Tuesday Midday Color

Here's what's piquing my interest so far today.

Breadth Review

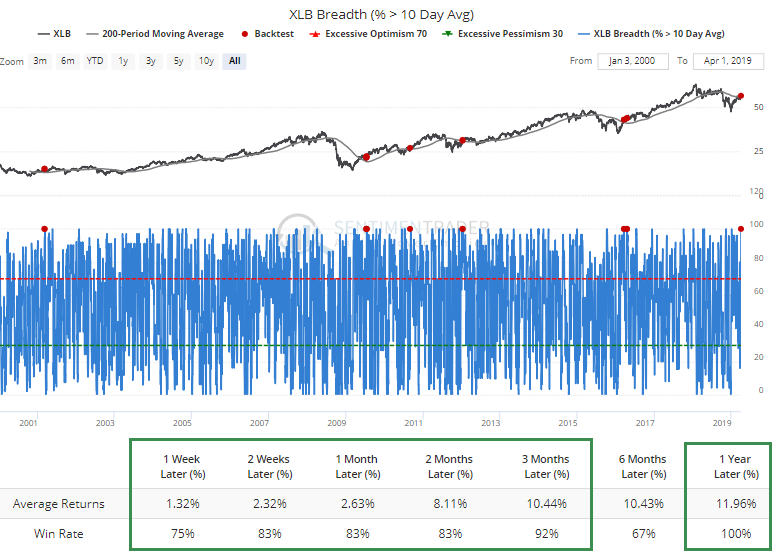

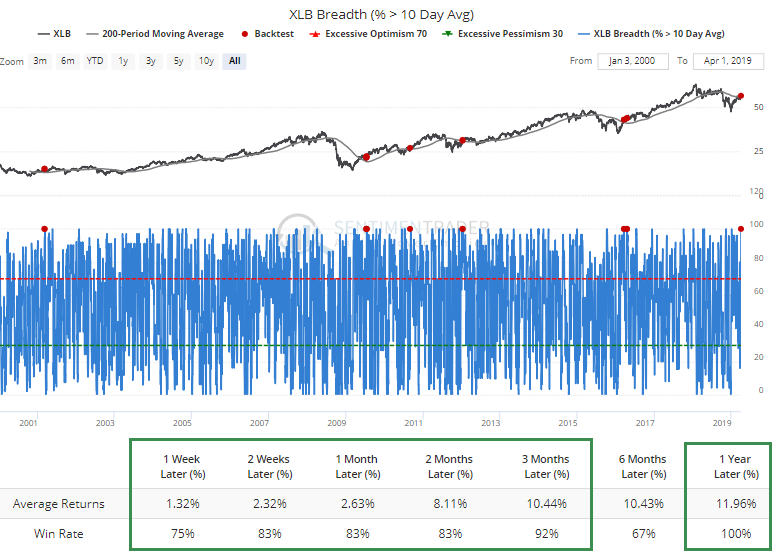

The jump on Monday triggered a number of new extremes. Every material stock rose above their 10-day moving averages, which we don't see too often. If we add some context and look for times it triggered when XLB rose above a declining 200-day average (emerging out of a downtrend), then it was a good sign of a thrust that typically continued to play out in the months ahead.

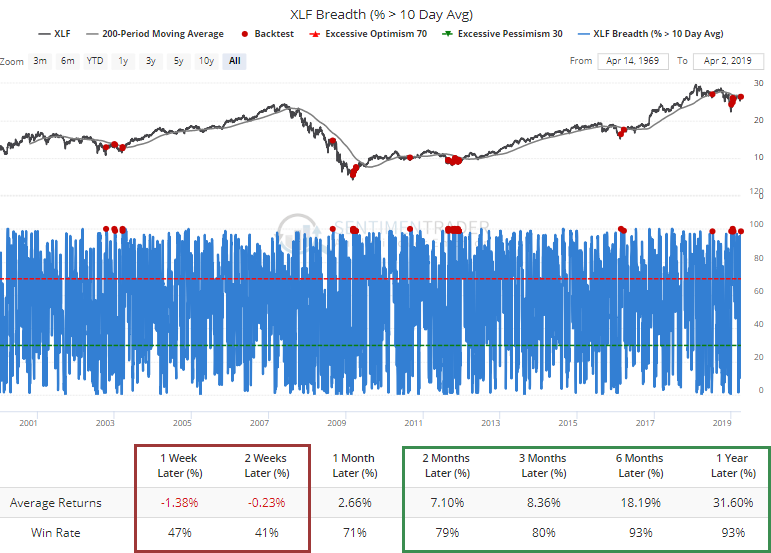

There was a similar jump in financials, with more than 98% of them trading above their short-term averages. XLF is still trading below its 200-day average. Similar conditions typically led to short-term weakness, long-term strength. There was a big failure right before the final plunge of the financial crisis, but other than that it was a good medium- to long-term sign.

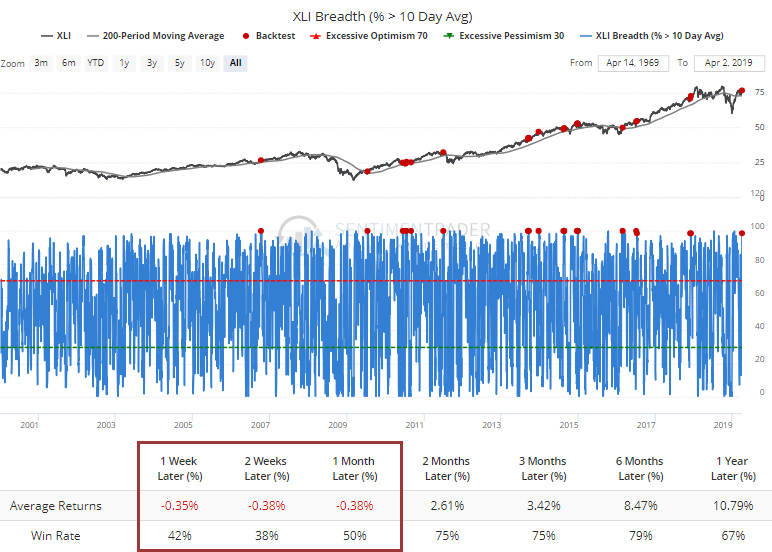

Almost every industrial stock is also trading above its 10-day average. During uptrends, that has preceded some short-term exhaustion for XLI.

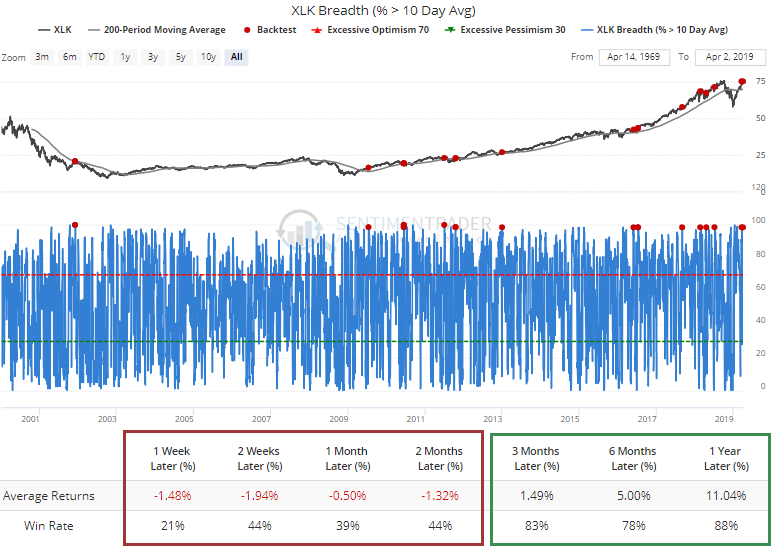

Same with tech stocks.

