Volume pops as volatility drops

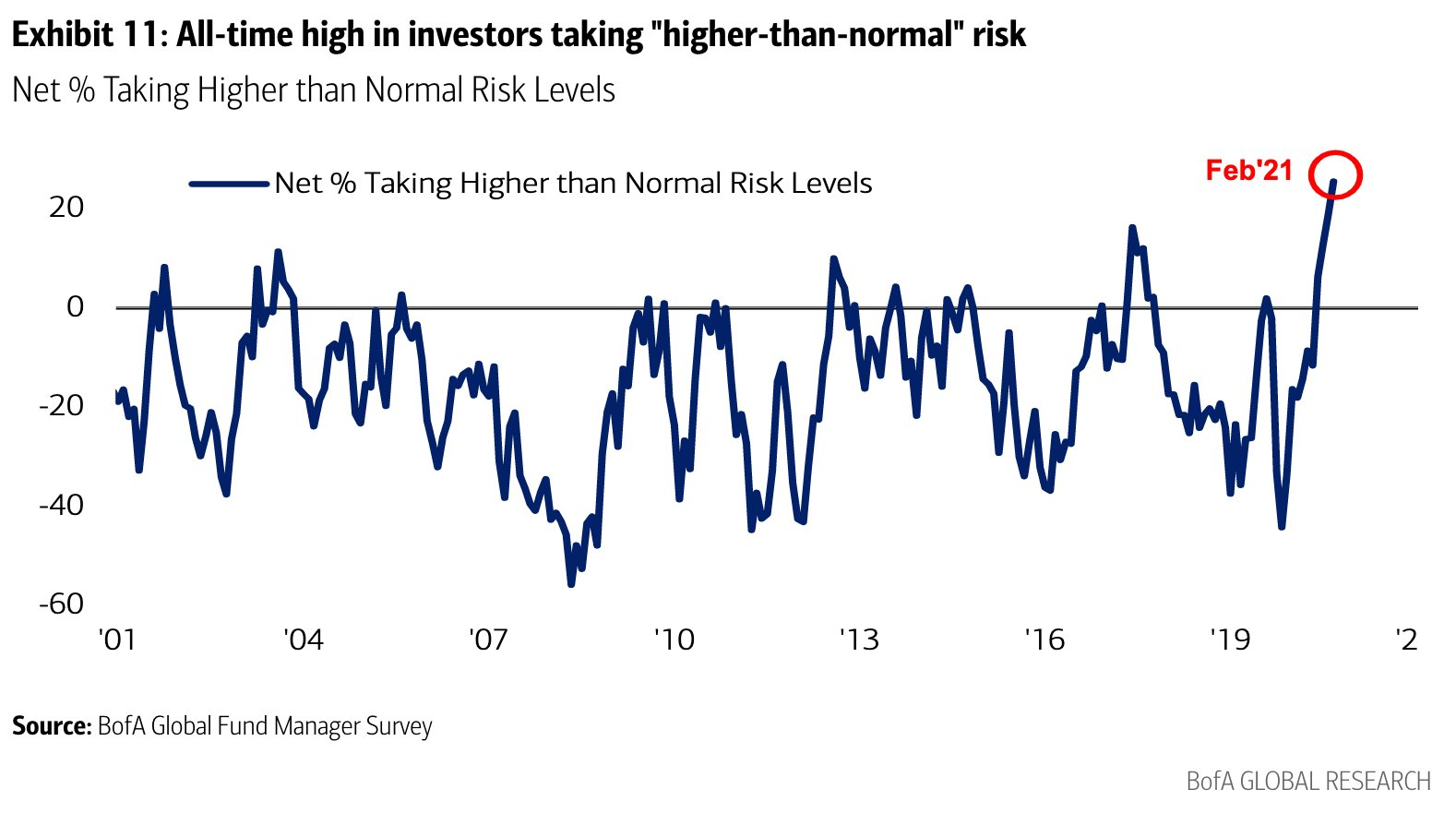

Bloomberg notes an interesting divergence - volume across U.S. exchanges is soaring higher even while implied volatility ("fear") plunges. There is a very close positive correlation between the two, so this is highly unusual.

If we look at each of them compared to their ranges over the past 200 days, they're at opposite extremes.

That means that the difference between them is nearly 100% (volume near 100% of its range and VIX near 0% of its range).

This didn't mean much in 2017 as stocks went on to enjoy many months of a creeper uptrend. That wasn't so much the case with the other times this triggered, as most of them suffered losses over the next couple of months.

