Valuations across sectors & countries

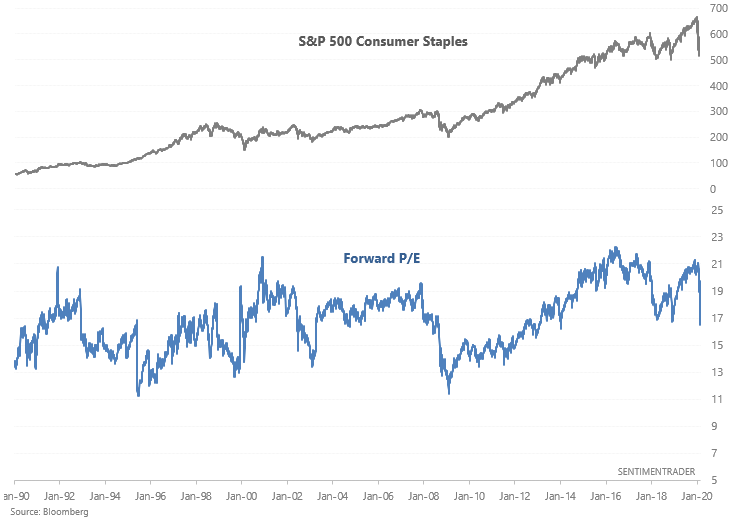

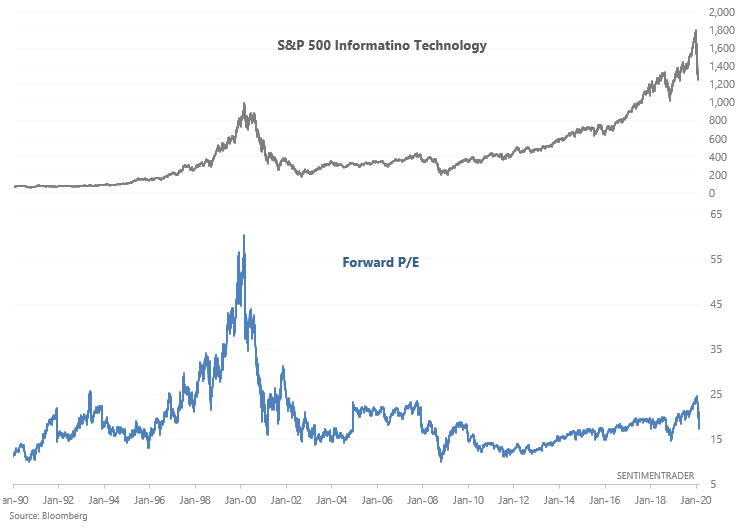

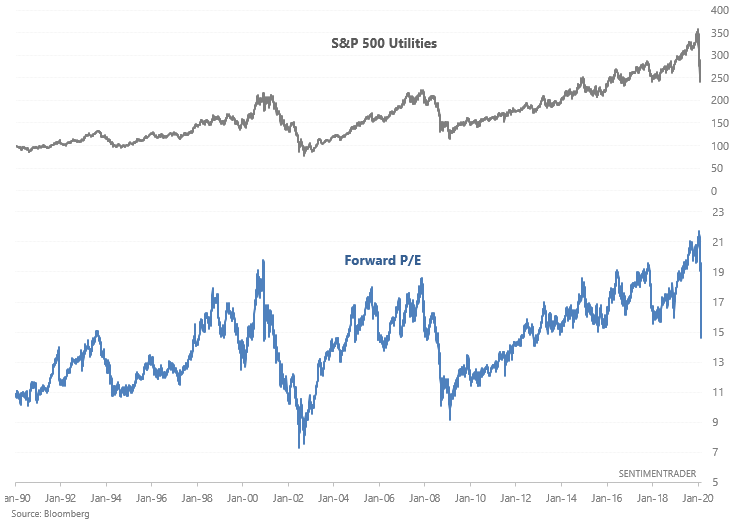

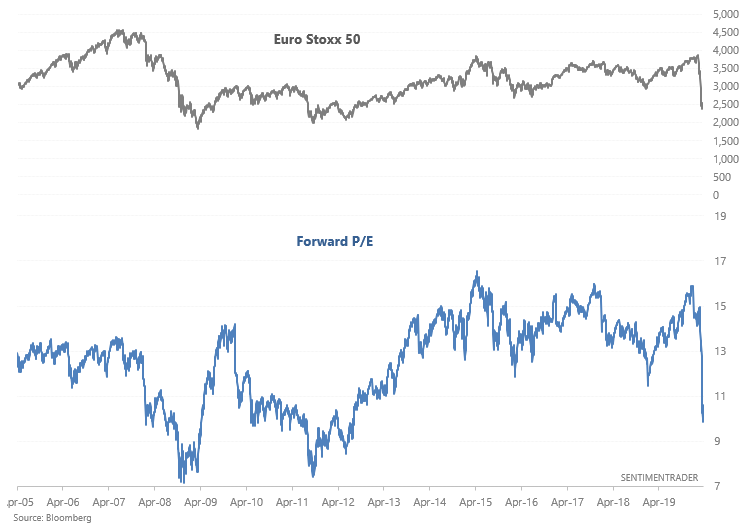

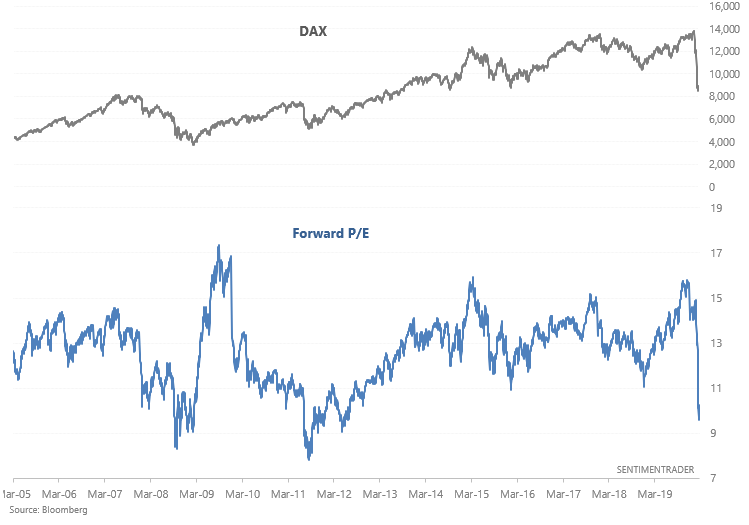

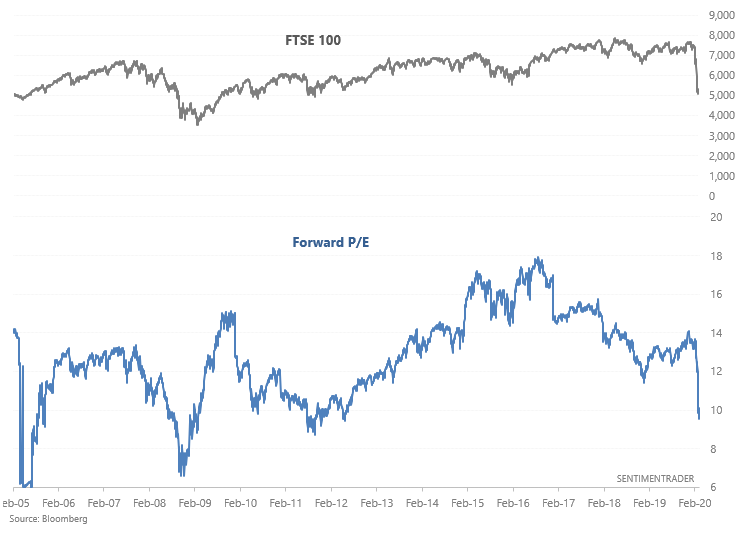

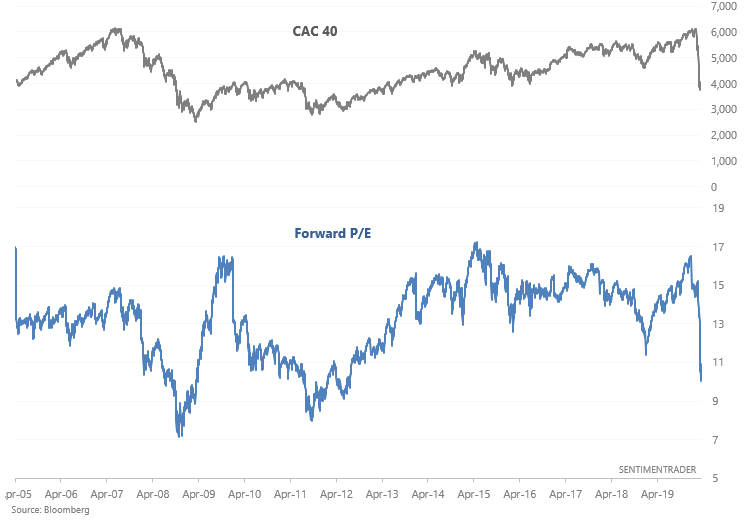

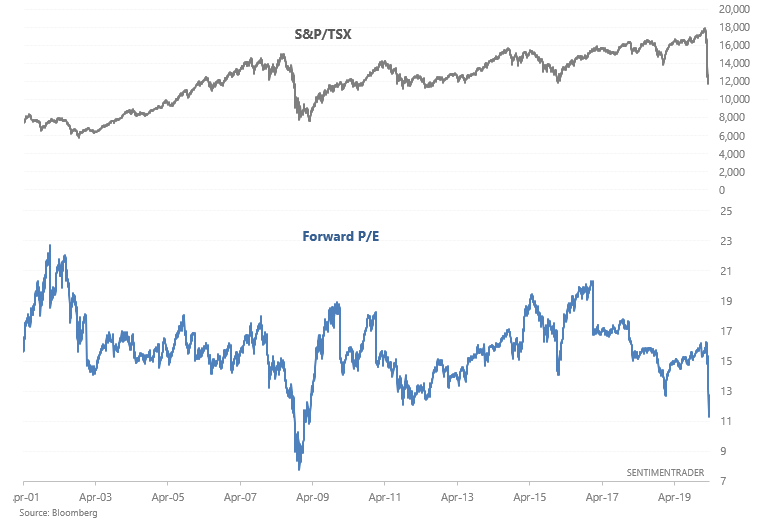

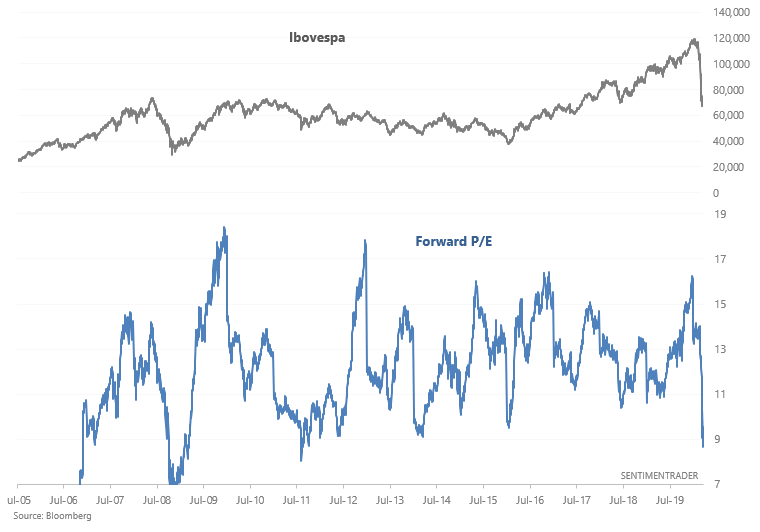

I looked at the S&P 500's valuations over the weekend. To re-iterate, valuations aren't very important for short-medium term traders, but are important for investors. While the S&P 500's valuations have improved significantly from just a few weeks ago, valuations are still not incredibly attractive. Valuations will become attractive for my portfolio if they fall a little more. Here are valuations across sectors and other countries if you're interested in more than just the S&P 500. The overall story is similar: valuations are getting towards the cheap side, but are not as cheap as during 2008.