So Many Extremes

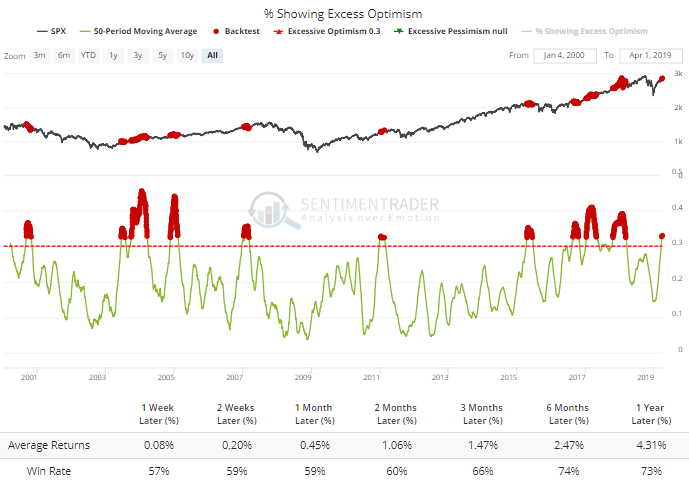

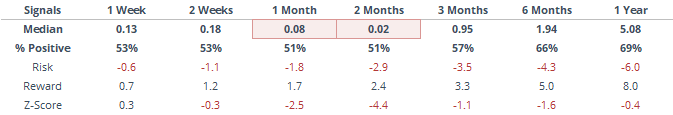

On an average day over the past 50 sessions, a third of our core indicators were showing excessive optimism. That's the most, and most prolonged, since early 2018. Historically, a reading this high has been unusual. The S&P's returns over the short- to medium-term were still positive, but less than random.

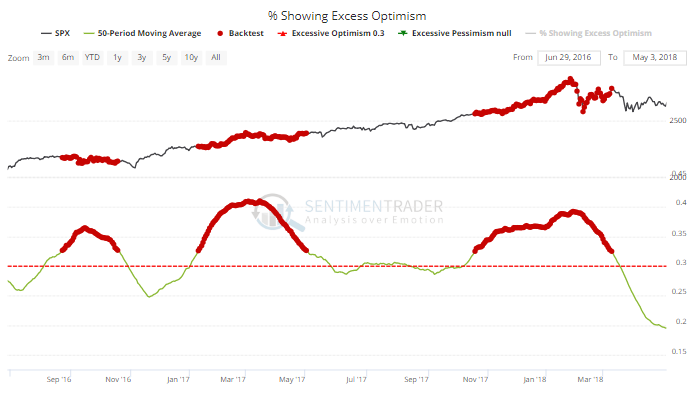

The key reason why returns were positive on average was the mo-mo market of 2017. Early that year, and again near the end of the year, the 50-day average got as high as it is now, yet stocks continued to levitate.

If we exclude only 2017 from the results since 1999, then the forward returns become more troublesome.

In this case, the S&P's average two-month return was more than 4 standard deviations below random. Of course, this is in direct opposition to the price-momentum studies we've looked at in recent days, and that's the struggle here - if the momentum enough to override what has typically been poor returns following extended bouts of optimism. So far, the answer is yes.

