Tuesday Midday Color

Here's what's piquing my interest so far on this recovery day.

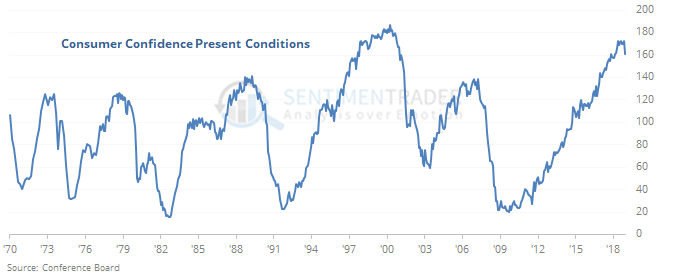

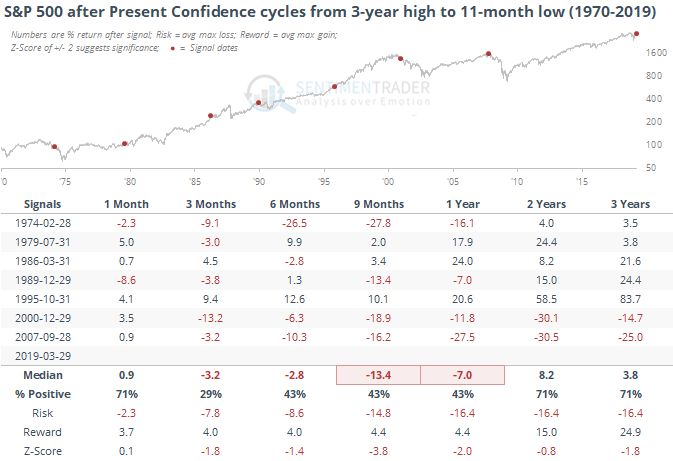

Waning Confidence

Today's release of the Conference Board's latest readings on consumer confidence revealed that attitudes about present conditions are at the lowest point in nearly a year. This is coming on the heels of what had been a multi-year high in confidence.

When confidence in consumers' present conditions has rolled over from a multi-year high in the past, it has not been good for stocks.

Pick Your Side

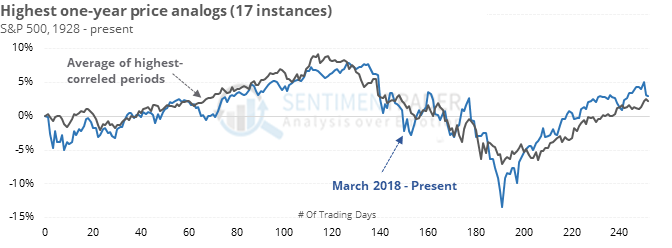

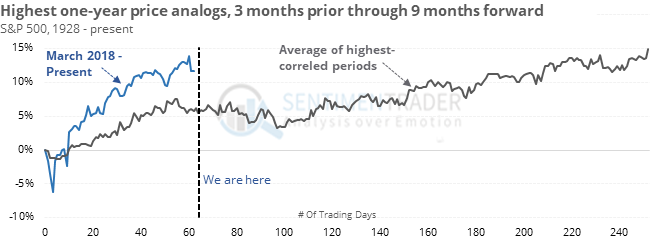

Every few months, there seems to be a rash of analogs comparing the current structure of the S&P 500 to some other disastrous year. Or a super bullish one, depending on the outlook the analyst wants to give. Currently, there are two comparisons that have been tossed around, from 1937 (disaster) and to 1995 to 2015 (bullish).

As always, let's forget the cherry-picking and look at the highest-correlated one-year patterns since 1928. There have been 17 time periods with a one-year correlation above 60%, and their median price path, by definition, is very close to what we've seen over the past year.

The biggest question is what comes next. If we roll forward, we can see that when the patterns reached their current juncture, there was most often some modest backing-and-filling before a resumption of the recoveries.

Bad Breadth

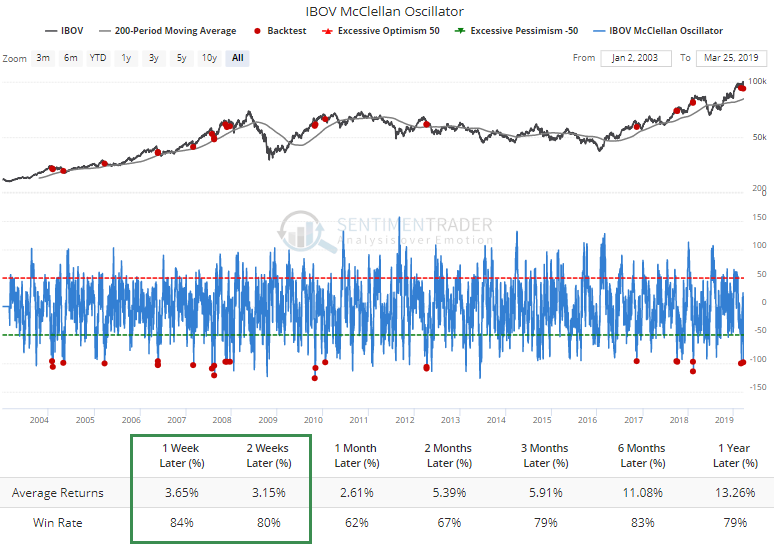

When the Ibovespa was hitting new highs last week, we looked at some cracks under the surface. The index subsequently fell nearly 7% and that generated at least one notable extreme, with a McClellan Oscillator that nearly touched -100. When the index is still above its 200-day average, that has indicated a tendency to snap back during the next week or two.

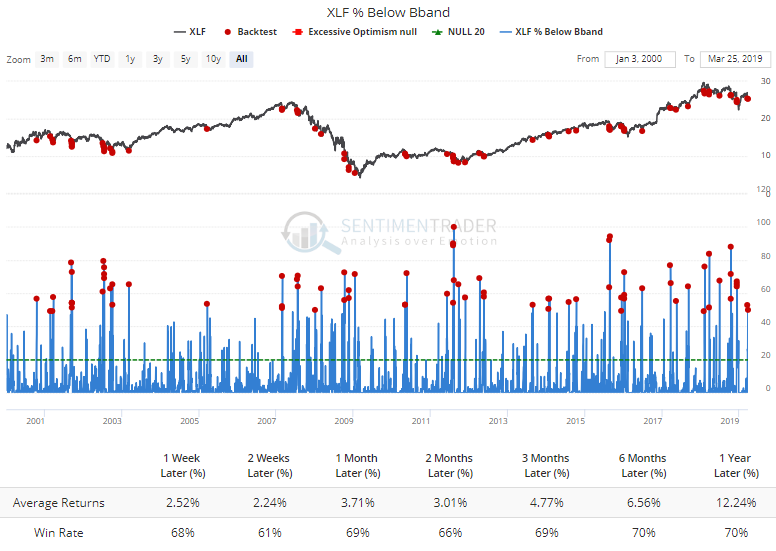

The sharp drop in financials has led to half of them trading below their lower Bollinger Bands. This has been a decent sign of excessive short-term selling pressure.

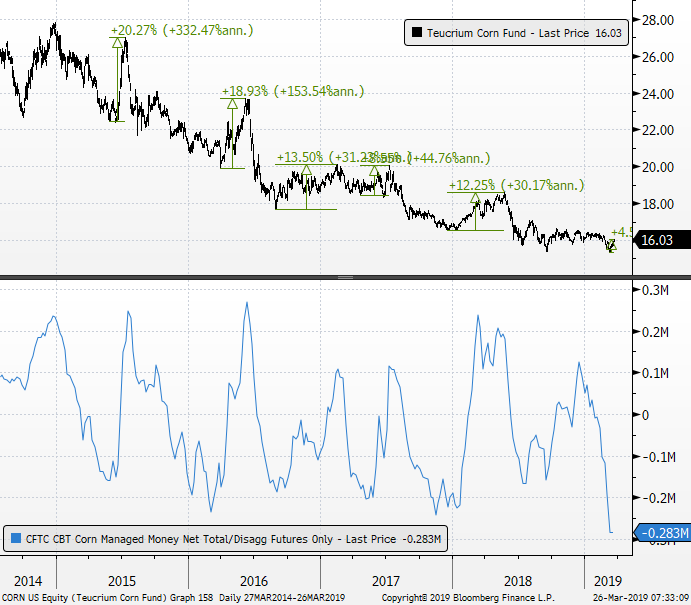

Corn Emerging From Hole

Some of the grains are finally starting to move. The CORN fund is up a little over 4% from its lows. The latest CoT report shows that money managers were holding a record short position, which has led to a rally of at least 8% off the lows the other times, so should still be more to go here.