VIX Panic Subsides As Smart - Dumb Spread Widens

This is an abridged version of our Daily Report.

Buy the panic, or wait

Buying into a panic is hard, and much advice suggests waiting until the panic has subsided.

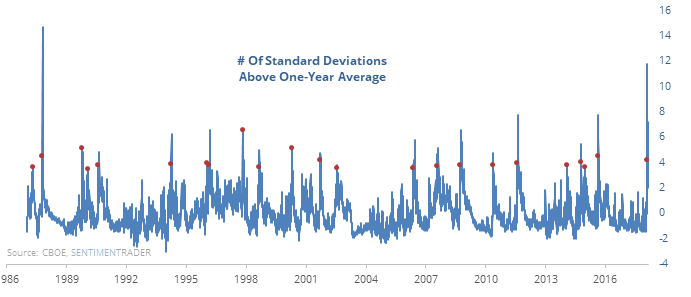

Looking at large spikes in the VIX “fear gauge”, we look at returns following the initial spike versus waiting. Buying into the panic resulted in better returns, more often, with a better risk/reward ratio.

Who’s buying?

Stocks rallied hard off the panic low, and the spread between Smart and Dumb Money actually got wider.

This is highly unusual and only happened one other time to this degree (November 2016). When the spread acts like this, long-term returns have been about double versus times when the spread collapses.

Wood is good

According to the Backtest Engine, the Optimism Index on lumber is how the highest since at least 1990. There have been only three other times approached this level, early January 1993, late August 1996, and late October 1996.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.