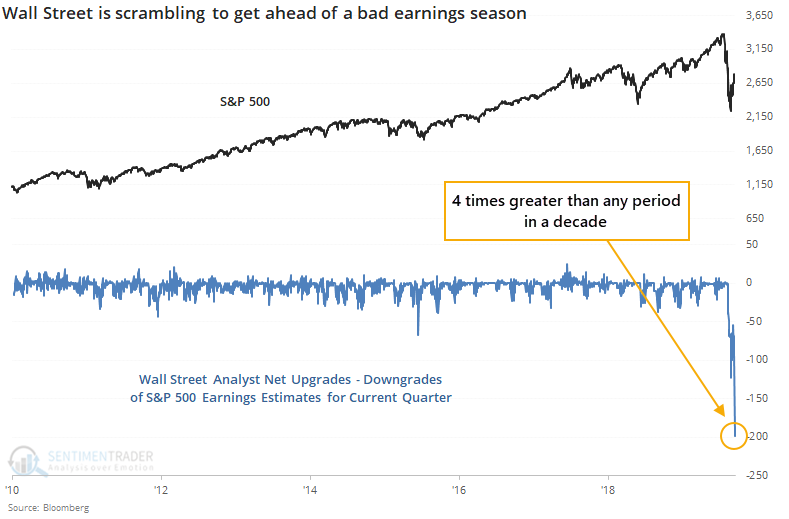

Wall Street's record downgrade deluge

Financial media is ablaze with the idea that this week is going to be an important one for investors. We'll be getting our first real glimpse at corporate earnings and how the pandemic has altered the corporate landscape.

Investors are forward-looking; earnings are backward-looking. Even forward earnings guidance and Wall Street estimates are heavily weighted by the recent past.

Based on the latest figures tallied by Bloomberg, Wall Street is scrambling to downgrade just about everything in sight to get ahead of these earnings releases.

When we enter an earnings season following a 30% or more decline in the S&P 500 during the immediately prior off-season, stocks rallied consistently over the medium- to long-term. Because stocks had just suffered massive losses, investors had already baked much of the worst of the coincident recessions and bear markets. Surely, the earnings reports were about to be terrible, but investors already knew that and were trying to look around the corner about what the prospects were once the economy recovered.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- S&P 500 returns during and after the 1st earnings season during a new recession

- S&P 500 returns during and after the 1st earnings season during a new bear market

- S&P 500 returns once earnings season starts and stocks already sold off more than 30%

- A close look at how much stocks retraced following an initial breadth surge

- The Liquidity Premium traders showed for ETFs is wearing off

- A 3-week "everything rally" across global equity indexes

- The "everything rally" included other assets, too