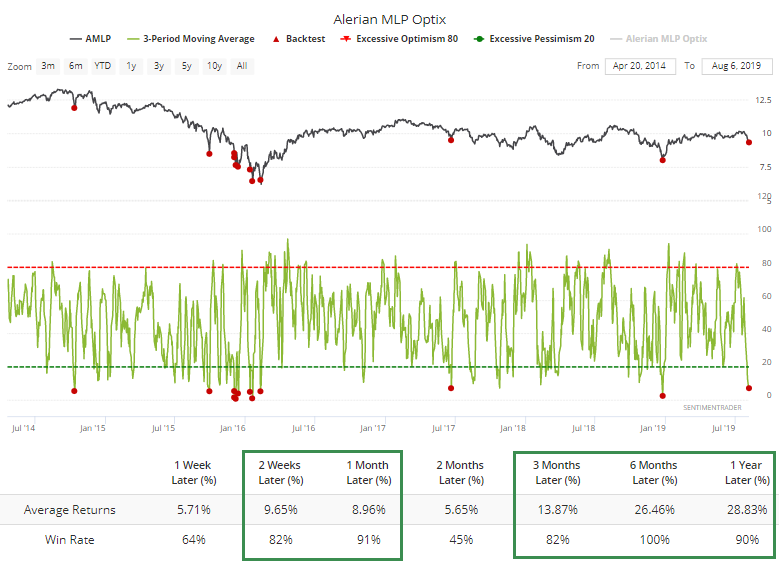

For funds like the AMLP fund tracking master limited partnerships, the 3-day average Optix is so low that it has resulted in quick rebounds almost every time it triggered during that fund's history.

Asian Anxiety

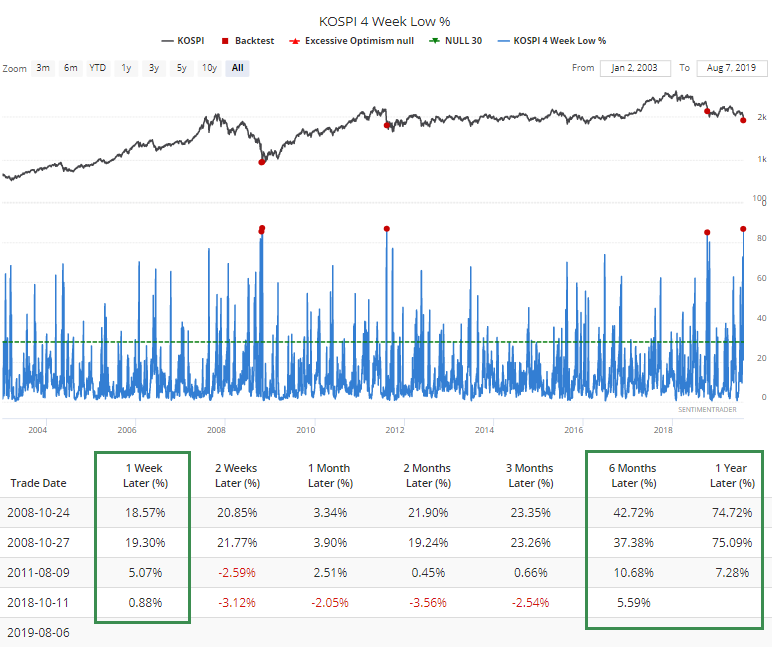

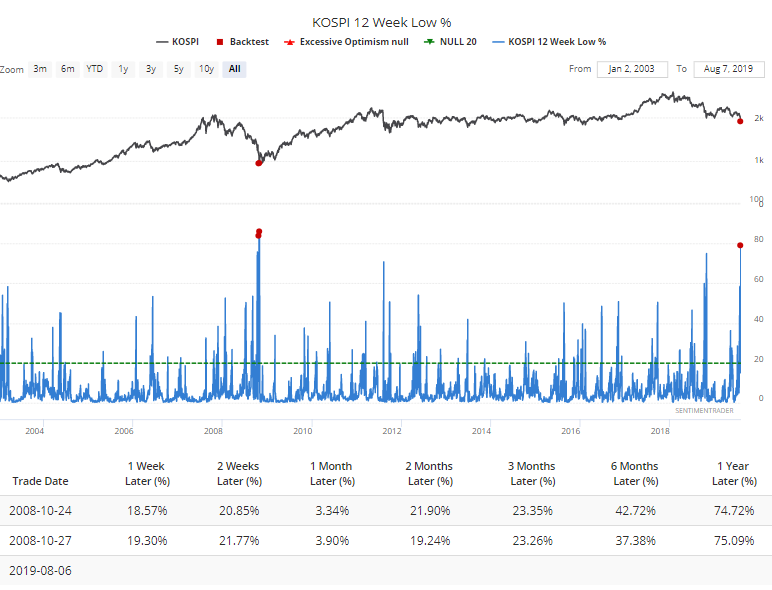

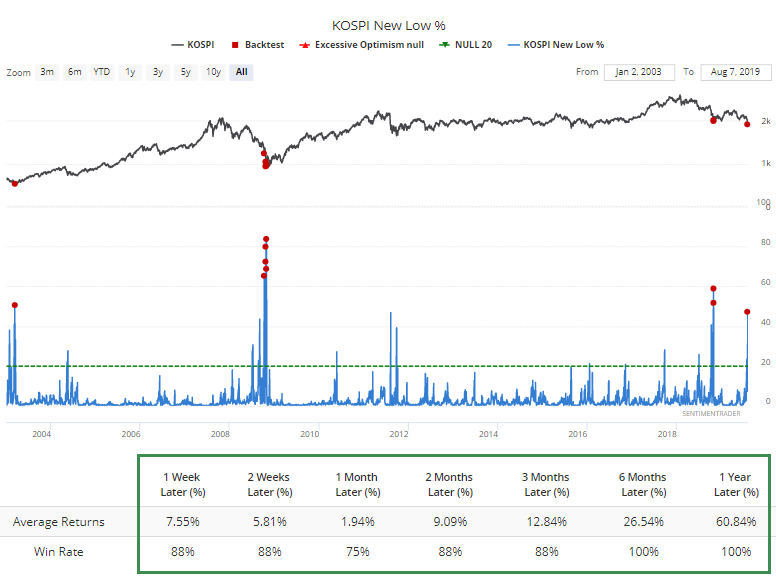

Asian markets have been hit especially hard, as we saw in yesterday's note. Among them is the Kospi, where more than 85% of stocks have slid to their lowest level in a month.

A remarkable 80% (almost) of stocks have slid to at least a multi-month low. Only October 2008 exceeded this.

Nearly 50% of them have plunged to 52-week lows. Long-term returns were astronomical after readings this high, at least over the past 15 or so years.

