VIX sentiment shows "smart money" betting against volatility

Thanks to heightened concerns about the looming presidential election, uncertainty about upcoming earnings reports, and negative developments in the fight against coronavirus, options traders have continued to price in wide swings in stocks.

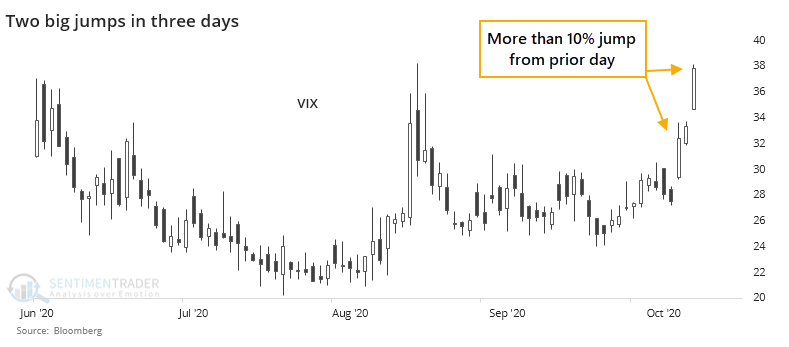

Even though bond volatility has been pushing higher, it's been relatively muted in stocks. But it's been muted at a much higher-than-average level, with a VIX "fear gauge" that has been persistently stuck above 25. At the peak of intraday concern, the VIX has jumped more than 10% on two out of the past three sessions.

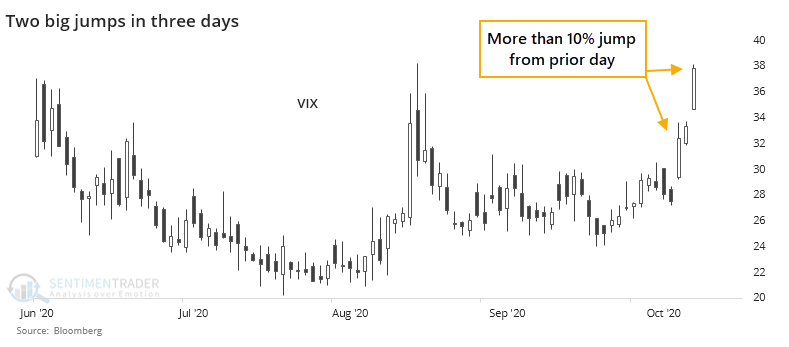

It's easier to see big jumps in the VIX when it's at a low level. It's much rarer to see it when the VIX is already high, especially when stocks aren't even in a correction at the time.

The other times this triggered, stocks typically rallied over the next 1-3 months, with only 2 losses out of 12 signals three months later. After that risk rose as two of the clusters triggered as the bull markets were nearing their peaks in 2000 and 2007.

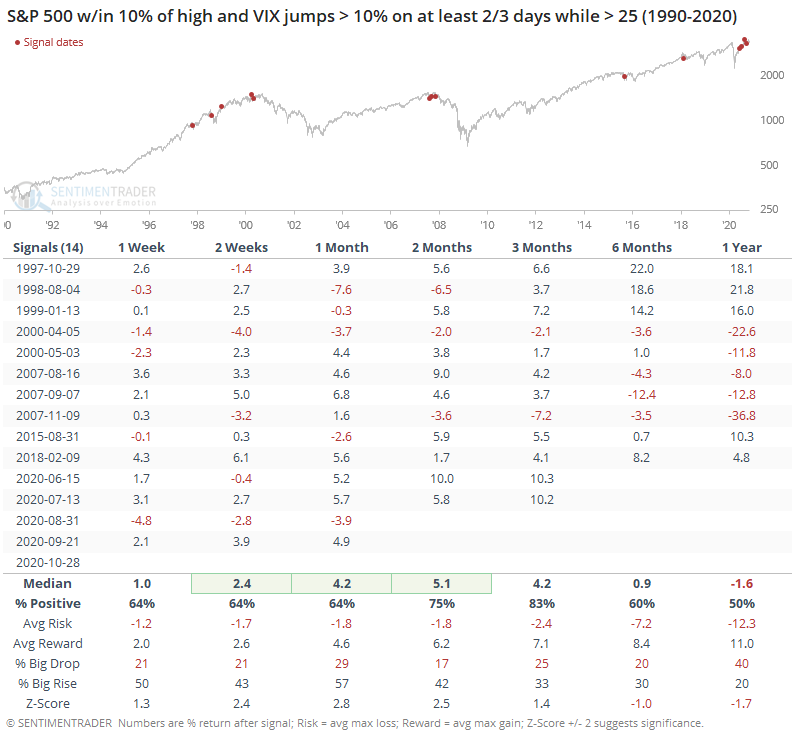

Over the past couple of weeks, more and more traders seem to be betting that it's too high. The 10-day average of the VIX Put/Call Ratio has climbed above 1.5, the highest in more than 13 years.

This means that on an average day, 50% more puts are being traded than calls. While we don't know whether the underlying trades are betting on increasing or decreasing volatility, the assumption is that the heavy put volume reflects bets that the VIX will decline. And usually, that's what's happened.

Trading activity in puts versus calls is one of the inputs of the VIX Sentiment model, which has climbed above 4.

From the site:

"VIX Sentiment looks at the skew in VIX options, the ratio of outstanding puts to calls, the term structure of VIX futures and the volatility of the VIX itself to gauge how traders are positioned in volatility. For the most part, they are "smart money" traders. When VIX Sentiment is high it means that they are aggressively betting against a rise in volatility, which is what usually happens as stocks rise. When VIX Sentiment is low it means that they are betting on an increase in volatility in the coming weeks, and that's what we usually see along with a decline in stocks."

