Utility stocks see surge in new uptrends

Utility stocks have managed to hold up better than usual. Earlier in the month, many of those stocks showed short-term surges, which typically lead to lower prices for such a staid sector.

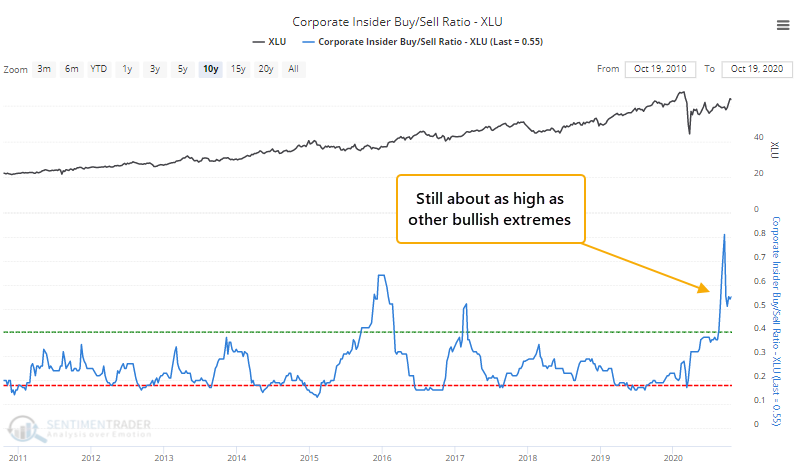

There have been positives for months, like insider buying interest. Those buys have tapered off, but sales have dropped even further, so the Buy/Sell Ratio is still impressively high.

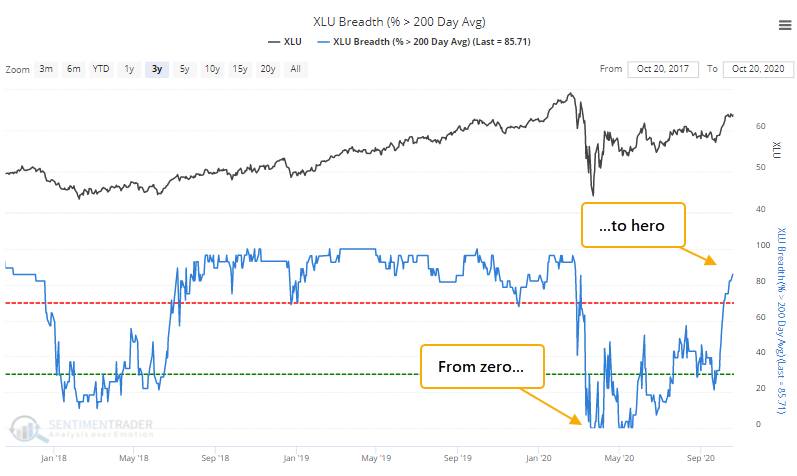

As many of those stocks have held up, more and more of them are crossing above their long-term 200-day moving averages. There was a total wipeout in these stocks during the pandemic crash in March, and even as late as mid-May, every utility stock was below its 200-day average. Over the past week, that has climbed above 80%.

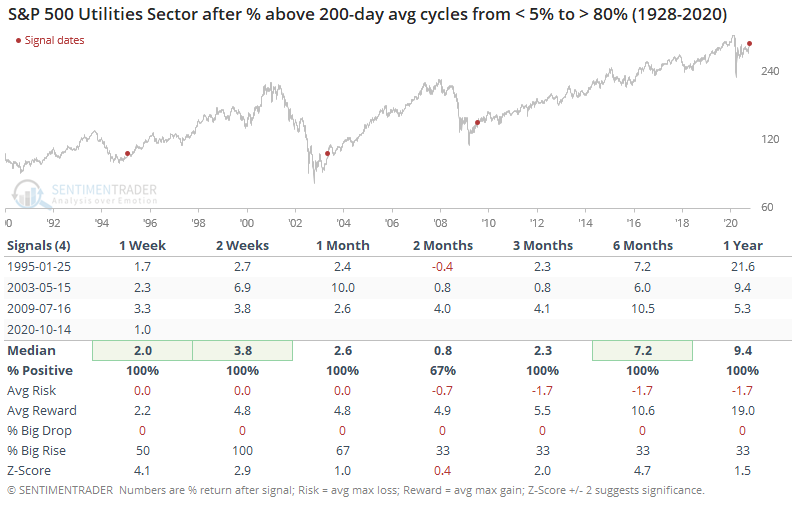

Over the past 30 years, there have been only 3 other times when this sector went from fewer than 5% of stocks above their 200-day averages to more than 80% of them being so within a year's time.

All 3 of them triggered during the initial recovery from a bear market, leading to large, sustained gains in the months ahead. The risk/reward was heavily skewed to the upside, and none of them saw an abnormally large loss at any point within the next year.

On a short-term basis, a sector like this has a lot of trouble when it reaches overbought levels. But on a medium- to long-term basis, this recovery has impressively positive precedents.