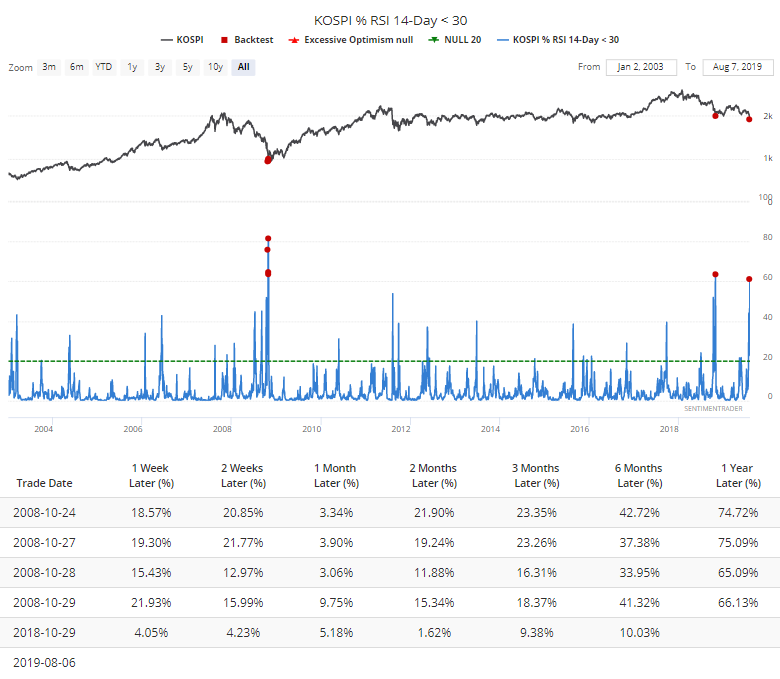

The decline has been so swift that more than 60% of the stocks are now oversold. The only other two distinct times this triggered, the Kospi rebounded strongly.

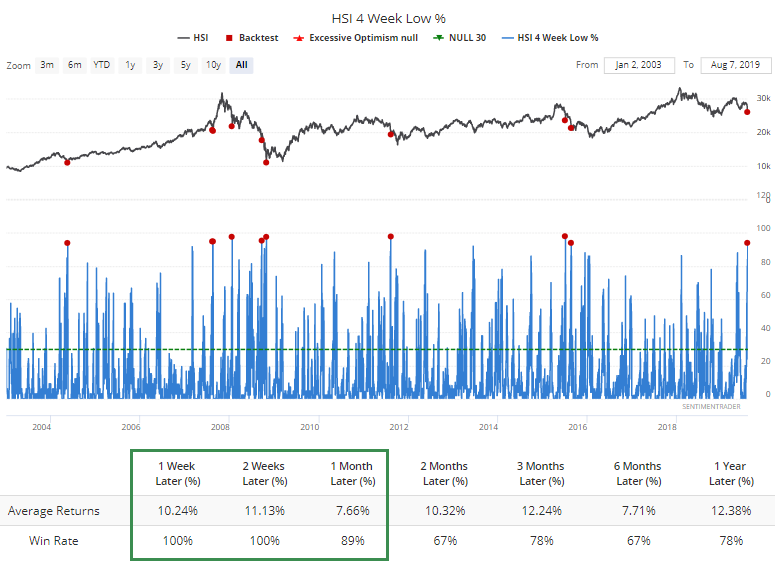

On the Hang Seng, close to every stock has hit a one-month low. Every time in the past ~15 years so many stocks have dropped together, the HSI rebounded over the next 1-2 weeks.

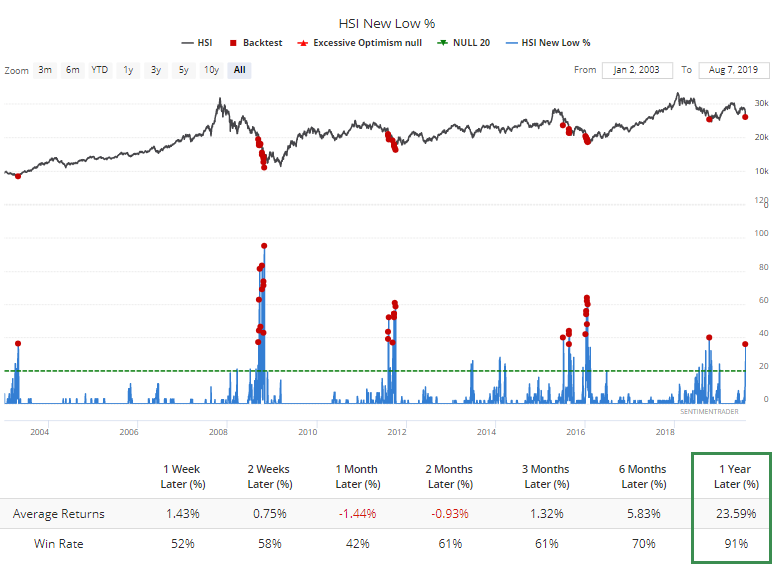

More than 35% of them are at 52-week lows. If the HSI continues to slide over the next few days, that should skyrocket to 50% or more, which has been a more meaningful signal.

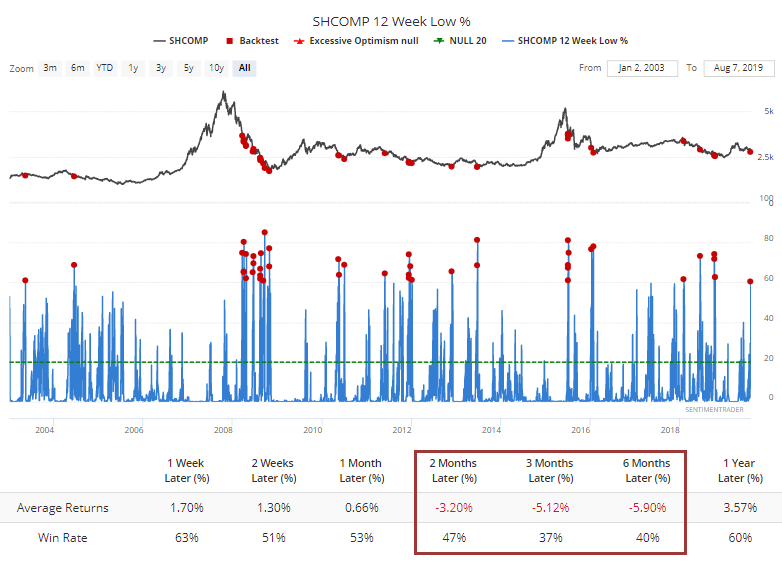

While not quite as extreme, breadth metrics are also showing some heavy pessimism on the Shanghai Composite. Unlike the other indexes, though, investors in the Shanghai have shown a much less consistent tendency to step in during conditions like this.

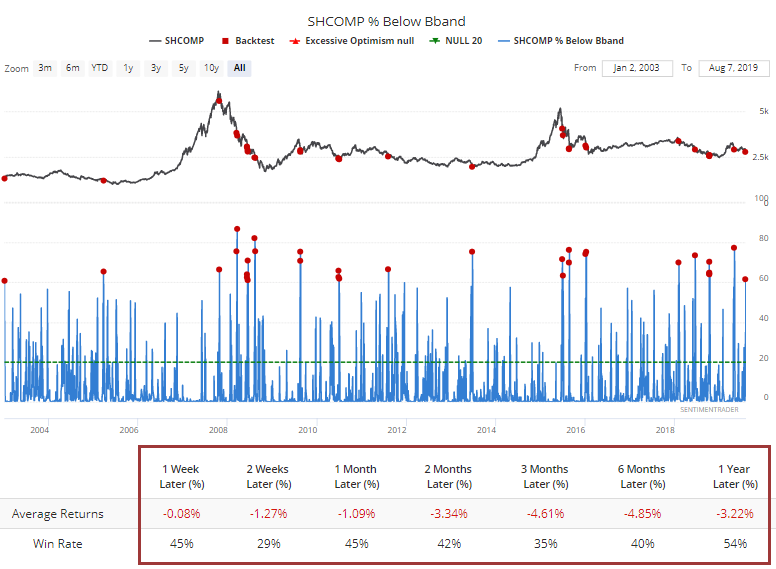

Even when the selling has been so swift and severe that it pushes more than 60% of stocks below their volatility bands, traders have not consistently been willing to buy.

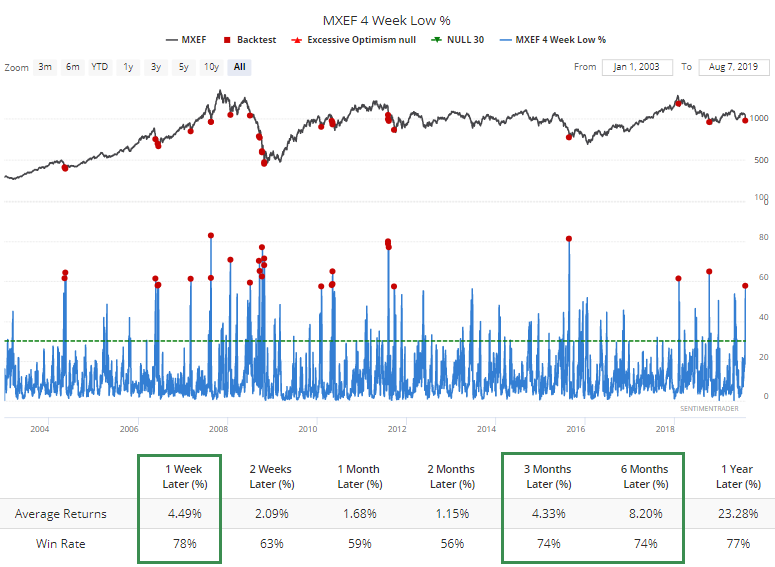

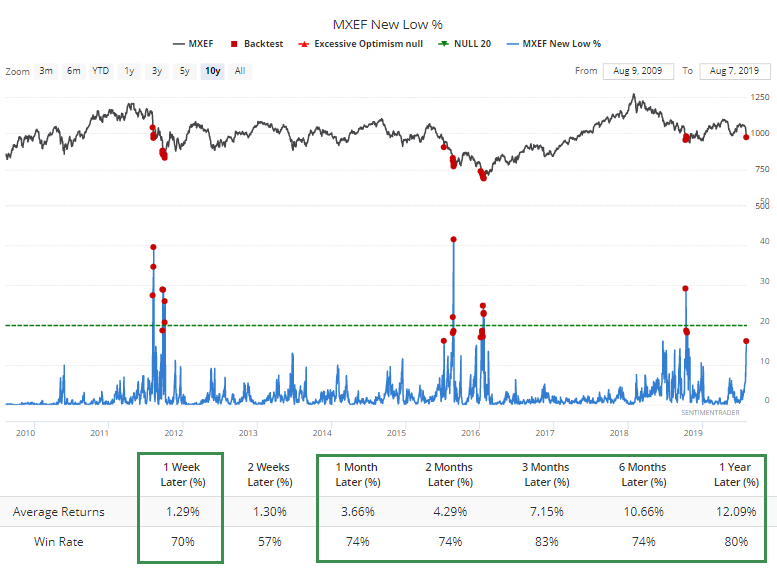

The Asian selling has contributed to a general malaise in emerging markets shares. Nearly 60% of them have sunk to a one-month low. That has been only modestly good for a shorter-term bounce.

