VIX Jumps 20% Again As Rates Lose 50-Day

This is an abridged version of our Daily Report.

A questionable precedent

A month ago, we saw that after a 10% decline, the Dow Industrials was most closely tracking “good” corrections. That has started to change in recent sessions, and now the closest precedent is from November 2007.

Double panic

The VIX “fear gauge” jumped more than 20% after having just done so a few days ago. Previous times it jumped 20% in close succession led to rebounds in stocks, and a drop in volatility every time.

Rate reprieve

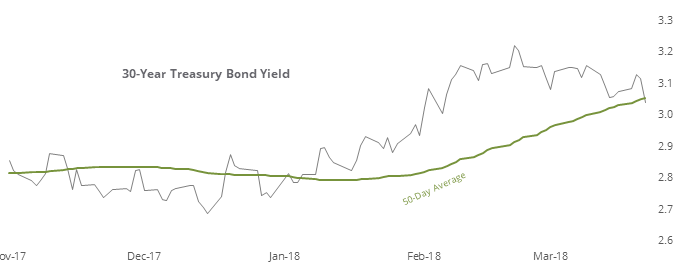

For the first time in months, long-term bond yields are challenging their medium-term uptrends.

When they drop below the average after recently setting a yearly high, the downtrend has asserted itself.

A painful streak

Consumer Staples have lost ground for most of the past two weeks and are trading at a 52-week low.

Fewer lows

Thursday was only the 2nd time since the 2009 low that the S&P 500 declined more than 2.5% yet the number of 52-week lows on the NYSE declined from the prior day.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.