Wall Street has never been more confused

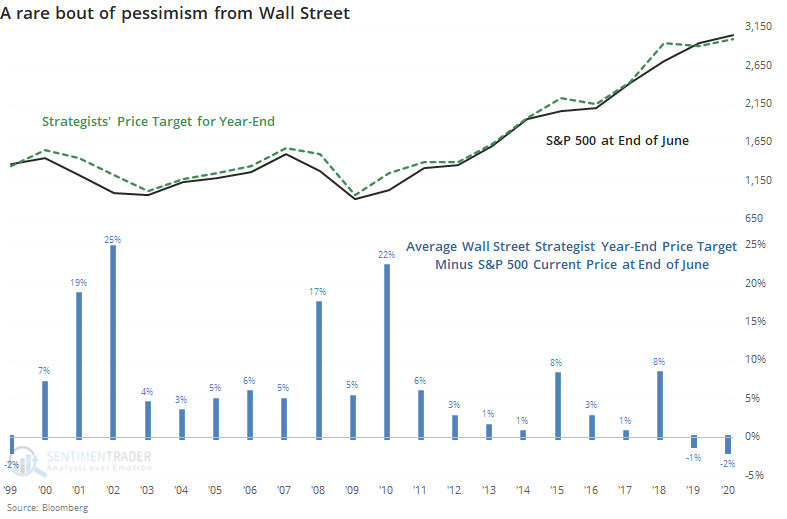

Wall Street has never been more confused, or apprehensive. Even while analysts have been upgrading price targets from the bottom up, strategists have hesitated to raise their price targets from the top down.

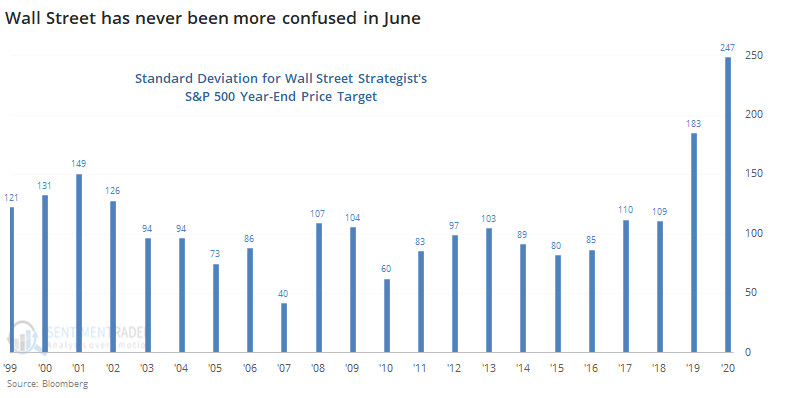

Bloomberg notes that there is a wide disparity in where strategists think the S&P 500 is going to end the year. Indeed there is - the standard deviation among year-end price targets at the end of June has never been wider, by a long shot.

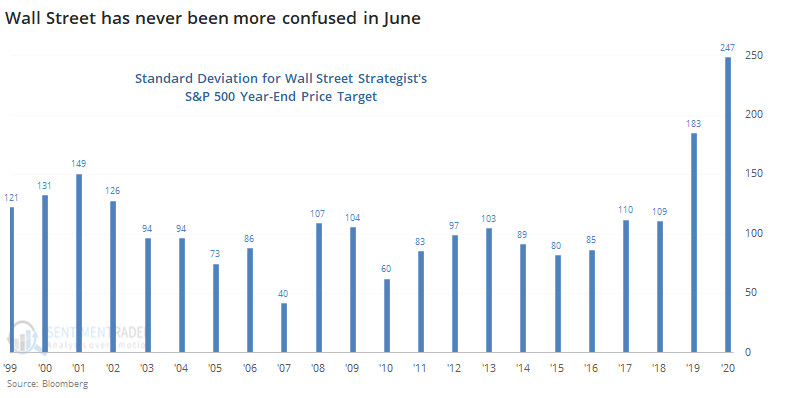

That's somewhat misleading since it uses the raw price level, and the S&P has rallied significantly over the past 20 years. Expressed as a percentage of the S&P's price at the end of June, the standard deviation among year-end targets is still the highest since 2009.

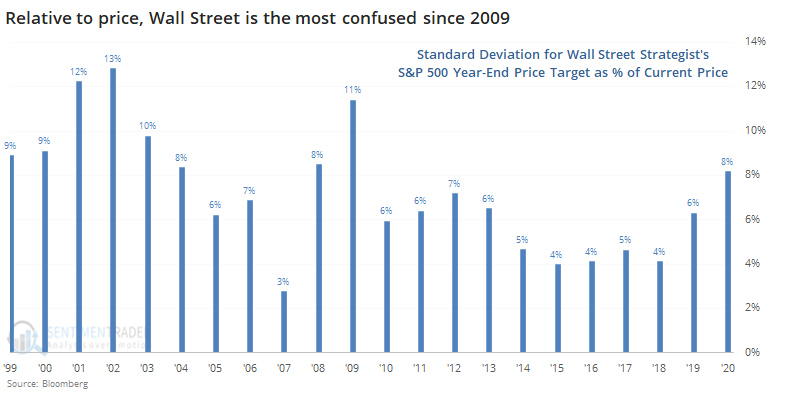

What's even more notable is that strategists aren't giving the S&P much room to rally. On average, they have a year-end target of 2998, about 2% below where the S&P is trading. That's tied for the lowest-ever year-end target relative to where the S&P was trading at the end of June.

