Wall Street strategists stay put as index roars

Earlier this week, we saw that as companies start to report Q1 earnings results in earnest, Wall Street analysts have been busy upgrading their estimates and price targets.

Analysts tend to work from the bottom up (fundamental earnings outlooks, company management quality, etc.), while strategists on the Street tend to work from the top down (macroeconomic principles, fiscal and monetary analysis, etc.). And those top-down outlooks haven't been able to keep up with stocks' torrid pace.

The S&P 500 is now above the median strategist year-end price target...and it's only April.

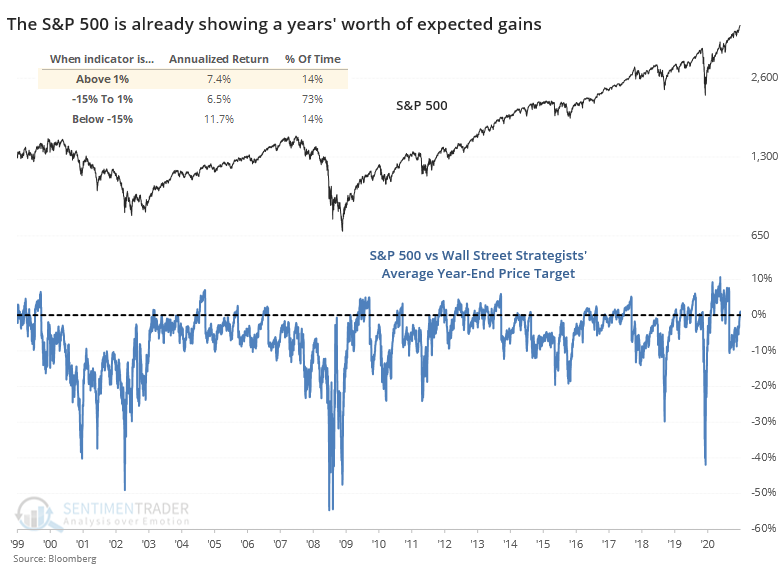

We've looked at this many times over the years, with the best opportunities coming when the S&P was 20% or more undervalued relative to strategists' price targets. When it gets more than 5% overvalued, then it has tended to pause and let strategists catch up.

We're not there yet, as the index is only about 1% above its average target price. This level of excess has led to an annualized return about in line with random, even a bit above.

The more this travels above 0, the harder it gets to reach an even greater extreme, because strategists are more likely to upgrade their price targets the further the rally goes. That's why it cycles like it does, as professionals adjust their expectations based on current trends, much like the Economic Surprise Index.

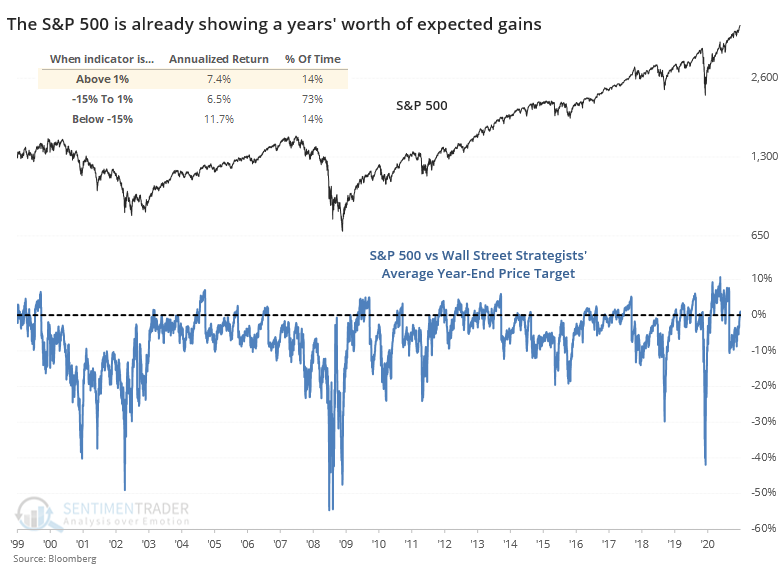

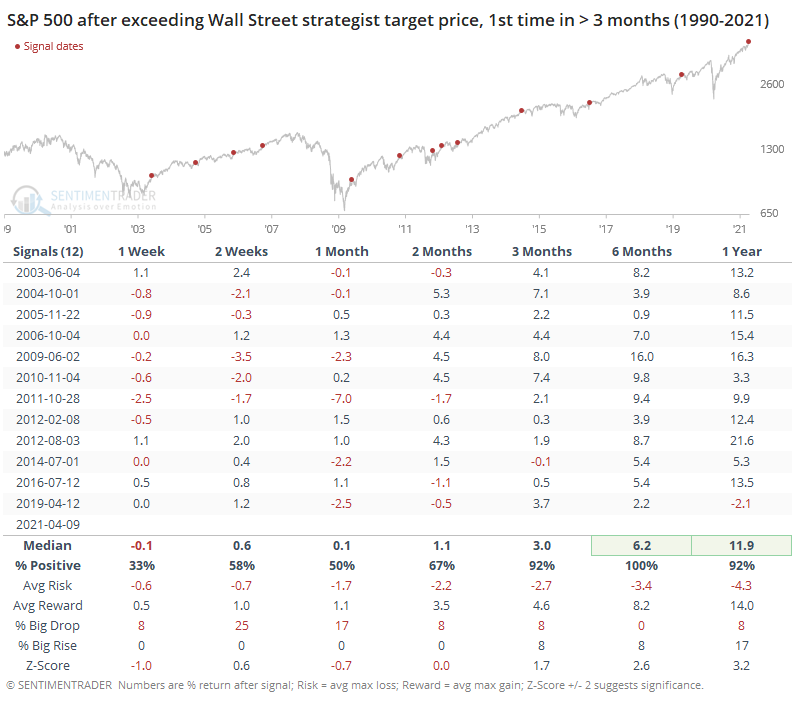

The current minor overvaluation is coming after several months of the index trading below strategists' average price target. Below, we can see forward returns once it first exceeds its year-end price target after several months.

It's more common to see this happen later in the year. Only 2 out of the 12 signals triggered before June, not including the current one. The only other years when it triggered early in the year like this, in 2012 and 2019, the S&P had some trough holding its gains over the next 1-2 months. The usual caveats apply with such a tiny sample size.

Over the next 3-12 months, there were almost no losses and none of any consequence. This is not all that surprising given that it shows impressive momentum from the index, and impressive momentum tends to lead to positive medium- to long-term returns.

Shorter-term, it's more of a (minor) worry.