U.S. Dollar at the Price/Seasonality Crossroads

The U.S. dollar appears to be at something of a crossroads. In a nutshell:

- On the one hand, price appears poised to rise on a technical basis

- On the other hand, history suggests that it should not

THE PRICE PATTERN SETUP

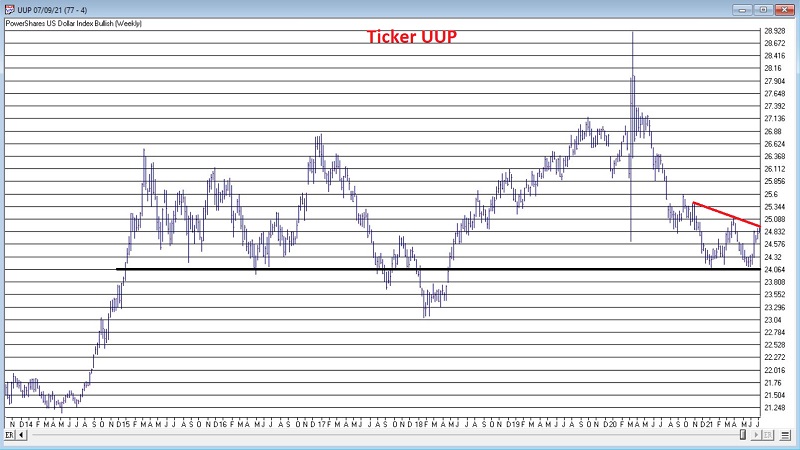

The chart below (courtesy of AIQ TradingExpert) displays ticker UUP (Invesco DB US Dollar Index Bullish Fund), an ETF that tracks the U.S. Dollar futures.

Many analysts are calling the latest price action a double bottom at a key support level. At this point, the contrarian outlook is for a surprisingly strong breakout to the upside.

And if the dollar DOES breakout to the upside, I will not fight it for one. But first things first.

THE SEASONALITY HEADWIND

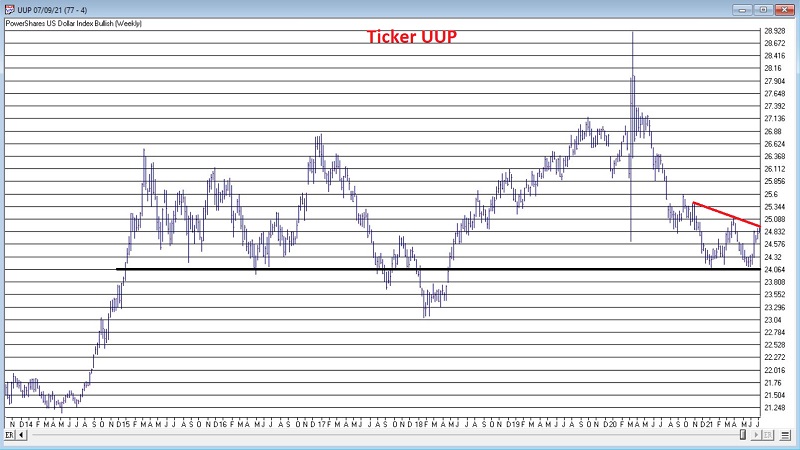

The chart below displays the Annual Seasonal Trend for the U.S. Dollar.

The dollar will seriously have to thumb its nose at the annual seasonal tendencies to break out and run to the upside in the near term. And it absolutely could.

- Remember, price (i.e., what is actually happening) always takes precedence over seasonality (what has happened in this time frame in the past).

- But also remember that one of the primary keys to long-term trading success is to put the odds in your favor as much as possible.

I am not making any predictions one way or the other (would it matter if I did?). Now is a time for patience to see which way the dollar wants to go. Given the current position on the seasonal chart, I, for one, would wait for an upside breakout to establish itself before "taking the plunge" into the long side of the dollar.