Volatility Signal Update

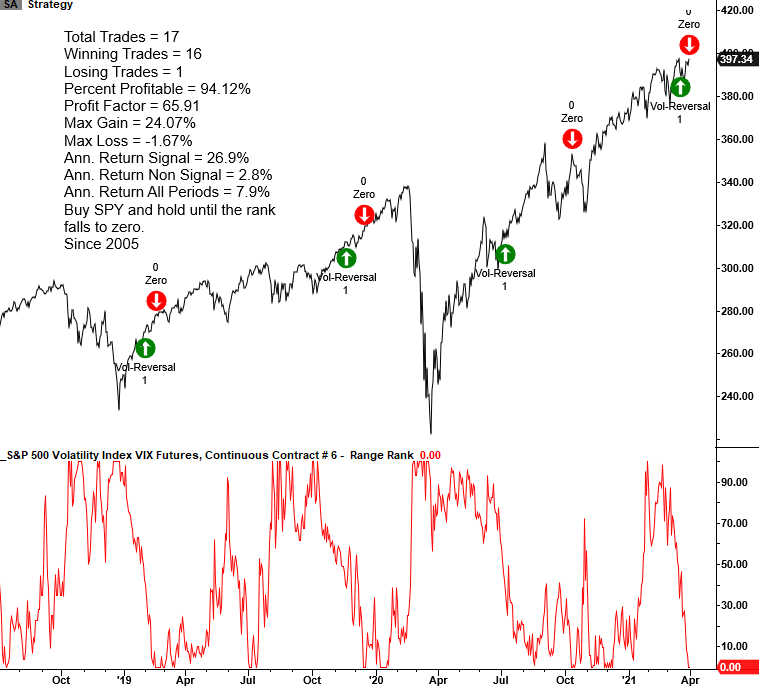

In a note on 3/18/21, I shared a buy signal for a VIX futures range rank reversal model that uses the VIX futures continuous contract #6. When the four-month range rank cycles from high volatility to low volatility, the model issues a buy signal for the S&P 500. The range rank has now fallen from the buy signal level of 45.5% to 0% as of 3/30/21. That means the VIX futures continuous contract #6 is now at the lowest point in the last four months.

Let's see what happens with the original VIX signal if we exit the trade when the range rank falls to zero and what one might expect if the model used the 0% level as the buy trigger instead of the optimized condition of 45.5%. i.e., what happens now that the range rank has reached zero.

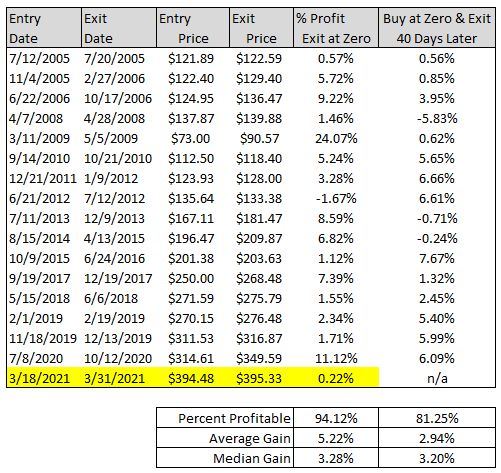

Volatility Signal - Original Trade Exit (39 Day Holding Period)

Volatility Signal - Exit Trade When Range Rank Hits Zero

The results look a little better by adjusting the criteria from the original days-in-trade exit to the new exit criteria, whereby the range rank falls to zero. The adjustment resulted in one less signal, and as it turns out, it eliminated a loss.

Volatility Signal - Buy the S&P 500 When the Range Rank Falls to Zero

While it's good to know where we've been, it's always better to know where we might be going on a forward return basis. Let's see what happens when the rank falls to zero as it did on 3/30/21. Results still look good.

Volatility Signal Performance

While the buy-at-zero results still look good, it doesn't appear as if the market will get away from us based on average and median returns. I would also highlight the current signal's weak performance when exiting the trade at a zero rank. It's well below the average and median.

Conclusion: Performance for the current volatility buy signal has been weak compared to other historical instances. I mentioned this potential in my original note as the broad market did not correct much during the tech swoon. Given the weak performance, I would not expect a runaway market from here, even with a lower volatile range. I suspect it's more of the same YTD slow grind. It's always crucial to understand the market environment when assessing trading signal performance