S&P 500 sectors

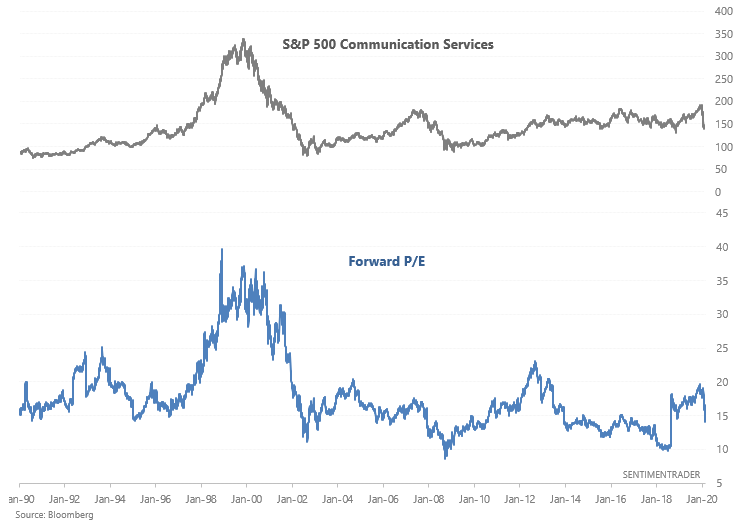

Communication Services forward P/E = 13.99

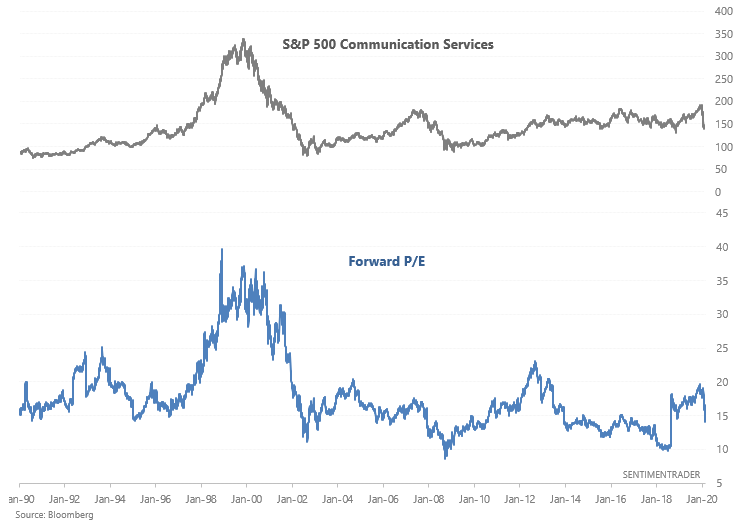

Consumer Discretionary forward P/E = 17.07

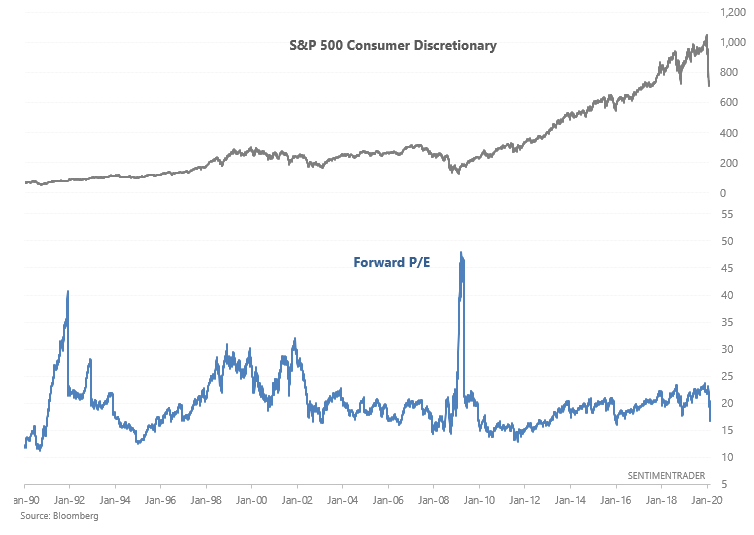

Consumer Staples forward P/E = 16.46

Energy forward P/E = 15.23

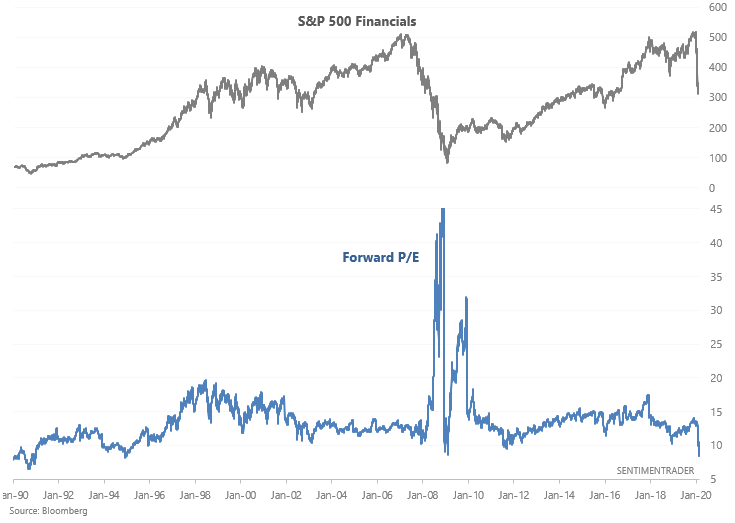

Financials forward P/E = 8.37

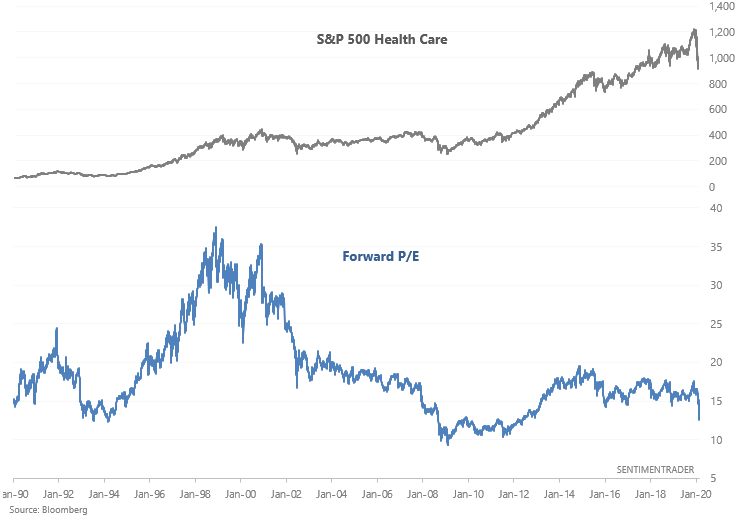

Health care forward P/E = 12.56

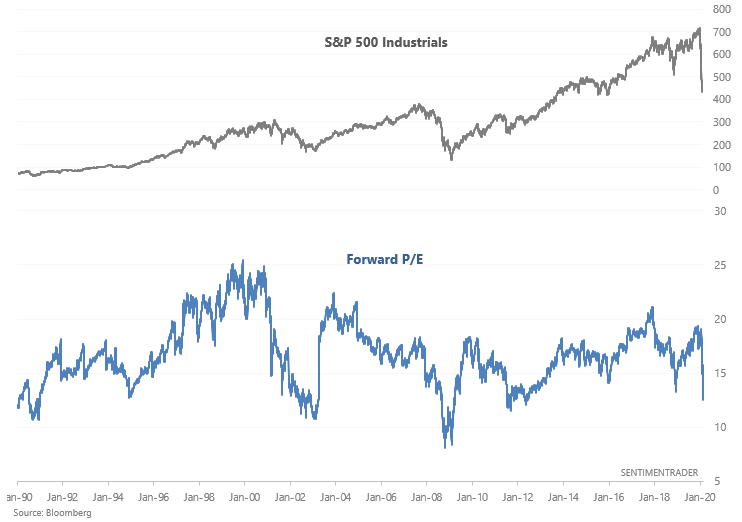

Industrials forward P/E = 12.47

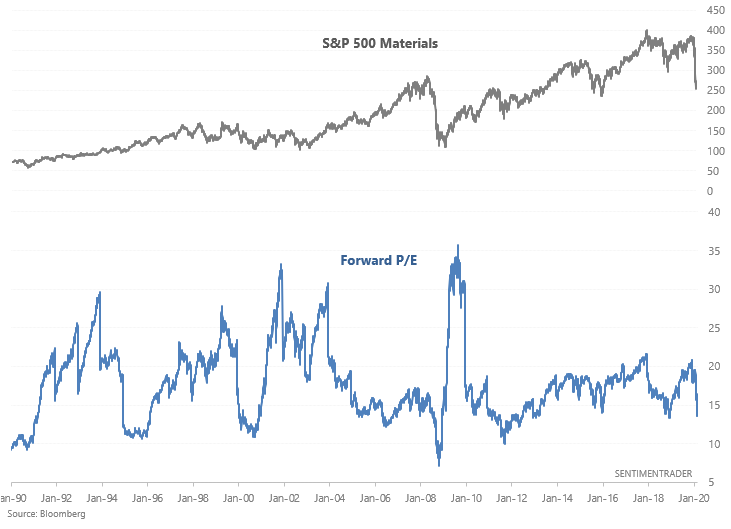

Materials forward P/E = 13.52

Technology forward P/E = 17.33

Utilities forward P/E = 14.6

Europe

Europe (Euro Stoxx 50) forward P/E = 10.62

Germany (DAX) forward P/E = 10.25

UK (FTSE 100) forward P/E = 9.97