What else we're looking at

- A more in-depth look at volatility versus volume

- Another quirk with the 20-year cycle in stocks

- What happens when there is a wide spread between optimistic and pessimistic indicators

| Stat Box On Friday, more than 50% of the core indicators we've tracked since 1999 were above their optimistic thresholds, while exactly 0% were below their pessimistic thresholds. This marks the first time since January 2020, and only the 9th day since 1999, when this has triggered. |

Sentiment from other perspectives

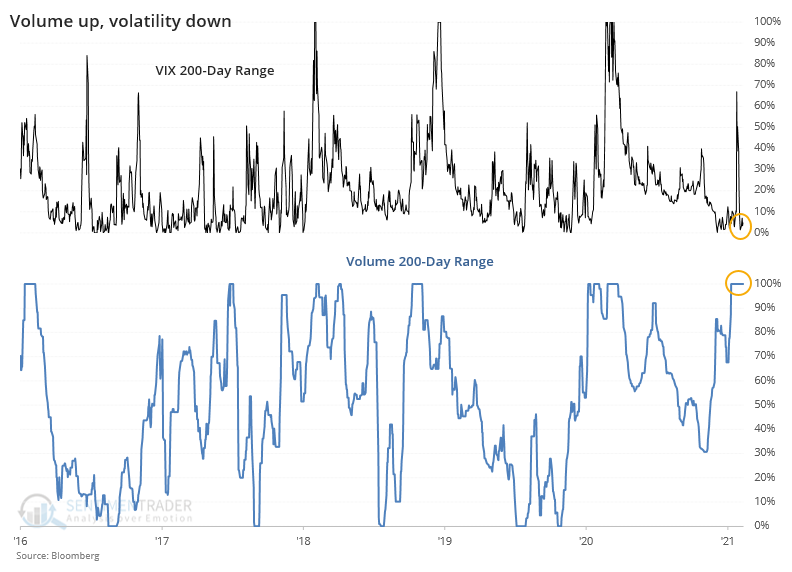

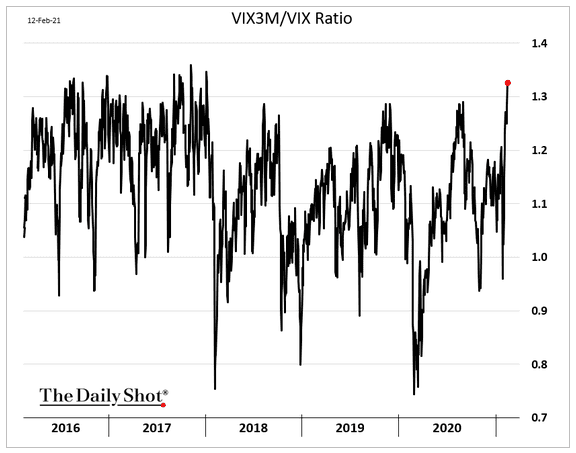

Volatility is a worry for later. Options traders are pricing in a larger probability of higher volatility 3 months from now versus volatility now. It's a sign of immediately complacency. Source: Daily Shot

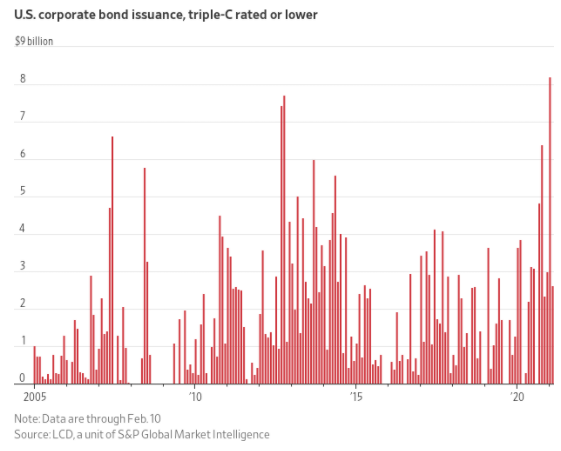

The riskiest investments get the most attention. Investors are in the part of the cycle where they're focusing heavily on trading the most speculative stocks and derivatives, and absorbing debt from the riskiest corporate borrowers. There has never before been such appetite to accept such low yields from such shaky borrowers. Source: Wall Street Journal

Even fund managers aren't immune. According to a monthly survey of big money managers from Bank of America, they've never been more willing to take risk. Source: BofA via Robin Wigglesworth