Using Options to Play a Spike in Volatility

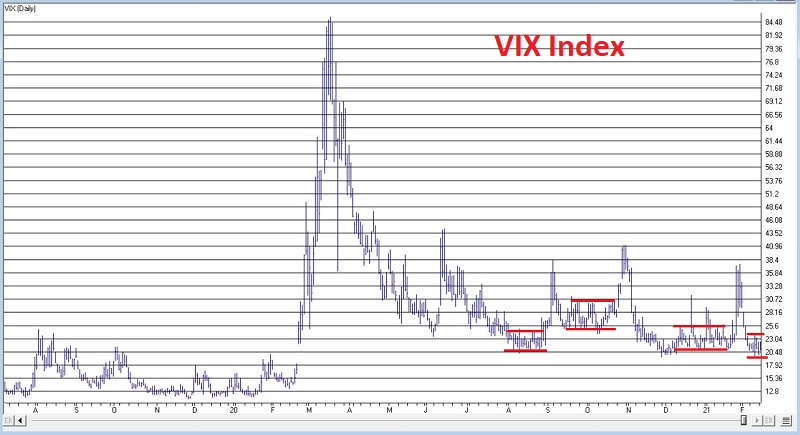

With all of the rampant speculation going on of late a number of traders are looking for a reversal of sorts in the near future. One expectation among those in this camp is that volatility will spike when the anticipated reversal of fortune occurs. As you can see in the chart below the VIX Index has definitely fallen into a bit of a "lull" (chart presented Courtesy of AIQ TradingExpert).

For the record, I am agnostic on the outlook for volatility. I am neither "predicting" an imminent spike in volatility nor am I "recommending" any of the example trades that follow. The purpose of this piece is simply to highlight "one way to play" if one wanted to bet on a pickup in volatility.

Ticker UVXY

Ticker UVXY is a leveraged ETF that is intended to deliver 1.5 times the daily return of of the 30-days-to-expiration weighted average of the front month and second month VIX future (which it should be noted can move in the opposite direction from VIX on a daily basis). So, for someone looking to play the long side of volatility it would appear to be just the right vehicle. HOWEVER, the reality is that because of the way it operates, UVXY's underlying index lags the VIX by about 30% every 6 months (see this article for more detail). As a result, UVXY is strictly a vehicle for short-term traders. If you expect a "pop" in volatility in the near future (1 day to no more than 1 month) then UVXY can deliver if you are correct. If you plan on holding a long position in UVXY - or a bullish option position - for ore than a month, your odds of success diminish greatly.

So, let's assume that a trader expects a spike in volatility in the next month and highlight an example trade.

The trade that we will consider combines:

- A bull call spread (long a lower strike call and short a higher strike call)

- A bull put spread (short a higher strike put and long a lower strike put)

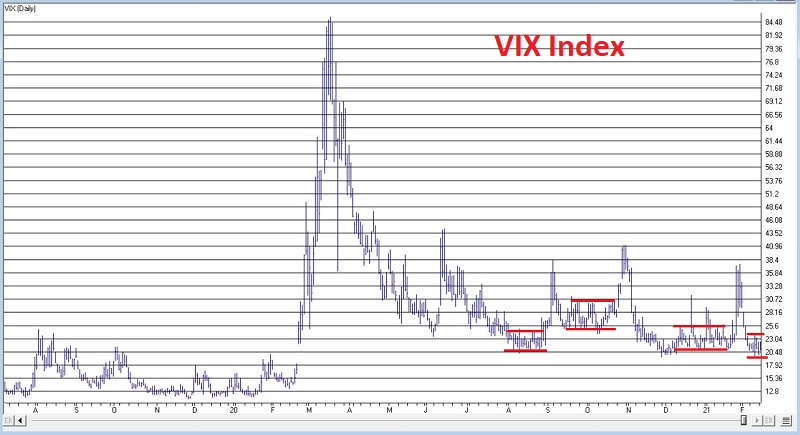

We will go out 30 calendar days to the Mar19 expiration and:

- Buy 10 Mar19 12 calls @ $1.16

- Sell 10 Mar 19 15 calls @ $0.92

- Sell 10 Mar19 8 puts @ $0.73

- Buy 10 Mar19 6 puts @ $0.05

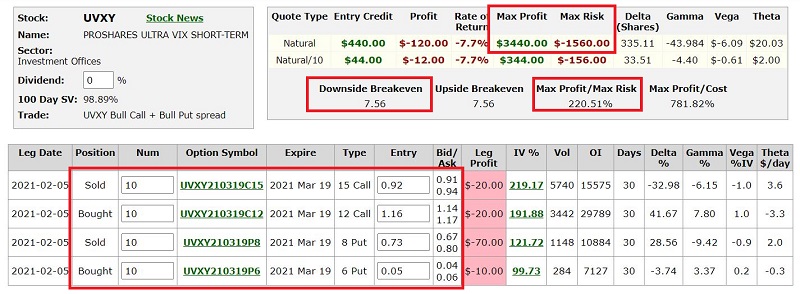

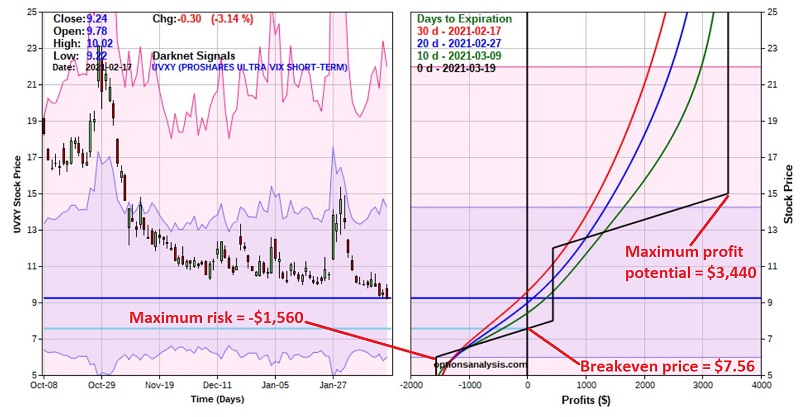

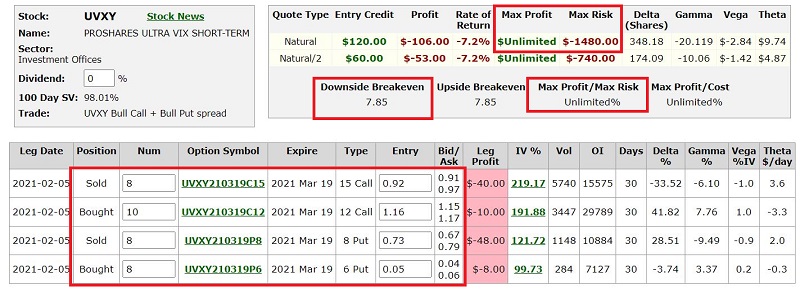

The particulars for this trade appear in the screen shot below and the risk curves in the chart below that (Courtesy www.OptionsAnalysis.com).

This trade has some potentially positive characteristics:

- The maximum profit potential ($3,440) is 2.2 times the maximum risk (-$1,560)

- The trade starts making money immediately if UVXY rises by any amount from its current level

- Time decay works in favor of this trade

- The breakeven price for this trade at expiration ($7.56) is actually 18% BELOW the current share price ($9.24)

- If UVXY is between $15 and $8 at expiration this trade earns a credit of $440

The risk in this trade is simply that volatility keeps falling and UVXY drops precipitously (which in all candor UVXY has been known to do on a regular basis).

Changing the Equation

As discussed above, the example trade above will show a profit at expiration as long as UVXY does anything but fall -18% or more in price between now and then (which - repeating now- it is more than capable of doing). As positioned, profit potential is capped at $3,440 if UVXY reaches $15 a share or higher.

For a trader expecting a true explosion in volatility, a simple alteration can open-end profit potential. This alternative trade still buys 10 of the Mar19 12 calls, however, it trades only an 8-lot of each of the other options, as follows:

- Buy 10 Mar19 12 calls @ $1.16

- Sell 8 Mar 19 15 calls @ $0.92

- Sell 8 Mar19 8 puts @ $0.73

- Buy 8 Mar19 6 puts @ $0.05

The advantages of this position include:

- A lower cost of entry and lower maximum risk (-$1,480 versus -$1,560 for the original trade)

- Unlimited profit potential

Because this trade holds 2 additional long calls, if UVXY were to soar above $15 a share this position would enjoy unlimited profit potential.

On the downside:

- This trade has a slightly higher breakeven price ($7.85 versus $7.56)

- If UVXY is between $15 and $8 at expiration this trade earns a credit of only $120 (versus $440 for the original trade)

Still, if your expectation is a major up move in volatility then a slightly higher breakeven price and a lower potential credit earned at expiration may be a small price to pay for unlimited profit potential to the upside.

A Trading Note

Repeating now - the trades above are NOT "recommendations", only examples. That being said, let's complete the example by talking a little bit about what happens after the trade is entered. One specific concern is the fact that if UVXY drops below $8 a share there is "assignment risk", i.e., a buyer of the 8-strike price put could choose to exercise their put options and a trader who is short the 8-strike price put could be required to buy 100 shares of UVXY at $8 a share. Typically - though not always - options are not exercised until most all of their time premium has dissipated. This generally occurs either, a) either an option trades deep-in-the-money, and/or b) close to expiration.

I like to say that when it comes to trading, between theory and reality there is a chasm a mile wide. Here is a case in point. On the face of it, the above look like potential "set it and forget it" trades. In reality they are not. So, when formulating a plan to manage these trades the following mindset might be appropriate:

- The trade is entered purely as a speculative bet on higher volatility in the next 30 days (i.e., you either need to have a strong conviction that such a move will occur, or you are willing to risk a small amount of your capital on a "just in case" trade. Otherwise, there is no reason to take the trade in the first place).

- If the trade moves in your favor you should have a plan regarding whether you will:

- Take a profit

- Adjust the original trade

- Let it ride

- These decisions depend in part on your conviction level. If you absolutely think volatility is going "to the moon" then you might be more inclined to simply hold on as long as possible. Another possibility is taking some profits or adjusting if and when UVXY hits the January high of $15.37 a share.

- The trades above are pure speculation, particularly since UVXY has already showed signs of breaking down in recent days. These example trades are "pure bottom-picking." As such, a trader might go into it with the assumption that if UVXY does breakdown towards the strike price of the short put and/or towards the trades breakeven price at expiration, the proper course of action might be to "cut bait", swallow a manageable sized loss and move on to the next trade.

IMPORTAN TRADING POINT: A breakdown in the price of UVXY could happen quickly and at any time (it could even have happened by the time you read this). So, consider this potential "reality": A trader puts on a trade and literally within minutes UVXY starts to break hard and hits the "uncle" point. In the immortal words of Sean Connery in the Untouchables, "What are you prepared to do?" If you are not prepared (mentally) to take swift action to cut your loss (if that is what your trade plan calls for) - even within minutes of entering a trade, then you should not take the trade in the first place.

Summary

Playing the long side of ticker UVXY is fraught with peril as its price is almost guaranteed to decline over the long term. But if a trader is looking to play the long side of volatility over a very short time window, then the opportunity to do so may exist. The example trades above should be considered no more than that - examples - and you should do your own homework before entering any option trade.