Wednesday Color - Reverval, Outflows, Overseas Surges, Copper

Here's what's piquing my interest so far today.

Reversals

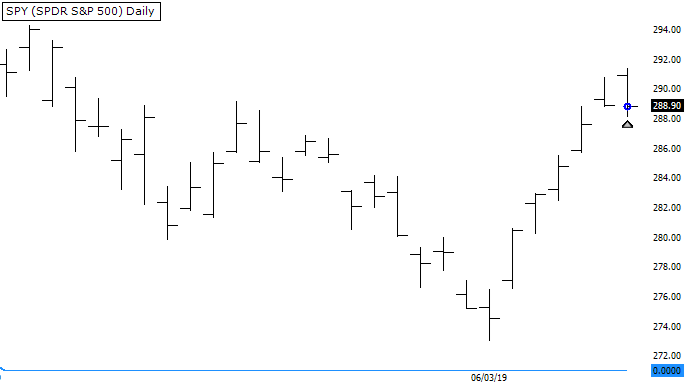

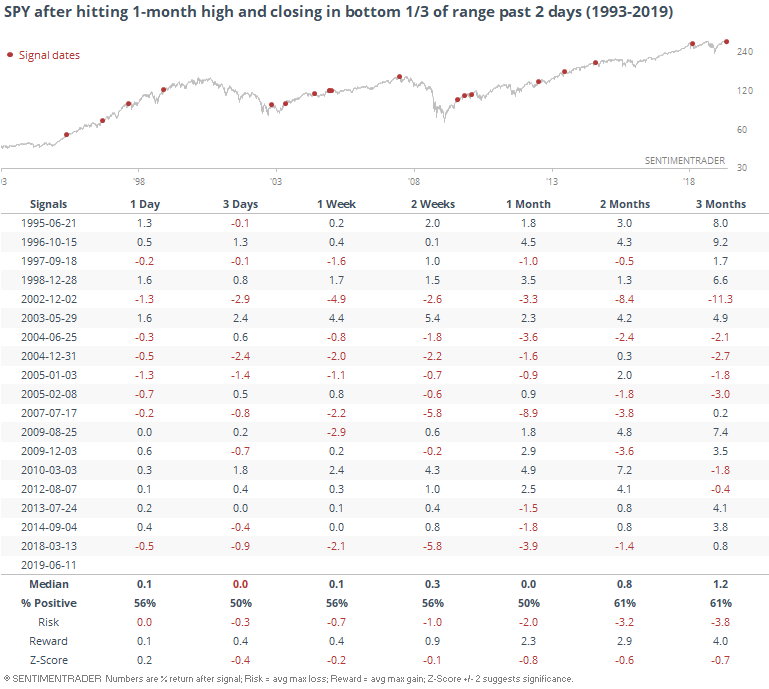

Yesterday I made a brief mention of the reversal pattern over the past two days, where SPY hit its highest level in a month intraday but reversed to close in the bottom third of its range both days.

For those wanting more detail, here are SPY's returns going forward. The worst was 4 days later (not shown) but we can see from the table it wasn't necessarily a rally-killer. Generally weak returns, though.

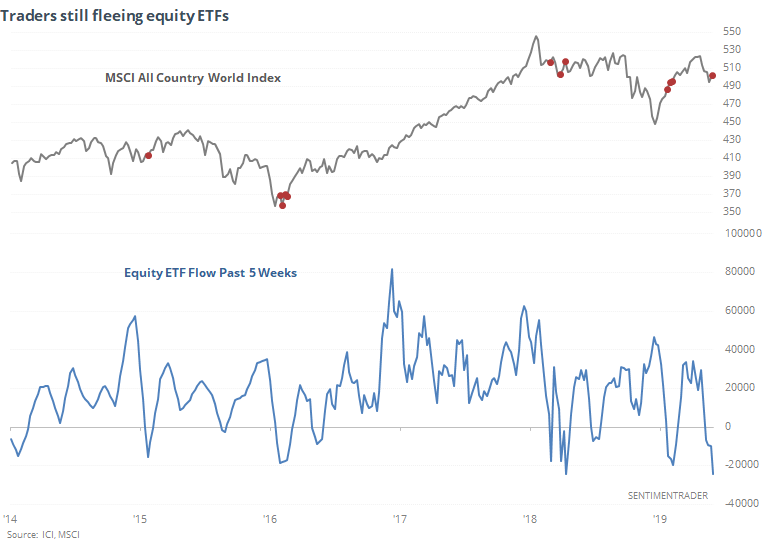

Fleeing Funds

According to the Investment Company Institute, traders continued to flee equity funds as stocks struggled into early June. All equity ETFs lost nearly $9 billion in assets, bringing their total outflow to more than $24.5 billion over the past five weeks, a new record.

