Using options to trade a positive seasonal window in TLT

Key Points

- The TLT bond fund is entering a period of seasonal strength

- We can craft an options trade to take advantage of the potential opporunity

TLT seasonality is turning up

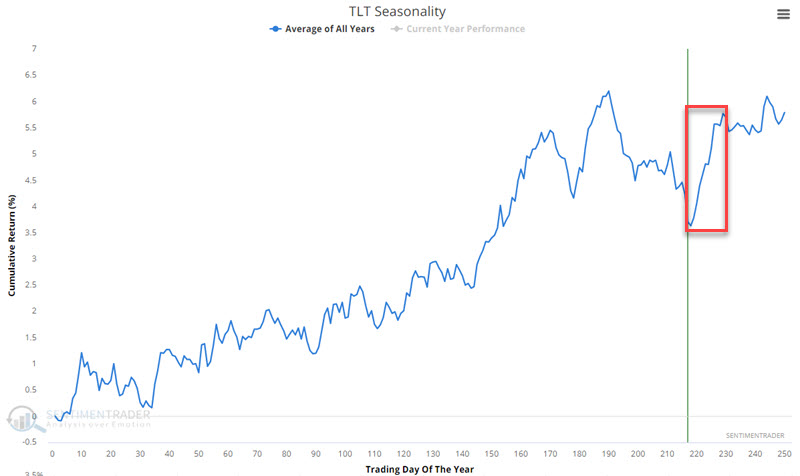

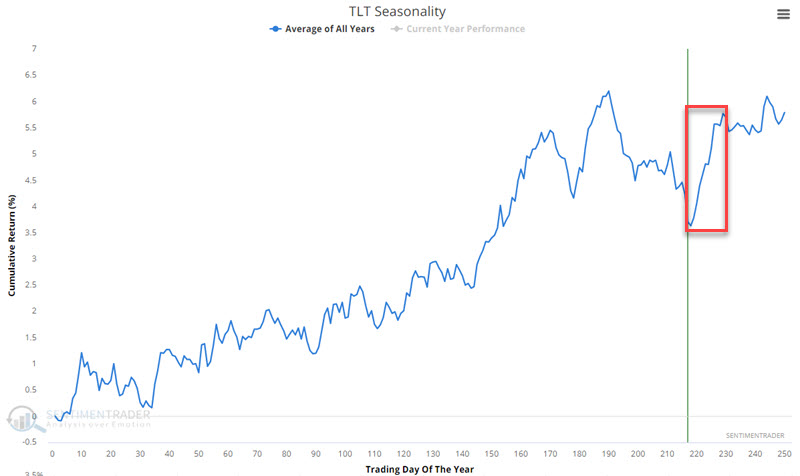

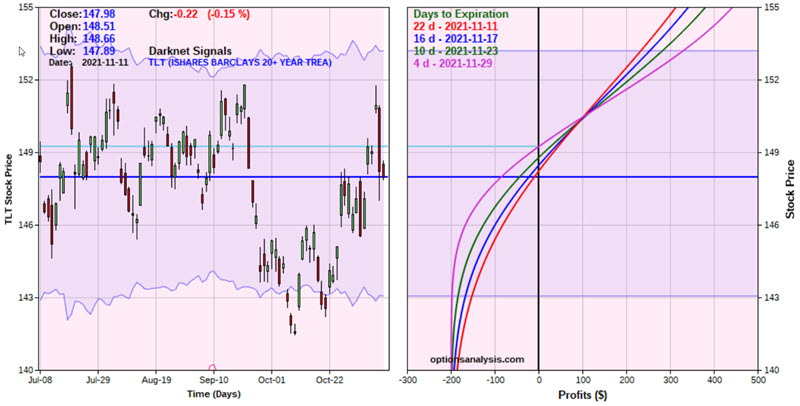

The chart below displays the annual seasonal trend for TLT (iShares 20+ Year Treasury Bond ETF ). We are about to enter a period of short-term seasonal strength.

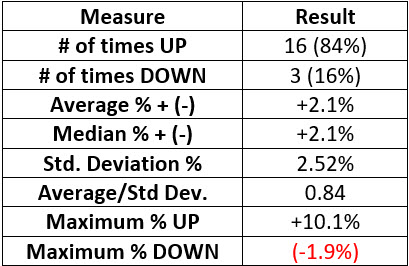

Since its inception, this period has seen TLT rise 84% of the time with a very favorable risk to reward ratio.

Playing TLT with options

There are many possible ways to play a short-term bullish setup using options on ticker TLT. For the sake of example, we will detail one possibility.

The strategy is a bull call spread that involves buying a call option at one strike price and selling another call option of the same expiration cycle at a higher strike price.

Our example trade involves:

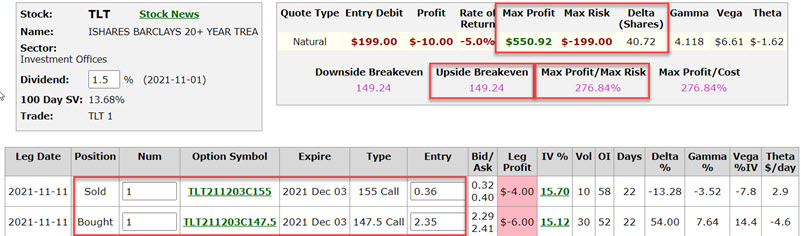

- Buying 1 TLT Dec03 147.5 call @ $2.35

- Selling 1 TLT Dec03 155 call @ $0.36

The particulars and risk curves for this example trade appear below (courtesy of Optionsanalysis).

Trading details - lower capital commitment, but high risk

The seasonally favorable period extends through November 29, 4 days before option expiration for the December calls. As a result, the risk curve chart above extends only through that date and not until expiration.

We assume that we place a limit order to enter the trade at the midpoint between the bid/ask prices for each option. The cost to enter a 1-lot is $199, which is also the maximum risk, while the maximum profit is $551.

The breakeven price for TLT shares is $149.24. The position has a delta of 40.72 which means it will behave like a position holding 41 shares of TLT (note that buying 41 shares of TLT would cost $6,067 instead of the $199 paid to enter the bull call spread. If TLT hits $152 a share, this position will show an expected profit of between $183 and $234 (92% to 113% of the capital risked), depending on whether $152 is hit sooner or later.

This example trade is a low-dollar risk trade ($199); however, it is not low-risk. Let me explain.

$199 is the cost to enter this trade that offers a maximum profit potential of 277%. However, if TLT fails to advance during the period when strength is expected, a loss of 100% of the $199 paid is possible and maybe even probable.

A useful rule-of-thumb for entirely speculative trades is to risk a minimal amount of your trading capital (think 1% to 5% at most).

A trading plan

There are no hard and fast rules for managing a trade like this. So, let's create an example plan that a trader can modify if they so choose.

Assume a 50K trading account and a willingness to risk 2% on this trade. $50K x 2% = $1,000. Since the position costs $199 for a 1-lot, I can buy a 5-lot for $995.

Because the catalyst for this trade is a seasonally favorable period, I will adopt the following rules:

- Exit the entire position if TLT approaches the short strike of $155 (to avoid any possibility of assignment)

- If $155 is not reached, then exit the entire position on 11/29 - whether for a gain or a loss

- If TLT falls back towards $143 a share, I may consider exiting the trade and salvaging whatever premium I can

What the research shows…

Entering trades based solely on seasonality should always be considered speculation and not investment. It is typically wise to bet relatively small amounts of capital on speculative bets. Options can allow you to leverage your winnings when you are correct and to limit your dollar risk when you are wrong. This can be a good strategy for betting a relatively small amount on a speculative strategy like short-term seasonal influences.