Violent weekly swings trigger an impressive internal recovery

Key points:

- The S&P 500 has swung by more than 5% almost every week for five weeks

- Its member stocks have gone from a few medium-term uptrends to nearly a quarter of stocks

- Similar volatility and reversals have (mostly) coincided with the ends of bear markets

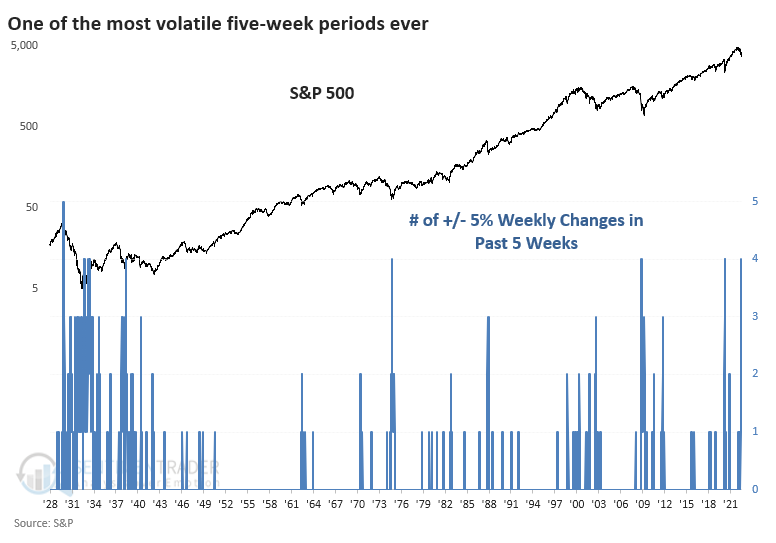

A historic streak of volatility

Investors have enjoyed a few days of relief. They deserve it after suffering through the most overwhelming selling pressure in history.

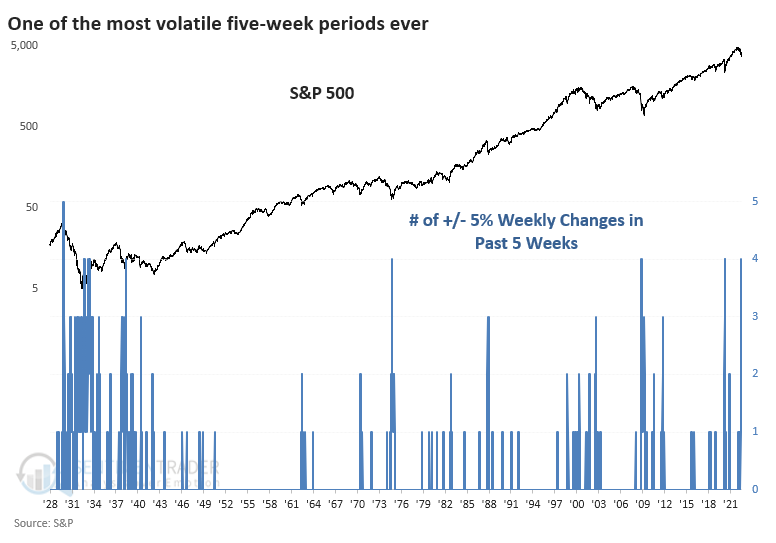

While the plunge to new lows was devastatingly lopsided, it's not like there haven't been attempts at a recovery, including last week. The S&P 500 has swung at least 5% weekly for four of the past five weeks. That ties it for the 2nd-most volatile five-week stretch since 1928.

The handful of other times it suffered such volatile action over such a compressed time frame, it tended to lead to short-term weakness but long-term gains. Only three other periods can compare during modern markets; all three were at or near market bear market lows.