Strategists by nature are optimists, so it's highly unusual to see them with such a low opinion of where the S&P should go over the next six months.

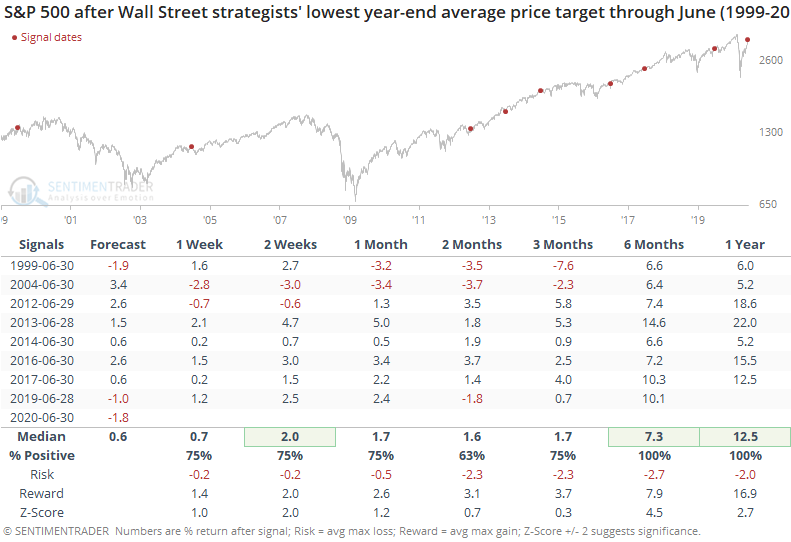

Below, we can see every year when strategists had the lowest year-end price forecast relative to where the S&P was trading at the end of June, and how the S&P fared in the months ahead.

This was a good sign. While the medium-term was mixed-to-positive, the next 6-12 months were invariably bullish. The S&P returned an average of more than 7% over the next six months, roughly July through December. Every signal saw a return of at least 6.4% and was remarkably consistent, which is why the z-score is so high even with a small sample size.

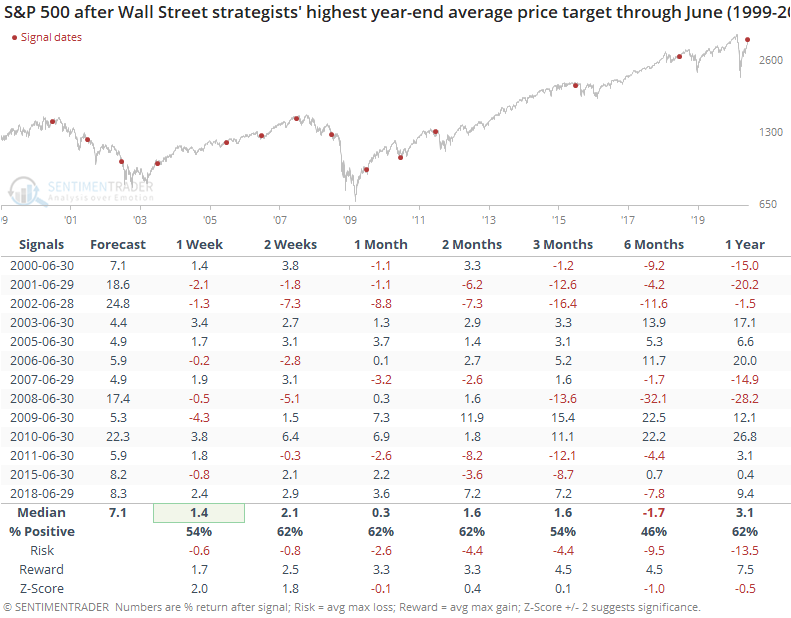

When we contrast that to years when strategists were the most optimistic, there is a stark difference in returns.

During those years, the S&P returned an average of -1.7% through year-end, with risk twice as high as reward.

Individually, these folks are invariably smart and well-educated. Like other surveys of smart money or big money populations, though, in aggregate we can sometimes see signs of group-think, and that tends to be a contrary indicator. That's the case here, too.

Even though there is a wide disparity among some of the year-end targets, the overall forecast is very low. And when strategists gave the S&P 500 the least credit this far into the year, it had a strong and consistent tendency to defy those expectations by rallying into year-end.