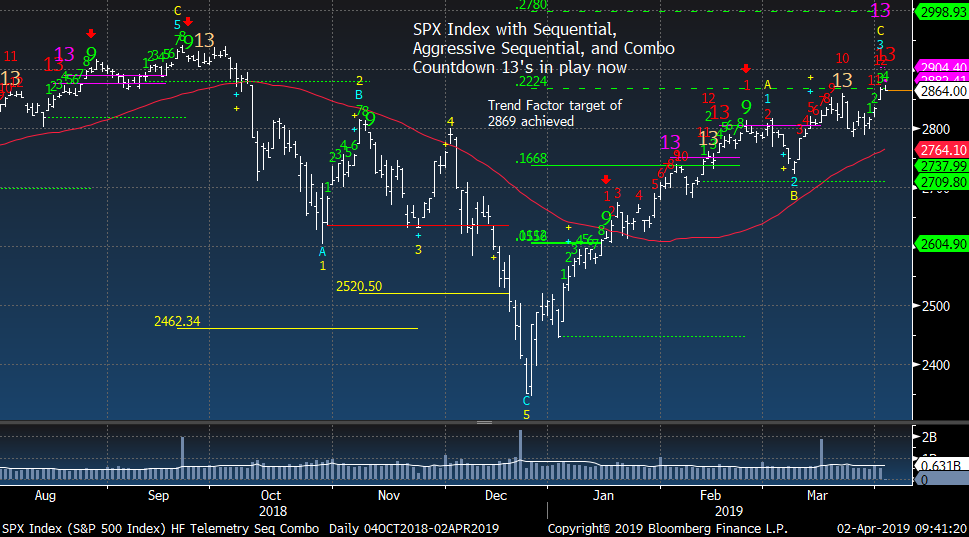

It is a bit more worrisome that some other technical exhaustion signals are triggering now, such as DeMark countdowns. When those occur in the context of extreme sentiment, they have a good record at signalling imminent (though not necessarily significant) pullbacks (via Tommy Thornton).

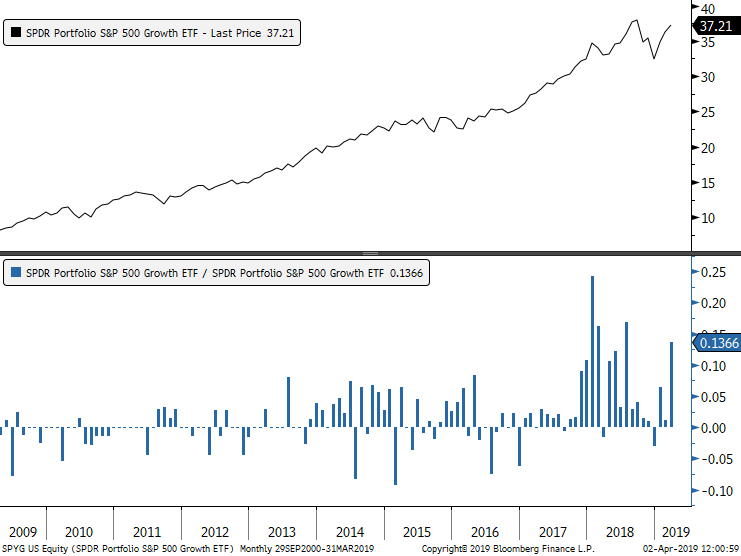

Go For Growth

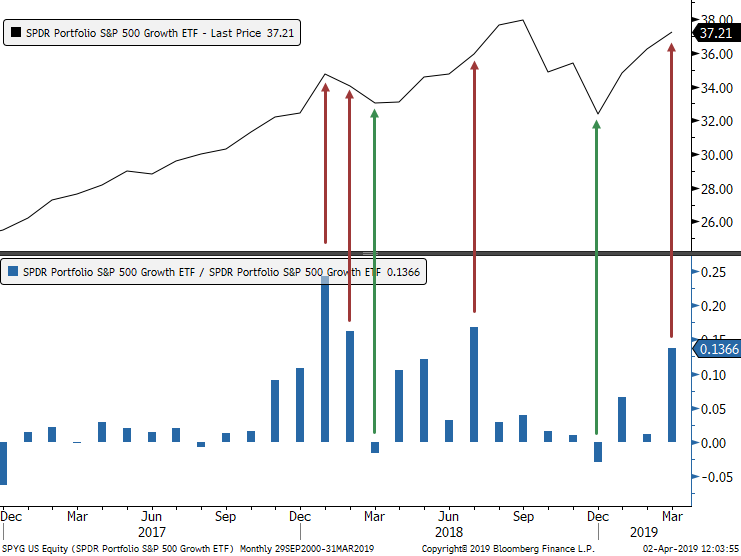

Bloomberg noted that investors have flooded into an "old" S&P 500 growth ETF, with a record intake in March. Similar inflows preceded peaks in the fund (and stocks in general). As a sign of excessive risk-on appetite, this is disturbing.

If we adjust the inflows for the asset level, then it's not quite as extreme. As more than 13% of all assets, the March inflow was still extremely high, though.

Over the past couple of years, these traders have been especially poor market-timers, getting out at the lows and surging back in just as growth stocks were about to take a breather. This is a minor worry here.