Using options to trade a seasonally strong dollar

Key Points:

- The U.S. Dollar is threatening to break out to the upside

- The Annual Seasonal Trend for several foreign currencies favors an upside dollar breakout

- If the dollar fails to break through to the upside, a quick and sharp downside reversal could be in the offing

The Action in the U.S. Dollar has been relatively strong, but…

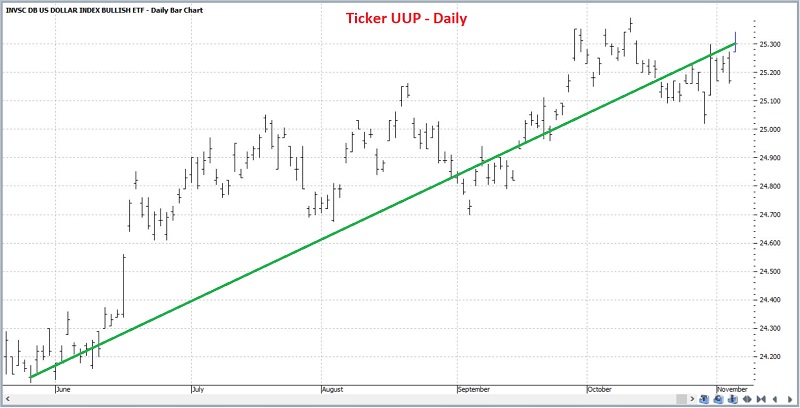

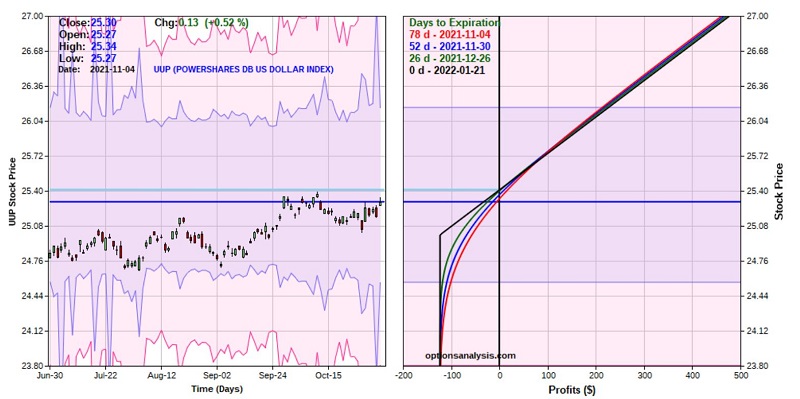

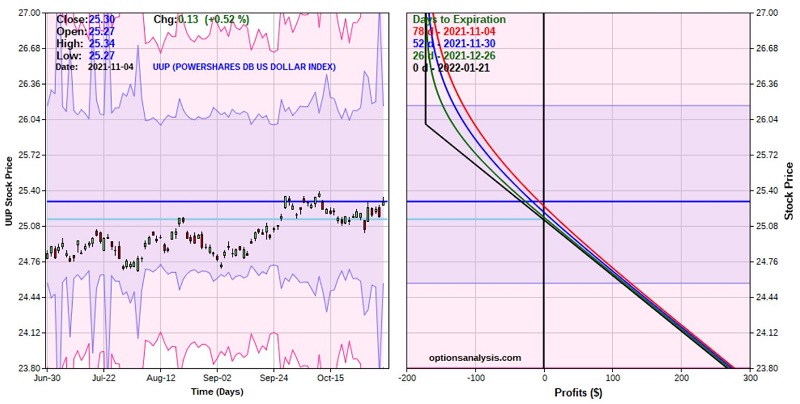

The chart below (courtesy of Profitsource) displays a daily chart for UUP (Invesco DB U.S. Dollar Index Bullish Fund) since June 2021. This ETF - which tracks U.S. Dollar futures - has been in a steady uptrend.

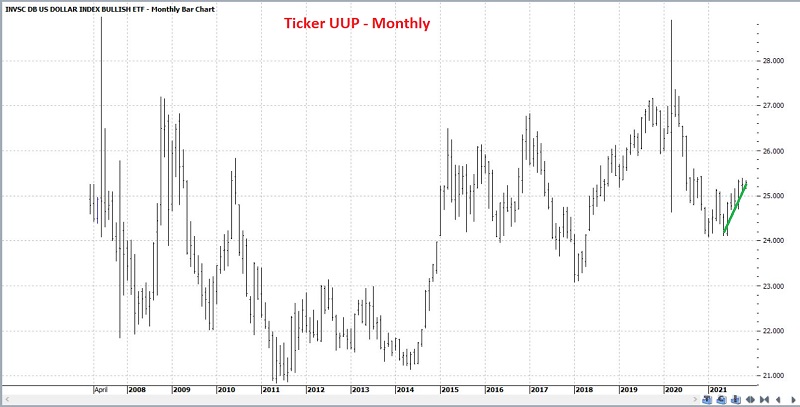

However, if we step back and look at a monthly chart, the recent gain seems far less impressive.

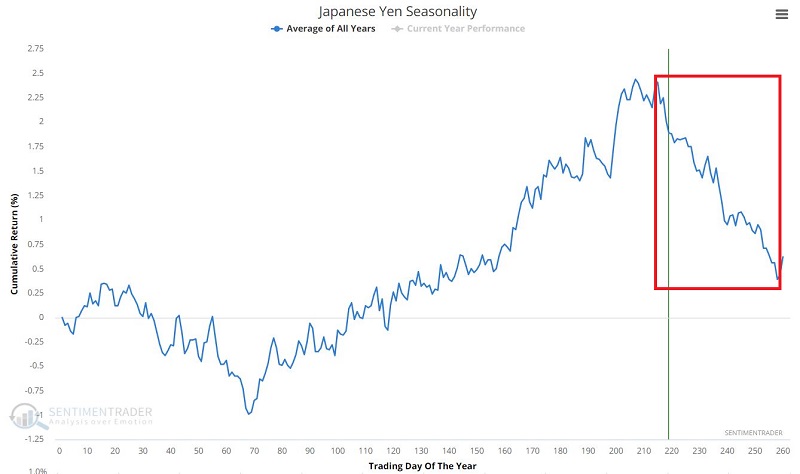

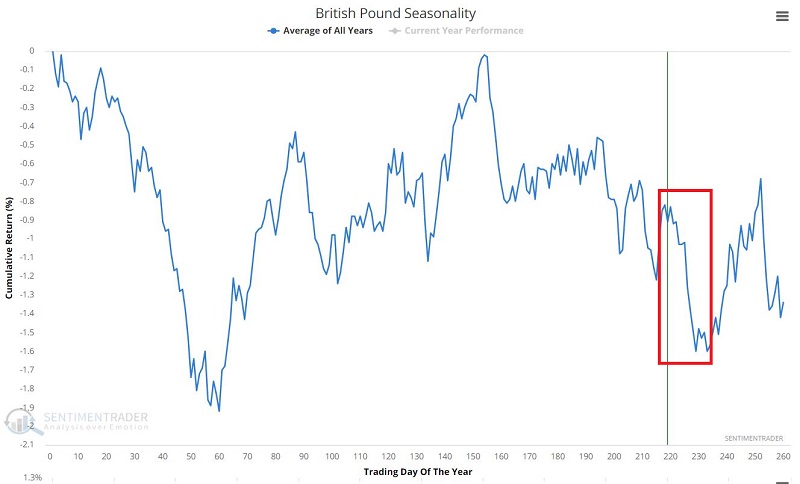

Currency Seasonality is weak (which is bullish for the U.S. Dollar)

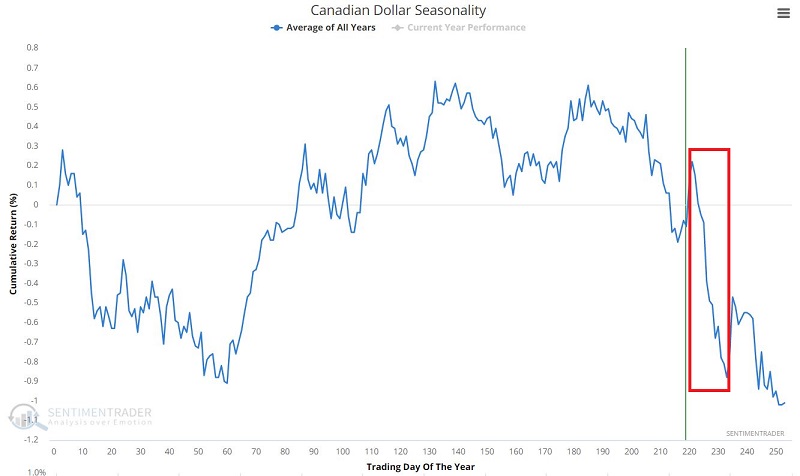

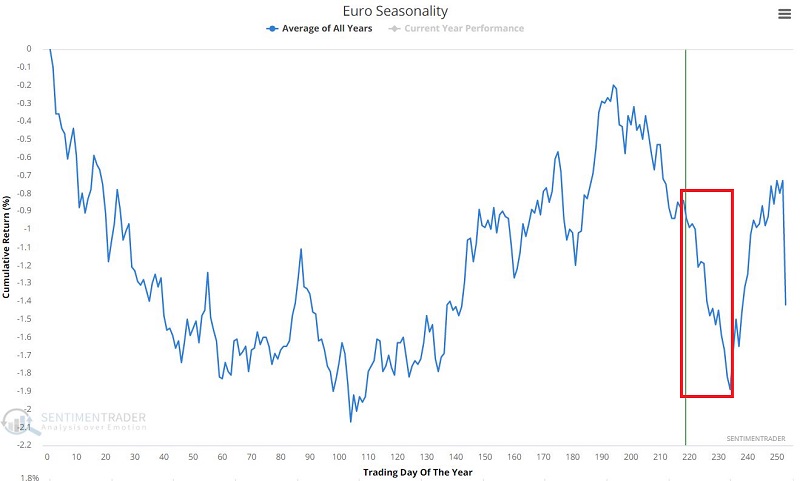

The charts below display the Annual Seasonal Trend for a variety of heavily traded foreign currencies. Note that they are all either in - or are soon to enter - a period of seasonal weakness.

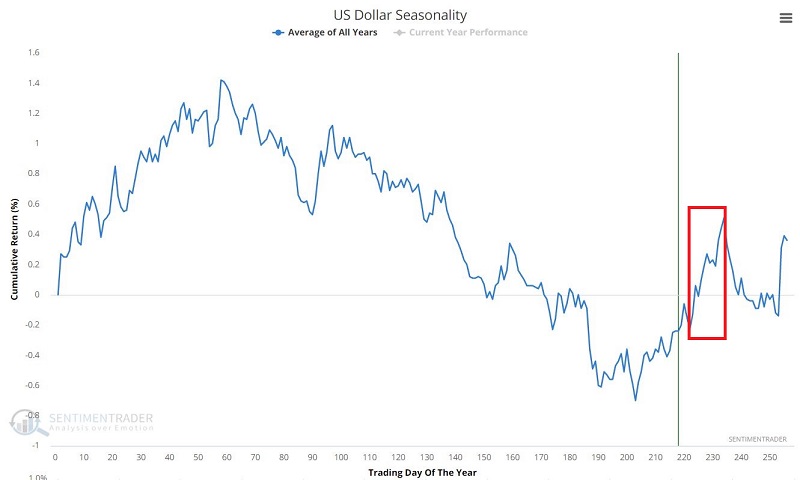

In contrast, the chart below displays the Annual Seasonal Trend for the U.S. Dollar.

If we combine the current uptrend with the dollar's favorable seasonal trend, the suggestion is that the dollar will show strength in the near term.

Playing the long side of the dollar with long call options

One way to play would be to buy 200 shares of ticker UUP, which would cost roughly $5,030. An alternative would be to buy 3 UUP Jan21 25 calls @ $0.41 for $123.

The particulars and risk curves for this example trade appear below (courtesy of Optionsanalysis).

At the time of entry, this trade has 78 days left until expiration. This means we can hold this trade for a short-term trade without worrying about significant time decay (which accelerates in the last 30 days before expiration).

Buying a 3-lot gives a delta of 196.56. This means that (for now) this position will behave like a position holding roughly 200 shares of UUP. The cost to enter is $123 versus $5,030 to buy 200 shares of UUP.

The maximum profit potential is unlimited, while the maximum risk is -$123 and would only occur if we held the position to January expiration with UUP below $25. At expiration, the breakeven price is $25.41, so above this price, the option will gain point-for-point with the shares.

This trade is specifically a bet on the dollar breaking out to the upside. Under any other circumstance, it will lose money.

In terms of exit criteria, there are no set rules. Some possibilities, however, include selling if UUP becomes overbought or when the seasonally favorable period for the dollar ends.

Or the downside with put options

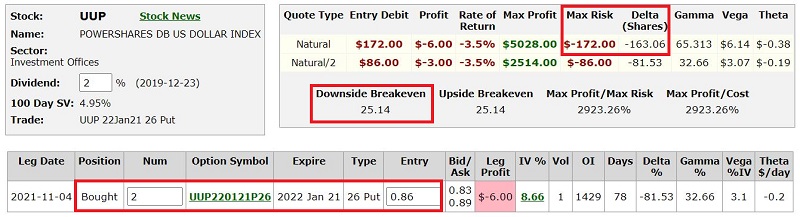

A swift downside reversal is possible if the dollar bumps its head on resistance and fails to break through to the upside. One potential way to play that situation would be to buy 2 UUP Jan21 2022 26 puts @ $0.86.

The particulars and risk curves for this example trade appear below.

At the time of entry, this trade has 78 days left until expiration.

Buying a 2-lot gives this trade a delta of 163.06. This means that (for now) this position will behave like a position holding short 163 shares of UUP. The cost to enter this trade is $172.

The maximum profit potential is unlimited and the maximum risk is -$172 and would only occur if we held the position to January expiration and UUP is above $26. At expiration, the breakeven price is $25.14, so below this price, the option will gain point-for-point with the shares.

This type of trade would typically be entered either:

- Immediately, if you fully expect the dollar to fail and reverse

- After the dollar attempts to break out to the upside and fails

A trader should plan what criteria would cause them to exit the trade with a profit and what criteria would cause them to exit the trade with a loss.

What the research tells us...

The U.S. dollar has staged a steady advance in recent months and is in the midst of a seasonally favorable period. Additionally, several foreign currencies are entering seasonally unfavorable periods which could further buoy the U.S. dollar. The caveat is that seasonal trends are never guaranteed to work as expected "his time around. Fortunately, options offer traders a simple way to play any expectation.