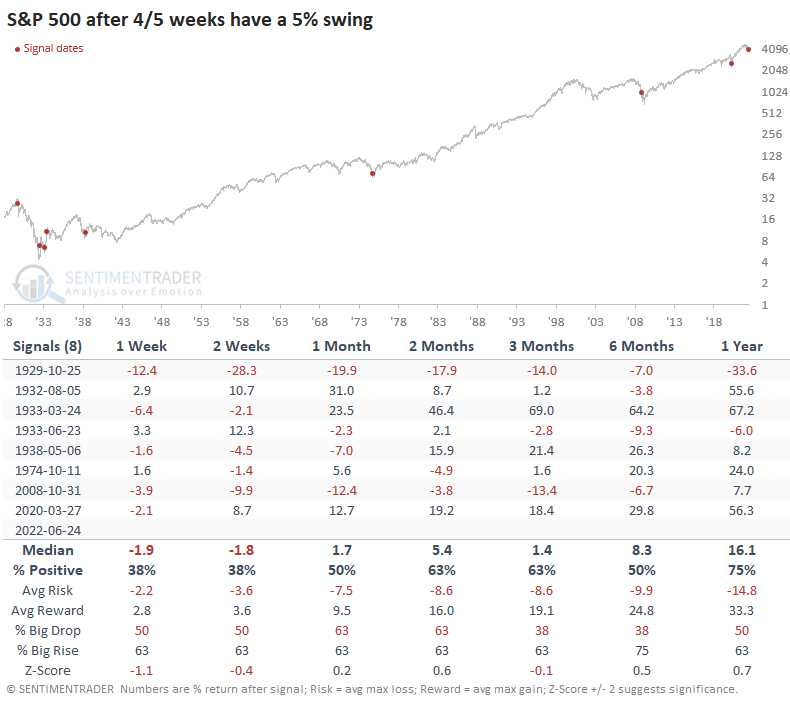

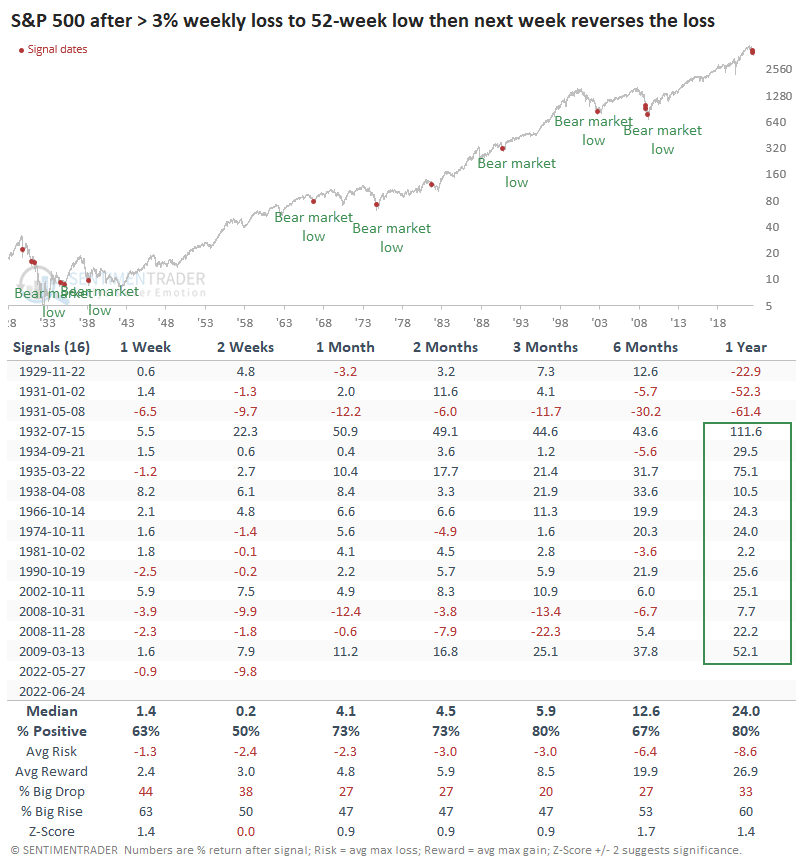

If we relax the 5% weekly swing threshold to 3%, then last week's reversal shows some impressive precedents when coming on the heels of a 52-week low. About half of them marked the ends of bear markets, or nearly so. Every signal since 1932 sported a positive one-year return.

