Tuesday Midday Color - Shorts, Emerging Mkts, Sector Extremes

Here's what's piquing my interest so far today.

Not Too Short

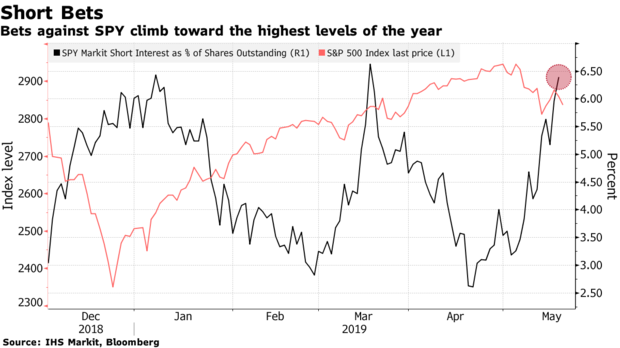

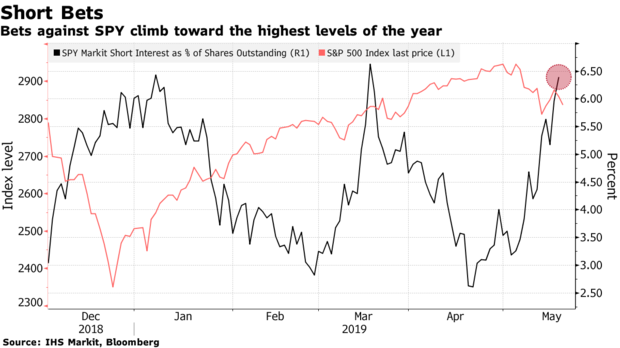

One of the hopeful charts bouncing around at the moment is the rising level of short interest in the largest ETF in the world. Looks like traders are betting on a big fall in SPY, which doesn't usually happen when they're expecting it. Via Bloomberg:

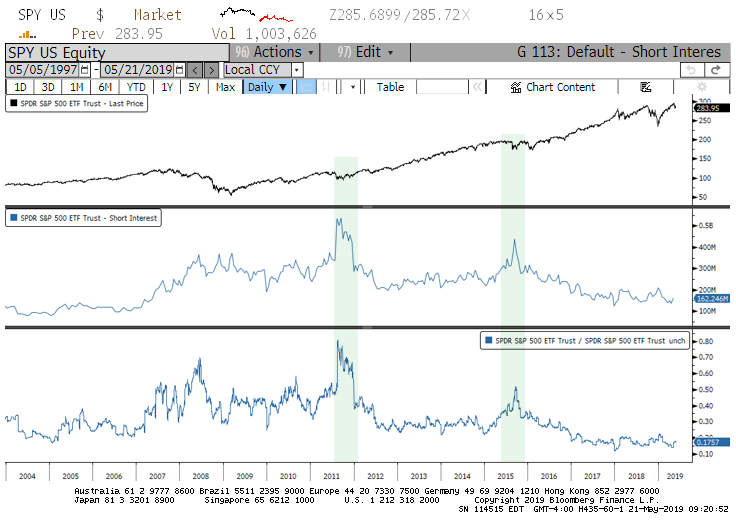

If we zoom out, though, it's not nearly so dramatic. We're not seeing anything like true short-selling nirvana in 2011 or 2015. There is a long way to go before short interest would be a contrary positive.

