Volume is declining

The U.S. stock market, and in particular tech stocks, continues to trend higher. In the meantime, volume has been trending lower. This is often seen as a bearish sign of non-confirmation by market technicians, but evidence for this theory is shaky at best, particularly during the holidays.

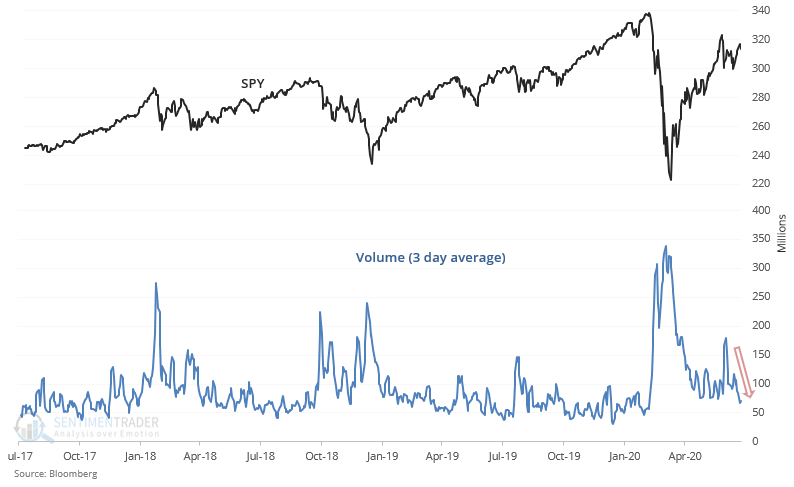

The following chart looks at SPY vs. its volume's 3 day average:

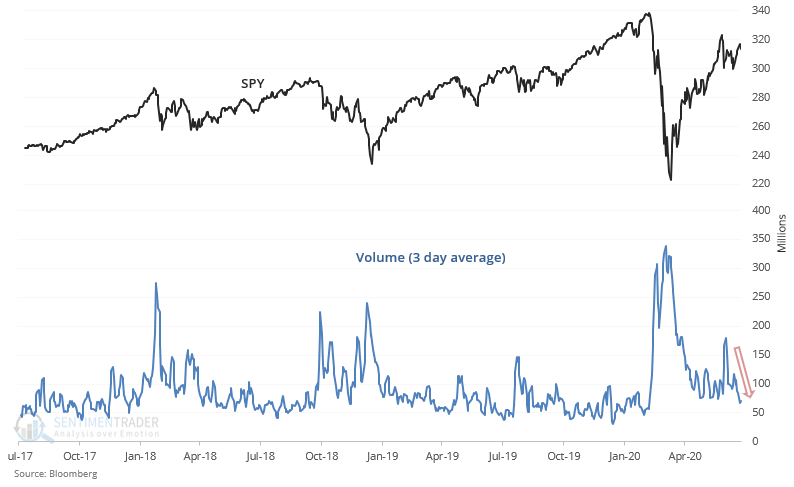

When SPY's volume swung from extremely high to extremely low over the past 100 days, this wasn't a consistently bearish sign for stocks on any time frame. Sure, this did happen during the 2007-2009 bear market and 2000-2002 bear market, but it also occurred during plenty of bullish cases:

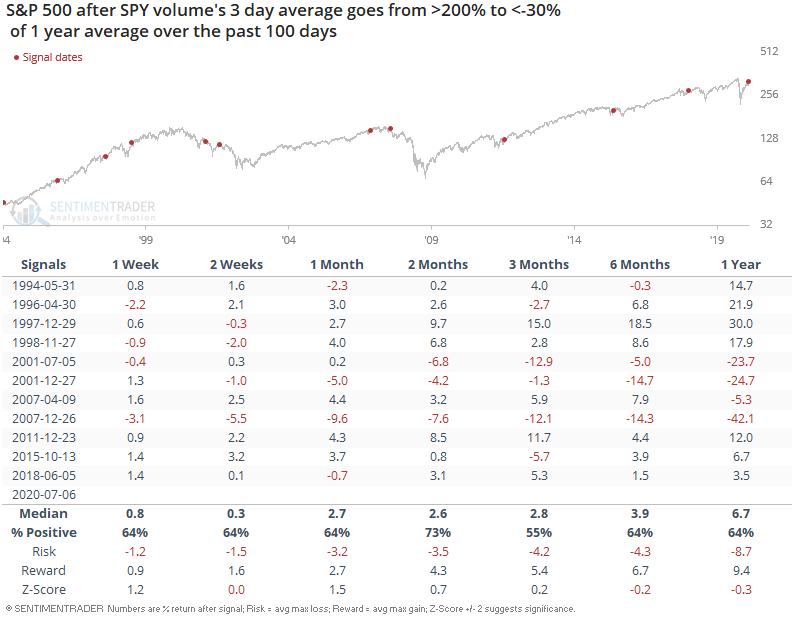

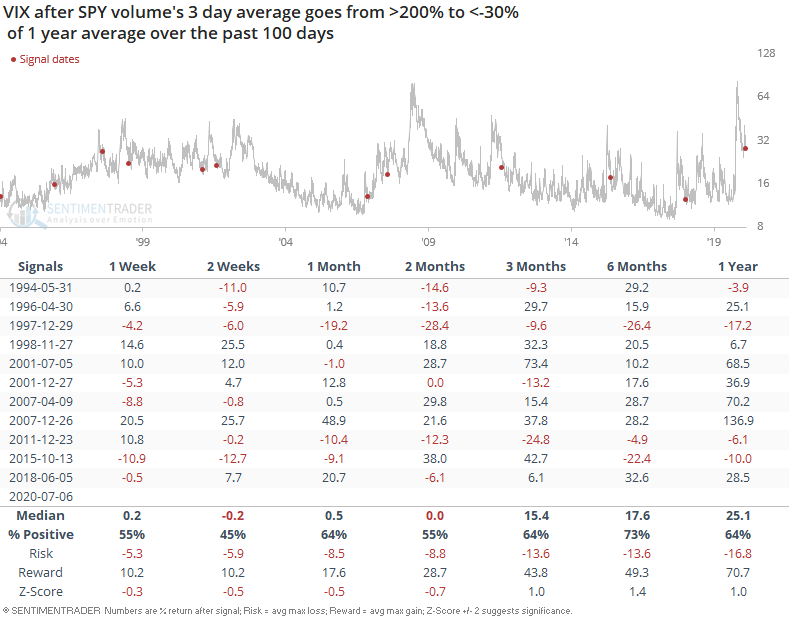

Since VIX moves inversely with the S&P, this wasn't a compelling bullish or bearish factor for VIX:

Overall, there are plenty of reasons to be cautious towards stocks right now. I wouldn't consider low volume to be one of those reasons, particularly during summer (which usually witnesses lower volume).