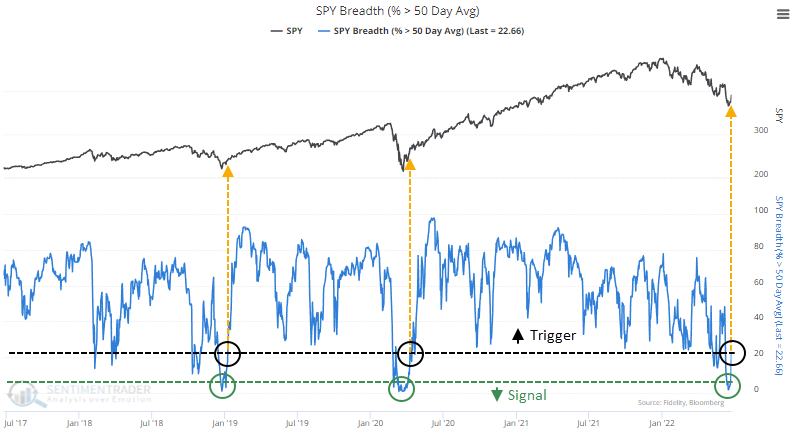

Not just a few stocks

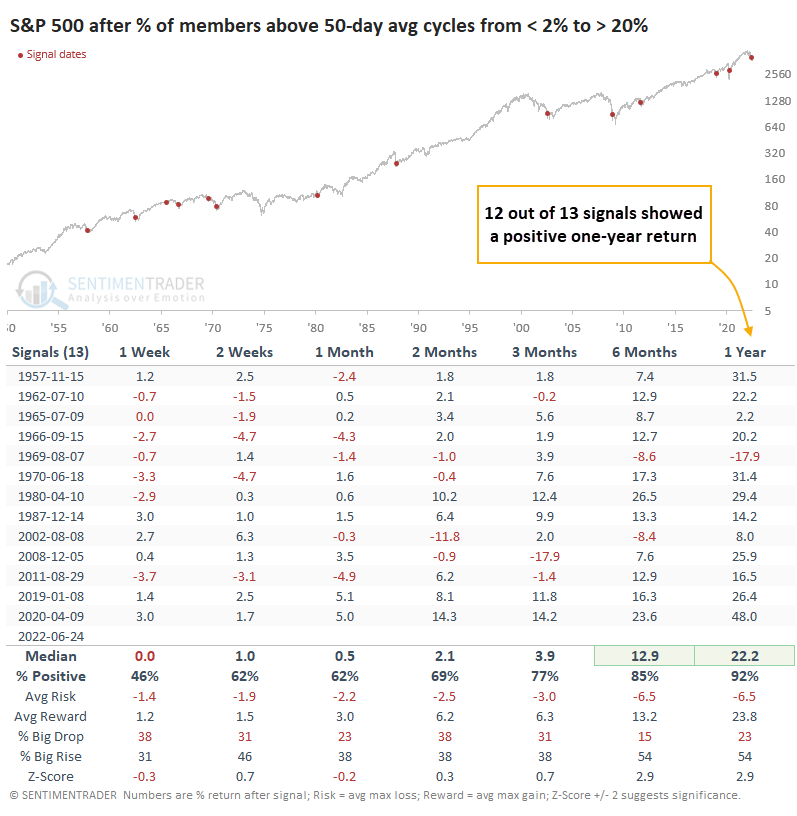

The recovery in the indexes showed broad participation. Recently, fewer than 2% of stocks within the S&P 500 were holding above their 50-day moving averages, one of the lowest readings in 70 years. Now, more than 20% have moved above their medium-term trend lines. The only times this happened in recent years marked the ends of bear markets.

If we go back to 1950, it's mostly the same conclusion. Out of 13 signals, only one of them failed to lead to a positive one-year return.

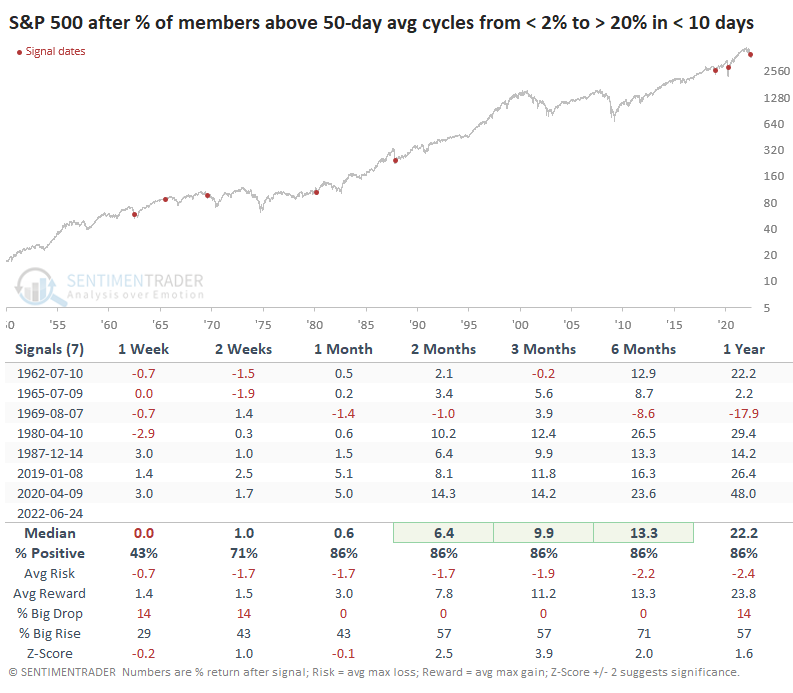

This was the fastest-ever recovery, taking fewer than five sessions. If we filter the table above to include the quickest reversals, those that take ten days or fewer, then medium-term returns improved considerably. All of the signals showed a positive return either two or three months later. The risk/reward skew from two months and beyond was tilted heavily toward "reward."

What the research tells us...

A week like last week tends to trigger a quick improvement in sentiment, but there is scant evidence that's the case. After more than a few fakeouts and failures, investors are understandably skeptical. By the price action and internal participation alone, though, there is compelling evidence that moods should improve in the coming weeks, helping to spur rising prices. It would be rare for the volatility and reversals similar to recent weeks to fail again and lead to lower lows.