Value is *finally* outperforming growth?

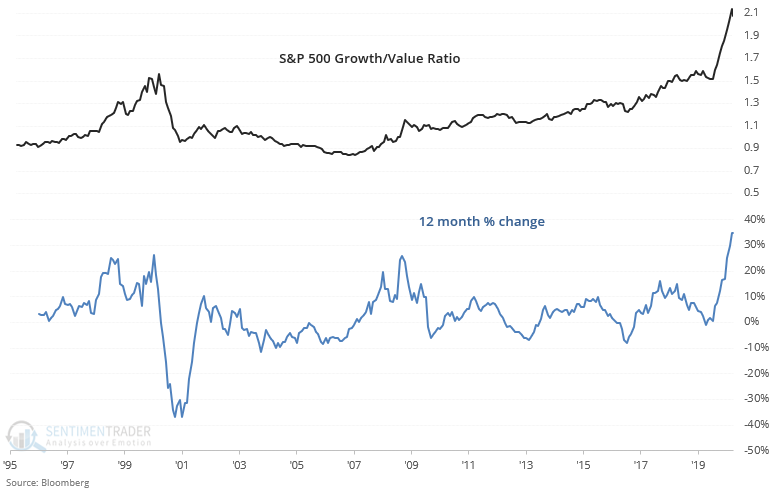

Over the past decade it seemed as if every few months the financial advice community would beat the drums and proclaim that it was finally time to buy value because "historically value outperforms growth, and growth is TOO overstretched". After a record surge in growth against value over the past year, it once again seems like now could be the time to buy value.

Perhaps.

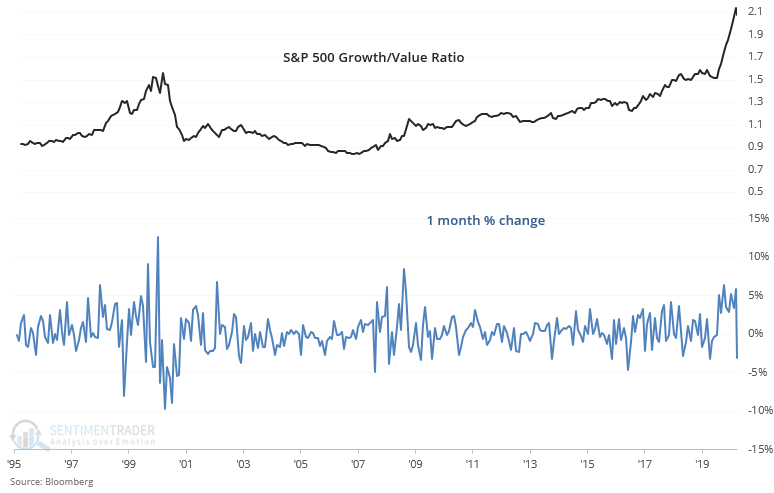

On a month-to-month basis, the S&P 500 Growth/Value ratio has dropped -3% this month so far (the following is a monthly chart):

*Keep in mind that September is not over yet.

