Volume flowing into declining stocks

Yesterday, we noted that despite a decent gain in the major indexes, volume on the NYSE was heavily skewed toward securities that were declining.

A big part of that was due to General Electric, which dropped on Thursday with massive volume. So perhaps we can excuse a single day's reading, but making excuses for indicators is a slippery slope.

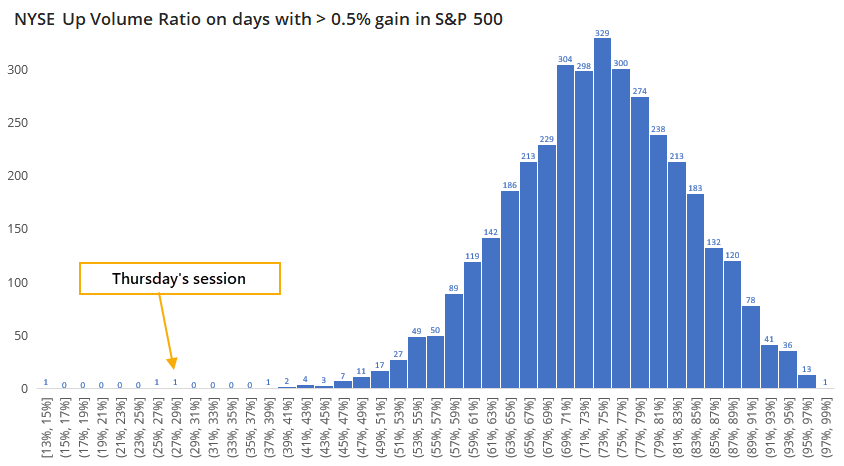

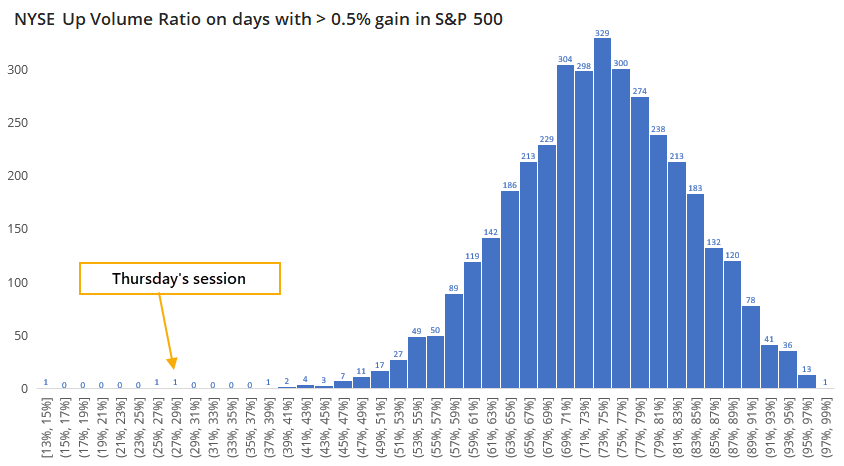

On a typical day when the S&P 500 rises 0.5% or more, the NYSE Up Volume Ratio averages 74%. Thursday's reading was only 29%, the 3rd-worst ever for that big of an up day in the S&P.

A histogram shows just how unusual this is, out of the 3,712 days that qualified since 1962.

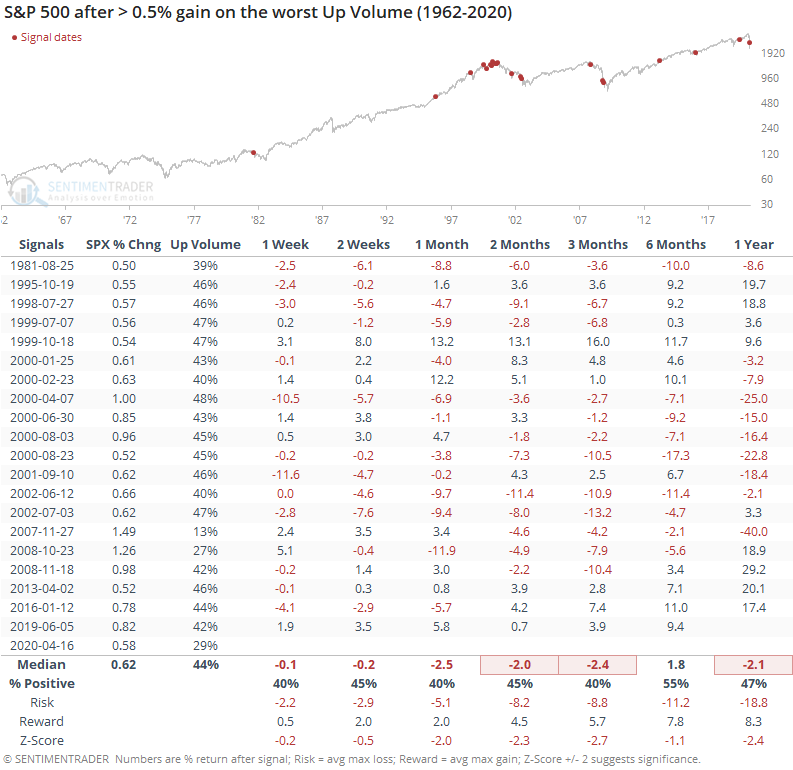

A day with such bad volume flow has typically led to poor returns for the S&P.

There were only a few dates in there that managed to see the index escape unscathed in the weeks ahead, including the last signal from June 2019.

We should hesitate before putting too much weight on a single day's reading, especially since we've already seen massively positive breadth thrusts over the past few weeks, including once again on Friday with a 90% up volume day. And without a single stock, this figure would have been significantly better. It's just a minor warning which will have more meaning if we continue to see relatively low volume flowing into advancing stocks in the days ahead.