Uncharted waters as Panic Button hits record

At this point, it might be necessary to toss out any historical comparisons. There's really nothing that investors have faced that can equate to not only the social, fiscal, and monetary developments over the past week, but also the price and selling intensity.

These are uncharted waters.

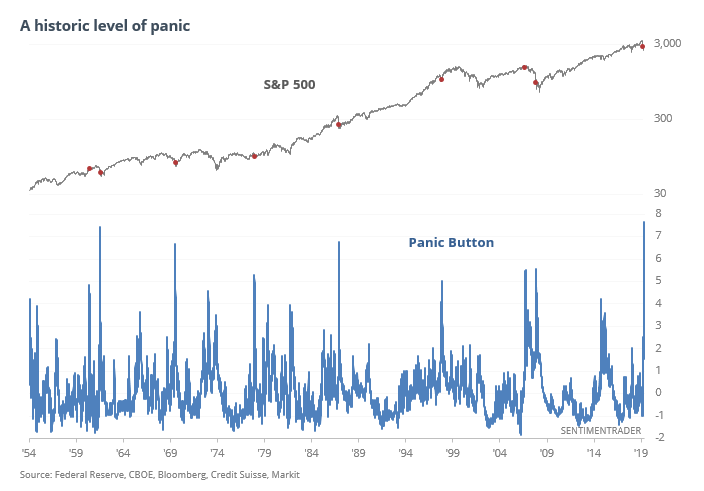

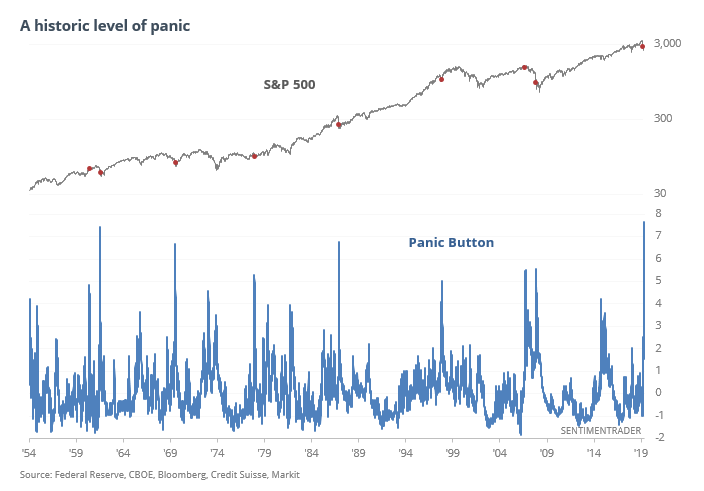

To get a sense for just how much panic is out there, it's time to dust off the Panic Button. We haven't had to update it for more than four years, and it just soared to a record high on Thursday. It ebbed a bit on Friday, but would likely hit another record on Monday if initial indications hold.

The indicator incorporates the TED Spread, Junk Bond Yield Spreads, a ratio of Volatility to 3-Month Treasury Bill Yields and High-Yield CDS Spreads. All of these spike higher when uncertainty about the economy, corporate outlooks and stock prices are high, and reach extreme high levels only during times of outright panic.

There have been only a few days since 1954 that neared the current level.

With the overnight action, traders are staring once again at massive losses on the opening bell. Pricing in ETFs suggests the losses would be nearly double what's indicated in the futures if the circuit breakers hadn't kicked in.

