Up more than 20% from lows

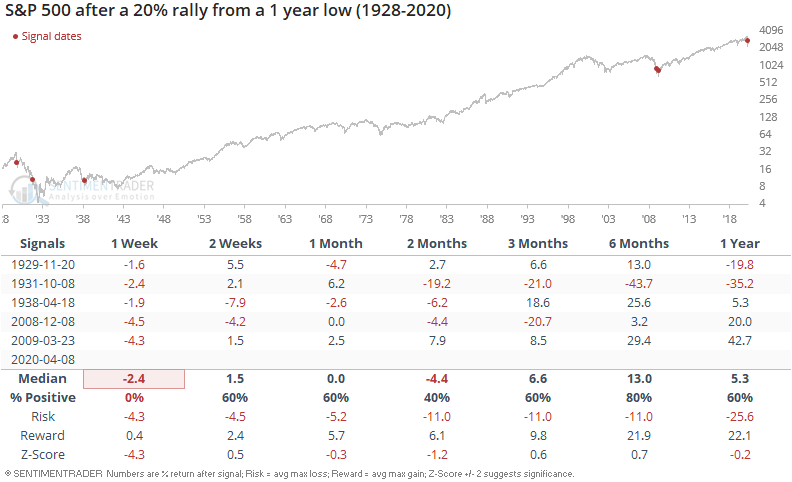

With stocks rallying around the world, more and more stock indices have entered into "bull market territory" based on the standard definition of a >20% rally off of lows. For example, the S&P 500 has rallied more than 20% since March 24:

It's rare for the stock market to rally so much, so quickly off of a 1 year low. When the S&P 500 entered into "bull market territory" within 3 weeks of hitting a 1 year low, the S&P often pulled back over the next week (and hence re-entered "bear market territory", demonstrating the problem with defining a "bull" / "bear" market based on any quantitative criteria).

Beyond that, the S&P rallied over the next 6-12 months in 2008/2009 case and 1938 case. As for the 1929-1932 cases, the bear market's bottom was far from in.

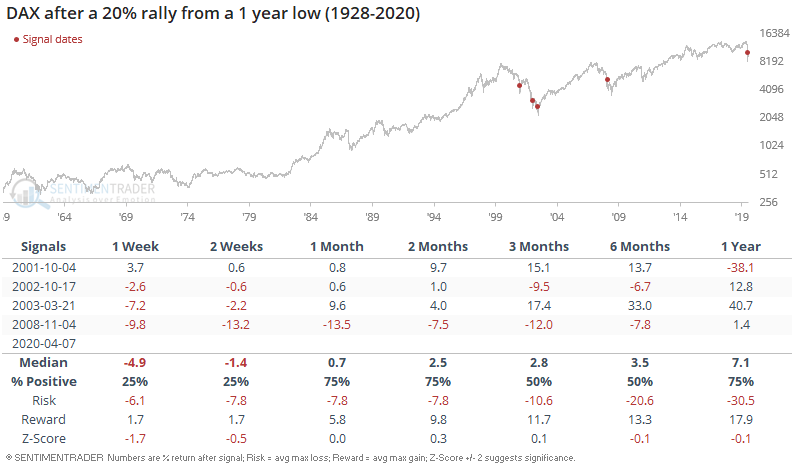

Similarly, the DAX rallied more than 20% within 3 weeks of hitting a 1 year low. Forward returns were slightly bullish.

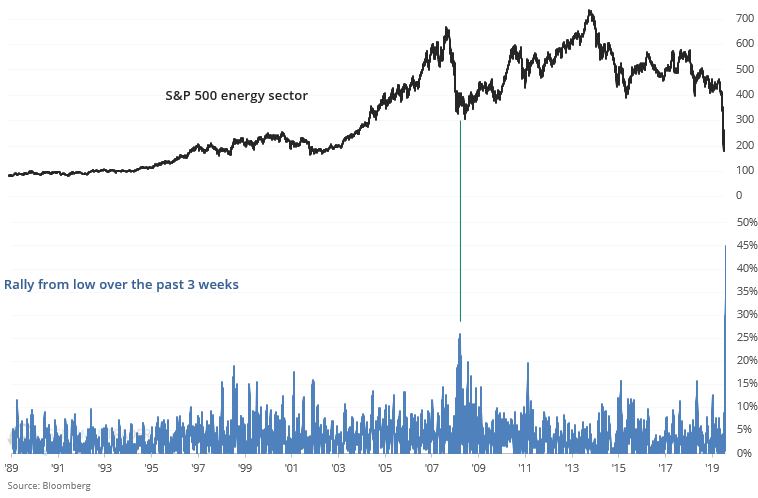

And for what it's worth, the energy sector has surged over the past few weeks:

In a time like right now, it's easy to find both bullish and bearish factors for stocks over the next 12 months. Truth is, no one knows where stocks will be 12 months later given the unprecedented challenges the global economy faces. If the government's actions are enough to stop further economic deterioration, then stocks will probably be significantly higher in 12 months. If the economic recession worsens and more defaults are triggered, then it's highly likely that stocks will be lower in 12 months. To pretend to have a crystal ball as to where the world will be in 12 months is, in my opinion, plainly dishonest. One can only speak in terms of probability - there is no certainty.

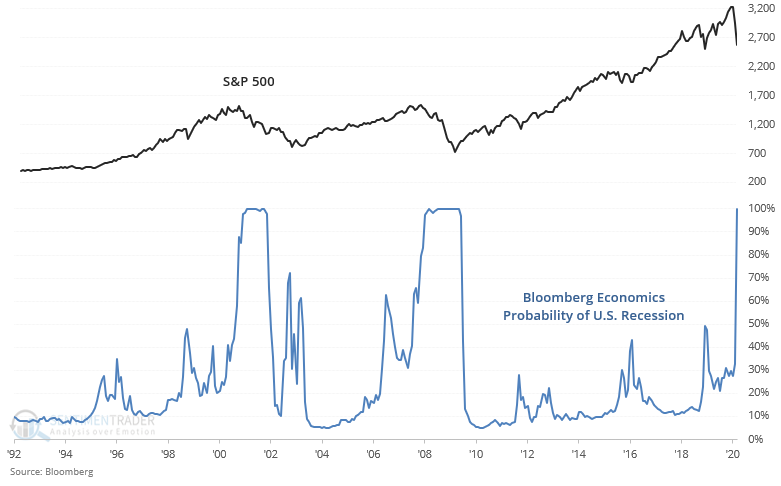

Bloomberg Economic's Probability of a U.S. Recession in the next 12 months is currently at 100%. This uses a range of market-based and economic indicators to gauge the 12 month risk of a recession:

From 1992-present, the risk of a recession only ever got this high during a recession and bear market. This happened near the start of the 2000-2002 and 2007-2009 bear markets.

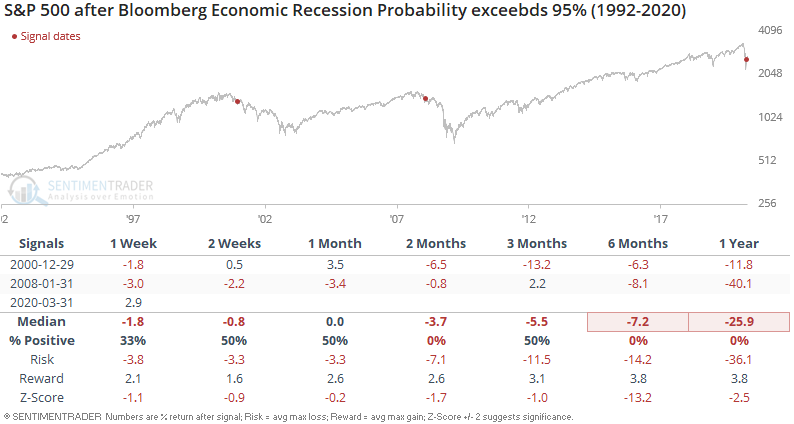

So while it's no surprise that "the last 2 times this happened, stocks crashed over the next year", there's no guarantee that this signal is still bearish for stocks:

- The 2 historical signals came relatively early in a bear market, when the stock market wasn't too far below all-time highs.

- The current recession is so different from these historical recessions that I don't think any comparison is very valid. The previous 2 recessions "rolled over", whereas the 2009-2019 economic expansion came to an immediate and screeching halt.

