Turnaround Tuesday Potential

We've discussed the Turnaround Tuesday pattern many times over the past 15 years, and it's something that continues to hold up.

Basically the idea is that if the market trends strongly over the few days into Tuesday, then we often see a reversal during mid-week.

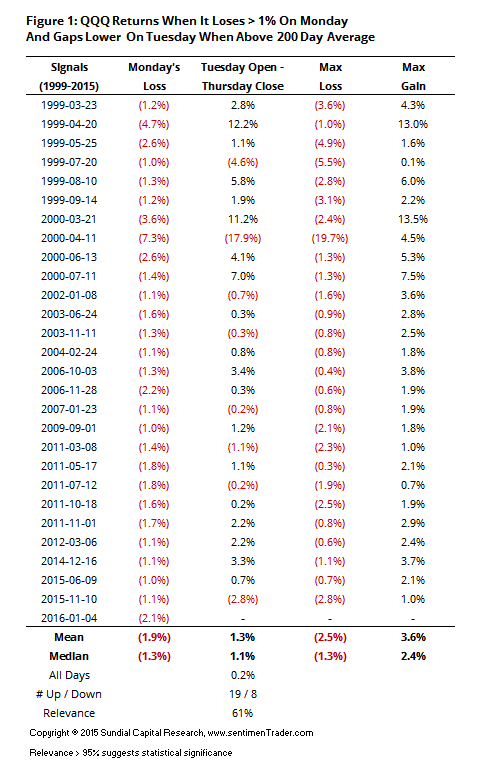

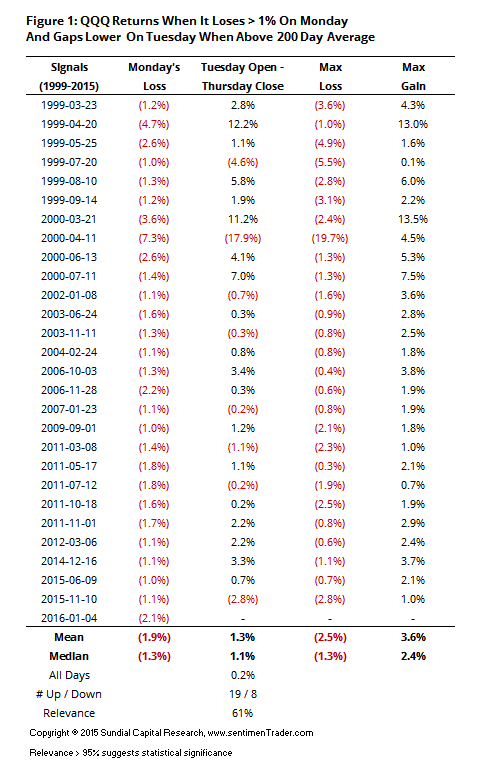

Since tech stocks got hit particularly hard, let's look at every time QQQ lost at least 1% on Monday then gapped down on Tuesday morning (Figure 1). Futures are recovering at the moment but still showing a slight loss. We'll restrict the instances to those when QQQ was trading above its 200-day average.

From Tuesday's open through Thursday's close, QQQ rallied 70% of the time with a positively skewed risk/reward ratio. There were three losses of more than -2% (including a doozy in April 2000) compared to ten winners of more than +2%.

If we stipulate that Monday's loss was -1.5% or more, then we get 9 winners out of 11 occurrences. That huge loss from 2000 is still among them, though the other loser was only -0.2%.

Combined with a few severely oversold short-term indicators (such as the Down Pressure readings over the past three days) and Monday's late-day reversal, the Turnaround Tuesday pattern has some potential. As noted in the Daily Report yesterday, sentiment still is not showing any extreme pessimism overall, so confidence is not particularly high.