U.S. stocks are valued more than almost half of global economic output

Stocks have disconnected from the economy, and that's not news. The divergence has been going on for months, with a relentless rally in stocks juxtaposed against terrible economic numbers and even more horrendous anecdotes about job losses, business closures, and bankruptcies.

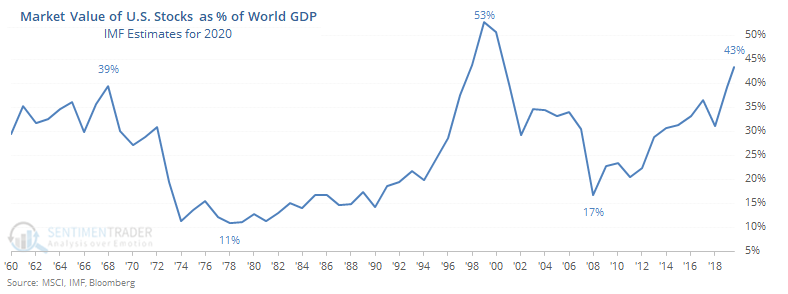

As Bloomberg notes, the capitalization of equities across the world has surpassed global gross domestic product. With the stunning rise in big American tech stocks, the U.S. portion of this global equity market capitalization is nearing all-time highs. While there isn't necessarily a connection between stock values and economic output, it is a way to estimate sentiment and valuations.

Whatever the theories behind the recent run of American exceptionalism (in stock valuations, anyway), by the time it nears 40% of global GDP, the run in U.S. stocks versus the rest of the world has been near its end, at least judging by the tiny sample size we have.

In the late 1960s, U.S. stocks had already started to underperform indexes in other parts of the world by the time this ratio peaked. In 1999, there was a bit more room to go before rolling over. Both times, equity values in the U.S. greatly trailed those outside the U.S. over the next five years at least.

It's hard for some investors to imagine what could knock U.S. stocks off their pedestals, but history is clear that something, somewhere, for some reason, will do it.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more detailed look at the ratio of U.S. to non-U.S. stocks after the former reach 40% of global GDP

- Gold's optimism suffered a record one-day plunge

- The silver ETF, SLV, is at a deep discount to its net asset value, and GLD is, too