VIX Sigh Of Relief

With apparent relief over French election results, stocks are showing large gains pre-market. More notably, volatility is collapsing.

At the moment, the VIX "fear gauge" is on track to open lower by 10% - 15%, triggering one of its largest opening implosions in 30 years.

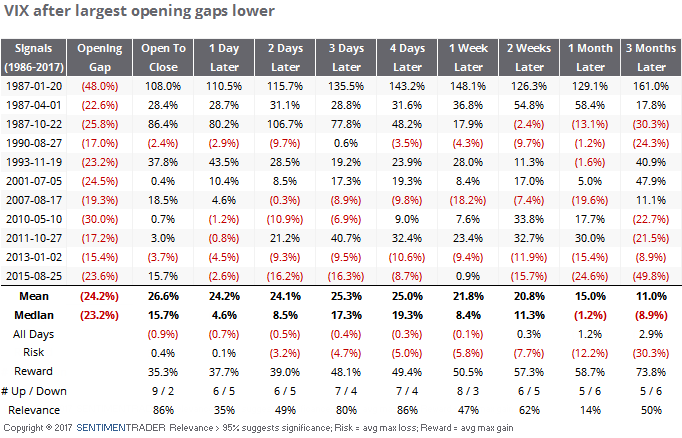

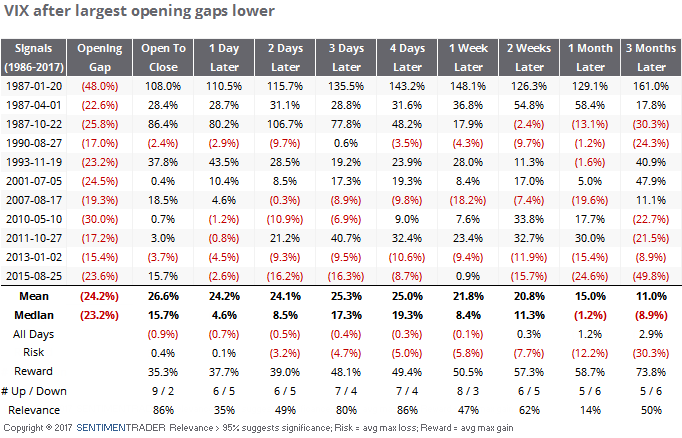

Assuming it opens on the lower end of its pre-market range, let's take a look at how it performed after its other largest opening gaps lower:

Most of the time, the open market about the low for the day. During the regular session, it rose 9 out of 11 times. Over very short-term, the risk/reward was heavily skewed to the upside, meaning that the vast majority of any decline in volatility expectations was already baked in at the open.

The only dates when this kind of gap occurred when the VIX was already below 15 were in November 1993 and January 2013. In '93, the VIX soared in the day(s) ahead, while in '13, it drifted lower.

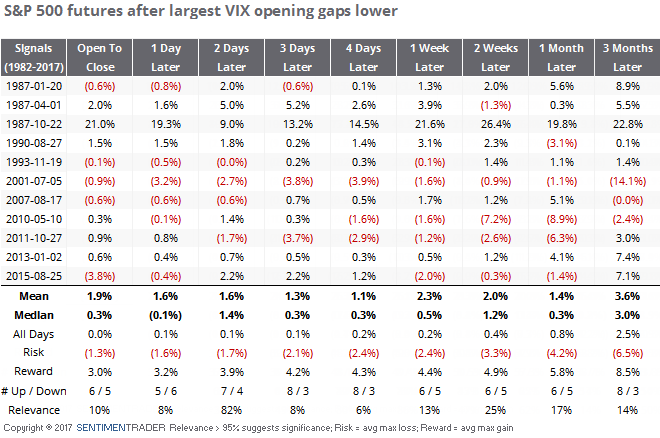

In terms of the volatility implosion's impact on stocks, the following table shows returns in S&P 500 futures after those same dates:

Mostly positive, especially over the next 3-4 days. The mean return was skewed higher by the October 1987 rally, so overall returns weren't great. But the risk/reward was about 2-to-1 to the positive, and had 8 winners out of the 11 attempts.

So even though the vast bulk of the relief is probably already baked into the VIX, these kinds of overnight relaxations have been mostly good for stocks in the short-term, even assuming a big positive open for the S&P.