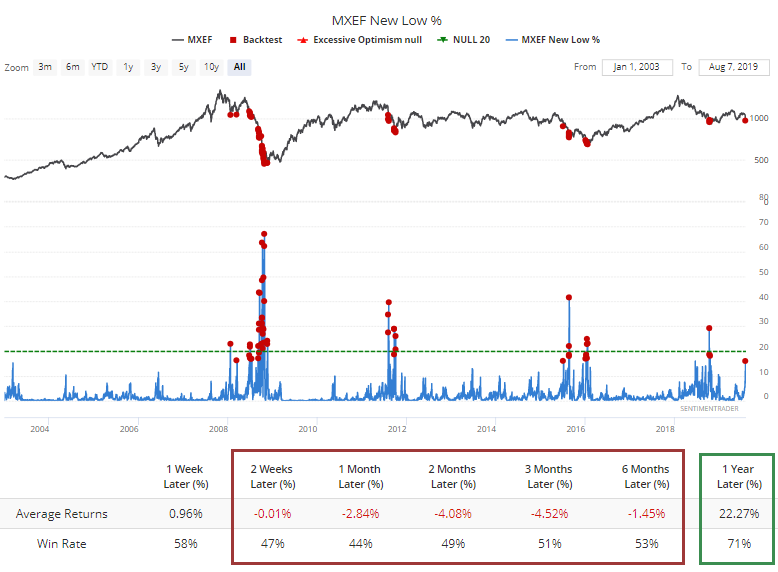

More than 15% of emerging markets stocks have slid to a fresh 52-week low. That's high, but it was high (and higher) during much of the 2008 meltdown.

Zooming in on just the last 10 years, returns were a lot better, but still not perfect.

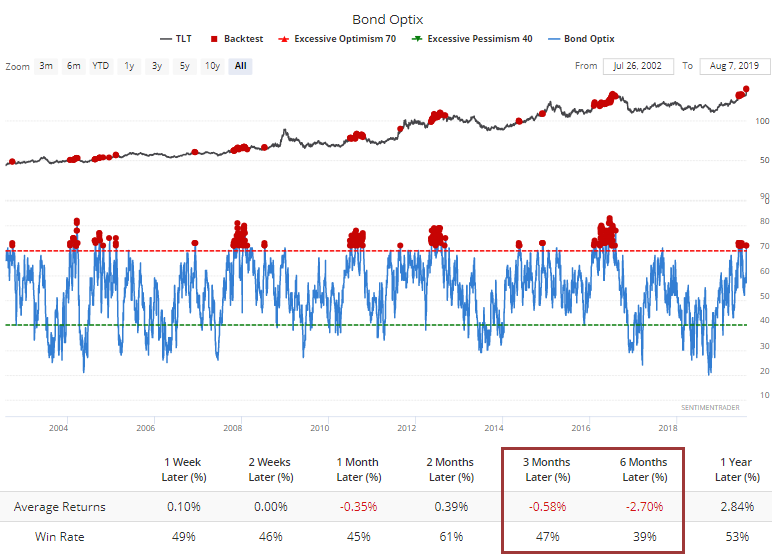

Bond Bonanza

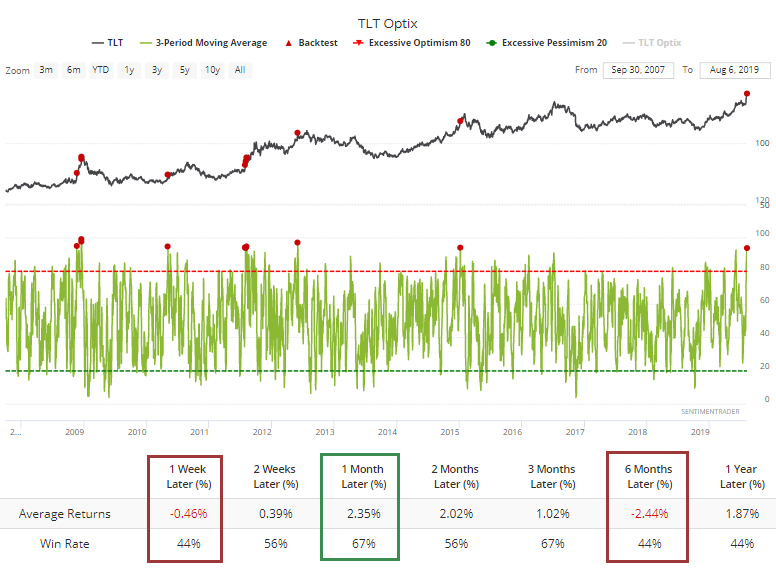

In bonds, the 3-day Optimism Index for TLT has neared 94%, a remarkably high reading last seen in late 2014. It did trigger during a couple of melt-ups, though, so returns were inconsistent.

The longer-term Bond Optimism Index is also very high, though, and that has led to more consistently negative 6-month returns for TLT.