Twas the day before Thanksgiving...

Key Points

- The trading day before and the trading day after Thanksgiving have demonstrated a favorable tendency over the years

- Short-term traders may be able to take advantage of this "edge"

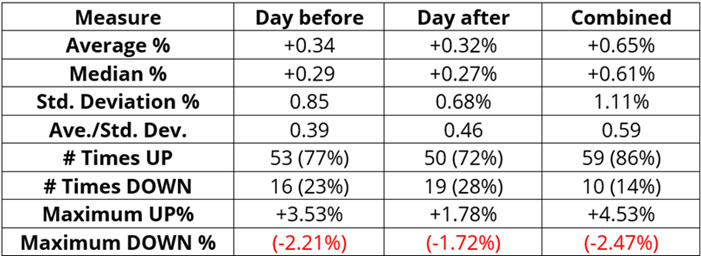

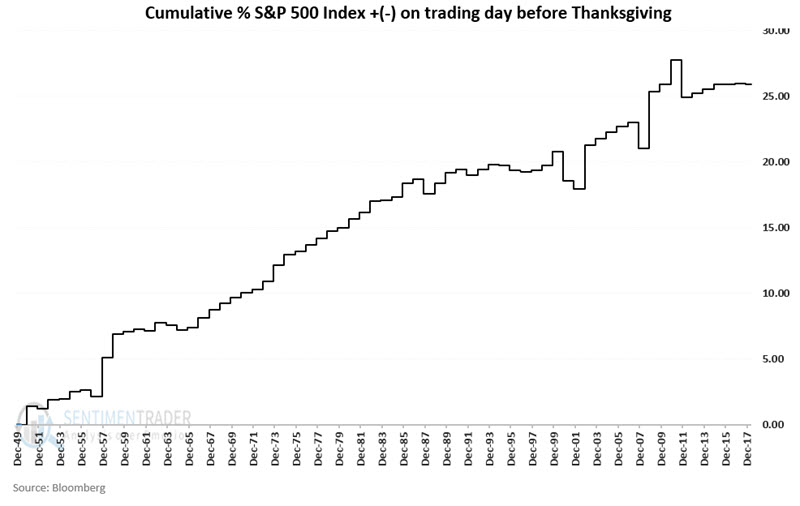

The day before Thanksgiving

The chart below displays the cumulative % gain for the S&P 500 Index held long ONLY on the trading day just BEFORE Thanksgiving (for the record, this implies buying at the close on Tuesday of Thanksgiving week and selling at the close the next day).

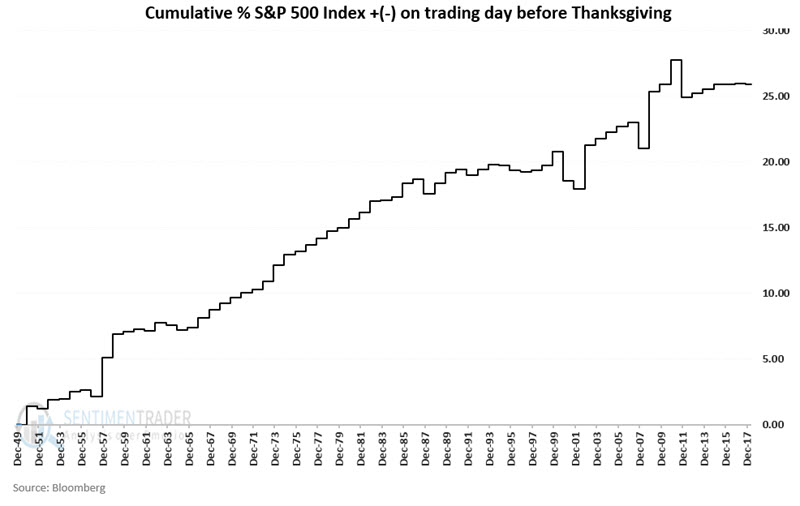

The day after Thanksgiving

The chart below displays the cumulative % gain for the S&P 500 Index held long ONLY on the trading day just AFTER Thanksgiving (for the record, this implies buying at the close on Wednesday of Thanksgiving week and selling at the close on Friday).

