Uh-Oh, Options Speculators Are Back

Sector battle

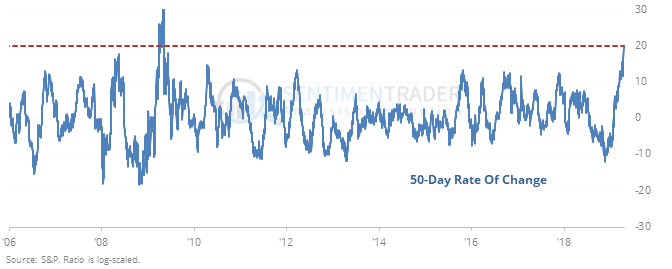

The ratio between the S&P 500’s technology and health care sectors has swung by an extreme amount. The 50-day rate of change in the ratio between the two has cycled from negative to a 10-year high.

Since 1990, other times it swung like this, tech suffered, while health care held up better. The S&P 500 itself was mixed.

Leveraged speculation

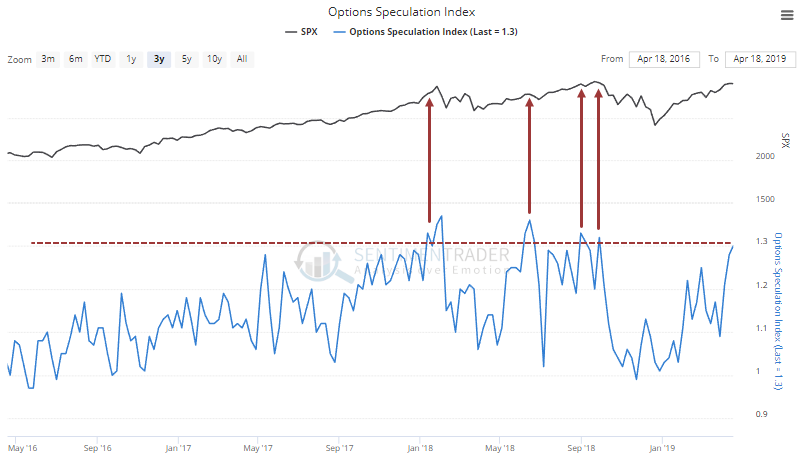

Last week, options traders across all U.S. exchanges executed 4 million more bullish opening transactions than bearish ones. That triggered an extreme reading in the Options Speculation Index.

Other times the indicator reached this high of a level since the year 2000, it was tough for stocks to maintain any upside momentum.

That FOMO feeling

News articles mentioning the “fear of missing out” among investors have skyrocketed over the past three weeks to a record high. The two other times there was a spike like this, stocks had been rallying but soon lost momentum.

The latest Commitments of Traders report was released on Friday, covering positions through last Tuesday

The 3-Year Min/Max Screen showed the usual culprits. Notably, “smart money” hedgers are holding at least 5% of the open interest net long in corn and soybean futures. Even within their persistent downtrends, this has usually led to positive returns over the short- to medium-term.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.