Other times that funds lost more than $15 billion over a 5-week span mostly proved to be a contrary indicator.

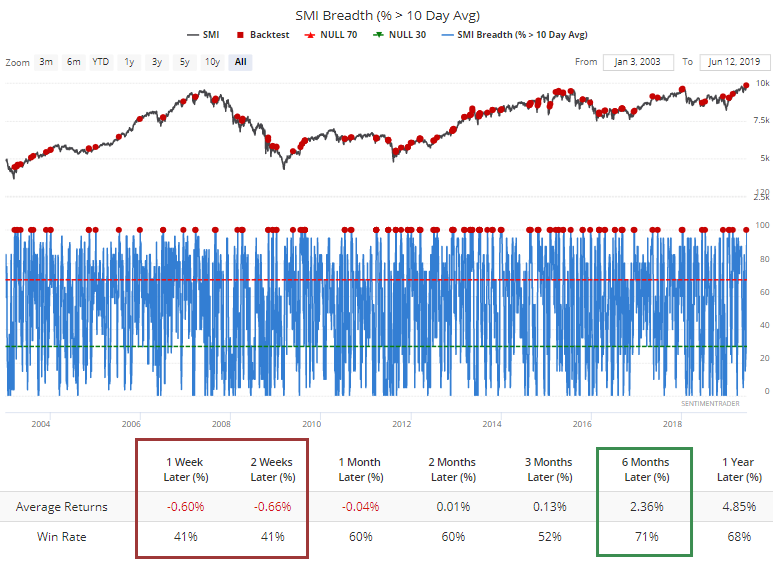

Breadth Review

Despite the week of gains, most breadth readings in the major U.S. indexes and sectors are relatively neutral or at only minor extremes. It's in the overseas indexes that some standout readings have triggered.

Every stock in the Swiss SMI index jumped above their 10-day moving average, typically leading to some short-term digestion of the gains.

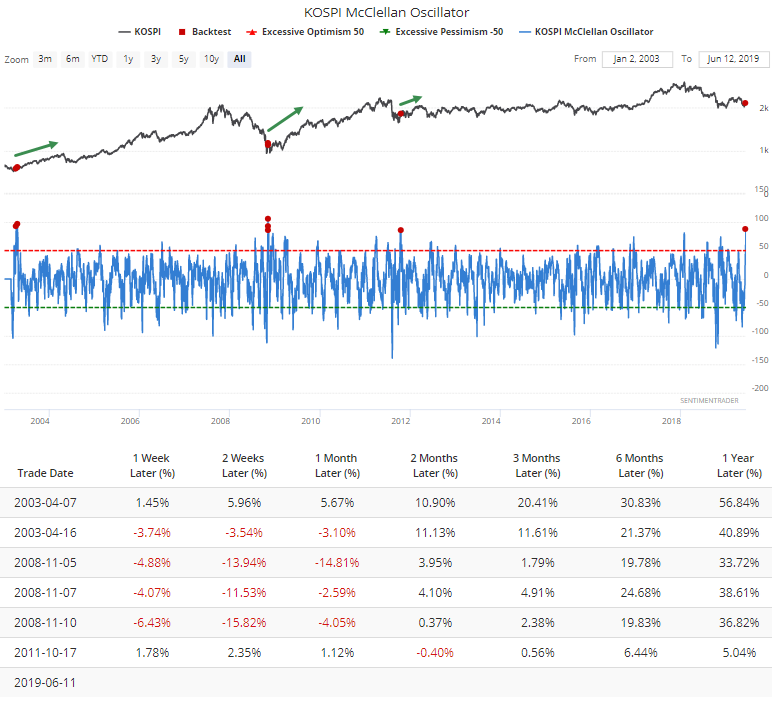

Korean stocks have enjoyed an immense change in character, enough to push the McClellan Oscillator above 85 for one of the few times in the past 17 years. While shorter-term whipsaws were the norm, the only 3 times this triggered led to large medium- to long-term gains.

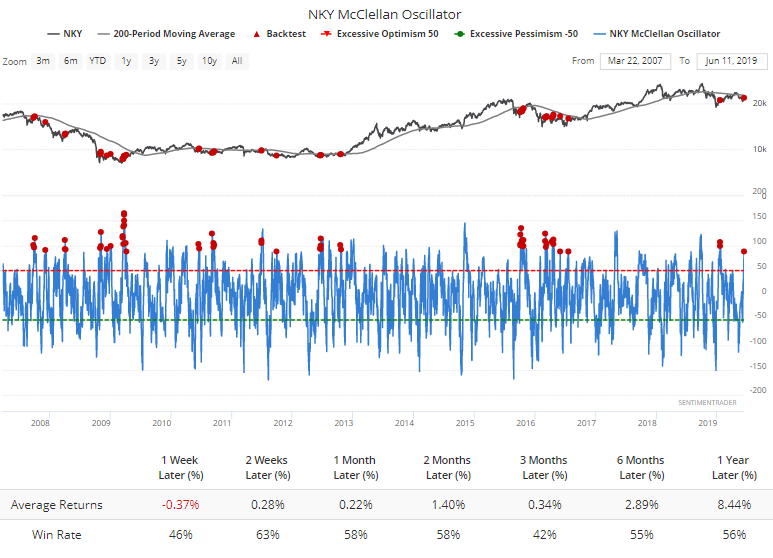

We're *not quite* seeing that on the Nikkei, where there has been a big jump in the Oscillator despite the index holding below its 200-day average. This has come near the beginnings of some nice recoveries, but it's quite enough of a thrust to be highly confident of it.

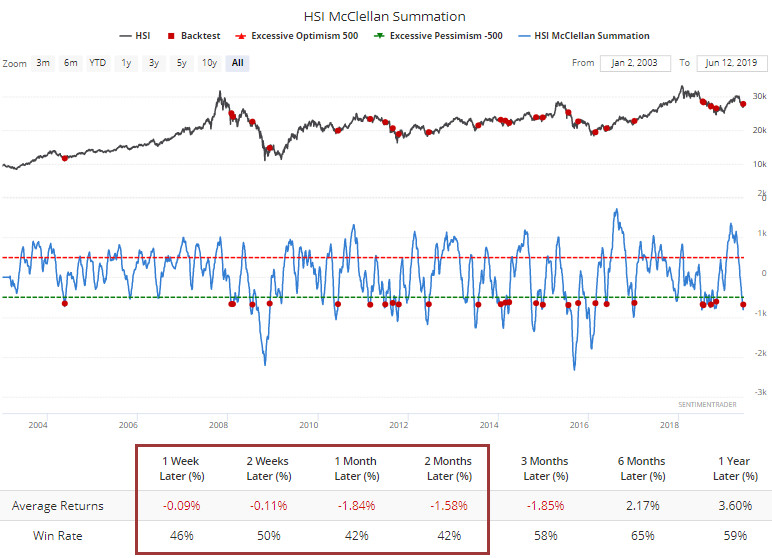

Stocks in Hong Kong have been hit pretty hard, and the McClellan Summation slid to on oversold reading. It has rebounded in recent days and managed to climb above -700.

These initial curls higher have typically led to some fall-back.

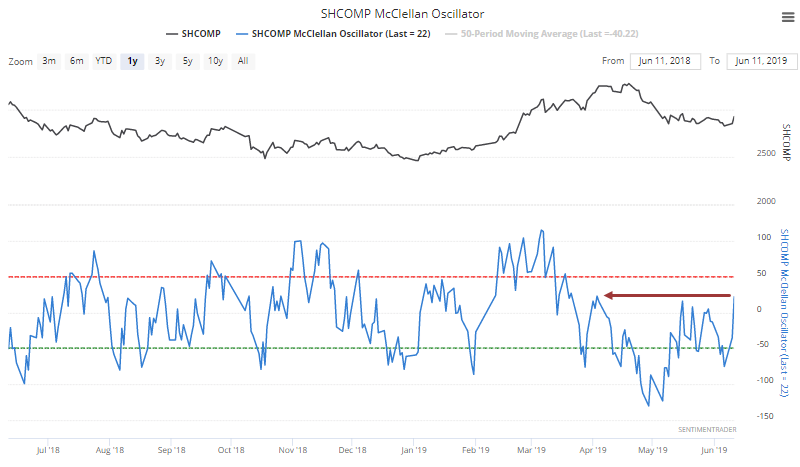

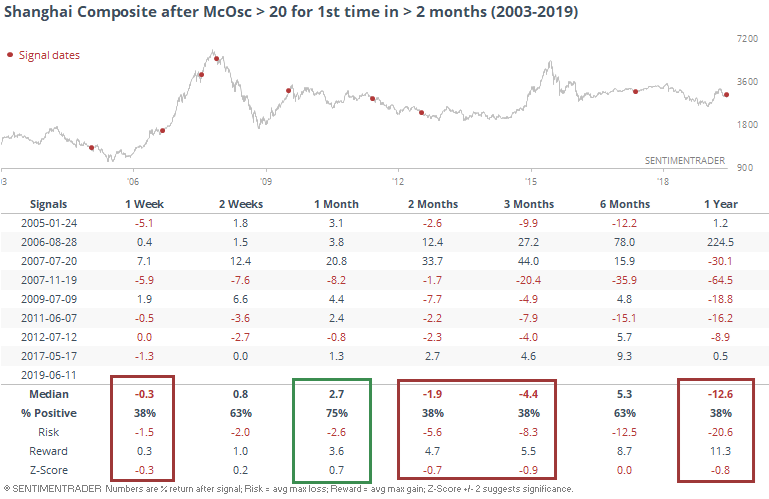

Chinese stocks also saw a thrust higher, and the Oscillator is above 20 for the first time in more than two months.

That's led to a pretty tough slog over most time frames.

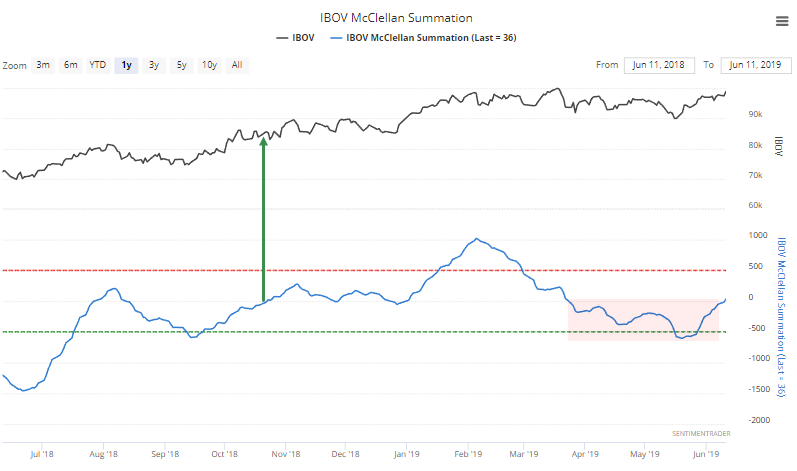

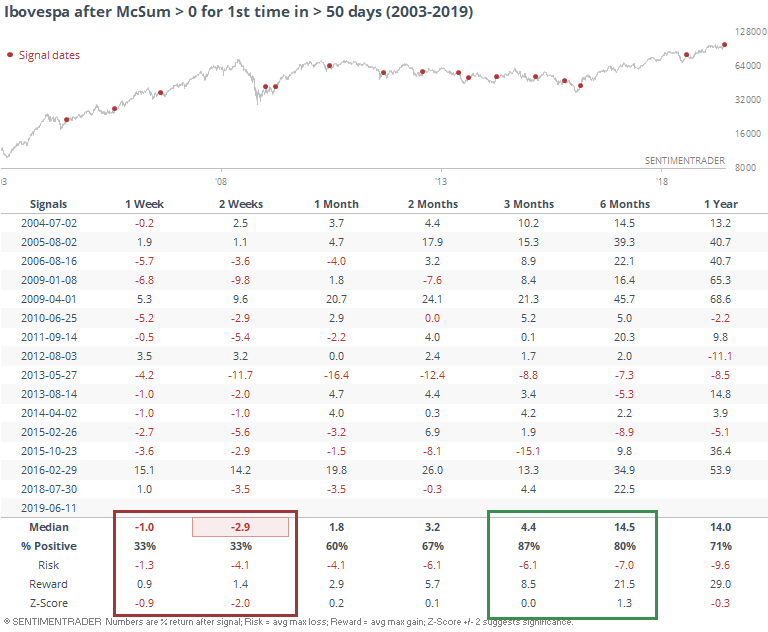

Brazilian stocks have marched steadily higher, and its Summation Index finally crossed above the zero line. That indicated a longer-term recovery in 2018 after some shorter-term volatility.