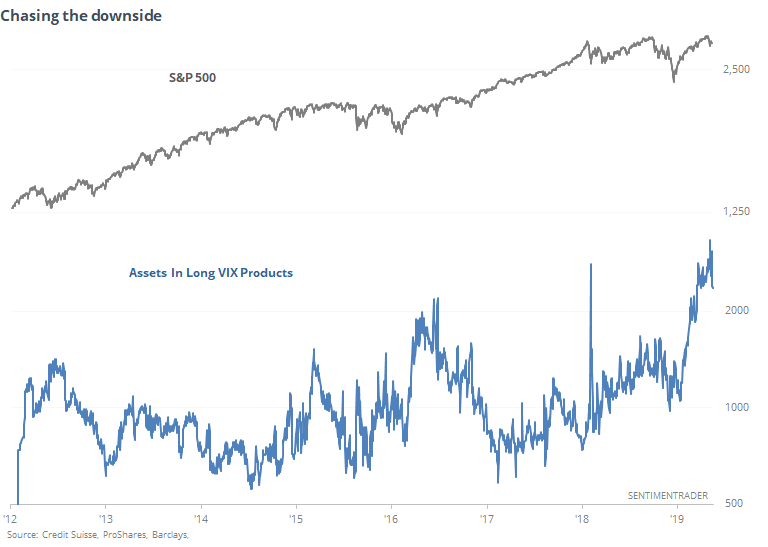

There are definitely other signs of anxiety, though, as we've touched on quite a few times over the past week. Volume in VIX options have jumped, and assets in VIX ETFs have skyrocketed.

Breadth Review

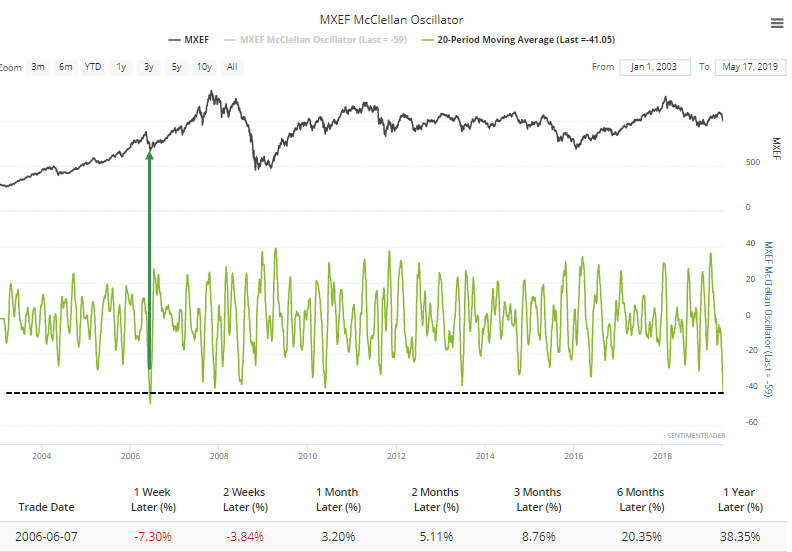

Despite the selling pressure on Monday, there weren't really any new notable developments in breadth. One that sticks out, though, is the persistently negative McClellan Oscillator for emerging markets.

Over the past 20 sessions, the Oscillator has averaged -41, which is the 2nd-most extreme reading in at least 15 years. The only other signal was in 2006.

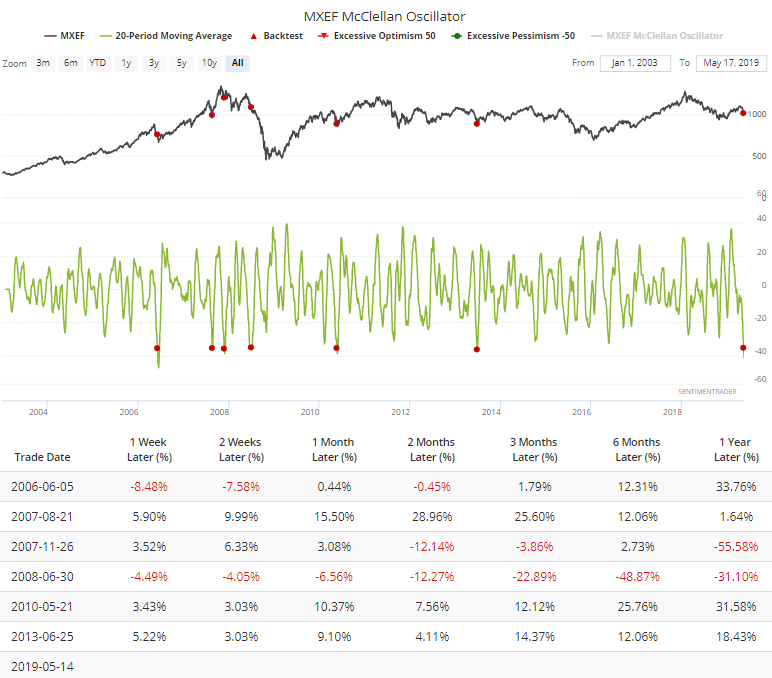

Using the Backtest Engine, we can look for times when the 20-day average Oscillator dropped below -35, which generates a few more signals.

