Tuesday Midday Color

Here's what's piquing my interest so far on yet another day with buyers stepping in on the smallest downtick.

Recovery

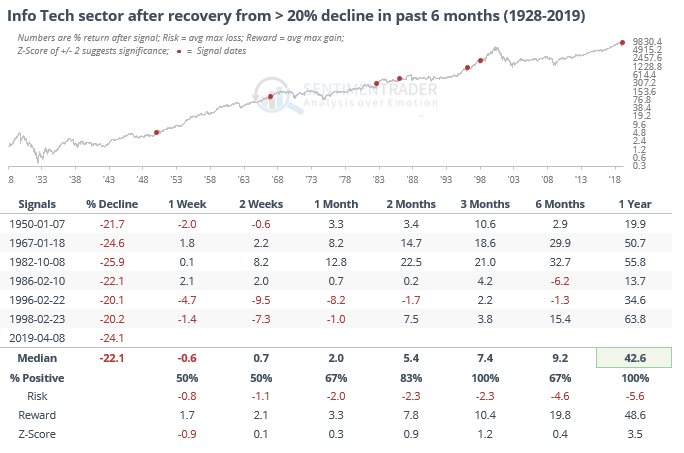

Among the major S&P 500 sectors, the first to entirely erase its decline was information technology, scoring its first new all-time high since last fall. That is a quick turnaround for what many view as an important leading indicator for the entire market. In its history, this ranks as one of only a handful of times info tech has completely erased a 20% decline within six months.

It has been a good sign for forward returns.

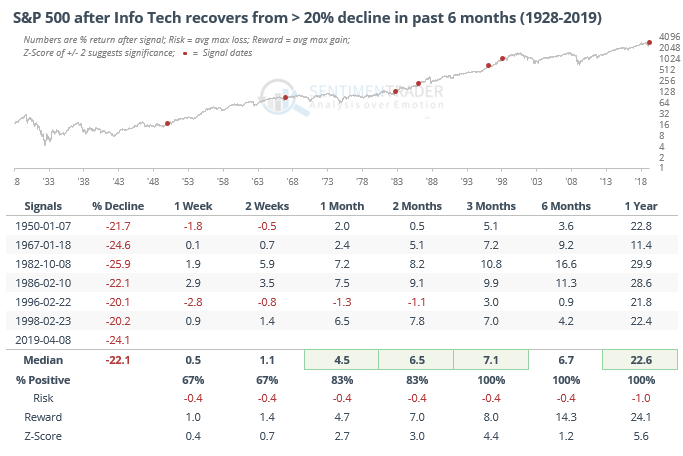

It was a good sign for the S&P 500, as well.

Momentum tends to stick, even in the face of extreme sentiment...

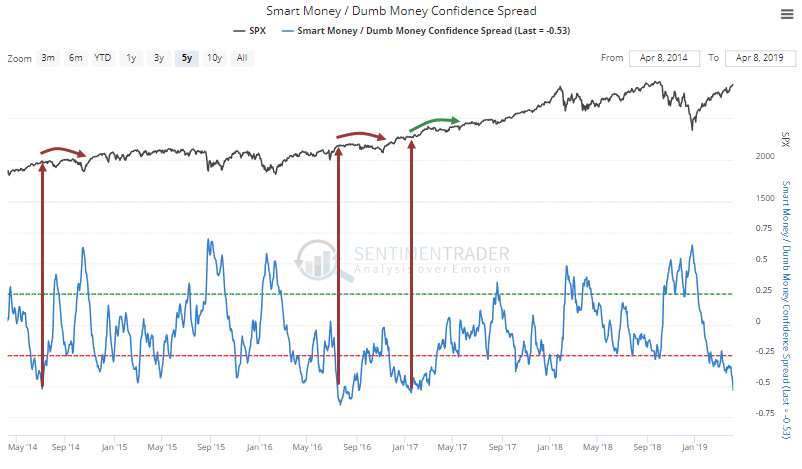

...speaking of which, the spread between Smart and Dumb Money Confidence has reached a true extreme.

Over the past 5 years, a spread this wide almost top-ticked the S&P in 2014 and 2016, but the incredible trend of 2017 rolled right over it. Historically, when the spread initially gets this wide, stocks have done okay. But it also means stocks are entering a higher-risk phase, and the longer sentiment remains this extreme, the less upside there is.

Going back to 1998, there have been 123 days when the spread was this wide while the S&P was hovering relatively near a high, and over the next three months, the S&P showed a positive return after only 32% of those days. So risk might not be high right now because of extreme sentiment, but it's entering the danger zone.

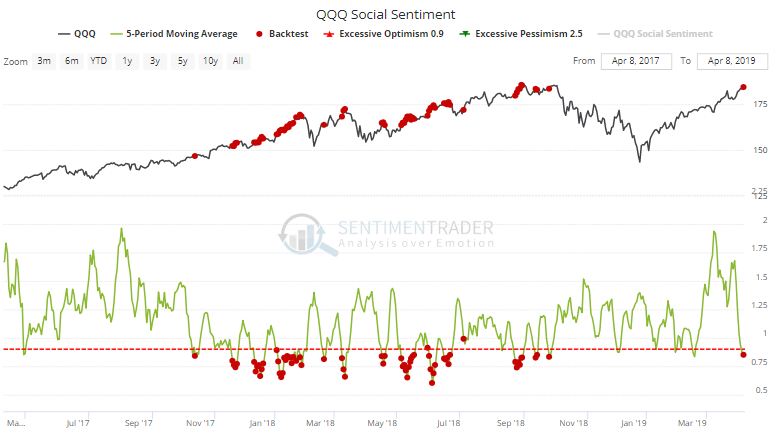

It's also a tiny bit troubling that the Twitterverse is catching on to tech stocks, with an increasingly bullish tone to the tweets.