That seemed to fit the pattern. Historically, a climb back above the zero line after at least 50 days below led to weak short-term returns but consistently positive medium- to long-term ones.

Copper

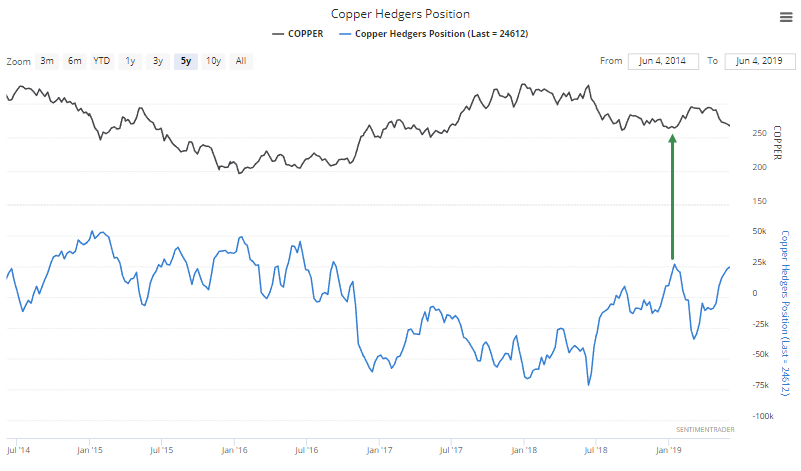

While hedgers have been busy selling gold aggressively, they are much more constructively positioned in silver and copper. They recently held a net long position in silver for one of the few times in history, and they're net long copper, as well.

It's not nearly as unusual in copper as it is in silver, and the last time they were long by this much, copper formed at least a shorter-term bottom (they got quite a bit long during the 2015 drop, though).

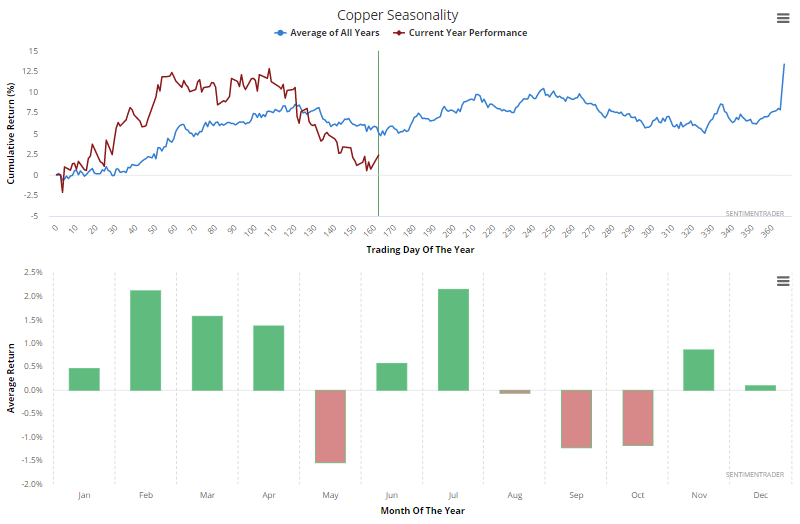

One of the interesting things about this setup is the seasonal pattern. While seasonality is an iffy thing, copper has adhered to its typical ebbs and flows well this year, and the metal just hit its seasonal low point.