There was a major failure at the onset of the financial crisis, otherwise these were good signs of exhaustion over the next 6 months.

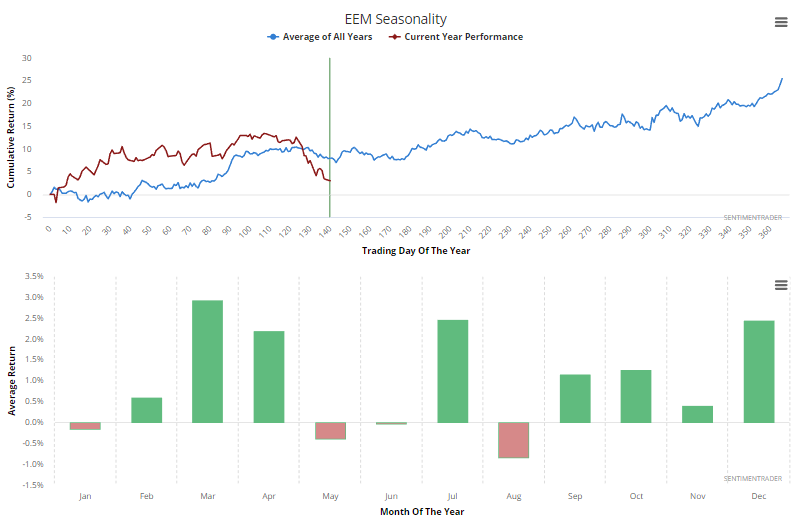

For what it's worth, the EEM fund has tended to form its spring/summer low right about now.

Sector Watch

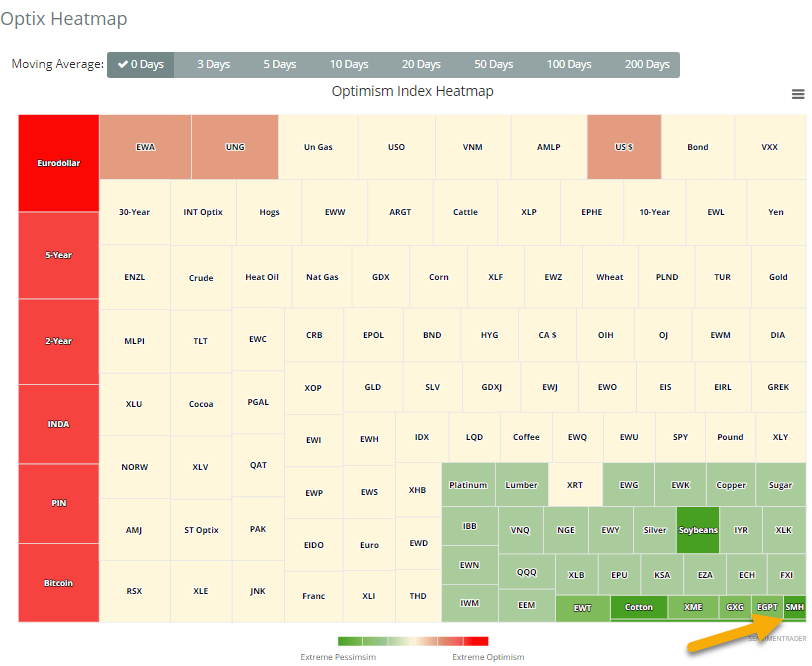

According to the Heatmap, the middle eastern funds that had taken such a beaten and were showing such low optimism last week have had a reprieve. Now we're seeing funds like SMH near the bottom of the heap.