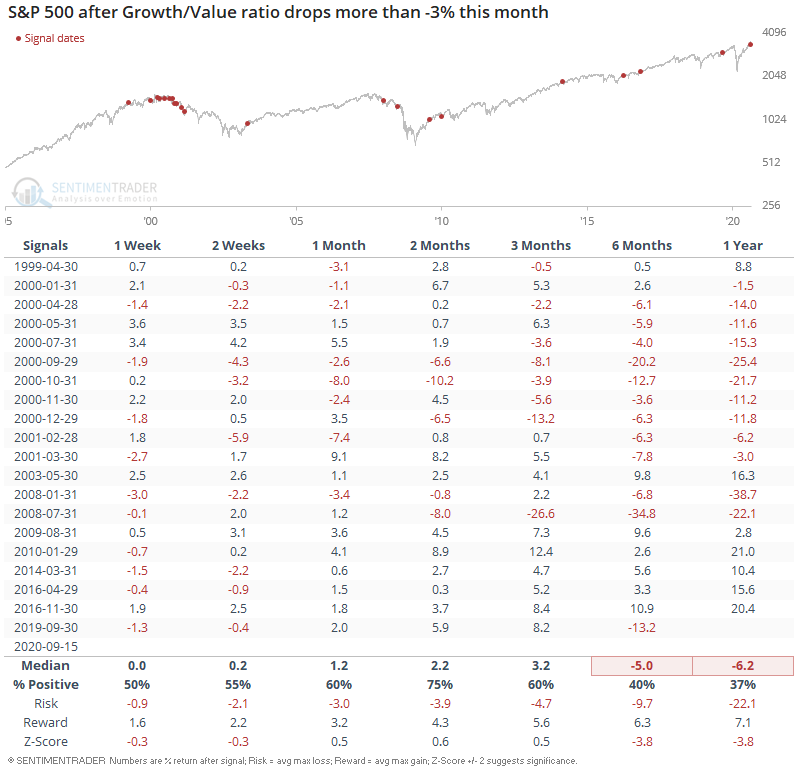

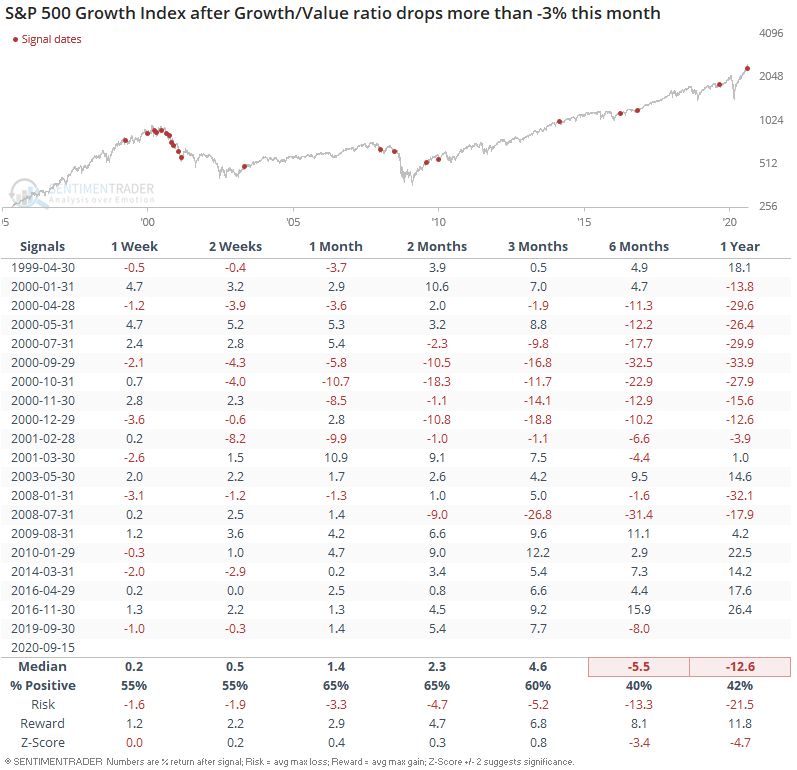

In the past this usually led to losses for the S&P over the next 6-12 months due to the abundance of cases in 2000 and 2008:

Leading to losses for the S&P 500 Growth Index over the next 6-12 months:

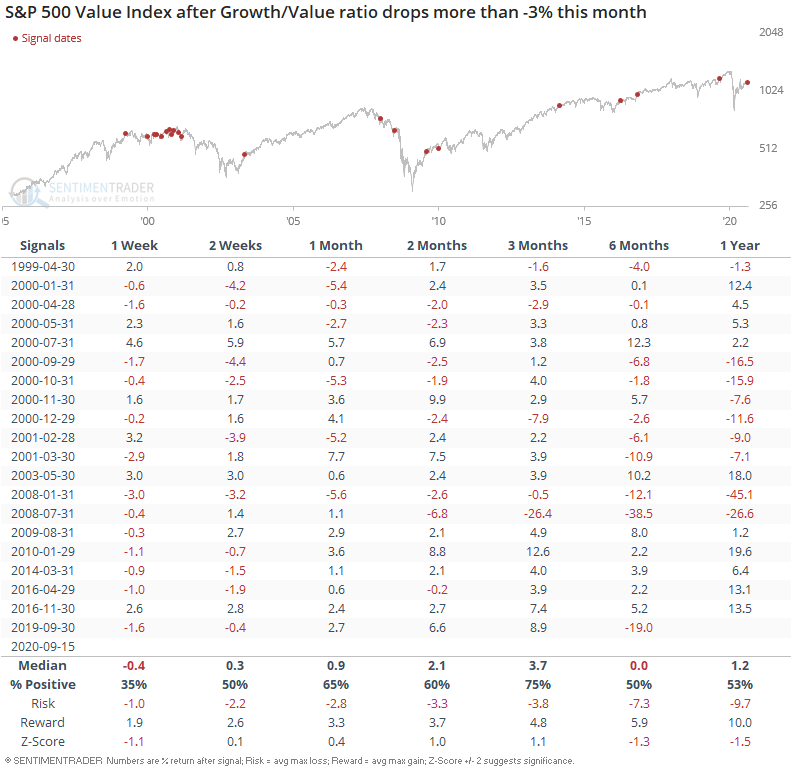

While leading to mixed results for the S&P 500 Value Index:

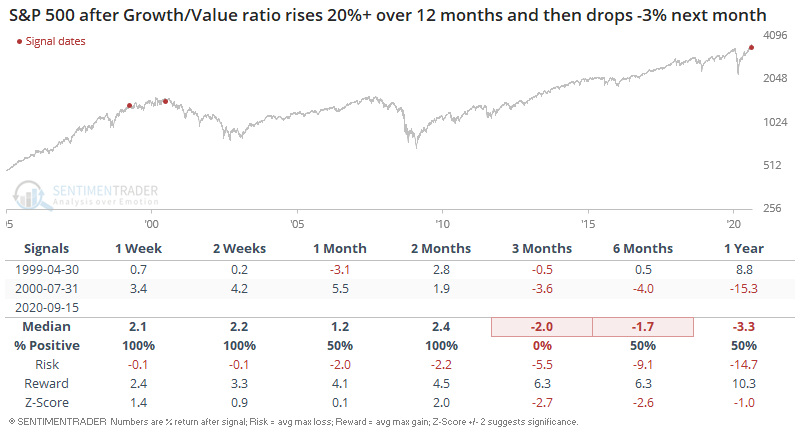

We can restrict the sample size to only look at historical cases which occurred after the Growth/Value ratio surged over the previous 12 months:

When we do that, we are only left with 2 historical cases (1999 and 2000):