V-Shaped Bounces And Explosion In Hedging

This is an abridged version of our Daily Report.

V-shaped probability

Following declines like the past month, v-shaped bounces were common. Almost 40% of the precedents formed a bottom within a couple of sessions. While some short-term volatility was normal, all but a few of the precedents ended up with a positive return over the next several months.

Suddenly, a desire to hedge

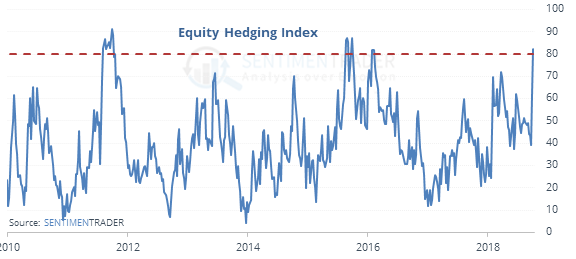

Due to a rapid increase in defensive strategies, the Equity Hedging Index has soared into extreme territory after last week’s drop.

Readings this high since 1999 have consistently led to positive two-month forward returns, even during bear markets.

Testing metals’ mettle

The impressive rally in gold miners has pushed the 3-day average of the Optimism Index for GDX above 80 for the first time in over a year. According to the Backtest Engine, a 3-day average above 80 has led to a positive return over the next week only 39% of the time.