Volatility as we approach the election

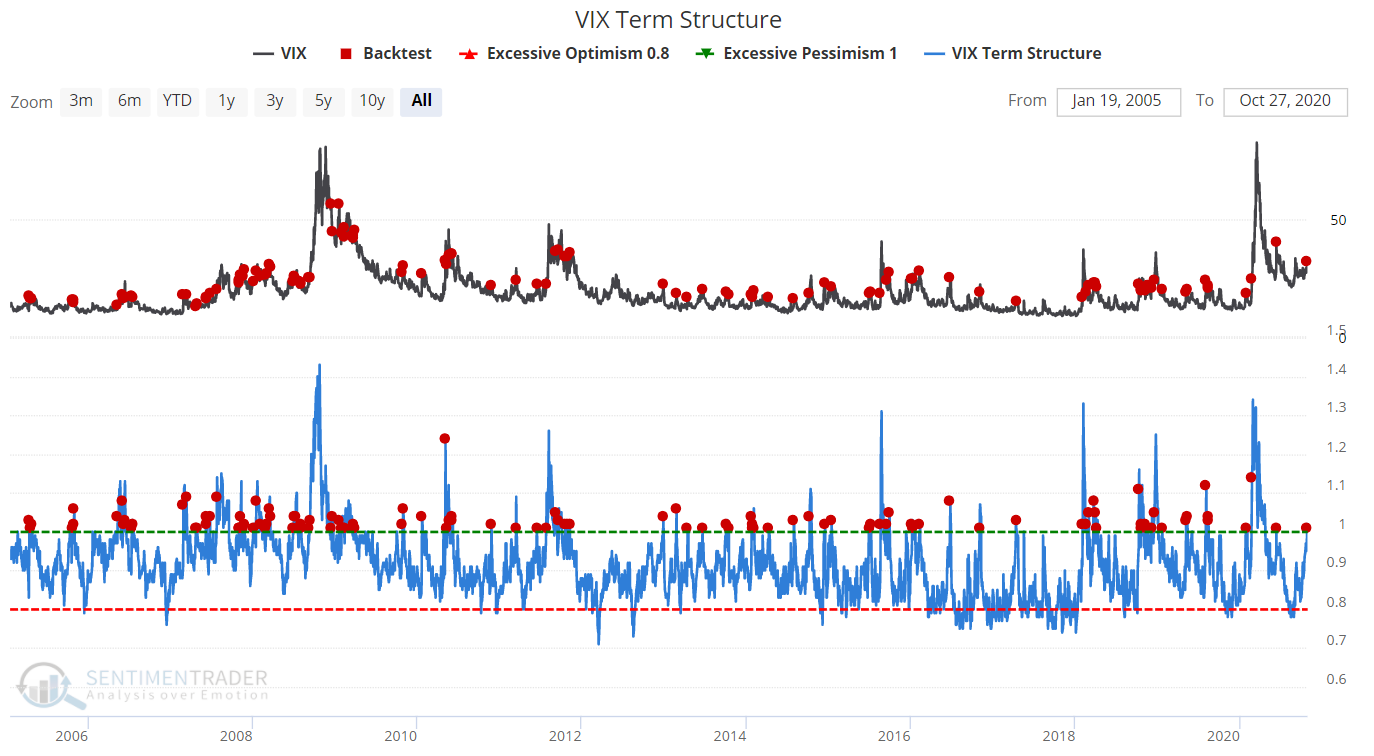

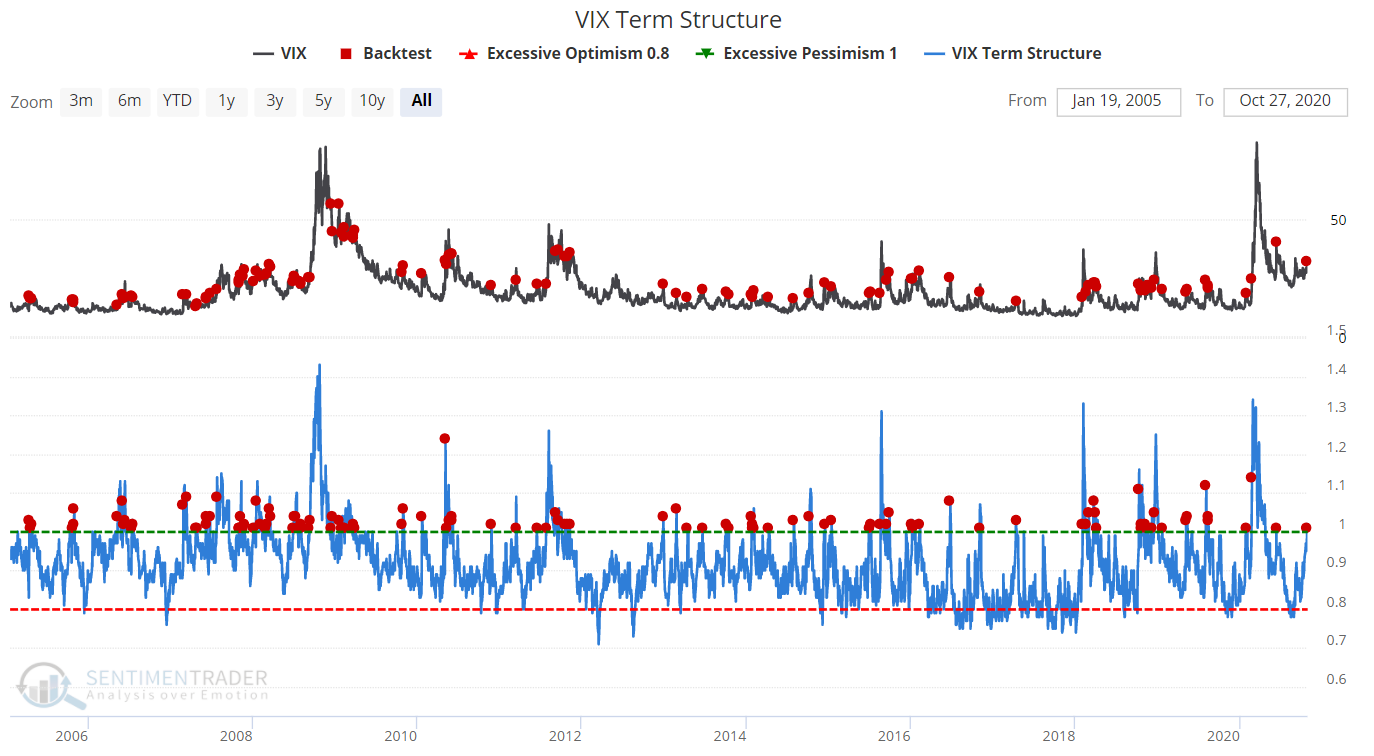

VIX is slowly rising as we approach the election in a week. VIX's Term Structure is now in backwardation, which is exactly what happened in the runup to the 2016 election.

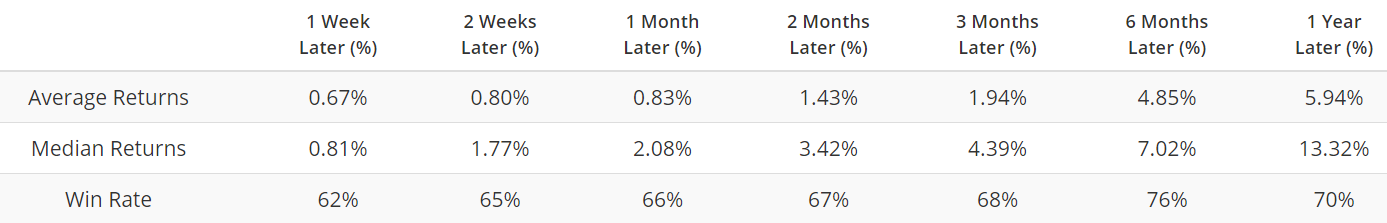

When VIX's term structure crossed above 1 in the past, VIX itself had a strong tendency to fall in the weeks and months ahead.