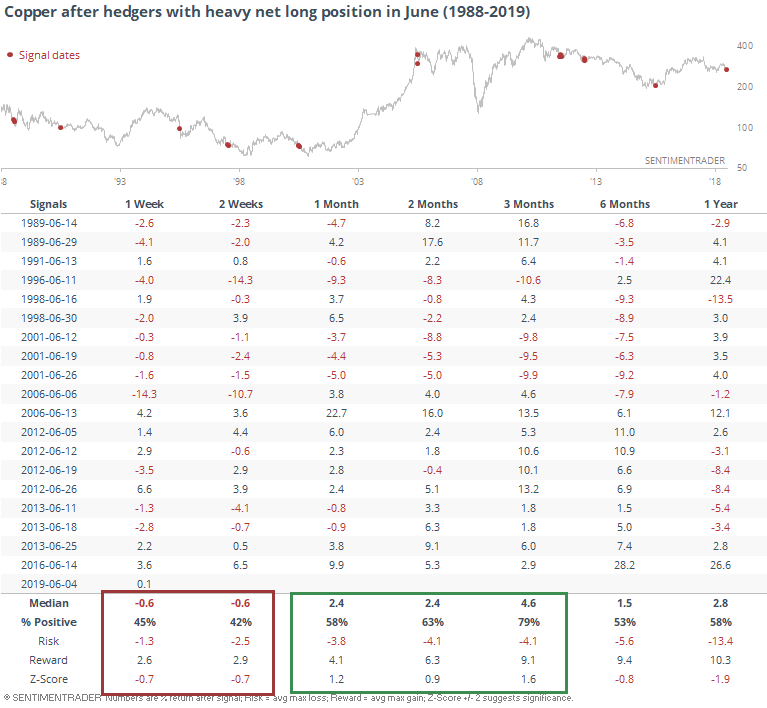

If we combine these two and look for times when hedgers were net long in June, and their position was in the top 75% of the range over the past year, short-term returns for copper were unimpressive, but much better over 1-3 months.

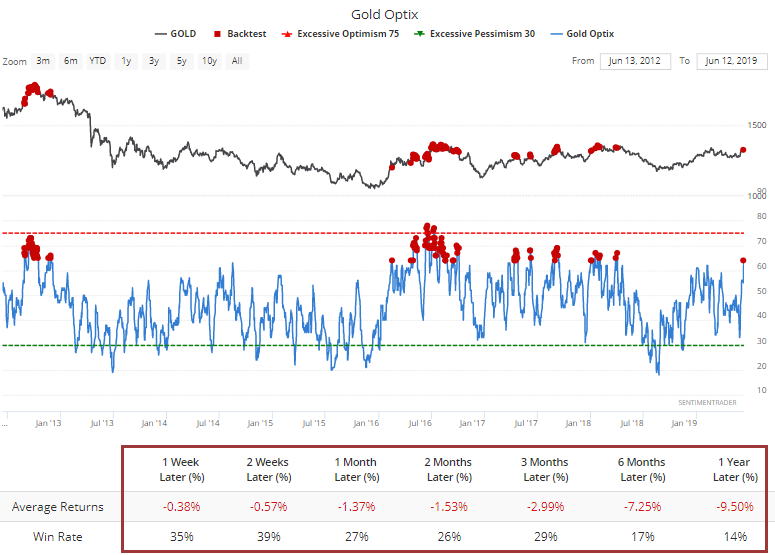

While copper has been languishing, gold took off, and so did sentiment. The Optimism Index is now the highest in more than a year. Since the metal peaked more than 7 years ago, readings this high have led to a poor risk/reward setup. Gold bugs better hope this is one of those "this time is different" inflections.

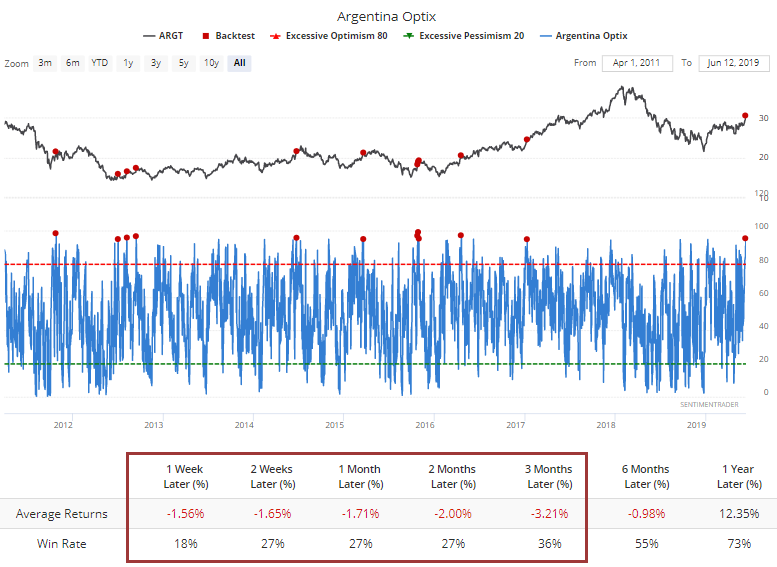

Argentina

Investor enthusiasm over a political appointee helped to fuel a big rise in Argentinian stocks. The Optimism Index on the ARGT fund surged above 95 for one of only a handful of times in its history. Short-term pullbacks were the norm.