Over the past 5 days, the average Social Sentiment score on QQQ has reached its most extreme level (fewest bearish vs bullish tweets) since September. This isn't a death knell, but it's a stark change from a few weeks ago.

Breadth Review

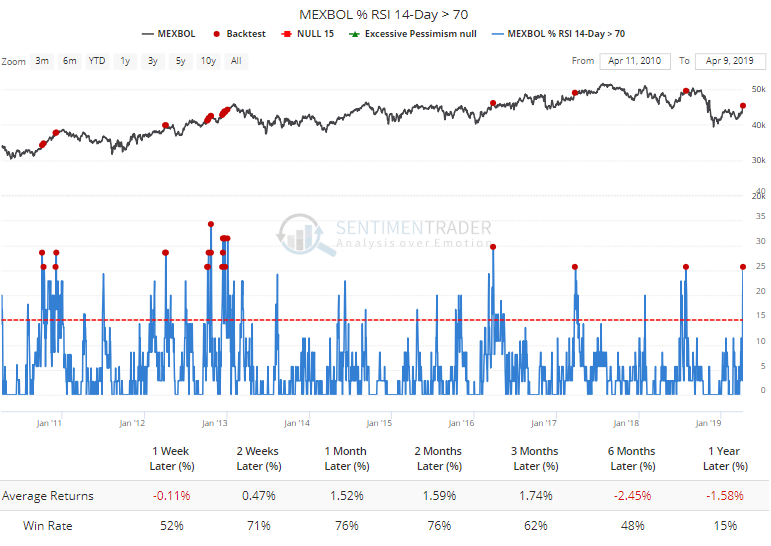

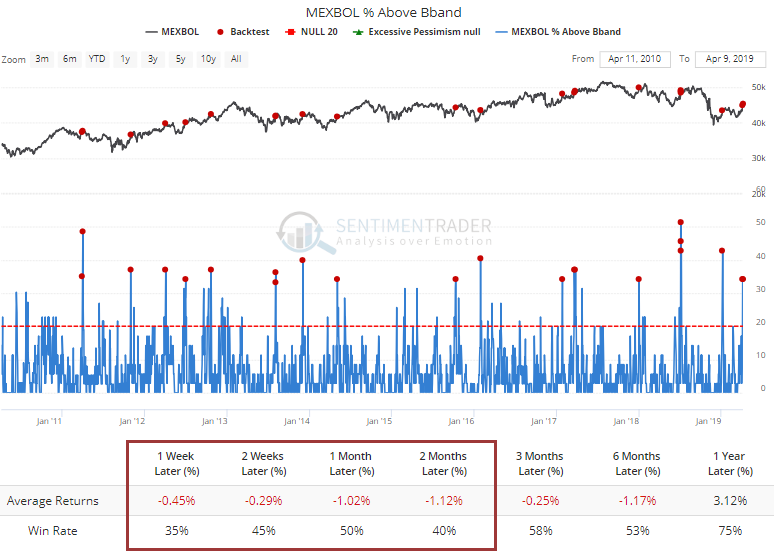

The jump in Mexican stocks has been impressive, and more than a quarter of them in the Mexbol index are now overbought. Since the depths of the financial crisis, this hasn't happened to many times, and it was a mixed blessing.

Not only are many of them overbought, but they've surged out of relatively tame trading ranges, pushing more than a third of them above their upper Bollinger Bands. This has been a more consistent signal of too-must-to-fast.

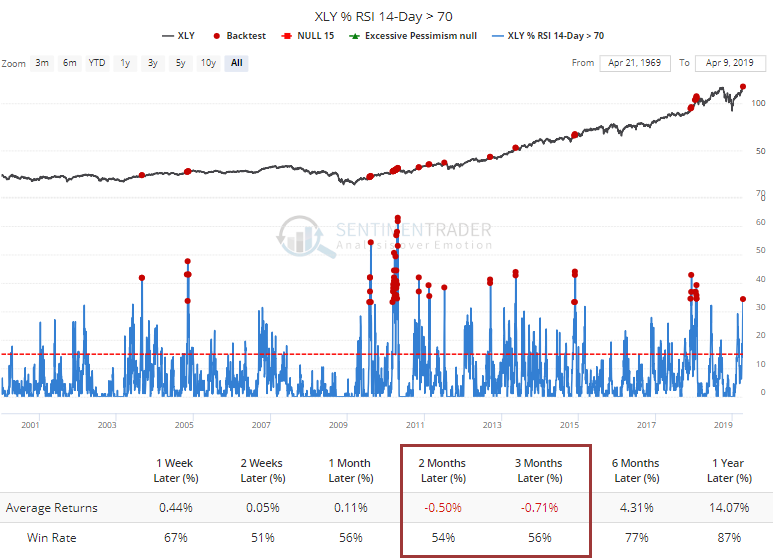

In the U.S., more than a third of consumer discretionary stocks are overbought, not something we see too often. While it didn't lead to exhaustion in early 2010 or 2017, almost all of the other dates saw the sector pull back over the short- to medium-term at some point.