Weakness in economic data

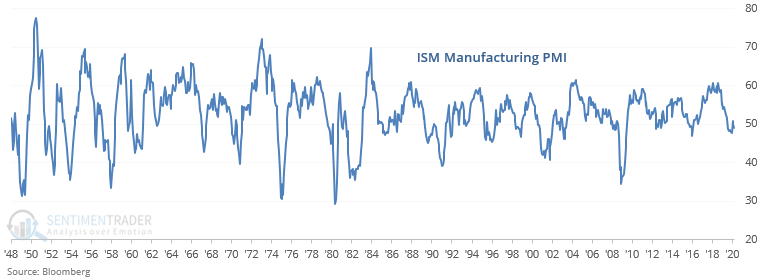

While the ISM manufacturing PMI indicated contraction for March, the figure wasn't as low as I had expected. This is mostly due to the fact that supplier delivery times increased. Without this increase, the ISM PMI would have been lower:

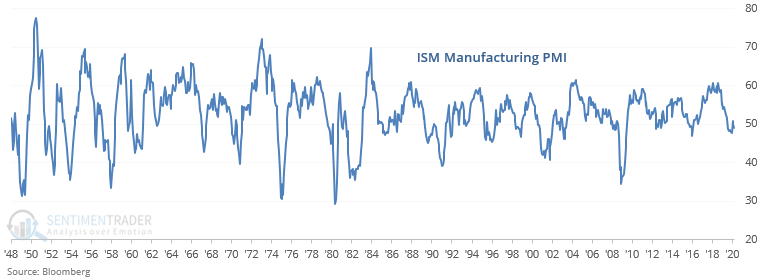

6 of the past 8 months have seen PMI in contraction. When manufacturing faced a prolonged period of weakness in the past, the S&P's returns over the next year were more bullish than usual. The range of outcomes varied significantly since this could happen in the beginning, middle, or end of a recession.

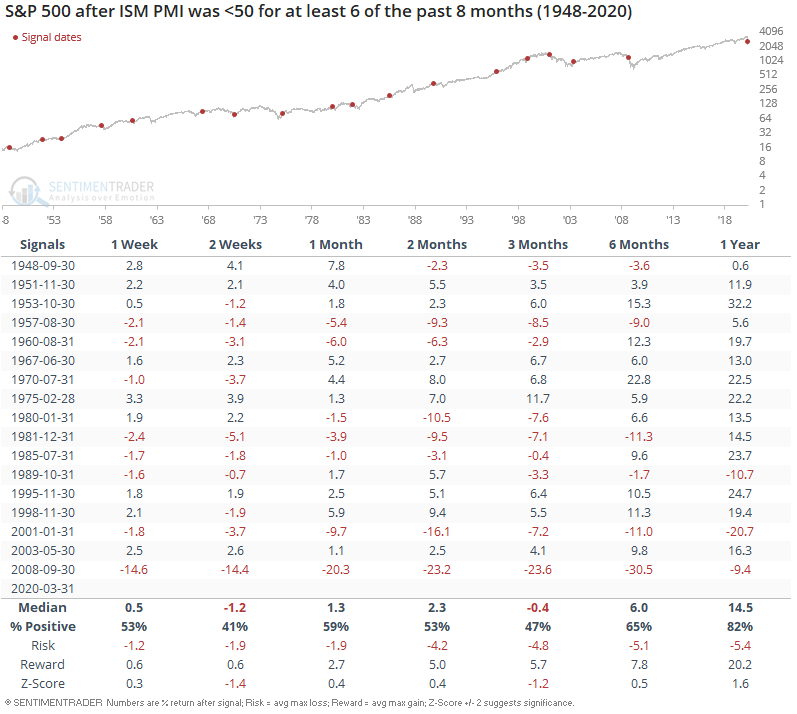

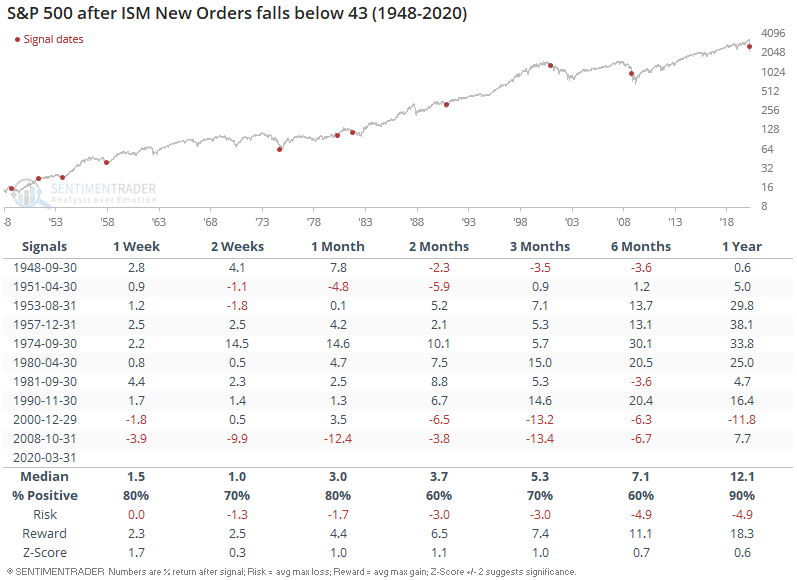

It's clear that the picture is gloomier if we look at ISM New Orders, which fell to the lowest level since the last recession:

When ISM New Orders were this low, the S&P almost always went up over the next year. The single biggest failure came in December 2000 when this happened just as the S&P started to fall into a major bear market:

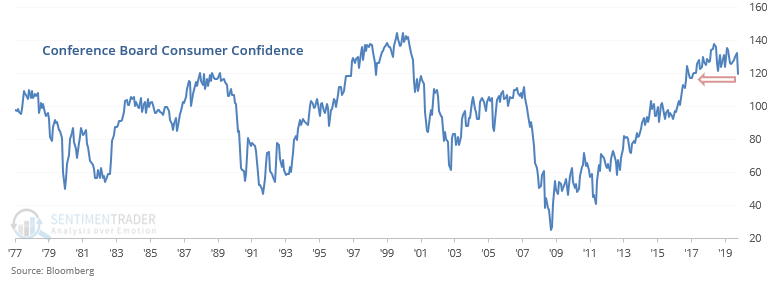

Consumer Confidence is also dropping, with the Conference Board's gauge falling to a multi-year low:

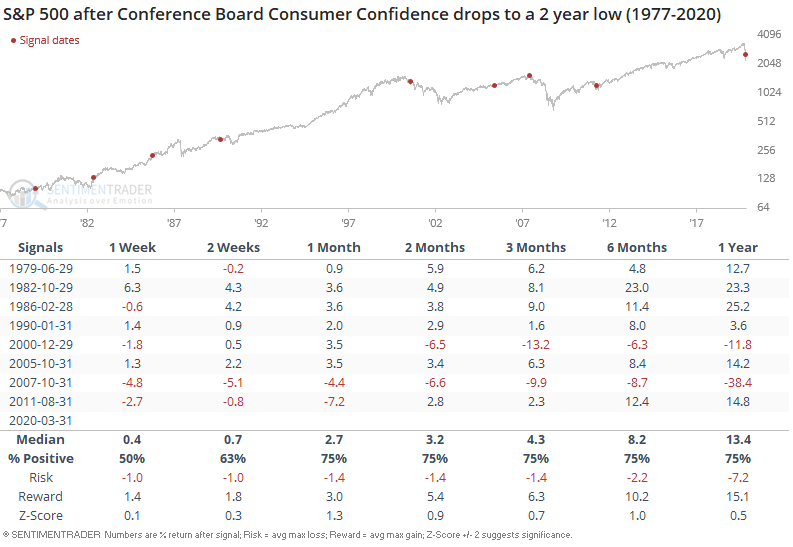

When this happened in the past, the S&P's returns over the next 6 months were slightly more bullish than usual

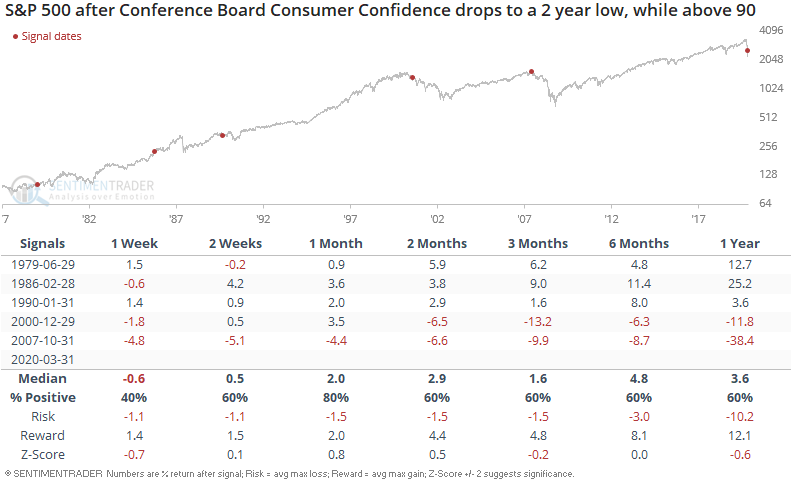

But if we only take into account cases when Consumer Confidence was still elevated (i.e. had more room to fall), the S&P's forward returns were less optimistic. This happened in 2000 and 2007. Prior to that, this happened a few months before the U.S. economy tipped into a recession in 1990.

Overall, I don't have much confidence in using economic data to predict the stock market right now. As I said yesterday, this recession is so different from previous recessions that using historical recessions as a playbook doesn't make much sense.