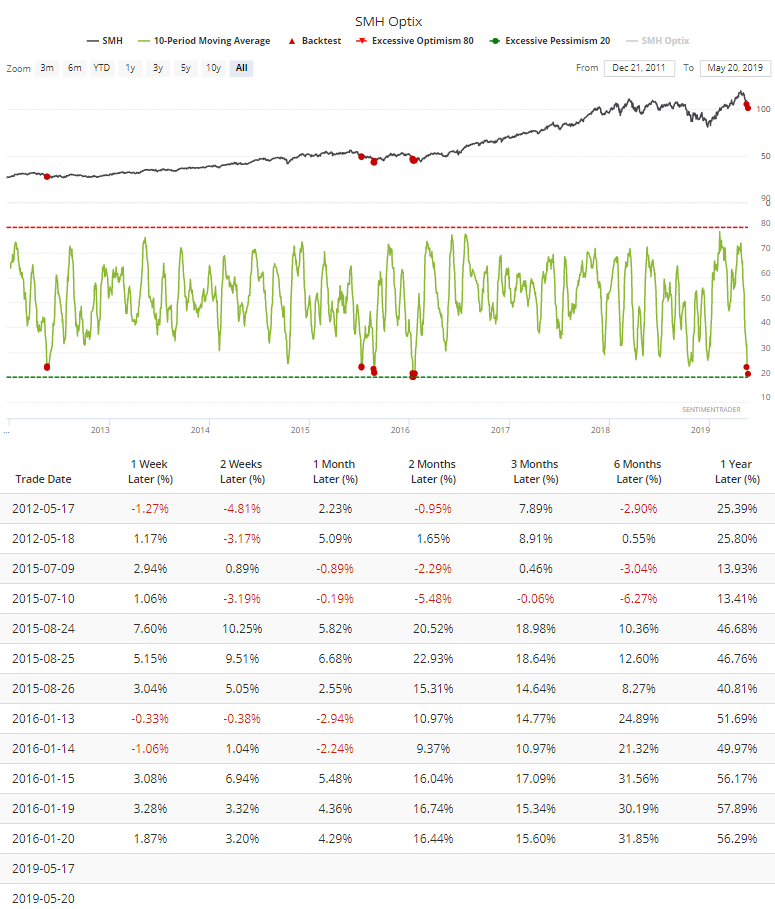

According to the Backtest Engine, a 10-day Optimism Index this low in SMH has preceded some good snapbacks.

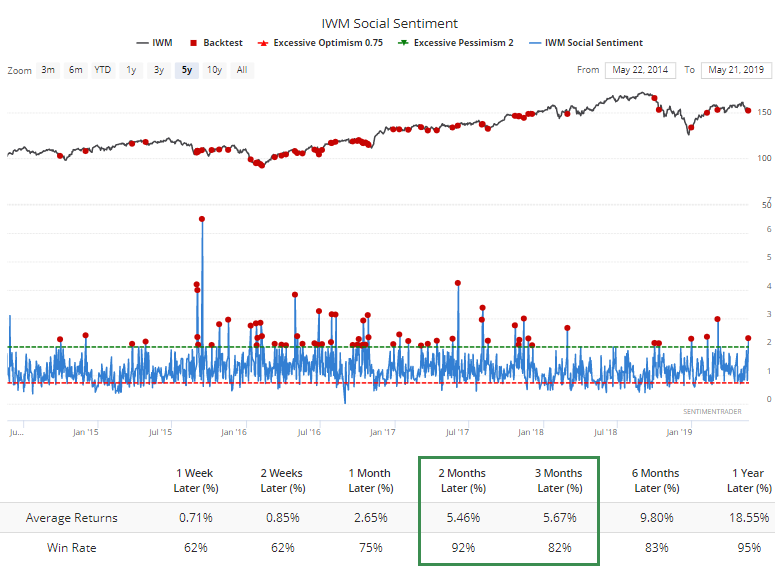

Small-caps have had some trouble holding gains lately, and Twitter has taken notice. There were twice as many bearish messages about IWM on Twitter as there were bullish ones. Over the past 5 years, that's led to some good returns.