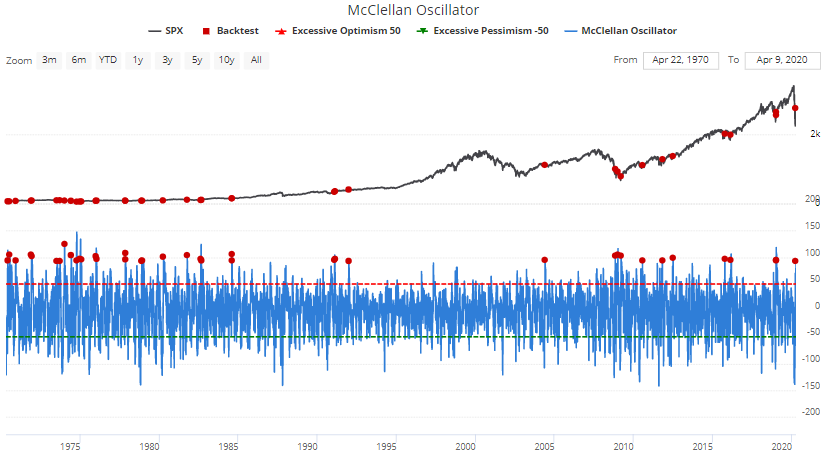

With that being said, the stock market's rally has pushed the McClellan Oscillator above 93.

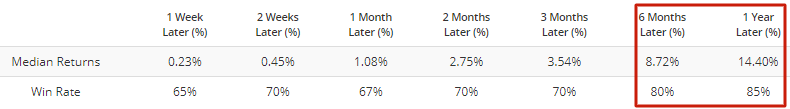

When this happened in the past, the S&P usually rallied over the next 6-12 months.

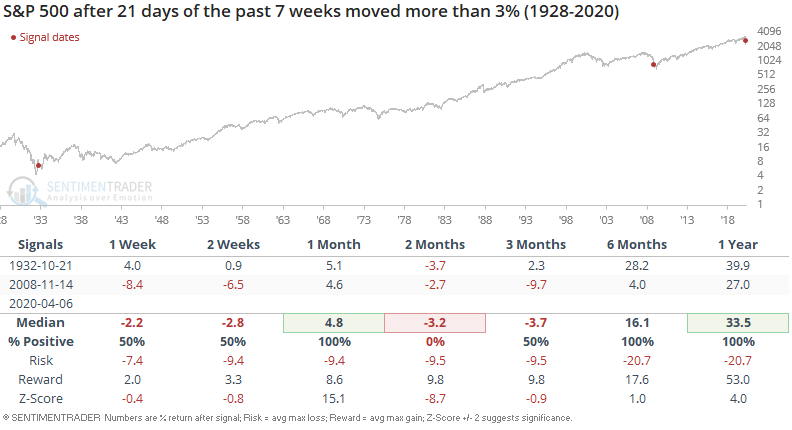

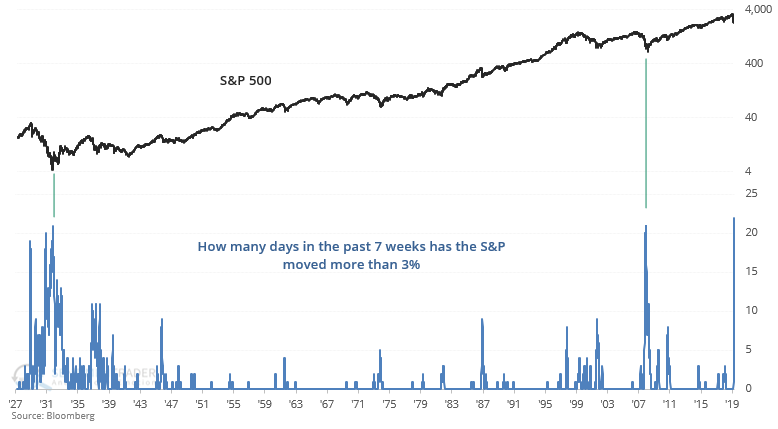

And lastly, 22 of the past 35 days (7 weeks) have seen the S&P rally more than +3% or fall more than -3%. This broke the previous records achieved in 1932 and 2008:

When the stock market was this volatile in the past, the S&P rallied significantly over the next year. The bear market was either already over (as in the 1932 case) or close to being over (as in the 2008 case).