Wall Street can't keep up with torrid gains in stocks

Wall Street strategists tend to work from the top down, utilizing macro inputs to gauge the likelihood of higher or lower prices. Analysts tend to work from the bottom up, evaluating earnings prospects for individual companies. After a historic panic in March, they've been busy upgrading the price targets on stocks they follow.

Our Backtest Engine shows that when analysts upgraded their price targets on a large number of stocks within the S&P 500, returns in the index over the next three months were poor and consistently negative.

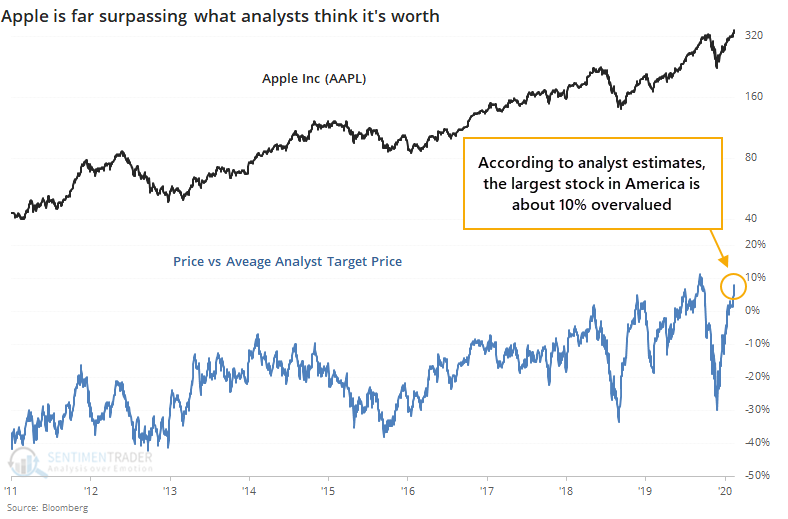

Curiously, they remain tepid on prospects for the largest stock in the U.S. The share price of Apple has run far ahead of where analysts think it should be, indicating that the stock is nearly 10% overvalued.

While this has not been a precise timing signal, when the stock has run this far ahead of analysts, its future returns were mediocre, with short-term gains usually given back during subsequent pullbacks.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Where the S&P 500 is relative to where Wall Street strategists think it should be

- What happens after Wall Street analysts start upgrading a bunch of price targets

- The ratio of cyclical to defensive stocks has just hit a new decade high

- Gamma exposure shows the likelihood of huge overhead selling pressure - what it means for the S&P 500 and the VIX

- Gamma exposure is high even when accounting for overall volume

- The Nasdaq has been above its 20-day average for a long time...too long?