VXX Optix provides another favorable sign for stock traders

Key Points

- VXX is an ETF that tracks VIX futures

- VXX tends to spike higher when the stock market falls hard as VXX traders quickly become more bullish (on the prospect for higher volatility)

- When that optimism among volatility traders wanes, it is a favorable sign for stocks over the next 6-12 months

Spikes in VXX Optix

The VIX Index tends to move inversely to stock prices, so when prices fall, volatility tends to pick up and vice-versa. VXX is an ETF designed to track VIX futures. VXX does not track the VIX Index very closely for technical reasons related to futures pricing. Still, when stock prices fall hard, the VIX tends to spike higher, VIX futures do the same, and so - to some extent - does VXX.

When this happens, VXX traders tend to get very optimistic very quickly - essentially believing that a major stock market decline is just beginning. However, more often than not, that optimism is misplaced. Optimism generally fades quickly, and VIX, VIX futures, and VXX reverse sharply.

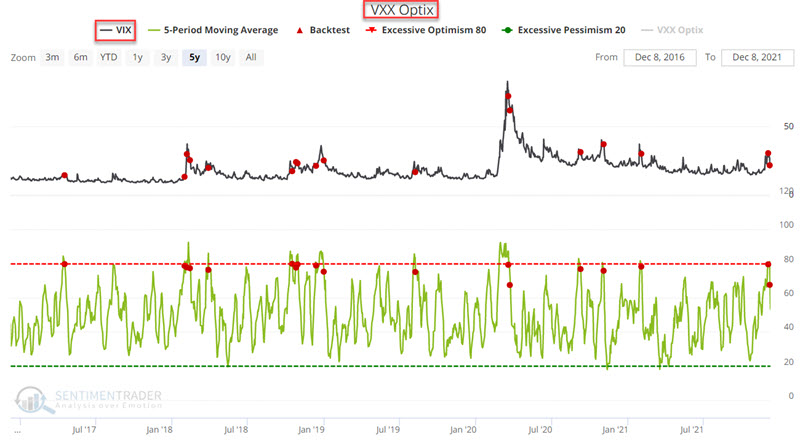

To illustrate, the chart below displays the action of the VIX Index itself following times when the 5-day average of VXX Optix dropped below 80.

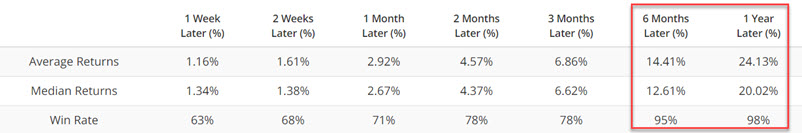

As you can see in the table below, the VIX Index tends to fall hard following these signals. The good news is that the VIX Index "falling hard" is almost invariably associated with higher stock prices.

QQQ and VXX Optix

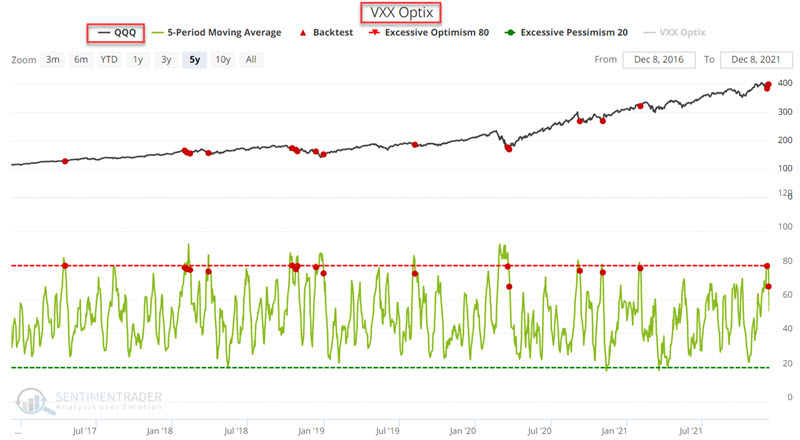

The chart below displays the action of QQQ (which tracks the Nasdaq 100 Index) following times when the 5-day average of VXX Optix dropped below 80.

As you can see in the table below, future six and 12-month results have been quite favorable.

What the research tells us:

In the past ten years (since VXX began trading), reversals in the 5-day average of VXX Optix from above 80 to below 80 have invariably been followed by higher stock prices in the next 6-12 months. There are, of course, never any guarantees that this will continue to be the case. But until proven otherwise, the recent signals on 12/3 and 12/7 offer another reason for bullish stock traders to push on.