Volatility in commodities is receding

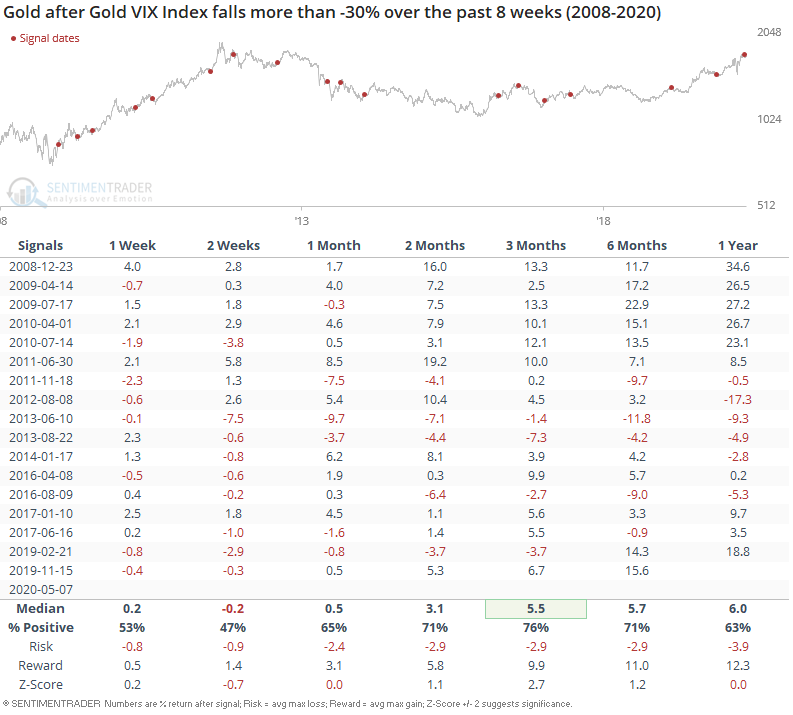

Volatility surged across asset classes in March and April as fears of a coronavirus-driven recession hit an apex. But now that equity markets are stabilizing, volatility in commodities is also receding. For example, oil's crash a few weeks ago caused a historic surge in volatility. And now that oil is bouncing around the $20-$25 range, oil VIX has fallen to a 2 month low:

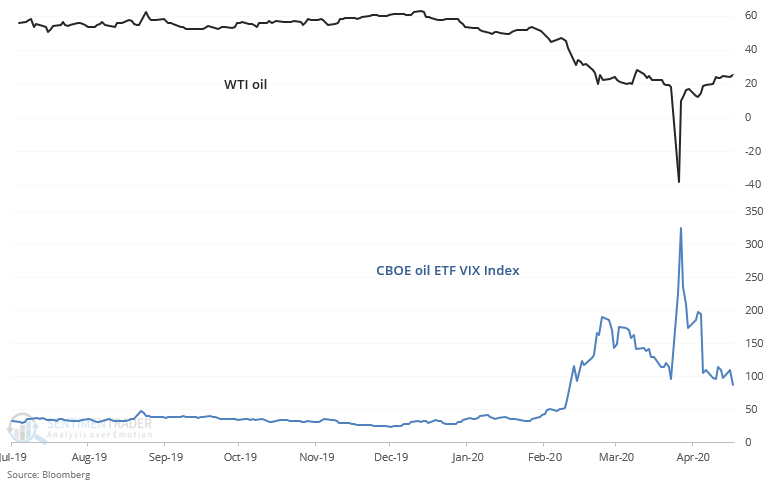

When oil VIX surged and then fell to a 2 month low, oil's forward returns were mixed. While this did happen during post-correction/crash rallies, it was hard to say how much further the oil rally would go. Sometimes the rally continued, and sometimes the rally was already over:

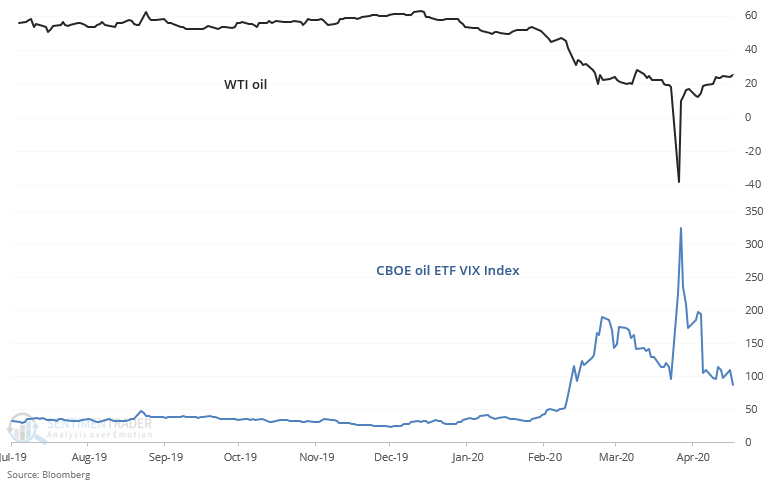

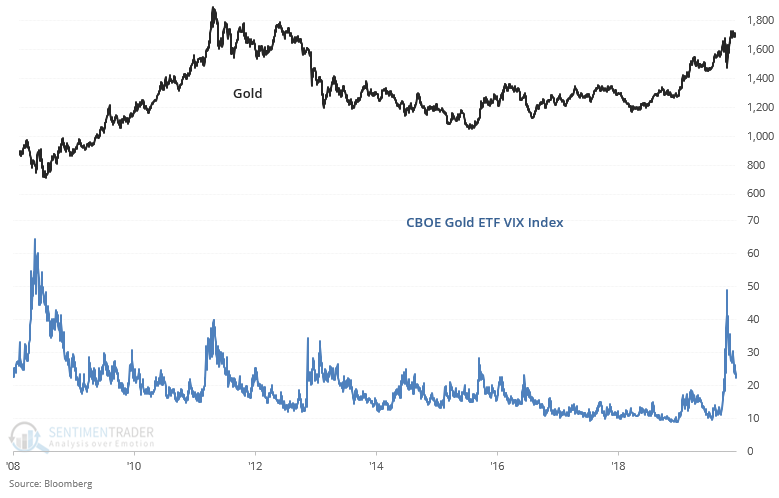

Similarly, gold VIX has fallen a record breaking -50% over the past 8 weeks:

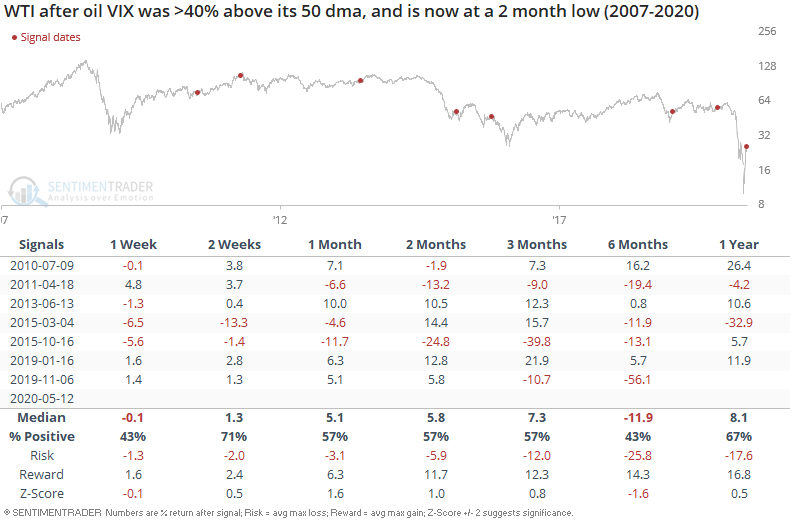

Less extreme declines in gold VIX usually led to more gains for gold over the next 3 months, although many of the bullish historical cases occurred during the 2008-2011 gold bull market: