VIX's unprecedented behavior

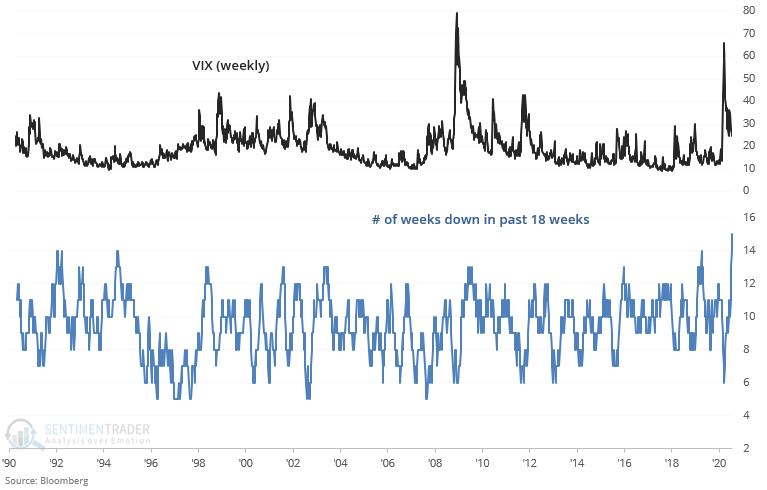

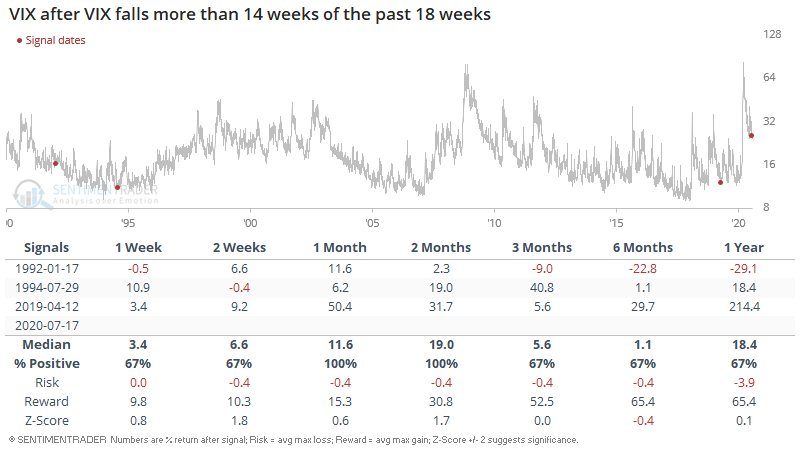

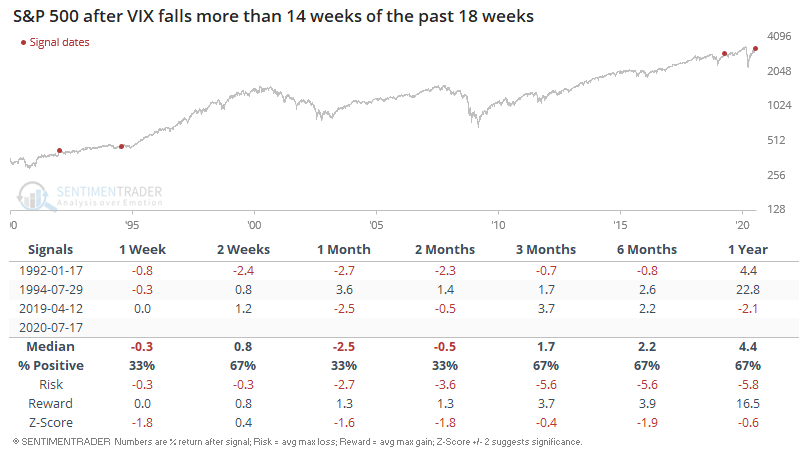

VIX has consistently trended downwards over the past few months as U.S. equities rallied. VIX fell 15 out of the past 18 weeks. This kind of behavior is unprecedented:

Historical cases in which VIX fell at least 14 of the past 18 weeks were usually short term bullish for VIX over the next 1 - 2 months.

However, this scenario led to losses in the S&P over the next 1 - 2 months.

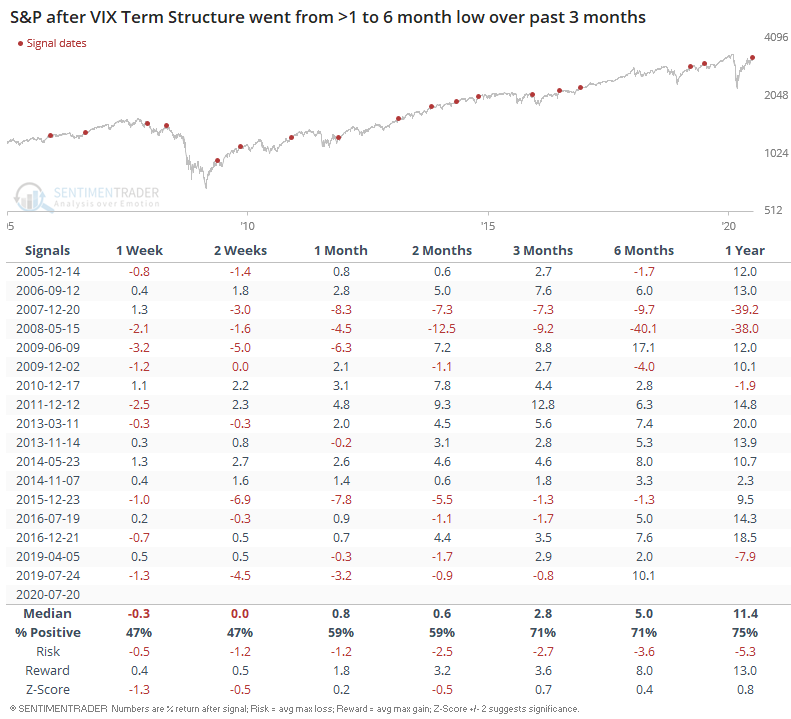

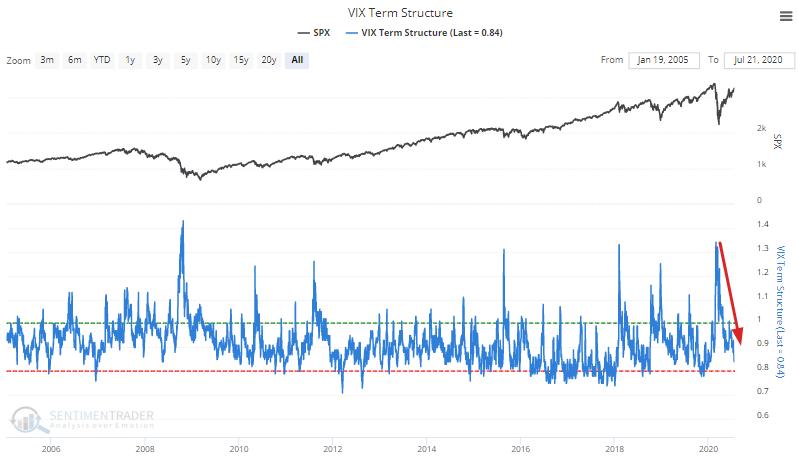

VIX term structure which compares 1-month VIX futures to 3-month futures fell to a 6 month low.

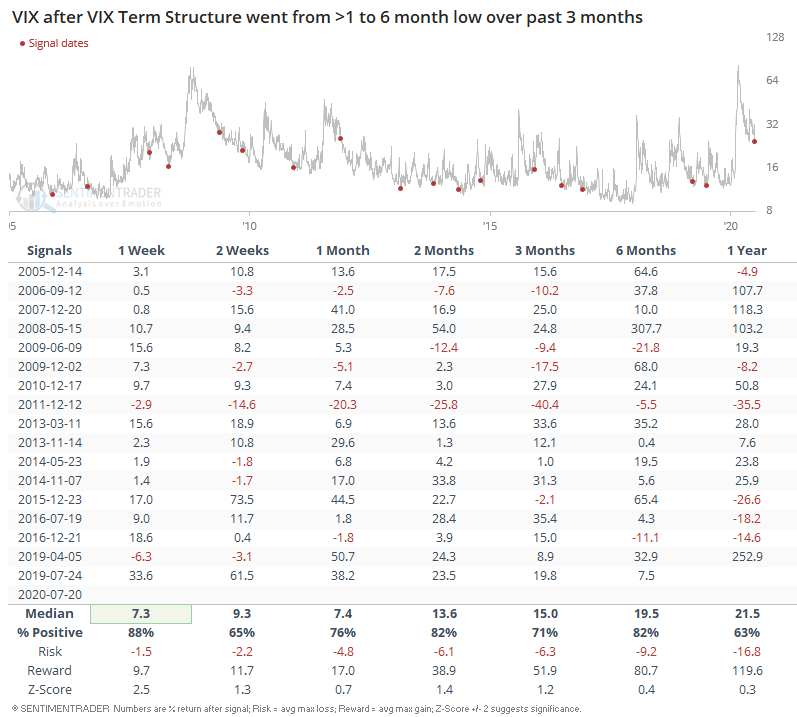

In the past when VIX term structure went from higher than 1 to a 6 month low within the past 3 months, it was a bullish sign for VIX over the next week:

And was somewhat short term bearish for the S&P 500: