Two Indicators Flashing Favorable Signs for Stocks - Part II

This is Part II of a two-part series highlighting a pair of little-known indicators that recently flashed favorable signals for the stock market. See Part I here.

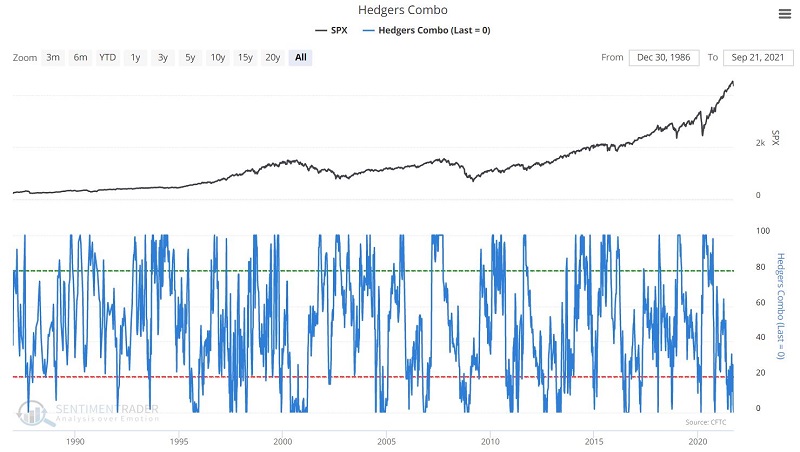

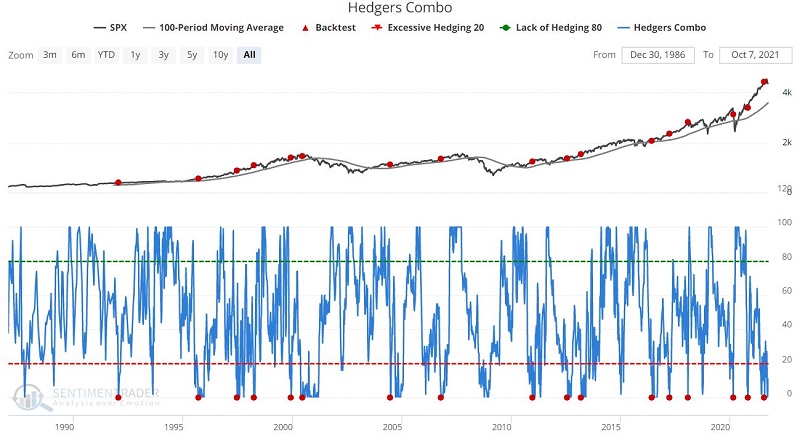

Indicator #2: Hedgers Combo

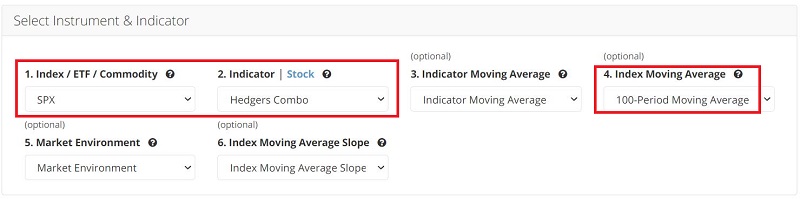

This chart reflects the positions of large "smart money" commercial hedgers in the S&P 500, Nasdaq 100, and DJIA futures. It combines the full contract and e-mini, adjusting for contract size, and calculates the dollar value of hedgers' positions. The chart shown is a one-year stochastic of this data, so if it reads 100, it means hedgers are the most exposed they have been in at least one year.

THE TEST

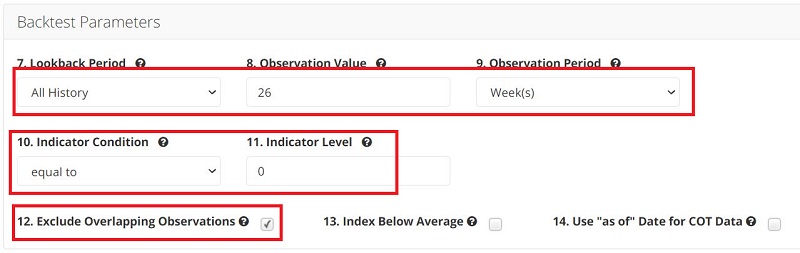

Let's highlight the performance for the S&P 500 Index following all days when:

- The value for this indicator is equal to 0

- AND SPX is ABOVE its 100-day moving average

- For the first time in 26 weeks

You can run this test by clicking here. The input screens appear below.

The output screen appears below.

The Summary screen appears below.

Note the Win Rates and Median Returns for the 2, 3, and 6-month time frames.

As we see in the screenshot below, the latest signal occurred on 8/3/2021

So far, the stock market has performed poorly since the latest signal on 8/3. However, before dismissing this as an errant signal, note in the table below that the S&P 500 Index has gained ground between the 2-month and 6-month market following 13 of the 16 previous signals (81% of the time). This tendency argues for a potential advance as the 4th quarter progresses.