Utility stocks have seen a big internal surge

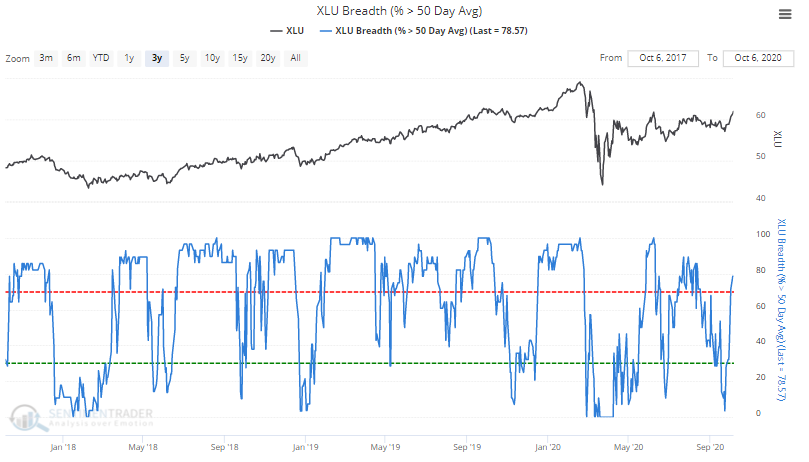

The past few days have seen U.S. stocks chop up and down. One of the few exceptions has been the utilities sector, which on a total return basis reached the highest level since the March crash.

As a result, the percentage of stocks in this sector above their 50-day moving averages surged from less than 15% to greater than 78% within 2 weeks.

We've seen repeatedly in the past that a staid sector like utilities does not tend to do well in the short-term after big bouts of positive momentum. There are some signs of that here, and shorter-term returns have been mostly weak as noted above. Longer-term, however, the bias was solidly higher.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- More detail on the internal strength in utilities

- Despite the gains, ETF traders are pulling money from funds like XLU

- Corporate insiders have been very busy in utility stocks