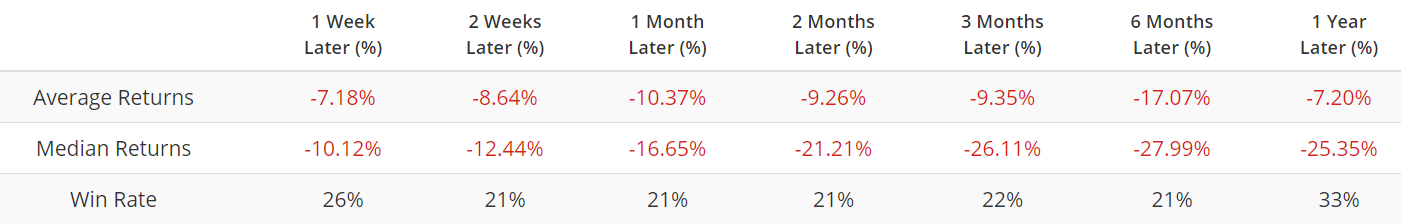

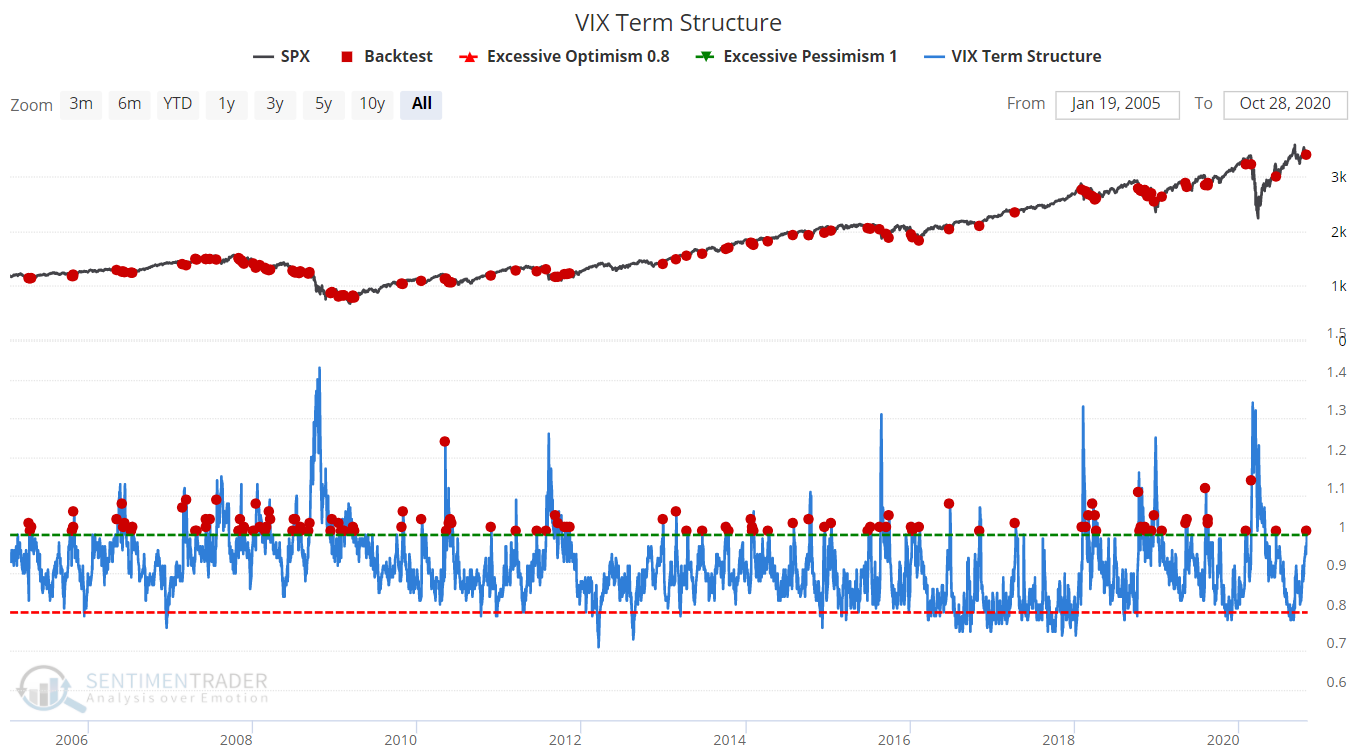

As for the S&P 500, this led to more bullish than bearish outcomes in the weeks and months ahead:

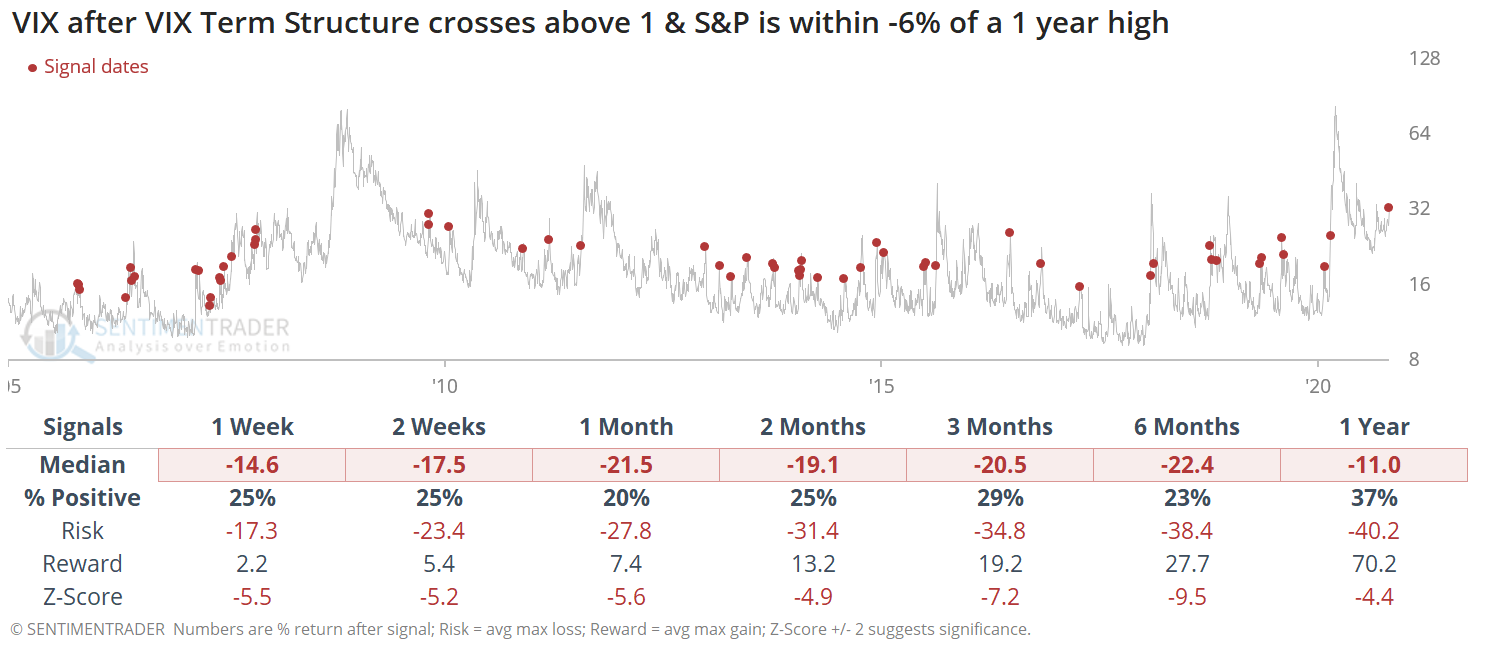

When we further narrow down the historical cases to when the S&P was within -6% of a 1 year high, VIX's forward returns were mostly the same:

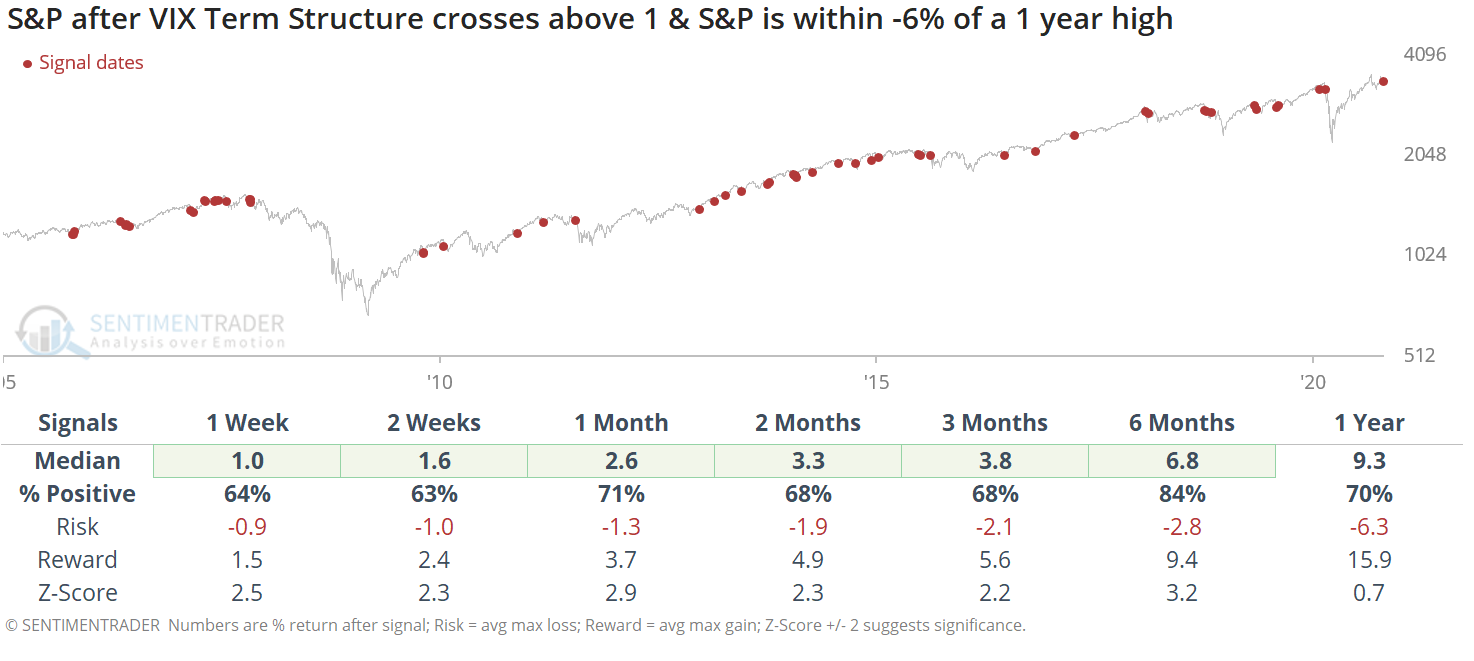

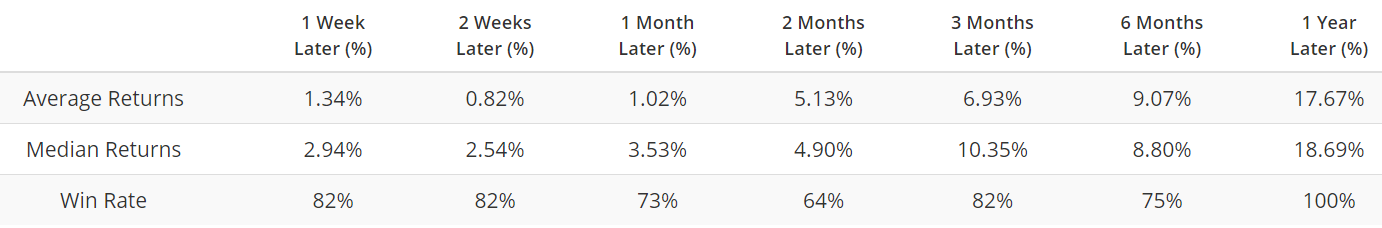

But the S&P 500's returns over the next 6 months were more bullish:

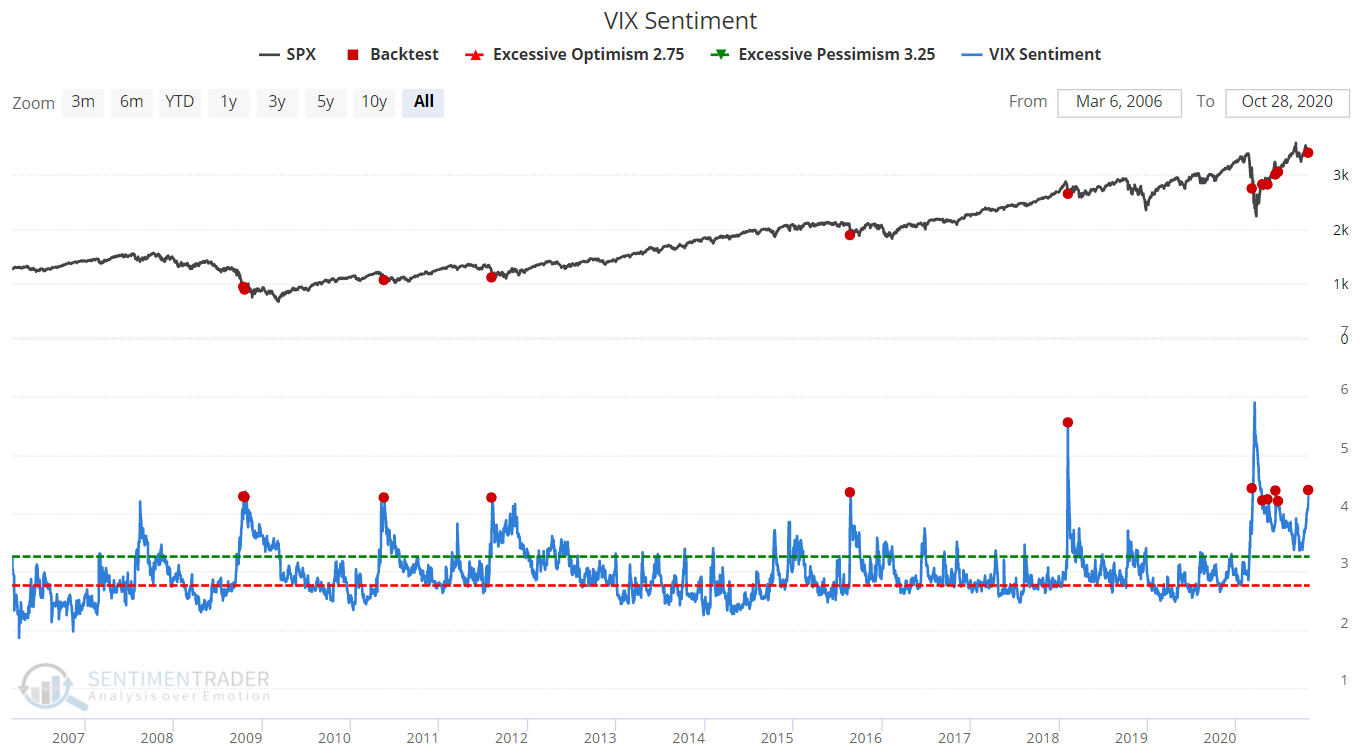

Our VIX sentiment indicator, which looks at how traders are positioned in volatility, has been curling up over the past few weeks after falling for months. It is now at a level that in the past, usually marked a medium term bottom for the S&P 500.

Given the uncertain and event-driven nature of the VIX setup over the next few weeks, I wouldn't put a heavy emphasis on this type of analysis.