Wall Street looks set to party in '21

This is the time of year to be thankful for what we have, make resolutions for improvement, and update our price targets for the S&P 500. Okay, maybe not that last one for most of us, but it's a must-do for many strategists on Wall Street.

According to the latest Bloomberg tally of prominent strategists on the Street, they're expecting the S&P 500 to gain a further 10% in 2021, a big jump from recent surveys.

We've looked at this many times in the past, and an expected gain of around 9% is pretty typical, no matter what the market did in the current year. Still, a 10% jump for the next year is a bit aggressive.

Whatever the reason, it's among the biggest jumps that strategists have ever priced in by mid-December. Other times they foresaw a big gain for the following year, the next 1-3 months were spotty. One of them showed a mild gain, while the other followed through very well on those positive expectations.

If we contrast to those years when strategists were the most conservative with their estimates, then we can see that there was a stark difference in forward returns.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Full returns when Wall Street strategists near year-end with big gains estimated for next year

- What happens when strategists have the opposite sentiment, too

- Analysts on the Street have also become extremely optimistic on the stocks they cover

- The enthusiasm is matched by Twitter users, with extremely optimistic Social Sentiment on SPY, QQQ, DIA, and IWM

| Stat Box Oil rallied 4 days in a row to reach a multi-month high. Going back to 1985, the probability that it can extend that winning streak to 7 days is only 9%. Its probability of going 10 in a row is exactly 0%, based on its historical behavior. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

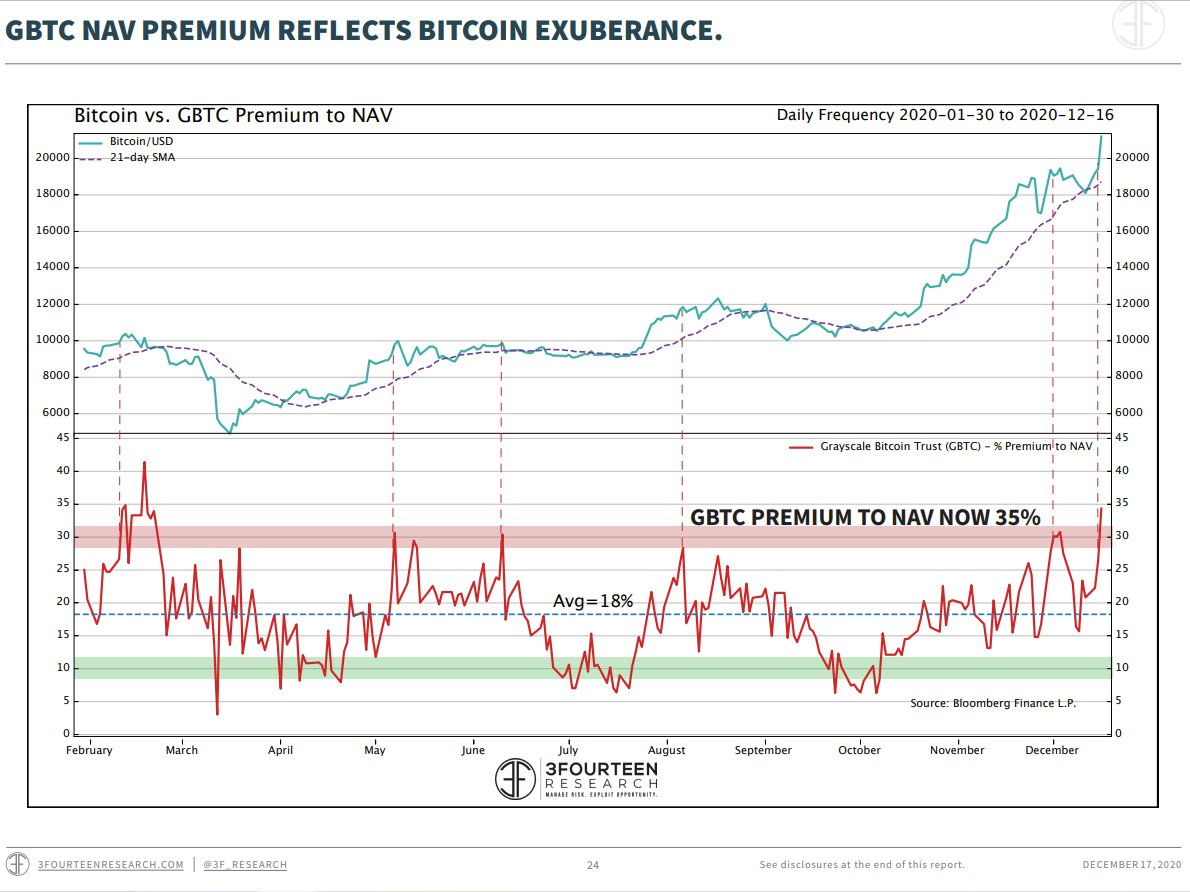

1. Crypto currencies have become easier for the layperson to buy and sell, but some still prefer to get their exposure through funds, like GBTC, the Grayscale Bitcoin Trust. When demand is high, assets pour in, and the fund trades at a premium to its underlying net asset value. Like right now. [Bloomberg and 3Fourteen Research]

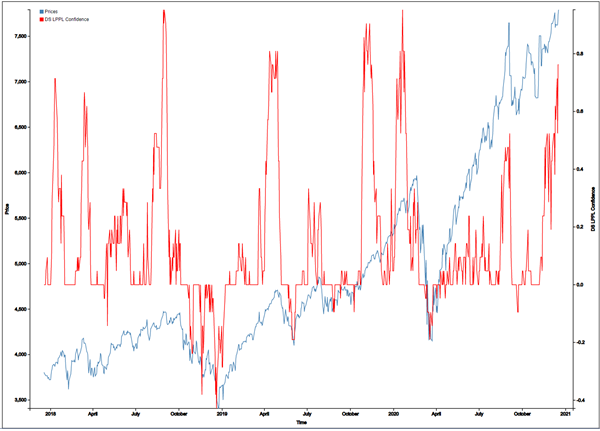

2. The risk that technology stocks are in "early bubble" territory have jumped in recent days. [Financial Crisis Observatory]

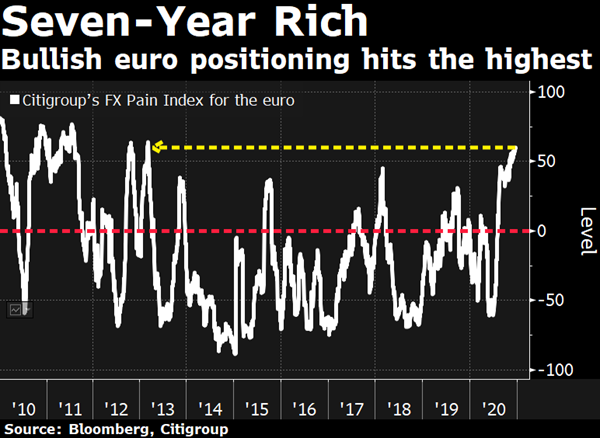

3. Traders are heavily positioned for a continued rally in the euro. Like really, really heavily. [Bloomberg TV]