Volume worries

The U.S. stock market's rally since March 24 has been accompanied by falling volume. As is the case every time the market rallies and volume falls, people get "worried".

While volume might be useful when it comes to trading individual stocks during breakouts, I don't think it's particularly useful for index ETFs. Volume always falls after a post-crash rally. It's neither bullish nor bearish - it just is.

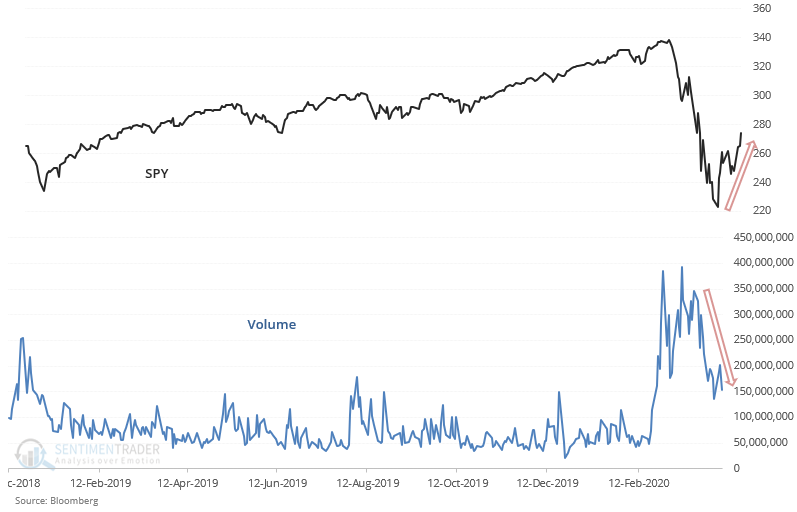

For example, here's SPY vs. its volume.

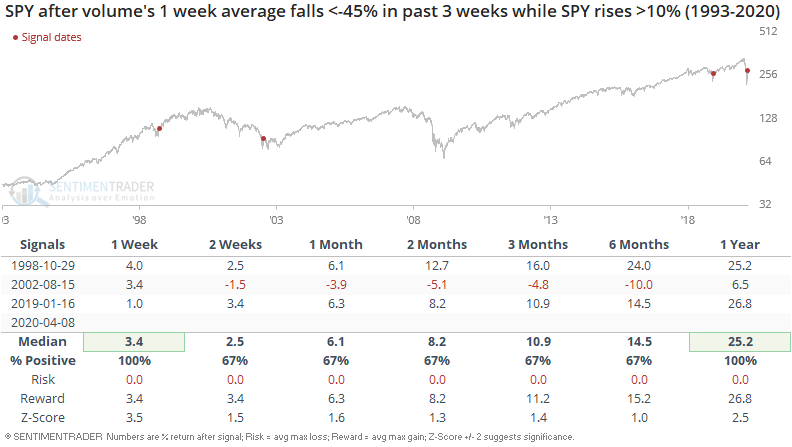

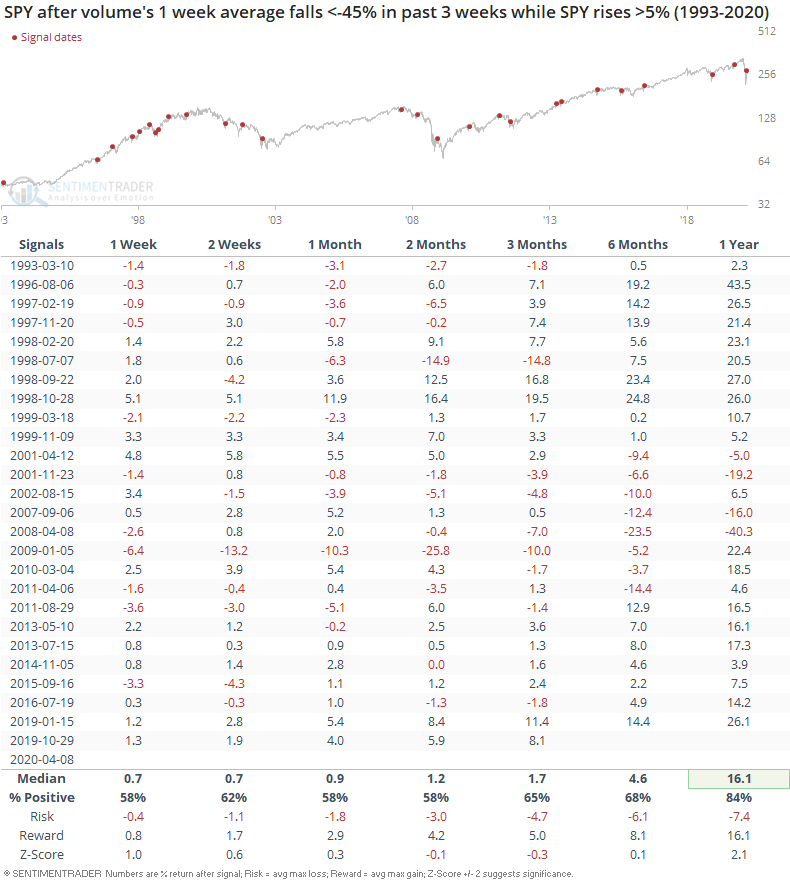

When SPY volume's 1 week average fell more than -45% over the past 3 weeks while SPY rallied +10%, the S&P rallied over the next year. This occurred after the crash of 1998, bear market of 2000-2002, and crash of 2018:

This normal (and somewhat bullish) phenomenon exists even if we relax the study's parameters to increase sample sizes. Once again, the S&P usually rallied over the next year:

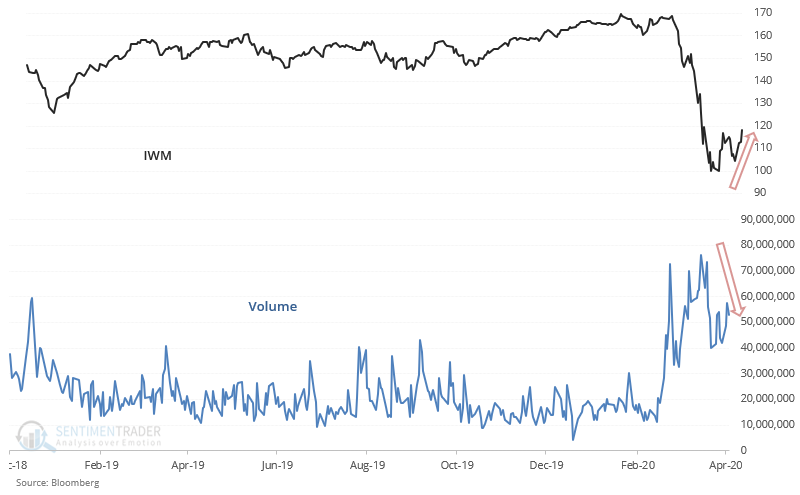

Similar to SPY volume, IWM volume slumped as the Russell 2000 rallied:

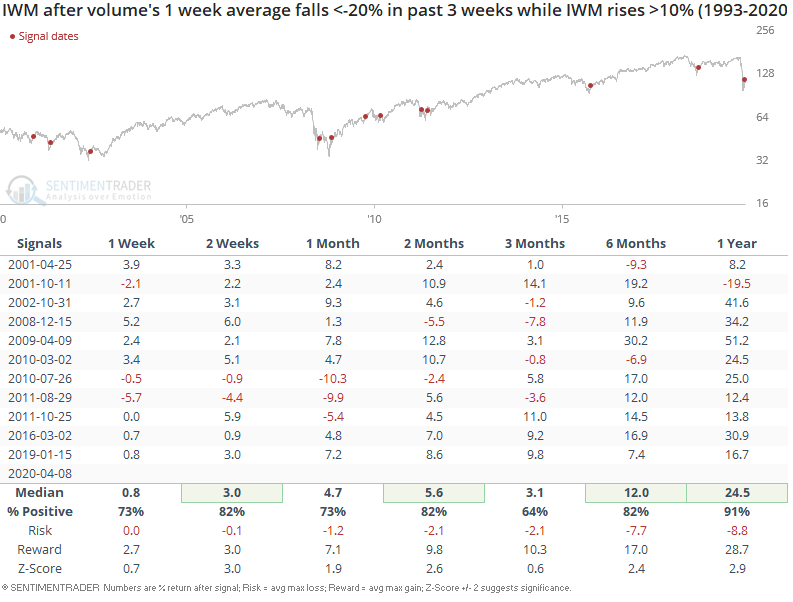

Once again, not consistently bearish for IWM on any time frame.

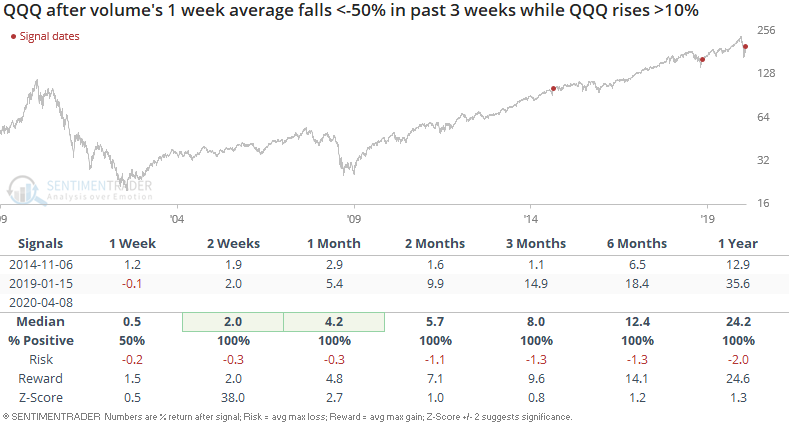

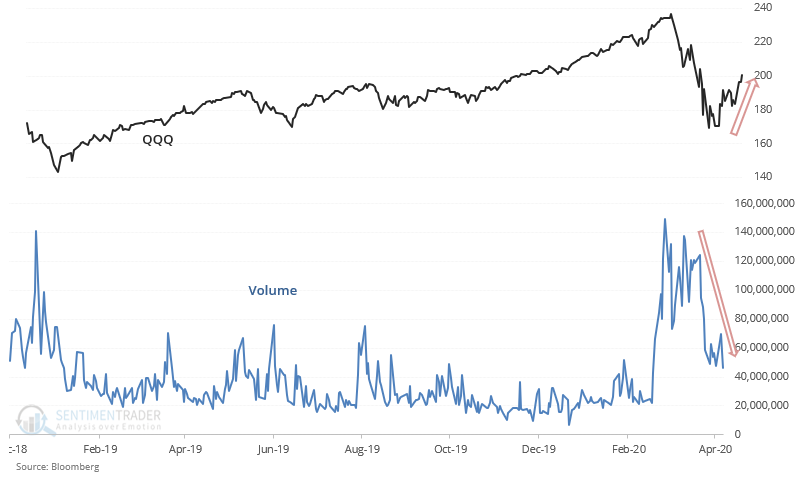

The same can be said about tech. QQQ's volume has plunged as QQQ rallies:

This wasn't consistently bearish for QQQ: