Utilities as a risk-on indicator

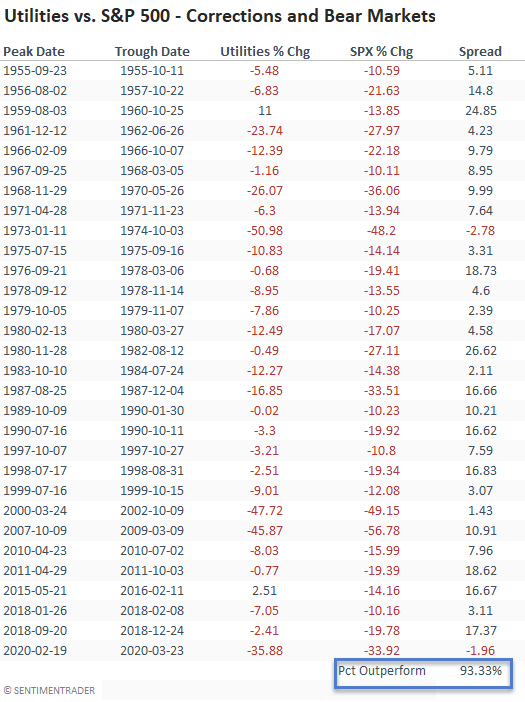

During periods of market stress, utilities are one of the go-to sectors for investors as they seek a more defensive portfolio allocation to minimize drawdowns. Since 1955, utilities have outperformed the S&P 500 index during correction and bear market periods 93% of the time.

Conversely, during bull market phases, utilities typically underperform the broad market as investors seek to allocate to sectors with a more high octane offensive tilt.

Today's note aims to share a concept that identifies when utilities reverse from a period of outperformance to underperformance that is typically associated with a bearish to bullish transition in the market.

COMPONENTS

- Percentage of S&P 500 utility members outperforming the S&P 500 index on a rolling 21-day basis.

- Percentage of S&P 500 members outperforming the S&P 500 index on a rolling 21-day basis.

The trading signal is based on the following formula.

PERCENTAGE OUTPERFORMING SPREAD

Spread = Percentage Outperforming Utilities - Percentage Outperforming S&P 500.

THE CONCEPT

The utilities outperforming spread signal identifies when the percentage of members outperforming spread between utilities and the S&P 500 increases above a user-defined threshold and reverses lower to cross below a user-defined buy level. i.e., the broad market is transitioning from a risk-off phase to a risk-on phase. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- If the spread crosses above 48%, the reset condition is true.

- If condition 1 and the spread crosses below the buy level threshold of -0.50%, then buy.

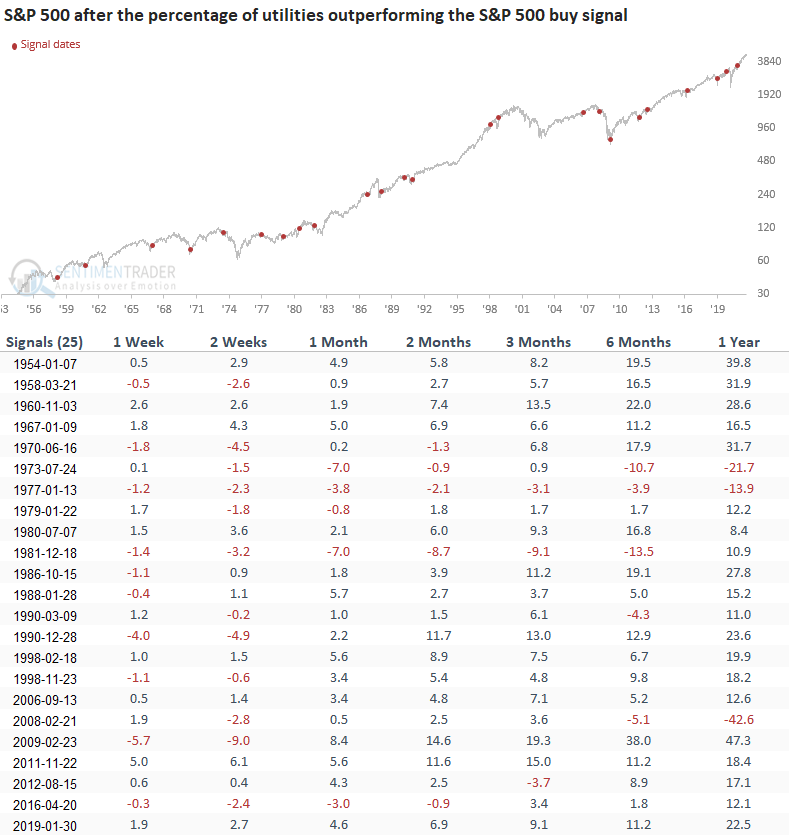

CHART EXAMPLE

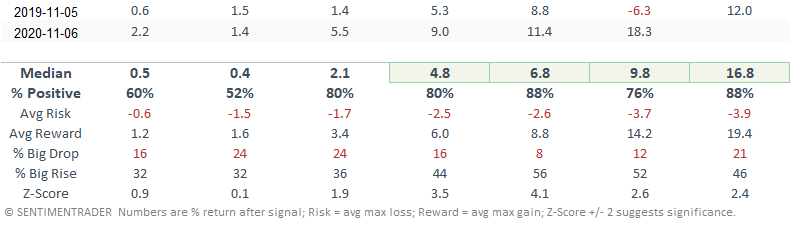

HOW THE SIGNAL PERFORMED

Results look excellent starting in the 1-month timeframe with several notable z-scores. Given that the signal is typically associated with a market transition from a period of stress, it's not a surprise to see somewhat lackluster results in the first two weeks.