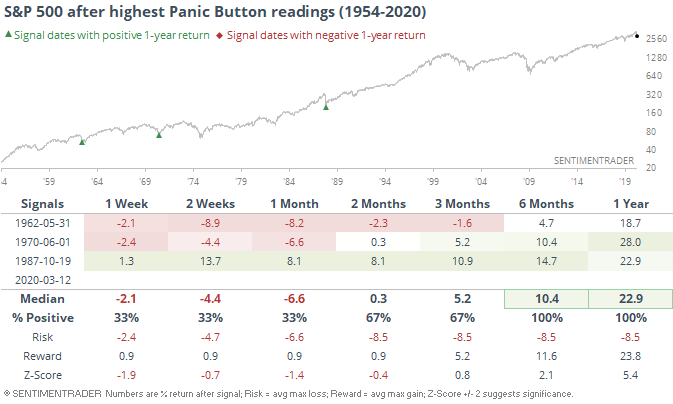

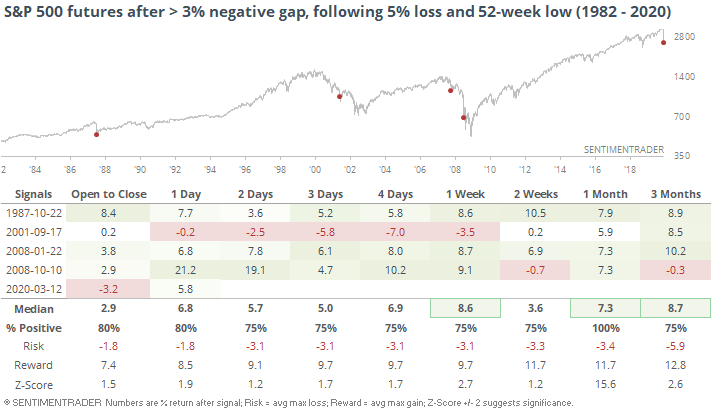

There are no real precedents for this, on many levels. If we look at lesser opening losses following what had already been a bad week, there were a few.

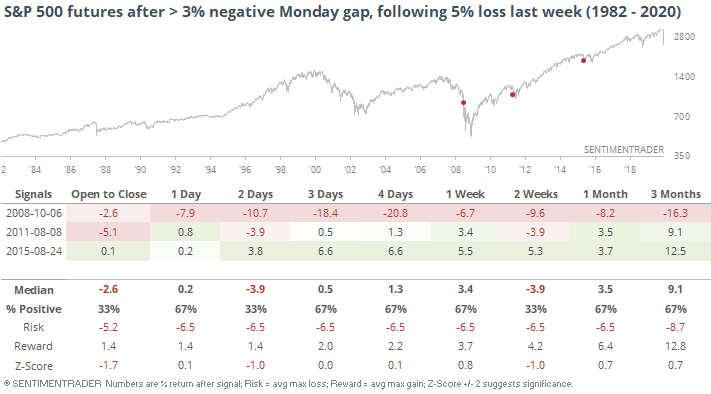

If we just want to look at weekend panics, then there were also a few times the futures gapped down 3% or more following at least a 5% loss last week. Again, these pale to current losses.

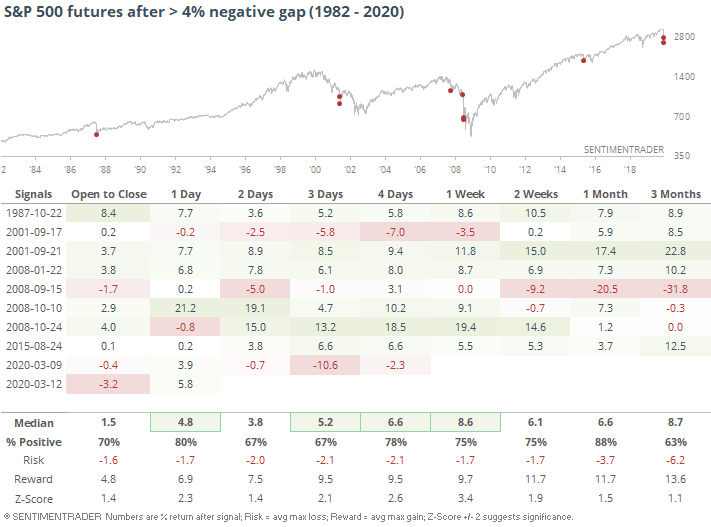

And we might as well re-visit the days that simply showed the largest losses at the open.

There were a couple in quick succession after 9/11 and a couple near the end of October 2008, but we already saw last week how the average gap over the past week is well beyond any other tine in nearly 40 years.

There is no playbook that can serve as a reasonable playbook here. I spent most of the weekend looking at market closures, wartime, and crises. None of them have seen near what markets have witnessed in just the past week. Governments and financial institutions have indicated they will do whatever it takes, and they likely will.

At any point, even nominal good news in the virus fight could send stocks higher by 15% in minutes...and vice-versa. Volatility will be enormous, to the point where they may have to temporarily close trading for days on end. Based on everything we've looked at, we should still see higher prices over the next couple of months, even within the context of a protracted bear market and recession. It's just hard to rely on "should" when we're essentially required to fly blind.