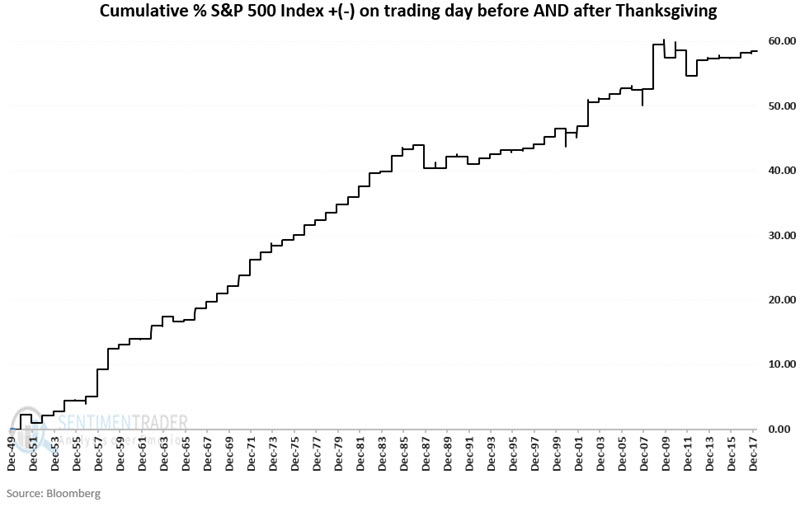

The day before AND after Thanksgiving

The chart below displays the cumulative % gain for the S&P 500 Index held long ONLY on the trading day just BEFORE AND AFTER Thanksgiving (for the record, this implies buying at the close on Tuesday of Thanksgiving week and selling at the close on Friday).

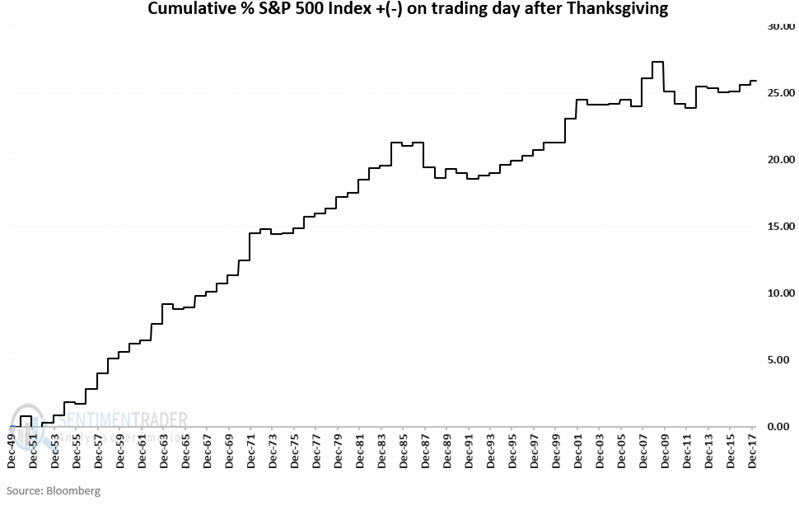

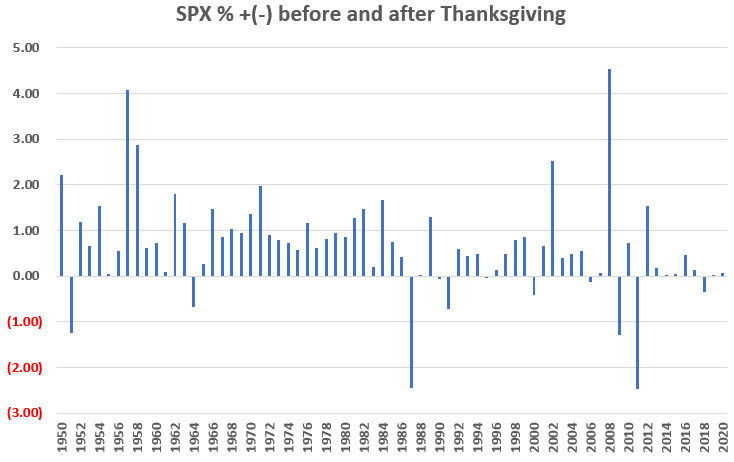

Analyzing results

The chart below displays the year-by-year % gain or loss for the S&P 500 Index held long ONLY on the trading day just BEFORE AND AFTER Thanksgiving.

The table below displays the particulars.

What the research tells us…

- The stock market has demonstrated a strong tendency to rally during the days just around Thanksgiving

- That said, results in recent years have not been as uniformly favorable as in prior years

- The strategy above can be traded with any standard or leveraged ETF or mutual fund (as long as there are no switching restrictions) that tracks the S&P 500 Index.