Volatility panic subsides, even with most stocks in downtrends

Traders continue to ease off the extreme panic seen in March, even though most stocks are still struggling.

The Wall Street Journal notes that:

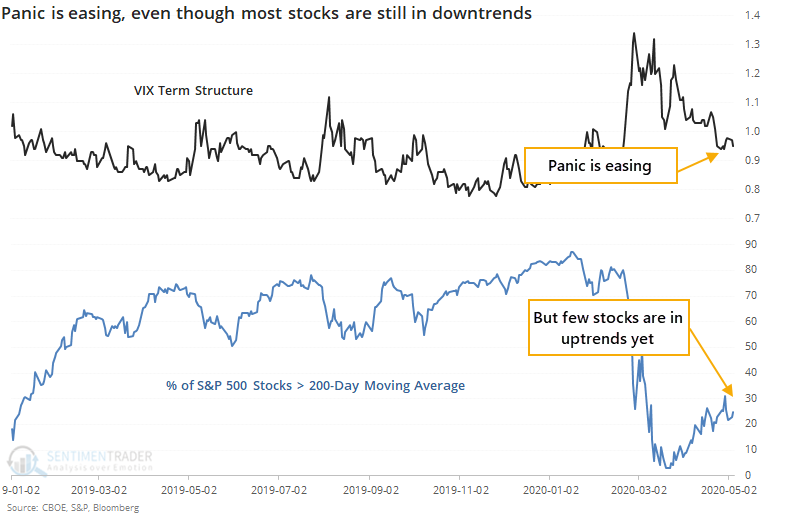

"While S&P 500 volatility levels have subsided, only 23% of stocks are above their 200-day moving average. That's an indication of low market breadth, according to State Street."

The VIX Term Structure showed that traders were pricing in higher volatility in the very short-term while lower levels longer-term. This happens during times of outright panic.

The spread between those futures contracts has contracted steadily since the peak in March and is now sitting near a 50-day low. Even while that has eased, though, fewer than a third of stocks within the S&P 500 have managed to climb back above their 200-day averages.

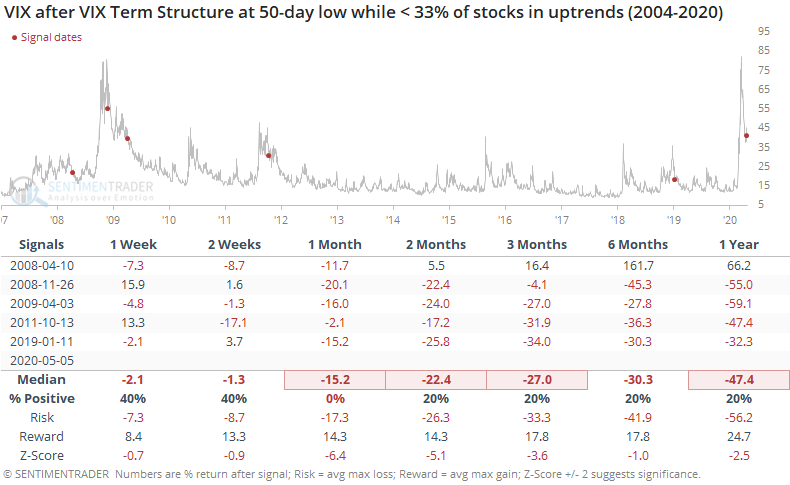

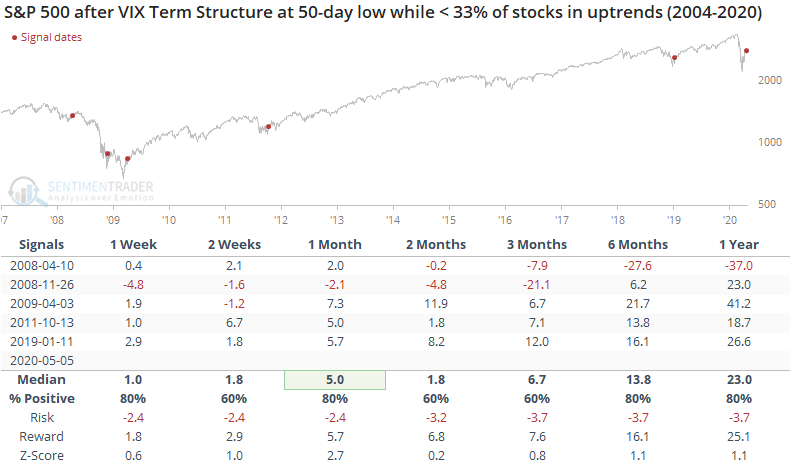

The suggestion is that volatility traders are getting ahead of themselves, with improving sentiment that's not backed up by a majority of stocks. VIX futures history is limited, so we don't have a lot to work with.

In 2008, traders got ahead of themselves, and stocks fell back hard both times. But when it triggered in 2009, 2011, and 2019, it was a sign that the worst was past and the easing panic led to more and more stocks recovering.

For the VIX, it led to lower levels each time during the next month, even in 2008, which is a bit of a surprise.