Waiting For A Breadth Thrust; Chinese Investors' Long Slog

This is an abridged version of our Daily Report.

Waiting for a thrust

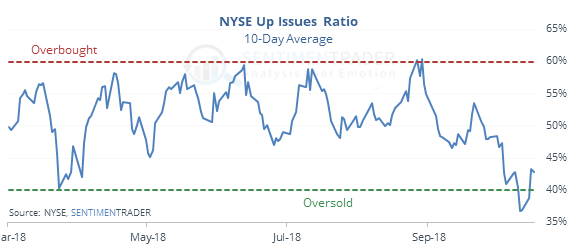

Breadth recent hit a deep oversold reading, now many are looking for an upside “thrust” that signals a return of buying interest.

But waiting for a breath thrust hasn’t worked well in bull markets. Future returns were better, and more consistent, by just buying into oversold. During bear markets, the opposite was the case.

Chinese investors’ long slog

The Shanghai Composite’s decline over the past 100 days is the worst since 2008, as it’s only enjoyed 37 positive sessions during that stretch. It’s also suffering some of its worst breadth in 15 years.

Wall Street analysts are pulling back

Analysts lowered their price target on 27 more stocks than they raised targets on, the most since April. According to the Backtest Engine, when this drops below -25 stocks, the S&P rose 90% of the time over the next two months, averaging 5.2%.

Homey don’t play that

Homebuilders are the most-hated sector. The 20-day Optimism Index on XHB has dropped below 25 for only the 2nd time since the 2009 bottom.