Watch This for a Big Clue About the Shanghai's Potential

Never short a dull market, that's what the textbooks tell us.

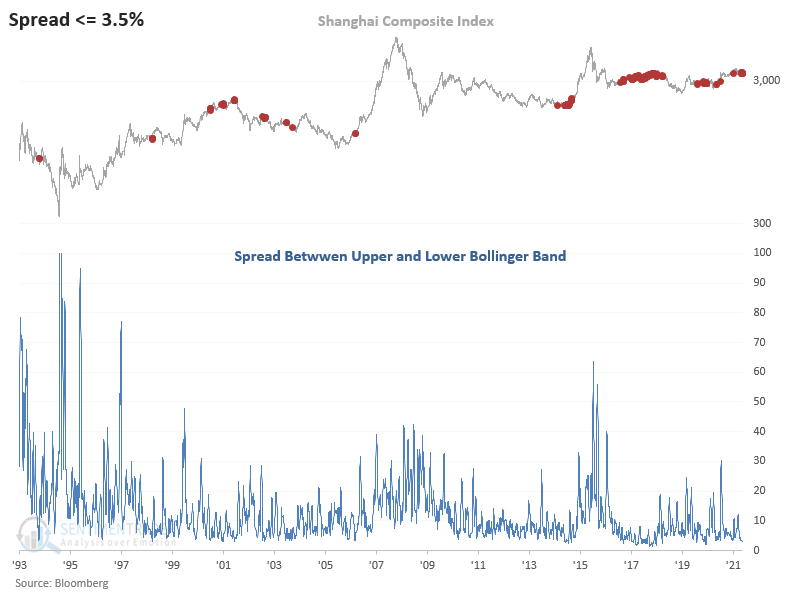

If that's the case, then we shouldn't be short Chinese stocks, because it doesn't get much duller than this. The Shanghai Composite (SHCOMP) has entered a low volatility consolidation phase that would suggest a future breakout swing trade opportunity.

The Bollinger Band Breakout system seeks to identify low volatility that sets up a future breakout. When the spread between Bollinger Bands, a measure of volatility relative to recent history, is less than 3.5%, and then Shanghai breaks out within 10 trading days, which way it breaks had a big impact on future returns.

Consider the table below:

| Breakout Direction | 3-Month Return | % of Time Positive |

| Up | +3.2% | 71% |

| Down | -2.6% | 38% |

There was a stark difference in the Shanghai's forward returns depending on which way it broke out of its volatility consolidation. Traders should pay heed to which way these stocks break in the short-term to get a big clue on the bias for the next several months.

| Stat Box Thanks to a late-week rebound, 48% of Nasdaq 100 stocks were in correction mode, down from 62% earlier in the week. This is still more than double the 20% of stocks that were in corrections in mid-February. |

What else we're looking at

- Full details following upside and downside breaks in the Shanghai Composite

- Using options for a low-cost way to trade an upside (or downside) break in bonds via TLT