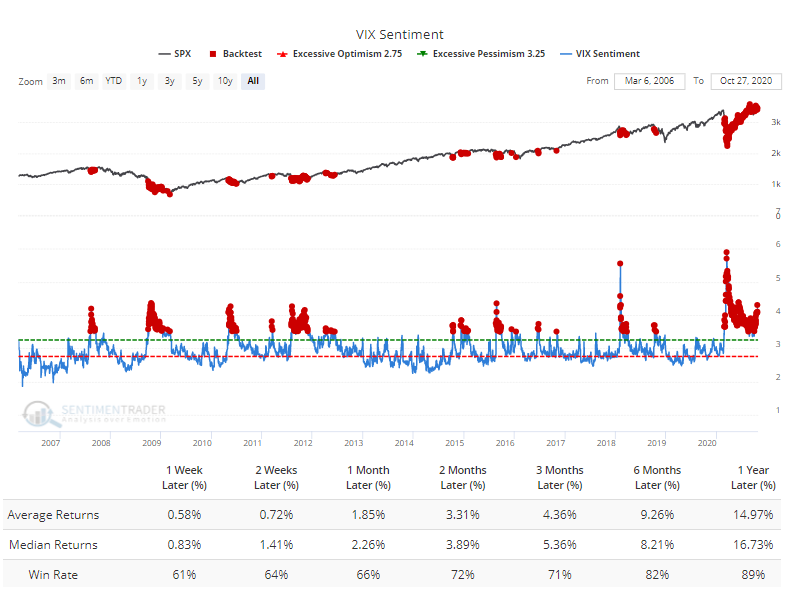

Any time that VIX Sentiment was above 3.5, the Backtest Engine shows that stocks usually reacted by rising in the months ahead.

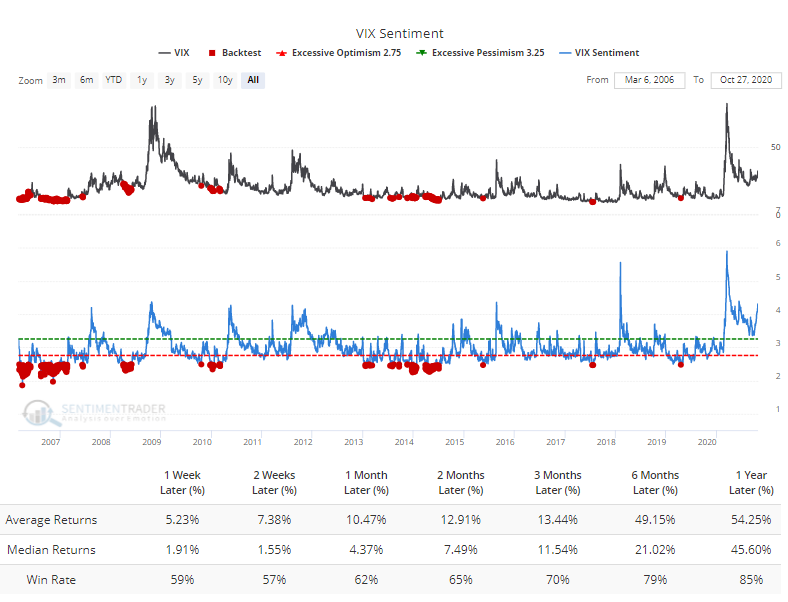

For the VIX itself, this almost invariably led to a lower level going forward.

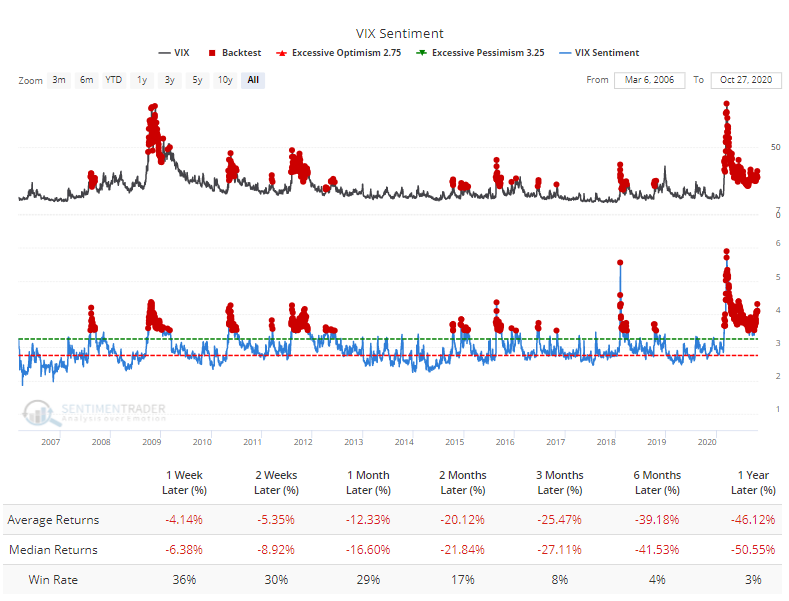

Contrast that to times when VIX Sentiment was below 2.5. After these signals, the VIX had a strong tendency to rise going forward.

There seems to be a pretty clear flow of upcoming events which has prompted traders to price in high volatility. But more and more, options traders are betting that it won't last much longer, and these traders have typically been proven correct. It suggests that despite the many seemingly legitimate concerns, volatility in stocks should decline in the months ahead.