Tuesday Midday Color

Here's what's piquing my interest so far today.

Cautious

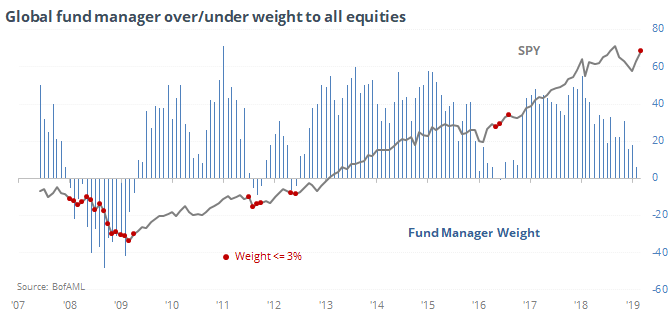

According to the latest monthly BofA fund manager survey, big money managers are still not showing any optimism toward equities as a general asset class, with only a 3% overweight. It has been declining consistently for the past 2 years and is now the lowest in 30 months.

This is not an automatic buy signal. Fund managers held a low (and declining) allocation throughout the 2008 bear market, so trying to fade that in a contrarian way was painful. They also held this low of an allocation in July 2011 and August 2016, after which the S&P declined more than 10% and 2%, respectively, over the next 1-2 months. Otherwise, though, the signals were better taken as contrarian signals.

No Pessimism

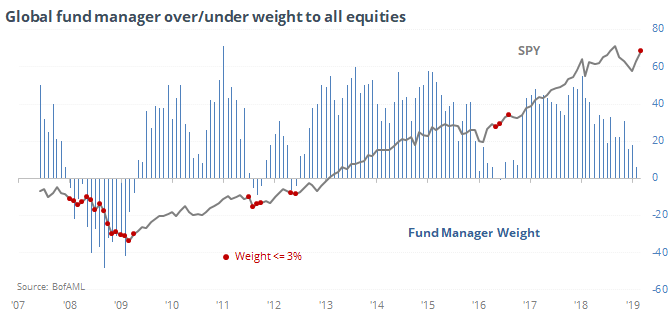

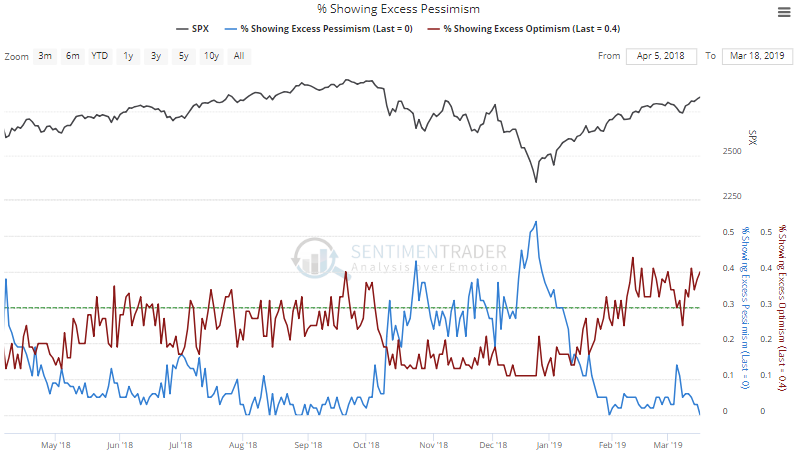

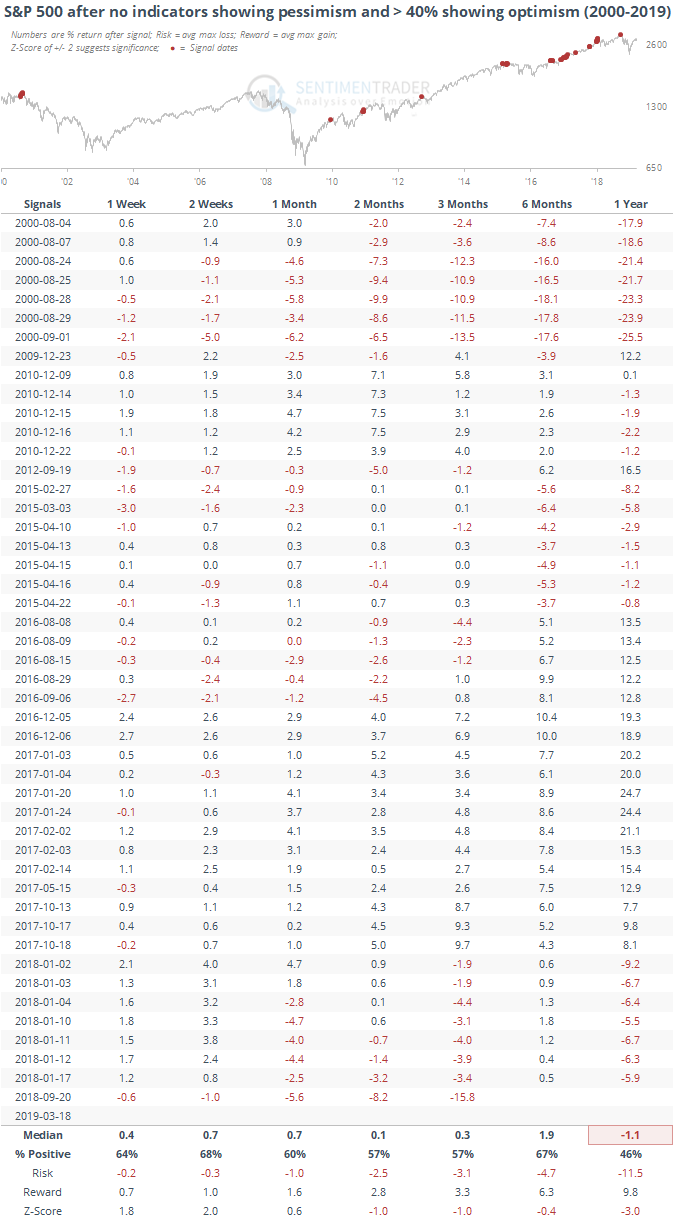

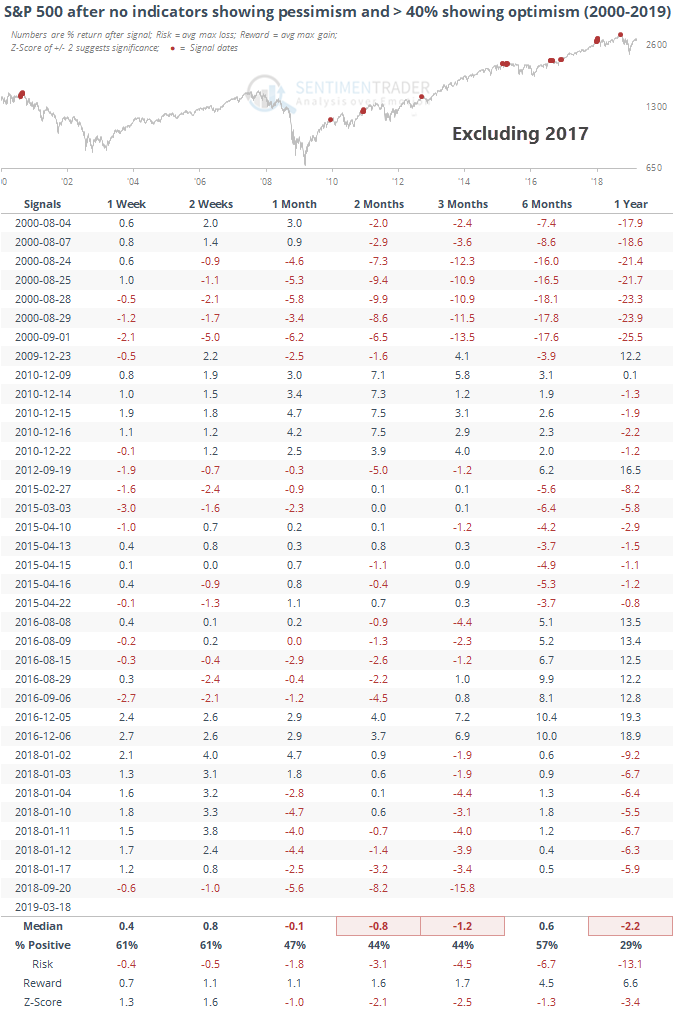

On Monday, none of our core indicators were showing a pessimistic extreme, but at least 40% of them were showing an optimistic one.

Going back to 1999, there have been 48 other days that showed this kind of condition. Future returns were "meh."

A lot of the positive medium-term returns were due to a single year, 2017. The extraordinary market that year just rolled right over everything. If we exclude that single year, then the returns turn considerably worse, with a particularly bad risk/reward ratio.

No Love For Japan

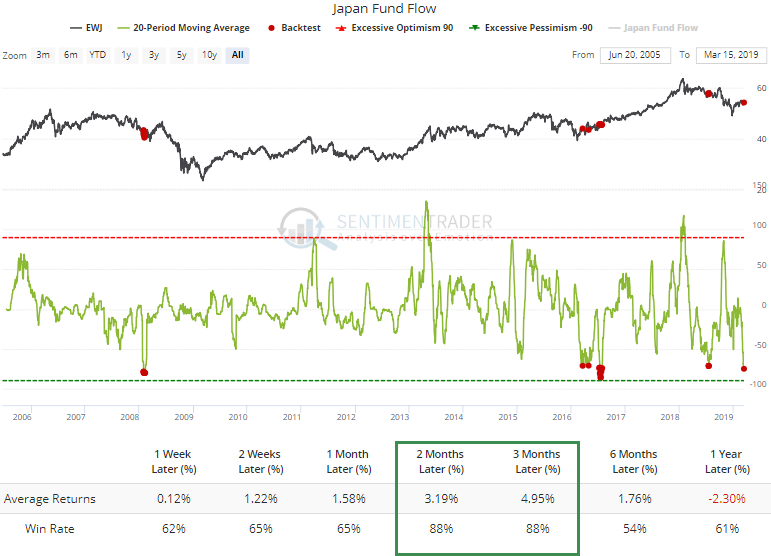

ETF traders have been pulling out of the EWJ fund for the past month. The fund has suffered an average outflow of nearly $75 million per day for the past month, ranking among the most severe and sustained outflows in its history.

There has been a decent contrarian nature to these flows, with decent 2-3 month returns for EWJ after traders flee the fund like this.

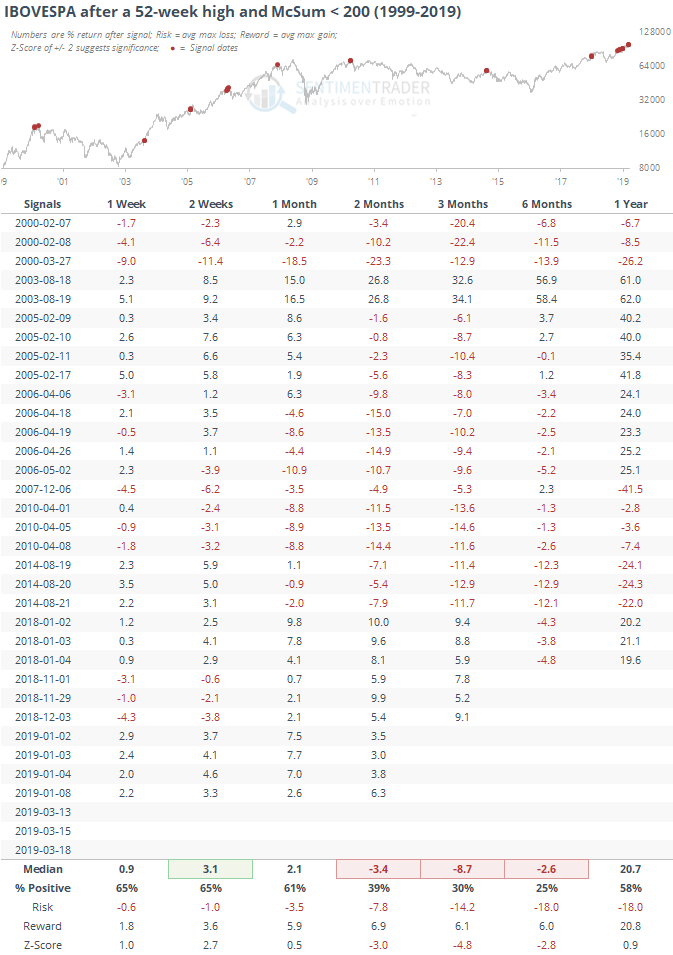

Waxing Brazilian

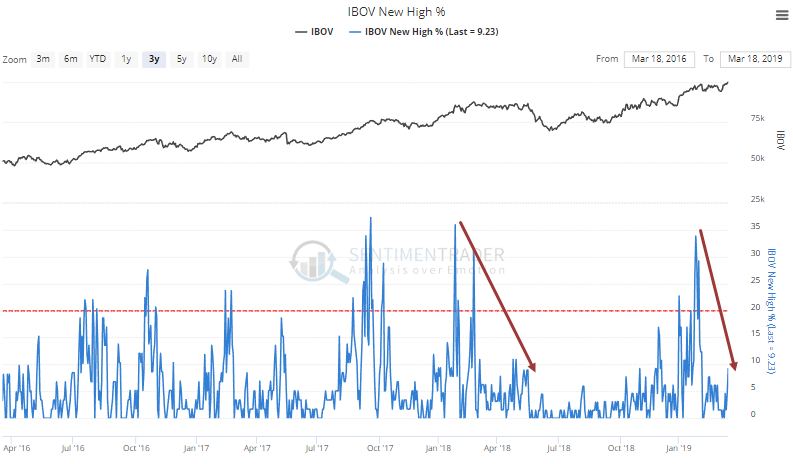

The Ibovespa Index of Brazilian stocks has been one of the most solid performers among international indexes and it continues to chug ahead, setting another new high on Monday. There are some cracks under the surface, though.

Breadth divergences are iffy things, so this isn't a major issue, but we are seeing a lack of thrust during this latest move. Fewer than 10% of stocks have hit a 52-week high, well below prior peaks. This is similar to the spring of 2018.

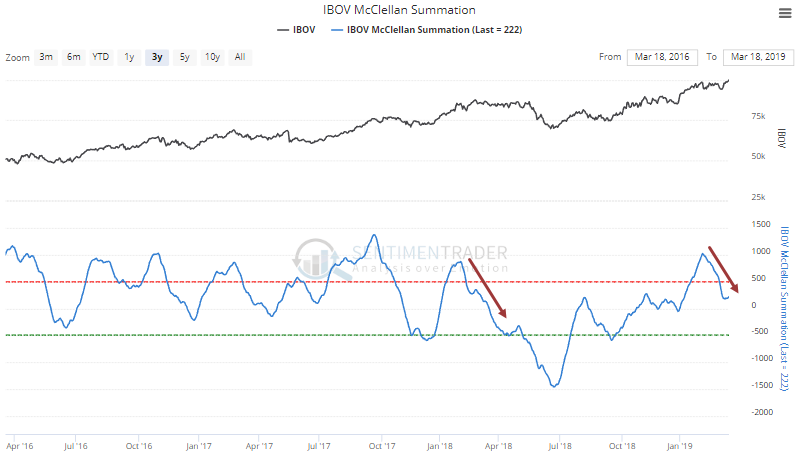

Same with the Cumulative Advance/Decline Line, which isn't making new highs along with the index.

Long-term breadth momentum is weak and has been declining for most of this latest move.

When the Ibovespa has made a new high and its McClellan Summation Index has been below 200, future returns were spotty at best.

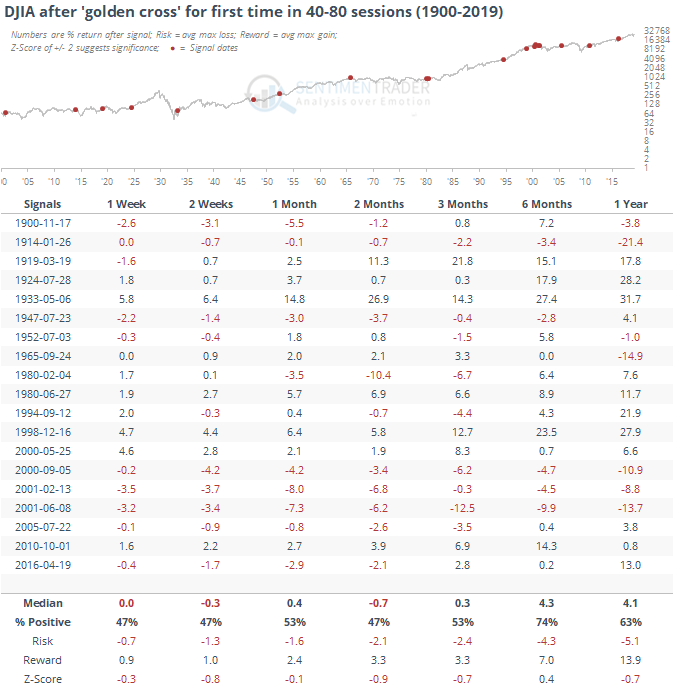

Double Crossed

The Dow is set to enjoy a "golden cross" today with its 50-day average crossing back above its 200-day average. This usually catches the interest of retail-focused financial media. It's mostly worthless, at least when occurring for the first time in 2-4 months.

Out of the 19 signals, 12 of them saw a negative return at some point over the next 1-12 weeks.