Utilities Have Been (Too) Strong

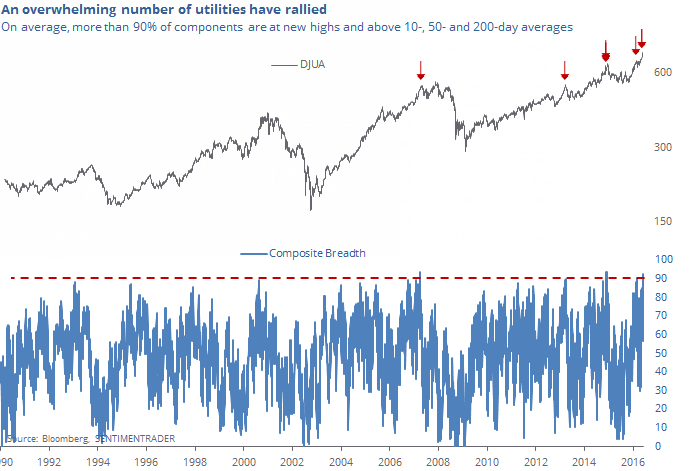

In Wednesday's Report, there was a note about the high number of utilities stocks that reached a 52-week high recently. At more than 80% of components in the S&P 500 utilities sector, it is the most since 1990 except for December 26, 2014. Utilities formed a peak shortly thereafter.

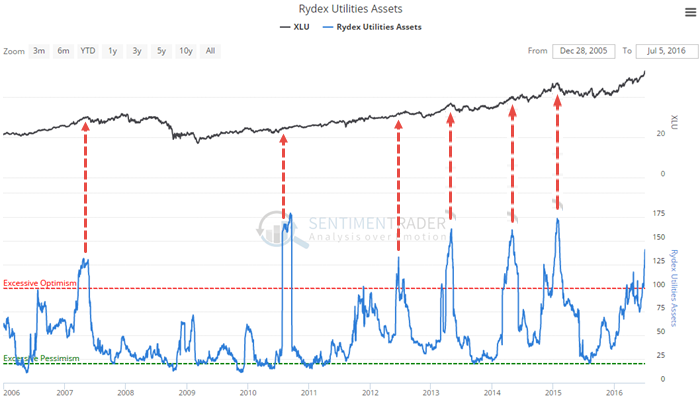

The run in utilities has garnered attention from a group that likes to jump on trends, usually well after they develop, Rydex mutual fund traders. They've pushed assets in the Rydex Utilities fund to more than $125 million, the highest in more than a year.

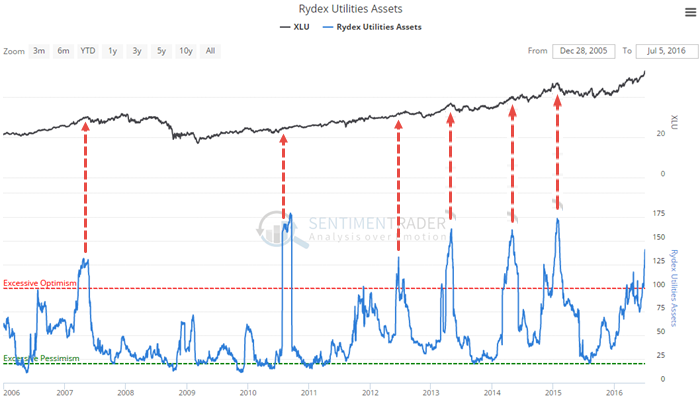

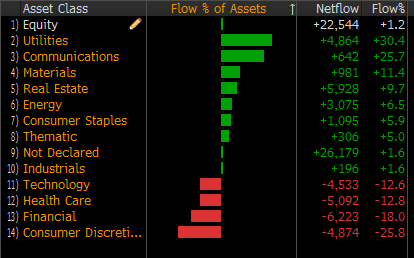

That hasn't been lost on ETF traders, either. Utilities-focused ETFs have increased their asset base by over 30% this year, the most extreme flow of any sector.

Going back to sector breadth, let's compute a composite score using the percentage of members in the sector that are trading at a 52-week high as well as trading above their 10-day, 50-day and 200-day moving averages. Currently, that figure stands at 91%, meaning that on average, more than 90% of stocks in the sector are trading above all their moving averages and at a 52-week high.

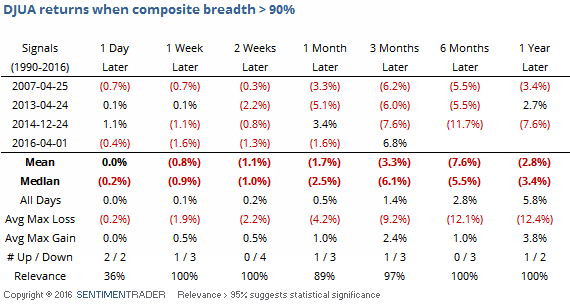

That's extraordinarily strong...too strong, according to the few other times it has occurred. It has gone above 90% only four other times since 1990.

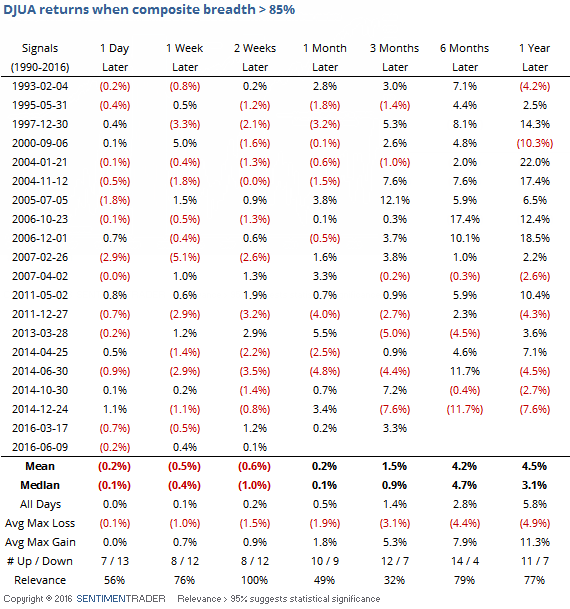

We can see that the returns going forward were weak, but the sample size is too small. If we relax the threshold to 85%, then we get more instances. The forward returns weren't as negative, but were still weak.

Based on the rush to get into these stocks (and the likelihood that yields have reached an exhaustion point as noted in Wednesday's Report), we should see utilities plateau somewhere around here for the next several weeks to months.