France (CAC 40) forward P/E = 10.91

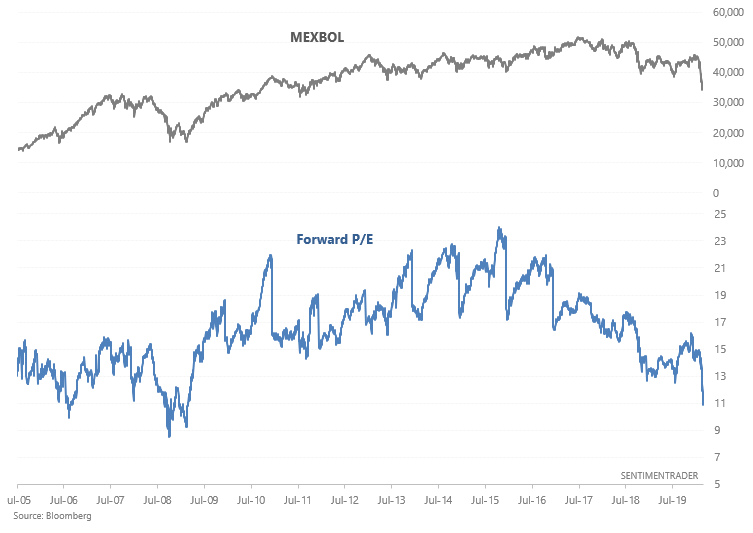

North & South America

Canada (S&P/TSX Composite Index) forward P/E = 11.62

Brazil (Ibovespa) forward P/E = 8.69

Mexico forward P/E = 10.88

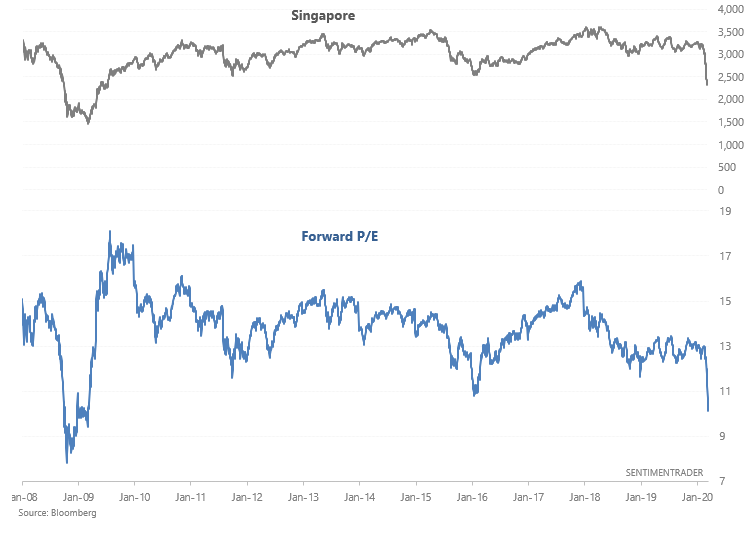

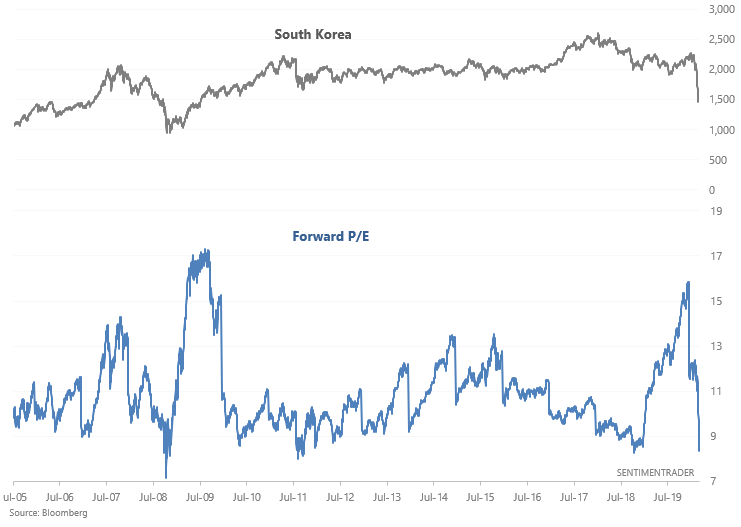

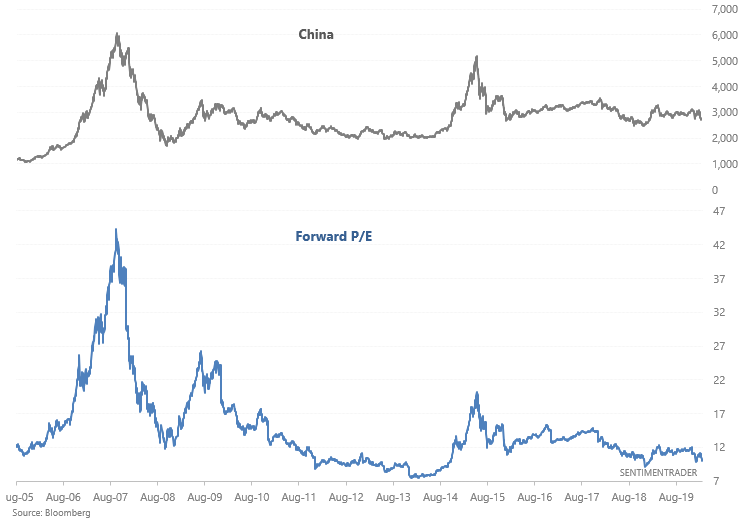

Asia Pacific

Australia (S&P/ASX 200) forward P/E = 13.1

Japan (Nikkei 225) forward P/E = 13.34

Singapore (Strait Times Index) forward P/E = 10.54

South Korea (KOSPI) forward P/E = Index

China (Shanghai Index) forward P/E = 10.14

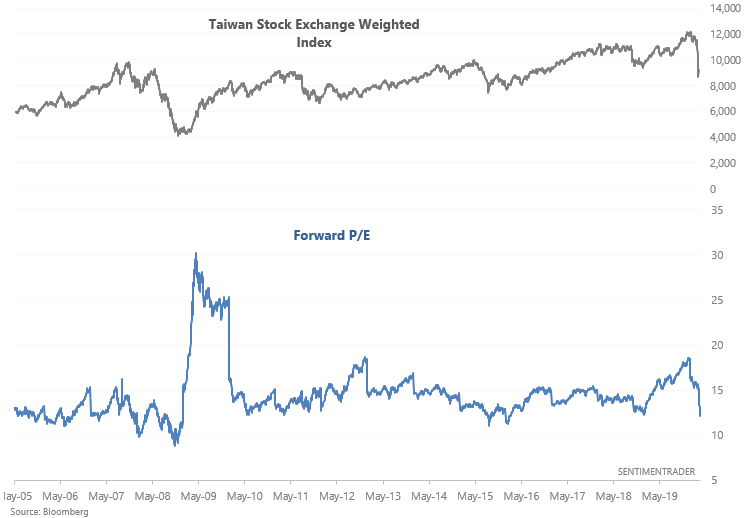

Taiwan (Taiwan Stock Exchange Weighted Index) forward P/E = 12.59

Emerging markets index

MSCI Emerging Markets Index forward P/E = 10.65