Under the surface, a surge in defensive stocks

Trouble under the surface of the Nasdaq 100

Does a surge in utility stocks, a traditionally defensive sector, signal too much pessimism and therefore provide a bullish market message for the S&P 500?

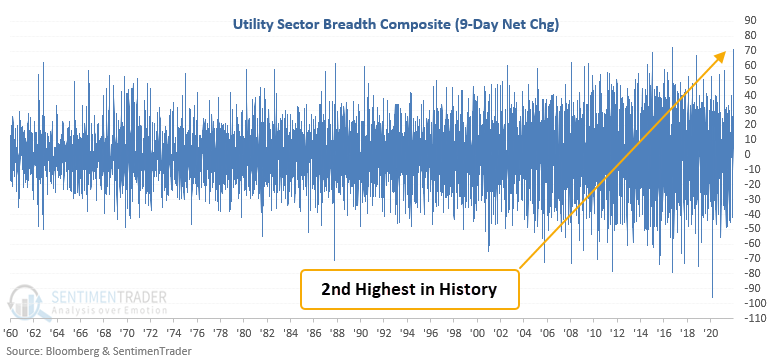

Dean conducted a study to assess the outlook for the S&P 500 after a composite breadth indicator for the utility sector surges above 70%. When he applied a 9-day net change to the utility sector composite, participation over the trailing 9 sessions has surged to the second-highest level in history.

This signal has triggered 33 other times over the past 68 years. After the others, future returns were strong.

| Stat box The Grayscale Bitcoin Trust (GBTC) is on track for its 5th consecutive weekly decline. That's the longest weekly losing stretch in its history. |

Staples are enjoying a surge

While breadth in more speculative areas is struggling, it most certainly isn't among more defensive names.

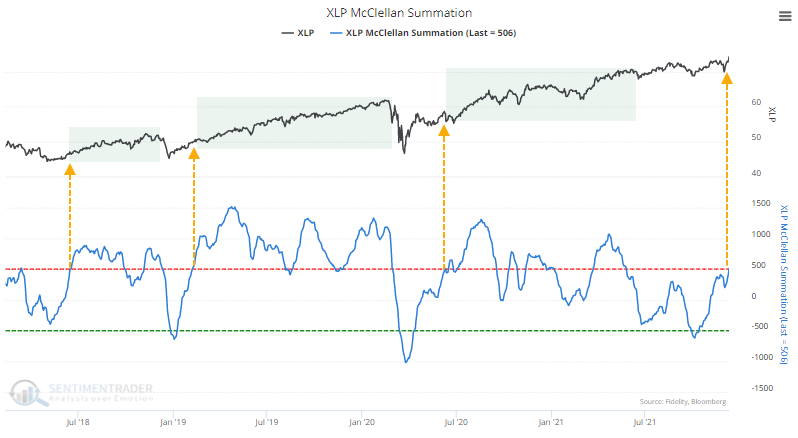

Heading into this week, there was a massive and sudden shift in short-term trends in Staples. Within a little over a week, fewer than 5% of stocks in the sector were trading above their 10-day moving averages, and then every single one of them was.

The short-term reversals in many stocks have helped push the long-term McClellan Summation Index for Staples above +500 for the first time in more than 6 months. In recent years, a move above +500 was the kick-off before significant, sustained gains in the sector.

Looking back more than 30 years, the first reading above +500 in several months preceded consistent gains for the sector. Other indicators are mostly supportive, including correlations among Staples stocks, and corporate insider trading activity.